Investing In CoreWeave (CRWV): Understanding Jim Cramer's Perspective On OpenAI

Table of Contents

Understanding CoreWeave's Business Model and its Link to OpenAI

CoreWeave (CRWV) is a cloud computing infrastructure company specializing in high-performance computing (HPC). Its core business involves providing the computing power necessary for training complex artificial intelligence (AI) models, particularly large language models (LLMs). This makes it intrinsically linked to the success of companies like OpenAI, which rely on immense computational resources to develop cutting-edge AI technologies.

The connection between CoreWeave and OpenAI is crucial. CoreWeave provides the infrastructure, the raw horsepower, that allows OpenAI and other AI developers to train their models. This involves:

- Utilizing Repurposed NVIDIA GPUs: CoreWeave cleverly leverages repurposed NVIDIA GPUs, creating a cost-effective and efficient infrastructure for its clients. This allows them to offer competitive pricing while maintaining high performance.

- Scalable and Efficient Infrastructure: CoreWeave's infrastructure is designed for scalability, allowing it to adapt to the ever-increasing computational demands of AI model training. This adaptability is a key advantage in the rapidly evolving AI landscape.

- Growth Potential in the Expanding AI Market: The global AI market is projected to experience exponential growth in the coming years, directly benefiting companies like CoreWeave that provide the essential infrastructure for AI development. This presents a significant opportunity for future expansion and increased revenue.

Jim Cramer's Public Statements on OpenAI and AI Investments

While Jim Cramer hasn't explicitly addressed CoreWeave (CRWV) directly, his pronouncements on OpenAI and the broader AI sector offer valuable insight. He has consistently expressed optimism about the long-term potential of artificial intelligence, viewing it as a transformative technology with significant market disruption capabilities. (Note: Specific quotes from Jim Cramer would be included here if available from reliable sources such as Mad Money transcripts or reputable financial news outlets).

Analyzing his past commentary on similar companies or technologies reveals a generally bullish sentiment toward AI investments. However, it's crucial to consider potential biases or conflicts of interest. For instance, his investment portfolio or relationships with certain companies could influence his public statements.

- Examples of Cramer's Statements: (Insert specific examples of Jim Cramer's statements related to AI investments, ideally with citations).

- Potential Biases: (Discuss potential conflicts of interest or biases that may influence his views on AI and related investments).

- Overall Sentiment: (Summarize whether Cramer's overall sentiment towards AI investments is bullish, bearish, or neutral).

Analyzing the Investment Potential of CoreWeave (CRWV) Based on OpenAI's Growth

Investing in CoreWeave (CRWV) presents both significant rewards and notable risks. The potential for substantial growth is driven by the explosive growth projected for the AI market and the continued success of OpenAI and other AI development companies. However, several factors must be considered:

- CoreWeave's Financial Performance: (Analyze CoreWeave's publicly available financial data, including revenue, profitability, and growth rates).

- Competition and Market Saturation: The cloud computing market is competitive, and the emergence of new players could lead to market saturation, impacting CoreWeave's market share.

- Long-Term Viability: The long-term viability of CoreWeave's business model depends on the continued growth of the AI market and its ability to maintain its technological edge. Consider alternative investment options within the AI sector, diversifying your portfolio.

Conclusion: Investing in CoreWeave (CRWV) – A Final Thought

Jim Cramer's generally positive view on AI, though not explicitly directed at CoreWeave (CRWV), aligns with the significant growth potential within the AI infrastructure sector. However, investing in CoreWeave carries inherent risks, including competition and market saturation. While considering Jim Cramer's insights can be helpful, conducting thorough independent research is paramount. Before you consider investing in CoreWeave (CRWV), learn more about CoreWeave's future prospects and assess the risks carefully. Research CoreWeave's financial performance, competitive landscape, and the broader AI market dynamics. Only after comprehensive due diligence should you consider investing in CoreWeave (CRWV) or any other AI-related company.

