Investing In Palantir In 2024: Assessing The Potential 40% Increase In 2025

Table of Contents

1. Palantir's Growth Potential and Market Position

Palantir Technologies is a leading provider of data analytics and software platforms, specializing in big data solutions for government and commercial clients. Its proprietary platforms, Gotham and Foundry, empower organizations to integrate, analyze, and act upon vast quantities of data. The potential for a 40% increase in its stock price hinges on several key factors.

1.1 Analyzing Palantir's Revenue Growth and Profitability:

Palantir's financial performance is a key indicator of its future potential. Examining its historical revenue growth, profitability, and projections helps gauge its long-term viability.

- Key Financial Metrics: While Palantir has shown consistent revenue growth, profitability remains a focus. Investors should track key metrics like year-over-year revenue growth, operating margins, and free cash flow.

- Government vs. Commercial Clients: A significant portion of Palantir's revenue comes from government contracts. This reliance presents both opportunities (stable, long-term contracts) and risks (dependence on government spending). The success of its expansion into the commercial sector is crucial for long-term, sustainable growth.

- Comparison to Competitors: Analyzing Palantir's performance against competitors like AWS, Microsoft, and Google Cloud provides context for its market position and growth trajectory. Its unique focus on data integration and advanced analytics sets it apart, but it faces fierce competition in the broader data analytics market.

1.2 The Expanding Market for Data Analytics and AI:

The demand for advanced data analytics and AI solutions is rapidly expanding across various sectors. This presents a significant tailwind for Palantir.

- Market Size and Growth Projections: The global market for data analytics and AI is projected to grow exponentially in the coming years, creating a massive opportunity for companies like Palantir.

- Palantir's Technological Advantages: Palantir's platforms boast cutting-edge technology, enabling complex data integration and analysis. This technological edge is crucial for maintaining its competitive advantage.

- Government and Commercial Applications: Palantir’s solutions find applications in diverse fields – from national security and public health to financial services and supply chain management. This diversification lessens its reliance on any single sector.

2. Assessing Risks and Challenges

While Palantir exhibits significant growth potential, various risks and challenges could impact its stock price.

2.1 Competition and Technological Disruption:

The data analytics and AI market is incredibly competitive. New technologies and innovative competitors could disrupt Palantir's market position.

- Key Competitors: Major technology companies like Amazon, Microsoft, and Google pose significant competitive threats, offering overlapping solutions and vast resources.

- Potential Technological Disruptions: Rapid advancements in AI and machine learning could render existing technologies obsolete, potentially requiring significant investment from Palantir to adapt.

- Palantir's Response Strategies: Palantir's ongoing investments in R&D and strategic partnerships are essential for maintaining its competitive edge and mitigating the risks of technological disruption.

2.2 Geopolitical Risks and Regulatory Uncertainty:

Palantir's significant involvement in government contracts exposes it to geopolitical risks and regulatory uncertainties.

- Impact of International Relations: Changes in international relations can impact government spending and contract awards, potentially affecting Palantir's revenue stream.

- Regulatory Hurdles: Increased regulatory scrutiny of data privacy and security could impact Palantir's operations and limit its ability to secure new contracts.

- Potential Legal Challenges: The nature of Palantir's work may expose it to potential legal challenges concerning data handling and privacy.

3. Valuation and Investment Strategy

Understanding Palantir's valuation and potential investment strategies is critical for making informed decisions.

3.1 Analyzing Palantir's Current Valuation:

Several metrics provide insights into Palantir’s valuation, including its market capitalization, P/E ratio, and other key financial ratios. Comparing these to industry peers provides context.

- Current Stock Price and Valuation Multiples: Analyzing the current stock price, P/E ratio, and other valuation multiples allows for a comparison with similar companies to gauge if the stock is undervalued or overvalued.

- Comparison to Competitors' Valuations: Comparing Palantir's valuation metrics to its major competitors is crucial to determine if its price reflects its growth potential and risks.

3.2 Potential Investment Strategies for Palantir Stock:

Investors can adopt various strategies based on their risk tolerance and investment horizon.

- Buy and Hold Strategy: A long-term buy-and-hold approach can be suitable for investors with a higher risk tolerance and a long-term investment horizon.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of stock price fluctuations. This strategy helps mitigate risk.

- Options Trading (Advanced): Options trading offers more complex strategies, but requires a sophisticated understanding of financial markets and carries significant risk. Only experienced investors should consider this.

4. Conclusion: Should You Invest in Palantir in 2024?

Investing in Palantir in 2024 presents both compelling opportunities and substantial risks. The potential for a 40% increase in 2025 is certainly attractive, fueled by strong growth potential in the data analytics and AI markets. However, intense competition, geopolitical risks, and regulatory uncertainties present significant headwinds. A thorough understanding of Palantir’s financial performance, its competitive landscape, and the inherent risks is paramount.

While investing in Palantir presents both significant opportunities and potential risks, thorough research into Palantir’s financial performance and future prospects is crucial before making any investment decisions. The potential for significant returns is undeniable, but due diligence regarding Palantir stock is essential.

