Iron Ore Falls As China Curbs Steel Output: Market Impact Analysis

Table of Contents

China's Steel Production Curb: The Driving Force

China's decision to curtail steel production stems from a confluence of factors, primarily focused on environmental concerns and a slowdown in the real estate sector. These interconnected elements have created a perfect storm, impacting global iron ore demand.

Environmental Regulations and Their Impact

Tightening environmental regulations in China are playing a crucial role in reducing steel output. The government is aggressively pursuing a greener economy, and the steel industry, a significant source of pollution, is under intense scrutiny.

- Increased fines for exceeding emission limits: Companies exceeding emission limits face substantially higher fines, making environmentally responsible production a financial imperative.

- Stricter environmental audits: More frequent and rigorous audits are ensuring greater compliance with environmental regulations.

- Promotion of green steel initiatives: The government actively promotes and incentivizes the adoption of more sustainable steel production methods, including the use of renewable energy and carbon capture technologies.

These measures directly affect the demand for iron ore. As steel production decreases, so too does the need for the primary raw material: iron ore. This creates a chain reaction impacting prices and market stability.

Real Estate Market Slowdown and its Effect on Steel Demand

China's slowing real estate sector is another significant factor contributing to the reduced demand for steel. The construction industry, a major consumer of steel, has experienced a noticeable slowdown.

- Reduced construction activity: Fewer new buildings and infrastructure projects mean less steel is needed.

- Impact on infrastructure projects: Government-led infrastructure projects, traditionally a major driver of steel demand, have also slowed down.

- Government policies aimed at controlling property speculation: Policies designed to curb property speculation have further dampened construction activity.

The reduced construction activity translates directly into lower steel demand, which, in turn, leads to decreased demand for iron ore, further impacting prices and market stability. This creates a domino effect throughout the supply chain.

Impact on Iron Ore Prices and Global Markets

The curtailment of China's steel production has had a profound impact on iron ore prices and the global commodities market.

Price Volatility and Market Fluctuations

Iron ore prices have experienced significant drops, resulting in considerable market instability. This volatility is driven by a number of factors, including reduced demand and market speculation.

- Charts illustrating price fluctuations: (Insert relevant charts and graphs showing price fluctuations). These visuals clearly demonstrate the impact of reduced steel production on iron ore prices.

- Analysis of trading volumes: Trading volumes have also been affected, reflecting the uncertainty in the market.

- Discussions on speculation and market sentiment: Market sentiment plays a crucial role, with negative news further exacerbating price drops.

For example, the price of iron ore fell by X% in the last quarter, directly impacting producers and traders. This price volatility makes it extremely challenging to predict future market trends.

Impact on Major Iron Ore Producers

Major iron ore producing countries like Australia and Brazil are feeling the pinch. The price drop significantly impacts their economies and industries.

- Impact on export revenues: Reduced iron ore prices translate directly into lower export revenues for these nations.

- Potential job losses: The decline in demand could lead to job losses in mining and related industries.

- Government responses to the crisis: Governments are implementing various strategies to mitigate the negative impacts.

These countries may need to explore diversification strategies, investing in other sectors to reduce their reliance on the iron ore market.

Future Outlook and Market Predictions

Predicting the future of the iron ore market requires careful consideration of various factors.

Potential for a Market Recovery

Several scenarios could lead to a rebound in iron ore prices.

- Factors that could lead to increased demand: A resurgence in global construction activity or a shift in China's economic policies could increase demand.

- Potential for government intervention: Government intervention to stabilize the market is a possibility.

- Analysis of long-term growth prospects for the steel industry: Long-term growth prospects for the steel industry will play a critical role in influencing iron ore demand.

The possibility of China relaxing its environmental regulations in the future, or finding ways to balance environmental concerns with economic growth, could also positively impact iron ore prices.

Strategic Implications for Investors and Businesses

Navigating the current volatility requires careful strategic planning.

- Risk assessment: Thorough risk assessments are crucial for investors and businesses operating in this sector.

- Diversification strategies: Diversification is key to mitigating risk.

- Long-term investment plans: Developing long-term investment plans that account for market fluctuations is essential.

Businesses should actively monitor market trends and adapt their strategies to reflect changing conditions. Conservative approaches and careful risk management are recommended.

Conclusion

China's steel production curbs, driven by environmental concerns and a slowing real estate market, have significantly impacted iron ore prices. This has created volatility in the global commodities market, affecting producers and investors alike. The interplay between environmental regulations, real estate trends, and global demand for steel will continue to shape the iron ore market for the foreseeable future.

Call to Action: Stay informed about fluctuations in iron ore prices and China's steel output. Understanding the interplay between these factors is crucial for navigating the complexities of the global commodities market and making informed decisions related to iron ore investment and steel market analysis. Regularly monitor market trends and consult expert analysis to effectively manage risk within the iron ore market.

Featured Posts

-

Scho Skazav Stiven King Pro Trampa Ta Maska

May 10, 2025

Scho Skazav Stiven King Pro Trampa Ta Maska

May 10, 2025 -

Post Roe America How Over The Counter Birth Control Changes The Landscape

May 10, 2025

Post Roe America How Over The Counter Birth Control Changes The Landscape

May 10, 2025 -

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025 -

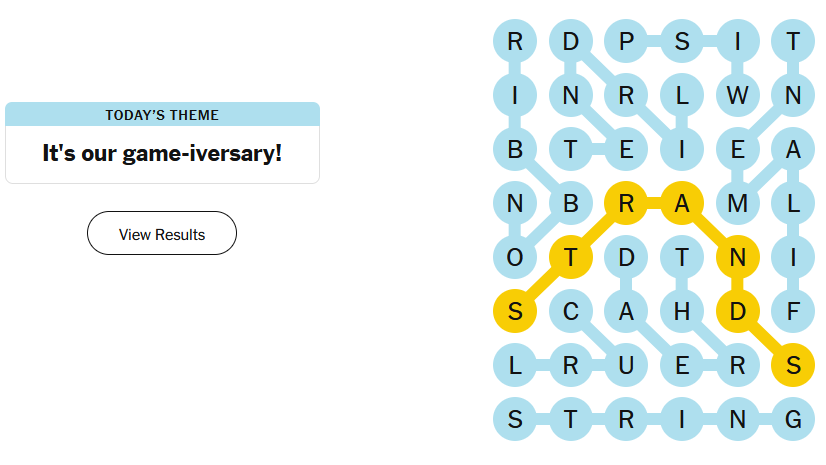

Nyt Strands Game 366 Solutions And Clues For March 4th

May 10, 2025

Nyt Strands Game 366 Solutions And Clues For March 4th

May 10, 2025 -

The Posthaste Problem High Down Payments And The Canadian Dream

May 10, 2025

The Posthaste Problem High Down Payments And The Canadian Dream

May 10, 2025