Investing In Palantir Before May 5th: A Look At Wall Street's Predictions

Table of Contents

Current Market Sentiment Towards Palantir

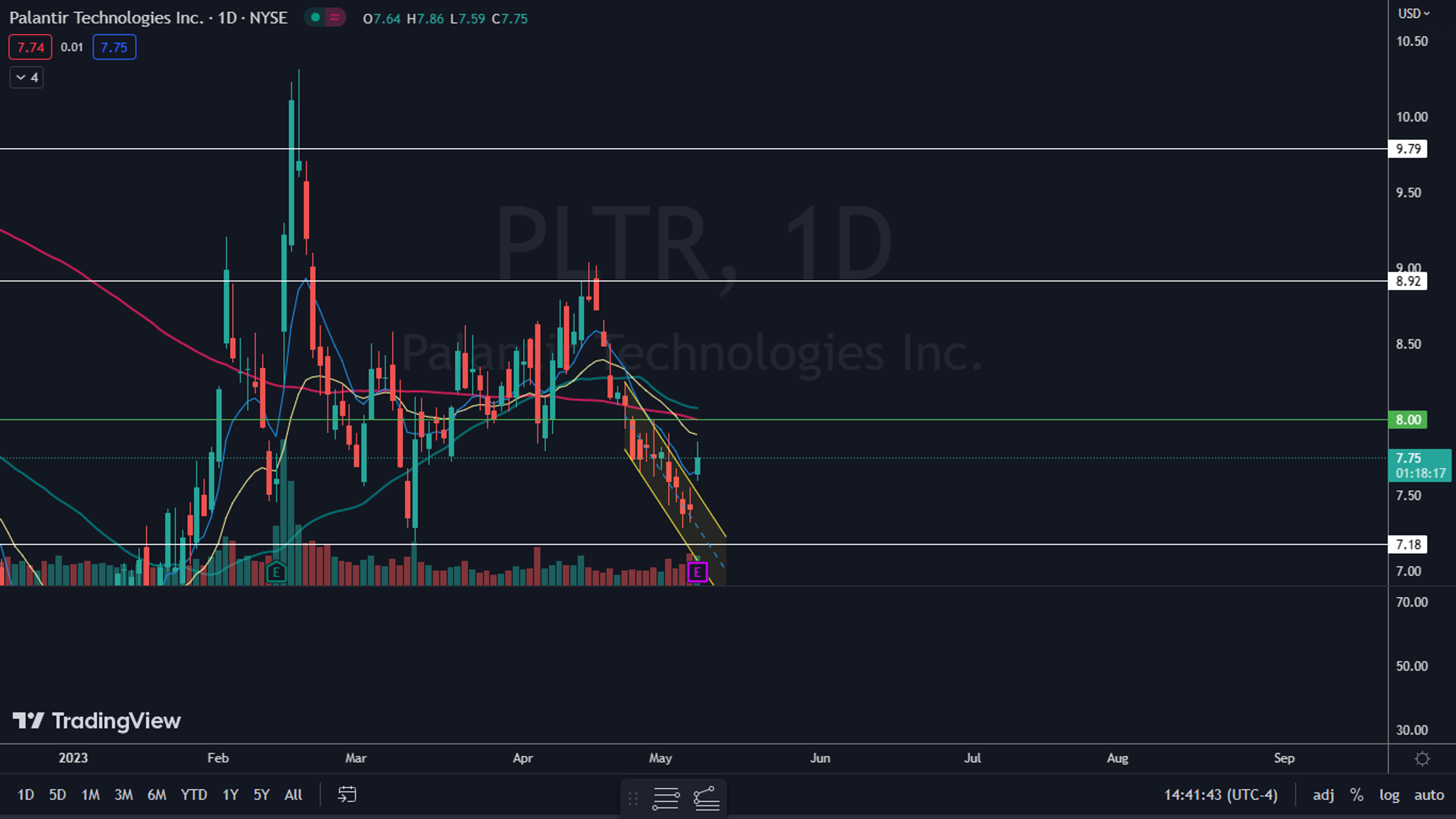

The overall feeling towards Palantir stock among analysts is currently mixed, reflecting the inherent volatility of the tech sector and the company's unique position within the data analytics market. Recent price fluctuations have been driven by a variety of factors, making a definitive Palantir prediction challenging.

-

Recent Price Fluctuations and Causes: Palantir stock has experienced significant price swings in recent months, influenced by factors such as earnings reports, contract wins, and broader market trends. For example, a strong earnings beat often leads to a surge in the Palantir stock price, while disappointing results or general market downturns can cause significant drops.

