Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Analysis

Table of Contents

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is primarily influenced by the performance of its underlying assets – the 30 companies comprising the DJIA. However, several other factors play a significant role:

-

DJIA Index Performance: The primary driver of the ETF's NAV is the overall performance of the DJIA. Positive market movements in the index generally translate to a higher NAV, and vice-versa. Understanding the market forces impacting the DJIA is therefore key to predicting NAV fluctuations.

-

Currency Fluctuations: For international investors, currency exchange rates between their local currency and the ETF's base currency (likely USD) can impact the NAV. A strengthening dollar against an investor's home currency will result in a lower NAV expressed in their local currency, even if the DJIA's performance is positive.

-

Expense Ratios and Management Fees: The ETF's expense ratio and management fees directly impact its NAV. These fees are deducted from the ETF's assets, leading to a slightly lower NAV than it might otherwise have. Choosing an ETF with a competitive expense ratio is crucial for maximizing returns.

-

Tracking Error: While aiming to closely mirror the DJIA, ETFs can experience a small degree of tracking error. This difference between the ETF's performance and the index's performance affects the NAV, albeit usually minimally.

Analyzing Historical NAV Data of the Amundi Dow Jones Industrial Average UCITS ETF

Analyzing historical NAV trends is essential for understanding the ETF's long-term performance and volatility. This analysis helps investors gauge the risk associated with the investment and inform their decisions.

-

Access to Data: Historical NAV data is typically available on the Amundi website, major financial news platforms like Yahoo Finance and Google Finance, and through brokerage account platforms.

-

Analytical Methods: Charting the NAV over time, alongside the DJIA's performance, provides a visual representation of the ETF's tracking capabilities. Spreadsheets can be used to calculate percentage changes in NAV and compare them to the DJIA's returns.

-

Long-Term vs. Short-Term: While short-term fluctuations in NAV are normal, focusing on longer-term trends (e.g., 3-5 years or more) provides a more accurate picture of the ETF's consistent performance and potential for growth.

Comparing the Amundi Dow Jones Industrial Average UCITS ETF NAV to Competitors

Comparing the Amundi Dow Jones Industrial Average UCITS ETF's NAV performance to similar ETFs tracking the DJIA allows for a more informed investment choice. Key factors to compare include:

-

Competitor ETFs: Several other ETFs track the DJIA; research these to identify potential alternatives.

-

Expense Ratios and Tracking Errors: Compare expense ratios to ensure you're selecting a cost-effective option, and analyze tracking errors to determine how closely each ETF mirrors the DJIA's performance.

-

Relative NAV Performance: Compare the historical NAV performance of different ETFs over various periods to see which has provided better returns after adjusting for expense ratios.

Interpreting NAV Changes and Implications for Investment Strategies

Understanding how to interpret NAV changes is vital for making informed investment decisions.

-

NAV Increases: Increases in NAV generally indicate potential capital gains and reflect positive performance of the underlying DJIA.

-

NAV Decreases: Decreases signal potential capital losses, reflecting negative movements in the DJIA.

-

Dividend Distributions: Remember that dividend distributions from the underlying companies will generally affect the NAV, usually leading to a decrease immediately after the dividend is paid.

-

Buy/Sell Decisions: Analyzing NAV trends alongside other market indicators can assist in determining optimal buy and sell points within your investment strategy. A consistently rising NAV may suggest holding or even increasing your investment, while a prolonged decline may signal a need to reassess.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Analysis

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is influenced by multiple factors, including the DJIA's performance, currency fluctuations (for international investors), expense ratios, and tracking error. Analyzing historical NAV data, comparing it to competitor ETFs, and understanding how to interpret NAV changes are crucial for making informed investment decisions. Before investing in the Amundi Dow Jones Industrial Average UCITS ETF, conduct a thorough NAV analysis to assess its historical performance, compare it against other DJIA-tracking ETFs, and ascertain its suitability within your overall investment strategy. Remember, understanding NAV is key to successful Amundi Dow Jones Industrial Average UCITS ETF investing. Use reputable financial websites and consult with a financial advisor if needed.

Featured Posts

-

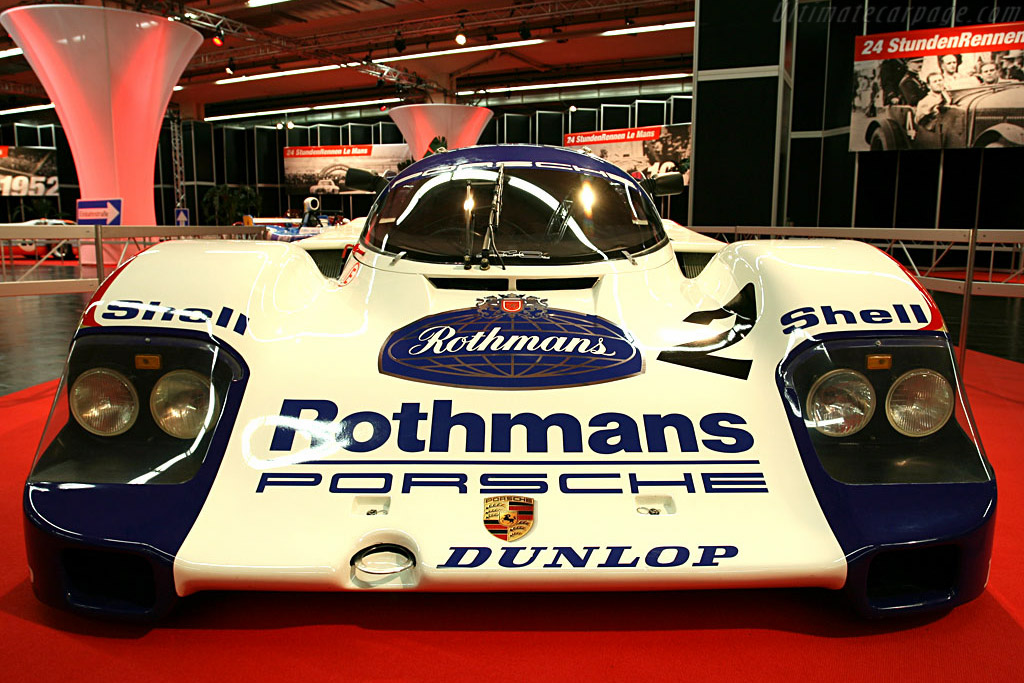

Porsche 956 Nin Tavan Sergisinin Sirri

May 25, 2025

Porsche 956 Nin Tavan Sergisinin Sirri

May 25, 2025 -

Ai Ar

May 25, 2025

Ai Ar

May 25, 2025 -

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis

May 25, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis

May 25, 2025 -

Bbc Radio 1 Big Weekend 2024 Blossoms Biffy Clyro Jorja Smith And The Full Lineup Revealed

May 25, 2025

Bbc Radio 1 Big Weekend 2024 Blossoms Biffy Clyro Jorja Smith And The Full Lineup Revealed

May 25, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025 -

17 Celebrities Whose Careers Ended Suddenly

May 25, 2025

17 Celebrities Whose Careers Ended Suddenly

May 25, 2025 -

The 17 Biggest Celebrity Reputation Implosions

May 25, 2025

The 17 Biggest Celebrity Reputation Implosions

May 25, 2025 -

17 Celebrities Who Destroyed Their Careers Overnight

May 25, 2025

17 Celebrities Who Destroyed Their Careers Overnight

May 25, 2025 -

The Love Lives Of Frank Sinatra His Four Wives And Their Impact

May 25, 2025

The Love Lives Of Frank Sinatra His Four Wives And Their Impact

May 25, 2025