Is Apple Vulnerable? Examining The Impact Of Tariffs On Buffett's Holdings

Table of Contents

Understanding the Scope of Buffett's Apple Investment

Berkshire Hathaway's investment in Apple is monumental, representing a cornerstone of its portfolio. The sheer size of this "Buffett Apple Holdings" stake makes it a significant factor in both Apple's valuation and the overall performance of Berkshire Hathaway. Buffett's initial investment, driven by his belief in Apple's brand strength and loyal customer base, has yielded significant returns. However, this massive investment isn't without its risks, particularly given the increasing global uncertainty surrounding trade.

- Investment Timeline: Berkshire Hathaway began accumulating Apple shares in 2016, gradually increasing its position over several years.

- Current Holdings: As of [Insert most recent data available], Berkshire Hathaway owns approximately [Insert percentage or number of shares] of Apple stock, representing a multi-billion dollar investment.

- Potential ROI: The potential return on investment for Berkshire Hathaway's Apple holdings is substantial, but heavily influenced by external factors such as tariffs, market sentiment, and competition.

The Impact of Tariffs on Apple's Supply Chain and Profitability

Tariffs, particularly those impacting goods manufactured in China, pose a considerable threat to Apple's intricate supply chain. A significant portion of Apple's products are assembled in China, and many components are sourced from various countries worldwide. Tariffs on imported components directly increase Apple's production costs. This cost increase forces Apple to grapple with several crucial strategic decisions: absorb the added expenses, raise prices, or seek alternative manufacturing locations.

- Affected Components: Tariffs impact various components, including displays, processors, and memory chips, all crucial for Apple's product lineup. Increased tariffs on these components could significantly increase the cost of production for iPhones, iPads, Macs, and other Apple products.

- Impact on Product Lines: The impact of tariffs varies across different Apple product lines. Higher-priced products like iPhones might be more resistant to price sensitivity, while more budget-friendly iPads or Macs might see a greater impact on demand due to price increases.

- Pricing Strategy: Apple's renowned pricing strategy balances premium branding with competitive pricing. Tariffs could force Apple to adjust its pricing model, potentially impacting sales volume and market share.

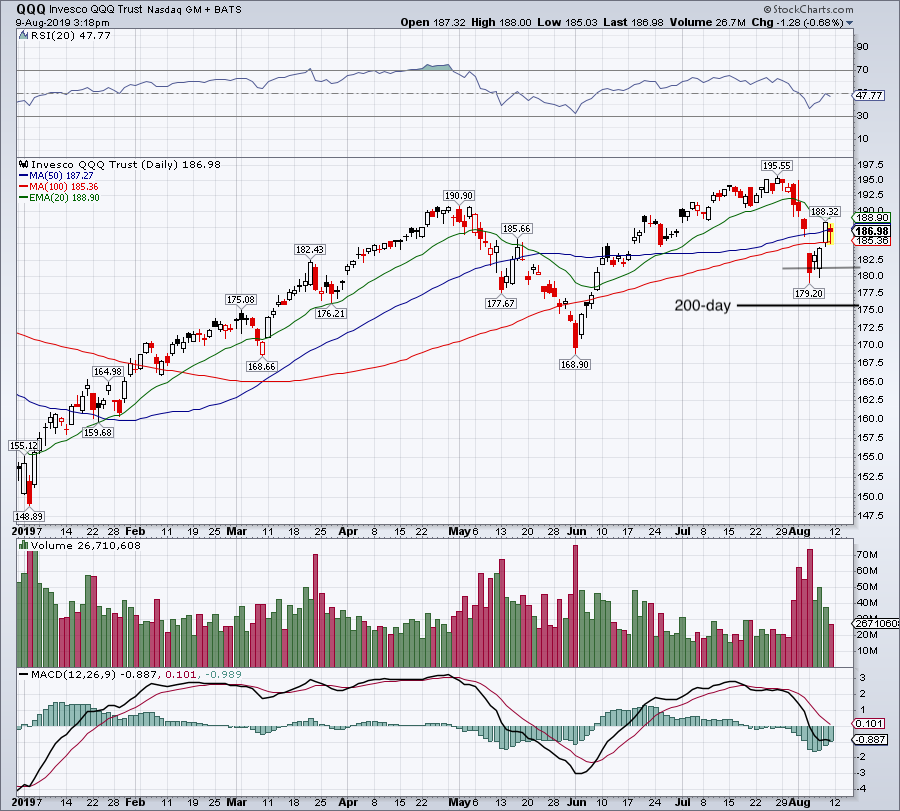

Assessing the Risk to Buffett's Apple Holdings

The potential financial consequences for Berkshire Hathaway are significant if Apple's stock price drops due to increased trade tensions and tariffs. However, Berkshire Hathaway's diversified portfolio acts as a buffer against such risks. The company's holdings span various sectors, reducing the overall impact of any single investment's decline.

- Scenario Analysis: A moderate increase in tariffs could result in a [Insert percentage] drop in Apple's stock price, potentially impacting Berkshire Hathaway's bottom line. A significant escalation of trade wars could lead to a more substantial decrease.

- Diversification: Berkshire Hathaway's portfolio diversification strategy mitigates the risk associated with its Apple holdings. Investments in other sectors help offset potential losses from a decline in Apple's stock price.