-

Significant News and Events: Announcements regarding major government contracts, partnerships with large corporations, and product launches often have a considerable impact on Palantir's valuation. These events often generate considerable interest, leading to increased trading volume and price volatility. Keeping abreast of these news items is vital for any Palantir investment strategy.

-

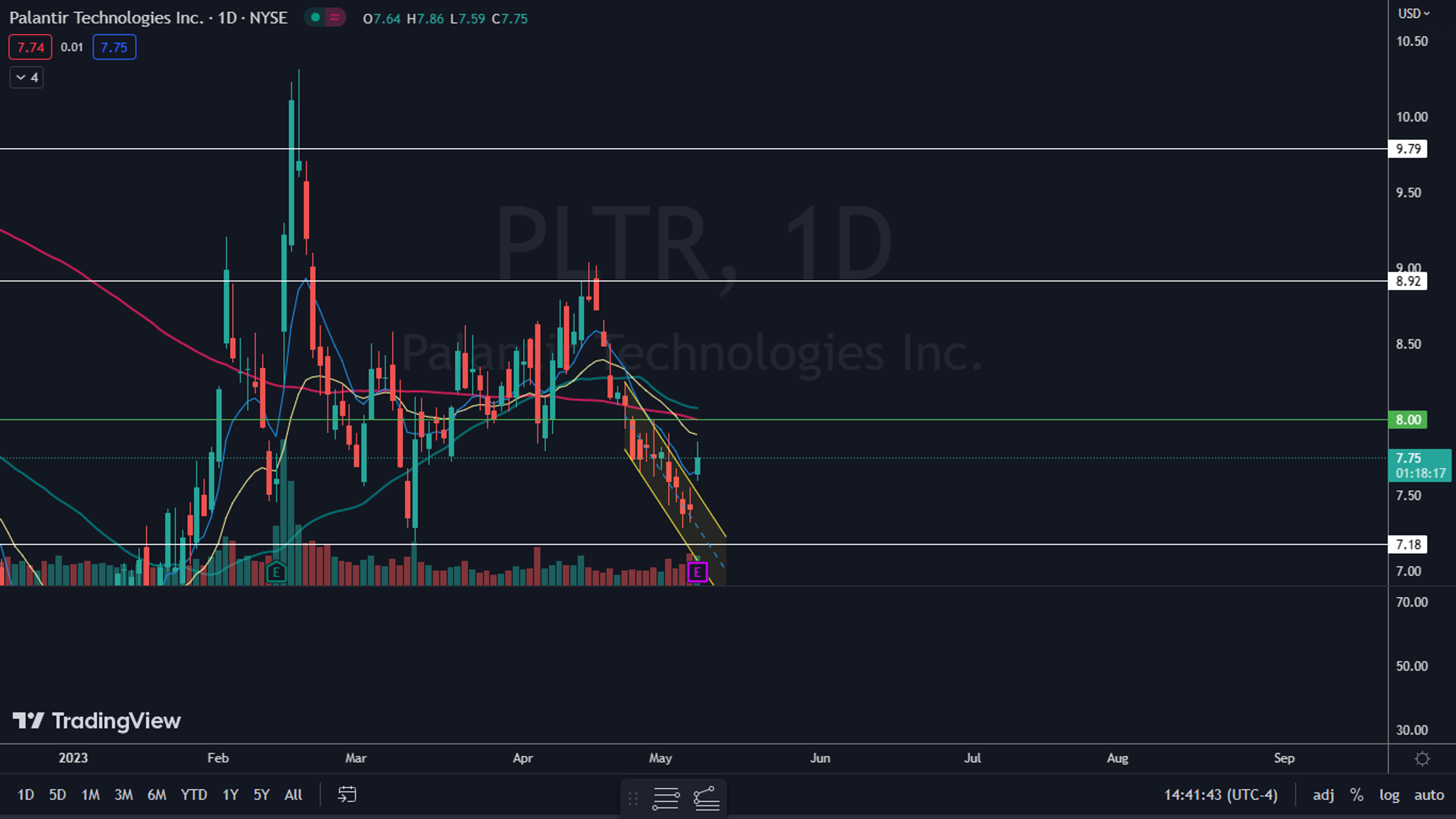

Analyst Price Targets: Analyst price targets for Palantir stock vary widely, ranging from conservative estimates to significantly higher projections, reflecting the diversity of opinions on the company's long-term growth potential. This range highlights the uncertainty surrounding future Palantir stock performance and the challenges in making accurate Palantir predictions.

-

Recent Financial Performance: Palantir's recent financial performance, including its revenue growth and profitability, significantly impacts investor sentiment and the price of Palantir stock. Investors closely scrutinize earnings reports for signs of consistent growth and operational efficiency.

Key Factors Influencing Palantir Stock Price Before May 5th

Several key factors are driving the diverse predictions surrounding Palantir stock. Understanding these factors is crucial for informed investment decisions related to Palantir investment.