Featured Posts

-

Judge Who Jailed Boris Becker Appointed To Chair Nottingham Attacks Inquiry

May 10, 2025

Judge Who Jailed Boris Becker Appointed To Chair Nottingham Attacks Inquiry

May 10, 2025 -

Transgender Rights The Impact Of Trumps Policies

May 10, 2025

Transgender Rights The Impact Of Trumps Policies

May 10, 2025 -

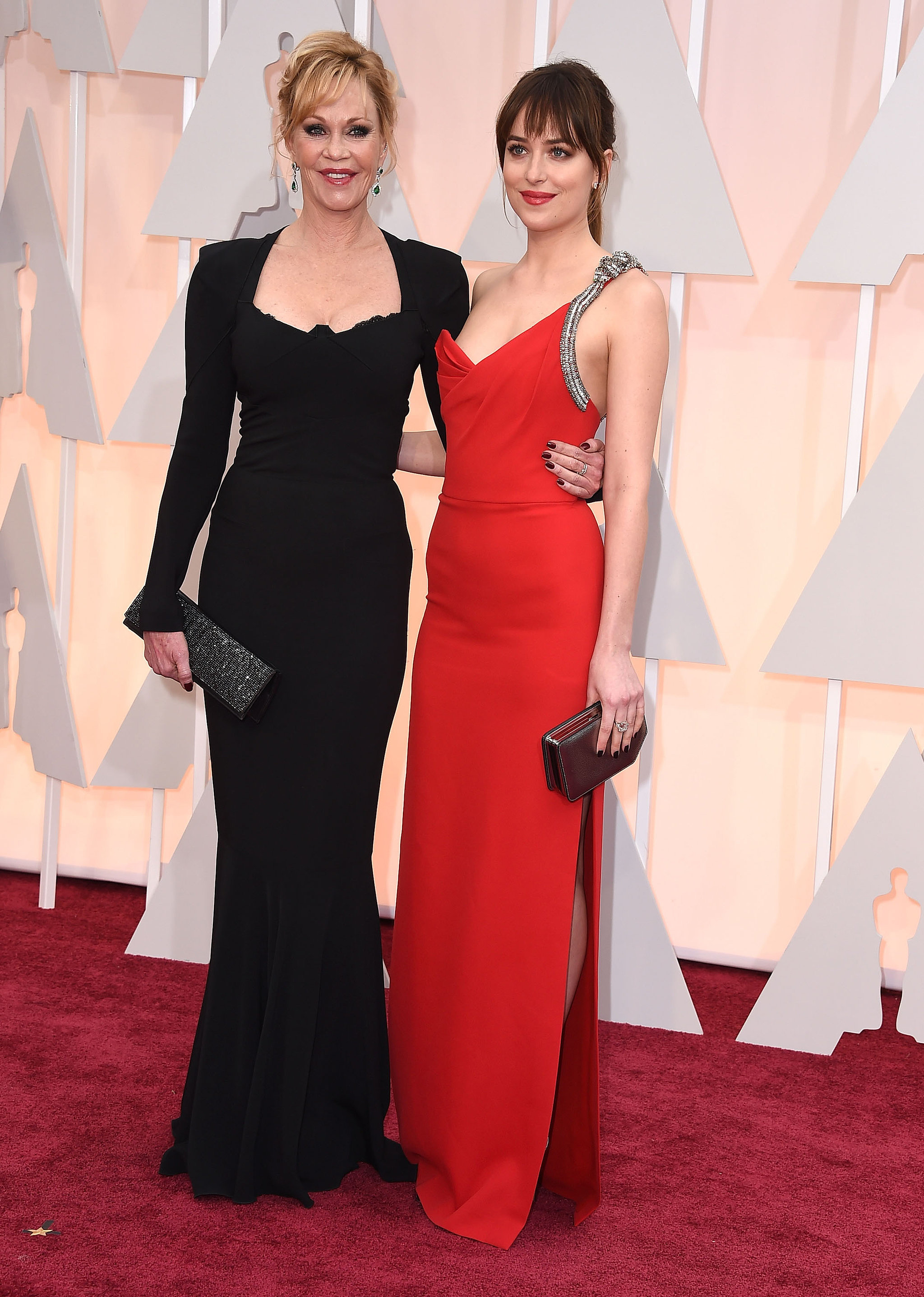

Spring Fashion Inspiration Dakota Johnson And Melanie Griffiths Looks

May 10, 2025

Spring Fashion Inspiration Dakota Johnson And Melanie Griffiths Looks

May 10, 2025 -

Indian Stock Market Update Sensex Nifty Performance And Key Movers

May 10, 2025

Indian Stock Market Update Sensex Nifty Performance And Key Movers

May 10, 2025 -

Canadas Housing Crisis High Down Payments Price Out Buyers

May 10, 2025

Canadas Housing Crisis High Down Payments Price Out Buyers

May 10, 2025