- Apple's Response: Apple could respond by adjusting its pricing strategy, shifting production to other countries, or negotiating with governments to alleviate tariff impacts.

Alternative Investment Strategies and the Future of Apple

Investors concerned about Apple's vulnerability to tariffs might consider diversifying their portfolios to include companies less reliant on global supply chains or those operating in sectors less susceptible to trade disputes. The tech sector itself offers many alternatives.

- Alternative Tech Investments: Consider investments in companies with stronger domestic manufacturing capabilities or those focusing on software and services rather than hardware.

- Long-Term Outlook: Despite the challenges posed by tariffs, Apple's long-term growth prospects remain strong. Its brand loyalty, innovation, and diversified product portfolio are key strengths.

- Adaptation and Resilience: Apple's history shows its ability to adapt to changing market conditions. The company is likely to find strategies to mitigate the impact of tariffs over time.

Conclusion: Is Apple Truly Vulnerable? A Look at the Future

The impact of tariffs on Apple and, consequently, Buffett's significant "Buffett Apple Holdings," presents a complex scenario. While the risks associated with "Apple Tariffs" and their effect on "Apple Stock Vulnerability" are undeniable, Apple’s resilience, brand strength, and Berkshire Hathaway's diversified investment strategy offer some mitigation. The long-term outlook for Apple remains positive, but investors should carefully analyze the evolving geopolitical landscape and its potential effects on their portfolios. Conduct further research on Apple's financial performance in relation to tariffs and make informed investment decisions based on your risk tolerance regarding "Apple Tariffs" and "Buffett's Apple Holdings." [Link to relevant financial news sources or research reports].

Featured Posts

-

2 Fall On Amsterdam Stock Exchange Impact Of Trumps Tariffs

May 24, 2025

2 Fall On Amsterdam Stock Exchange Impact Of Trumps Tariffs

May 24, 2025 -

Konchita Vurst Kak Se Promeni Sled Pobedata Na Evroviziya

May 24, 2025

Konchita Vurst Kak Se Promeni Sled Pobedata Na Evroviziya

May 24, 2025 -

Tathyr Atfaq Altjart Alsyny Alamryky Ela Mwshr Daks Wswlh Ila 24 Alf Nqtt

May 24, 2025

Tathyr Atfaq Altjart Alsyny Alamryky Ela Mwshr Daks Wswlh Ila 24 Alf Nqtt

May 24, 2025 -

Nicki Chapman Shares Her Beautiful Chiswick Garden On Escape To The Country

May 24, 2025

Nicki Chapman Shares Her Beautiful Chiswick Garden On Escape To The Country

May 24, 2025 -

Annie Kilner Spotted Without Wedding Ring Following Kyle Walkers Night Out

May 24, 2025

Annie Kilner Spotted Without Wedding Ring Following Kyle Walkers Night Out

May 24, 2025

Latest Posts

-

Tax Bills Impact Stock Market Bond And Bitcoin Price Movements

May 24, 2025

Tax Bills Impact Stock Market Bond And Bitcoin Price Movements

May 24, 2025 -

Stock Market Today Analysis Of Bond Sell Off And Bitcoins Rise

May 24, 2025

Stock Market Today Analysis Of Bond Sell Off And Bitcoins Rise

May 24, 2025 -

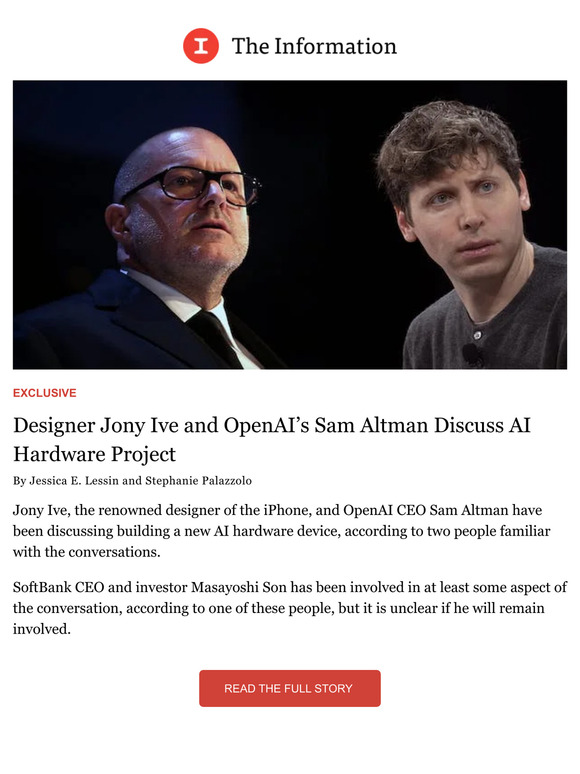

Sam Altmans New Project An Exclusive Look At The Collaboration With Jony Ive

May 24, 2025

Sam Altmans New Project An Exclusive Look At The Collaboration With Jony Ive

May 24, 2025 -

Dow Futures And Bitcoin Stock Market Analysis Following Tax Bill Vote

May 24, 2025

Dow Futures And Bitcoin Stock Market Analysis Following Tax Bill Vote

May 24, 2025 -

Shooting Near Jewish Museum In Washington Israeli Embassy Staff Among Victims

May 24, 2025

Shooting Near Jewish Museum In Washington Israeli Embassy Staff Among Victims

May 24, 2025