-

Government Contracts: Palantir's significant reliance on government contracts makes it susceptible to shifts in government spending and policy. Securing large contracts can drive substantial growth, while delays or contract losses can negatively impact Palantir's stock price. Analyzing the pipeline of potential government contracts is essential for any Palantir prediction.

-

Commercial Business Expansion: Palantir's growth in the commercial sector is a key indicator of its long-term viability. Success in securing and expanding commercial partnerships is critical for reducing dependence on government contracts and fostering sustainable growth.

-

Competition in the Data Analytics Market: The data analytics market is highly competitive, with established players and emerging startups vying for market share. Palantir's ability to differentiate its offerings and maintain a competitive edge is vital for its long-term success.

-

Regulatory Changes: Potential regulatory changes impacting data privacy and security could significantly affect Palantir's operations and growth. Staying informed about relevant regulatory developments is vital for making accurate Palantir predictions.

-

Overall Market Conditions: Broader market factors, including interest rates, inflation, and overall economic sentiment, also play a significant role in influencing Palantir's stock price. These macroeconomic factors can significantly impact investor appetite for riskier investments like Palantir stock.

Analyzing Wall Street's Predictions: Bullish vs. Bearish Arguments

Wall Street analysts offer a spectrum of opinions on Palantir, ranging from bullish to bearish.

-

Bullish Arguments: Bullish analysts highlight Palantir's innovative technology, significant growth potential, particularly in the expanding commercial sector, and the increasing demand for advanced data analytics solutions. They see a strong future for Palantir stock.

-

Bearish Arguments: Bearish analysts express concerns about Palantir's high valuation, intense competition in the data analytics market, and dependence on government contracts. They point to potential risks related to revenue predictability and profitability.

-

Analyst Reports and Methodologies: Numerous analyst reports provide detailed insights into their predictions, often outlining the specific methodologies used, including discounted cash flow analysis, comparable company analysis, and other valuation techniques. Understanding these methodologies provides valuable context for evaluating their predictions. For example, [Analyst Name] at [Investment Bank] recently published a report with a bullish outlook, citing strong growth in the commercial sector. Conversely, [Analyst Name] at [Investment Bank] expressed a more cautious view, highlighting concerns about competition.

Understanding the Risk-Reward Profile of Investing in Palantir

Investing in Palantir involves a significant degree of risk, as with any investment in the stock market.

-

Volatility: Palantir stock is known for its volatility, meaning its price can fluctuate dramatically in short periods. This is inherent to growth stocks and demands a higher risk tolerance.

-

Upside and Downside Scenarios: The potential upside for Palantir stock is substantial, driven by its innovative technology and growth prospects. However, significant downside risk exists if the company fails to meet growth expectations or encounters unforeseen challenges.

-

Diversification: Diversification is crucial for mitigating risk. Investing in Palantir should be part of a well-diversified portfolio to reduce the impact of potential losses.

-

Investment Amount: The appropriate investment amount in Palantir should be determined based on your individual risk tolerance and overall investment strategy. Consider only investing an amount you are comfortable potentially losing.

Conclusion

This article has examined the current market sentiment surrounding Palantir stock before May 5th, analyzing key factors influencing Wall Street's predictions. We've explored both the bullish and bearish arguments, assisting investors in understanding the inherent risk-reward profile of investing in PLTR. We've considered factors such as Palantir's government contracts, commercial expansion, competition, and overall market conditions, all vital elements in any Palantir prediction.

Call to Action: While this information offers valuable insight, remember that investing in Palantir or any stock involves inherent risk. Conduct thorough due diligence before making any investment decisions related to Palantir stock, considering your own risk tolerance and financial goals. Make informed decisions about your Palantir investment strategy before May 5th and beyond. Remember to carefully analyze all available information before investing in Palantir stock.

Featured Posts

-

Should You Buy Palantir Stock Before May 5th A Prudent Investors Guide

May 10, 2025

Should You Buy Palantir Stock Before May 5th A Prudent Investors Guide

May 10, 2025 -

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025 -

Remembering Americas Pioneer The Passing Of A Nonbinary Icon

May 10, 2025

Remembering Americas Pioneer The Passing Of A Nonbinary Icon

May 10, 2025 -

Increased Disney Profit Outlook Parks And Streaming Success Story

May 10, 2025

Increased Disney Profit Outlook Parks And Streaming Success Story

May 10, 2025 -

Muutoksia Britannian Kruununperimysjaerjestykseen Ketkae Ovat Seuraavaksi

May 10, 2025

Muutoksia Britannian Kruununperimysjaerjestykseen Ketkae Ovat Seuraavaksi

May 10, 2025