Should You Buy Palantir Stock Before May 5th? A Prudent Investor's Guide

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Analyzing Q4 2023 Earnings and Revenue Growth

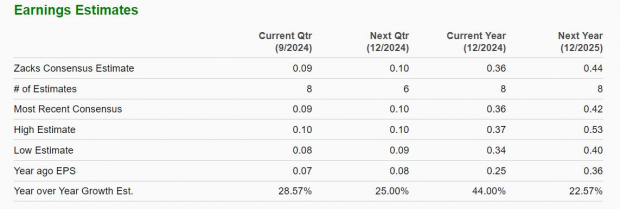

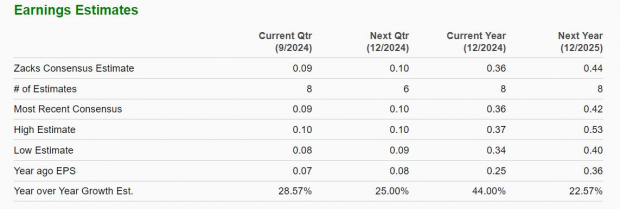

Palantir's recent financial results provide a critical lens through which to view the potential of a Palantir investment. Analyzing key metrics like revenue growth, net income, and operating margins is crucial for any Palantir stock analysis. Comparing these figures to previous quarters and competitor performance offers valuable context. For example, a significant increase in revenue year-over-year, coupled with improving profit margins, signals positive momentum for the Palantir stock price. Conversely, a decline in key metrics might suggest caution.

- Revenue growth percentage: (Insert actual data from Q4 2023 report here. For example: "Q4 2023 showed a 25% year-over-year revenue increase.")

- Profit margins: (Insert actual data from Q4 2023 report here. For example: "Operating margins improved to 18%, exceeding analyst expectations.")

- Key financial ratios (e.g., P/E ratio): (Insert actual data from Q4 2023 report here and provide context. For example: "The P/E ratio of 30, while seemingly high, reflects investor confidence in Palantir's future growth potential.")

(Insert relevant chart illustrating revenue growth and profit margin trends here.)

Assessing Palantir's Long-Term Growth Potential

Palantir's long-term growth potential hinges on several factors. Its software and data analytics services cater to a burgeoning market, offering significant opportunities for expansion. Analyzing the company's strategic initiatives and their potential impact on revenue and profitability is essential for any prospective investor considering buying Palantir stock.

- Key growth drivers (e.g., government contracts, commercial partnerships): Palantir's success relies heavily on its government contracts and expansion into the commercial sector. Sustained growth in these areas is critical for future profitability.

- Market penetration strategy: How effectively Palantir expands its reach into new markets and customer segments will significantly impact its long-term growth.

- Competitive landscape analysis: Understanding Palantir's competitive positioning relative to other data analytics companies is key. Identifying competitive advantages and potential threats is crucial to evaluating the Palantir stock price.

- Future product launches or advancements: Any anticipated new products or technological advancements could significantly impact Palantir's future revenue streams and, consequently, the Palantir stock forecast.

Evaluating Market Conditions and External Factors Influencing Palantir Stock

Impact of the Current Economic Climate on Tech Stocks

The overall economic climate significantly impacts the technology sector and, consequently, Palantir's valuation. Factors such as interest rate hikes and inflation directly affect investor sentiment and the willingness to invest in growth stocks like Palantir.

- Interest rate hikes: Higher interest rates often lead to decreased investment in riskier assets, potentially impacting Palantir's stock price.

- Inflation rates: High inflation can erode profit margins and dampen consumer and business spending, creating headwinds for Palantir's growth.

- Investor sentiment towards tech stocks: The overall mood of investors towards the tech sector is a key factor influencing Palantir's stock performance.

Geopolitical Risks and Their Potential Effect on Palantir

Geopolitical events can significantly impact Palantir's business, particularly its government contracts and international expansion. A thorough analysis of these risks is crucial before deciding whether to invest in Palantir stock.

- Specific geopolitical risks: Identify potential risks like international conflicts or changes in government policies that could impact Palantir's contracts or operations.

- Potential impact on Palantir's revenue streams: Analyze how these geopolitical risks could affect Palantir's revenue streams and overall profitability.

- Strategies to mitigate these risks: Evaluate Palantir's strategies for mitigating these risks and their potential effectiveness.

Considering the Risks and Rewards of Investing in Palantir Stock

Identifying Potential Risks Associated with Palantir

While the potential rewards of investing in Palantir are enticing, it's crucial to acknowledge the inherent risks. The volatility of the stock market and the specific risks associated with Palantir's business model must be carefully considered.

- Competition: The data analytics market is competitive. Palantir faces competition from established players and emerging startups.

- Dependence on large government contracts: A significant portion of Palantir's revenue comes from government contracts. Any changes in government spending could significantly impact the company.

- Technological disruption: Rapid technological advancements could render Palantir's technology obsolete, impacting its long-term viability.

Weighing the Potential Rewards Against the Risks

Investing in Palantir stock presents both potential rewards and risks. A balanced assessment of these factors is vital.

- Potential for high returns: Palantir's growth potential offers investors the possibility of high returns, making it an attractive investment for those with a higher risk tolerance.

- Strong growth potential: The expanding market for data analytics provides a solid foundation for Palantir's future growth.

- Innovative technology: Palantir's innovative technology and data analytics capabilities offer a competitive advantage in the market.

Conclusion

The decision of whether to buy Palantir stock before May 5th depends on a multitude of factors, including Palantir's financial performance, prevailing market conditions, and your personal risk tolerance. This guide has highlighted key elements for consideration, including Palantir's recent financial results, future growth prospects, and the influence of external factors. Remember that this analysis is not financial advice. Conducting thorough independent research and consulting with a financial advisor are vital steps before making any investment decision.

Ultimately, the decision to invest in Palantir stock is a personal one. By carefully considering the factors outlined in this guide, you can make a more informed and prudent investment decision regarding Palantir stock. Remember to consult a financial advisor before making significant investment choices.

Featured Posts

-

Wynne Evans Called Out By Joanna Page During Bbc Show Appearance

May 10, 2025

Wynne Evans Called Out By Joanna Page During Bbc Show Appearance

May 10, 2025 -

Ryujinx Emulator Development Halted Nintendos Involvement Explained

May 10, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Explained

May 10, 2025 -

Us Debt Ceiling Crisis August Deadline Approaches

May 10, 2025

Us Debt Ceiling Crisis August Deadline Approaches

May 10, 2025 -

The Rise Of Otc Birth Control A Post Roe Reality Check

May 10, 2025

The Rise Of Otc Birth Control A Post Roe Reality Check

May 10, 2025 -

Bert Kreischers Netflix Stand Up A Look At His Marriage And Risque Material

May 10, 2025

Bert Kreischers Netflix Stand Up A Look At His Marriage And Risque Material

May 10, 2025