Featured Posts

-

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League Terakhir

May 22, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League Terakhir

May 22, 2025 -

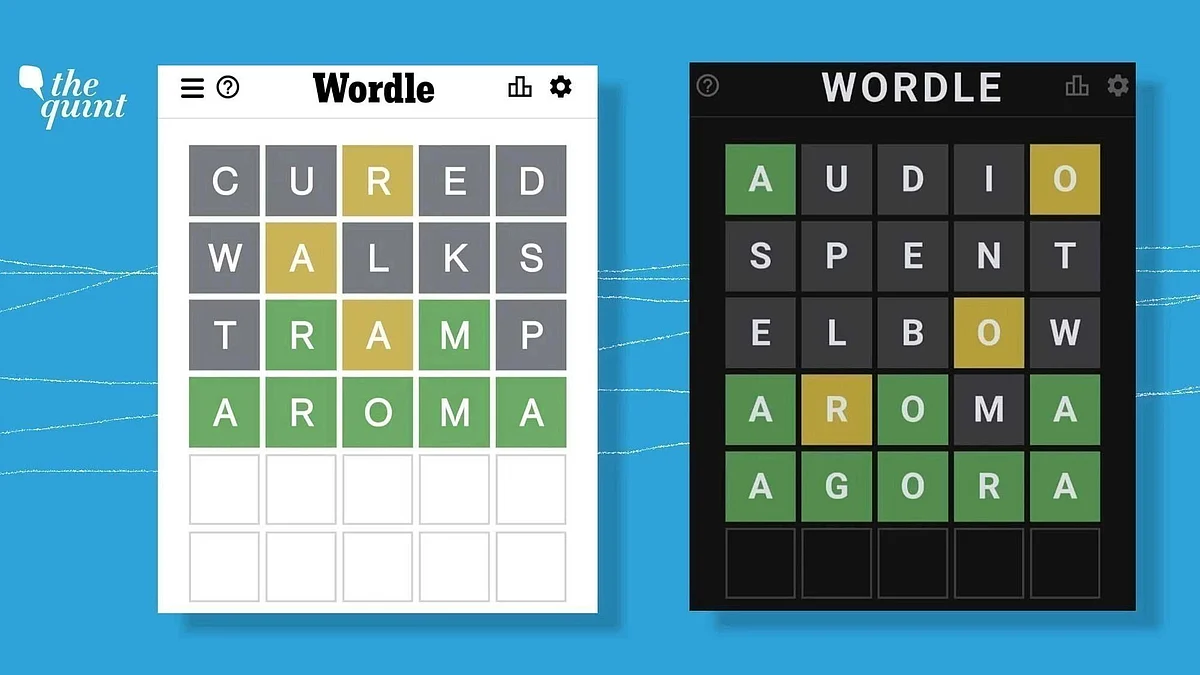

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025 -

Vstup Ukrayini Do Nato Ostanni Peregovori Ta Pozitsiya Yevrokomisiyi

May 22, 2025

Vstup Ukrayini Do Nato Ostanni Peregovori Ta Pozitsiya Yevrokomisiyi

May 22, 2025 -

Toledo Residents See Lower Gas Prices This Week

May 22, 2025

Toledo Residents See Lower Gas Prices This Week

May 22, 2025 -

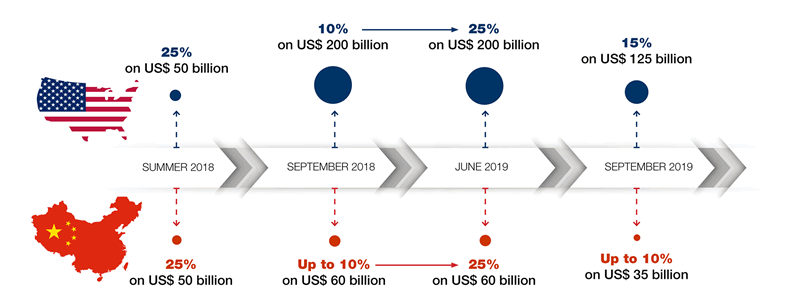

Us China Trade Surge A Race Against The Clock Before Trade Deal Expiry

May 22, 2025

Us China Trade Surge A Race Against The Clock Before Trade Deal Expiry

May 22, 2025

Latest Posts

-

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025 -

Wordle March 8th 1358 Clues And Solution

May 22, 2025

Wordle March 8th 1358 Clues And Solution

May 22, 2025 -

Wordle 1358 Hints And Answer For March 8th

May 22, 2025

Wordle 1358 Hints And Answer For March 8th

May 22, 2025 -

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025