The Posthaste Problem: High Down Payments And The Canadian Dream

Table of Contents

The Soaring Cost of Down Payments in Canada

The Canadian real estate market has experienced significant price increases in recent years, leading to a corresponding surge in the required down payment. This "Posthaste Problem" makes homeownership increasingly difficult for many Canadians, especially first-time buyers. Average home prices vary drastically across the country, impacting down payment requirements significantly.

-

Average down payment percentages required for different property types: For example, purchasing a condo might require a 5% down payment, while a detached home often necessitates a 20% down payment or more, significantly increasing the financial hurdle. These percentages can fluctuate depending on the lender and the specific circumstances of the mortgage.

-

Regional variations in home prices and down payment requirements: The cost of housing in major metropolitan areas like Toronto and Vancouver is drastically higher than in smaller cities or rural areas. This disparity translates directly to higher down payment requirements in expensive markets, effectively pricing many potential buyers out of the market. In contrast, cities like Calgary or Halifax may present more accessible home prices and thus lower down payment needs.

-

The impact of rising interest rates on affordability and down payment needs: Recent interest rate hikes have further exacerbated the affordability crisis. Higher interest rates not only increase monthly mortgage payments but also reduce borrowing power, requiring larger down payments to secure a mortgage. This makes saving for a down payment even more challenging for prospective homebuyers.

The Impact on First-Time Homebuyers

The Posthaste Problem disproportionately affects first-time homebuyers in Canada. The burden of saving a substantial down payment while simultaneously managing student loans, rent, and other living expenses creates significant financial strain. This generation gap in homeownership is widening, with many young adults facing a considerably longer timeframe to achieve their homeownership goals.

-

The lengthening timeframe required to save a down payment: Saving for a down payment is a significant undertaking that requires careful financial planning and discipline. In many cases, the time required to accumulate the necessary funds has increased dramatically, delaying homeownership for years, if not decades.

-

The impact of rising living costs on saving capacity: Increased costs for groceries, transportation, and utilities significantly reduce disposable income, making it harder to allocate funds towards a down payment. This constant pressure on household budgets adds to the stress and difficulty of saving for a down payment.

-

The psychological impact of delayed homeownership: The prolonged struggle to save for a down payment can create considerable emotional distress and feelings of hopelessness. The desire to build equity and have a stable home can be greatly impacted, affecting mental well-being and overall life satisfaction.

Potential Solutions and Strategies

While the Posthaste Problem presents significant challenges, various strategies can help aspiring homeowners overcome the high down payment hurdle. Exploring available government programs, alternative mortgage options, and sound financial planning are key to achieving homeownership goals.

-

Overview of available government programs (e.g., CMHC): The Canada Mortgage and Housing Corporation (CMHC) offers various programs designed to assist first-time homebuyers, including mortgage loan insurance for high-ratio mortgages (mortgages with down payments less than 20%).

-

Exploring options like shared equity mortgages: Shared equity mortgages allow homebuyers to purchase a property with a smaller down payment by sharing equity with a third party, such as a family member or government program.

-

Smart saving techniques and budgeting strategies: Creating a detailed budget, tracking expenses, and identifying areas to cut back are essential steps in accelerating the down payment saving process. Seeking advice from a financial advisor can also provide a personalized plan.

-

Seeking professional financial advice: A financial advisor can provide tailored guidance on saving strategies, budgeting techniques, and exploring suitable mortgage options based on individual circumstances and financial goals.

The Future of Homeownership in Canada

The high down payment problem presents significant challenges to the long-term sustainability of the Canadian housing market. Addressing this issue requires a multi-faceted approach involving government intervention and policy adjustments.

-

Predictions for future home prices and down payment requirements: Without significant changes, home prices and down payment requirements are expected to continue rising, making homeownership increasingly unattainable for many Canadians.

-

Potential government interventions to improve affordability: Government initiatives aimed at increasing housing supply, regulating speculation, and providing additional financial assistance to homebuyers are crucial in mitigating the Posthaste Problem.

-

The impact of changing demographics on the housing market: Canada’s changing demographics, including an aging population and increasing urbanization, will continue to impact the housing market and influence housing policy decisions.

Conclusion

The high cost of down payments in Canada presents a significant barrier to achieving the Canadian dream of homeownership, impacting first-time buyers disproportionately. This "Posthaste Problem" requires a comprehensive solution, combining personal financial planning with government intervention. By exploring government programs like those offered by CMHC, adopting smart saving strategies, and seeking professional financial advice, Canadians can navigate the challenges and work towards their homeownership goals. Don't let the Posthaste Problem discourage you; take proactive steps to understand your options and begin planning your path towards homeownership. Share your experiences and insights to help others overcome the high down payment hurdle and ensure the Canadian dream remains attainable for all.

Featured Posts

-

The Benson Boone Harry Styles Comparison Fact Or Fiction

May 10, 2025

The Benson Boone Harry Styles Comparison Fact Or Fiction

May 10, 2025 -

Hurun Global Rich List 2025 A 100 Billion Loss Doesnt Stop Elon Musks Reign

May 10, 2025

Hurun Global Rich List 2025 A 100 Billion Loss Doesnt Stop Elon Musks Reign

May 10, 2025 -

Trumps Legacy A New Trade Pact With Britain

May 10, 2025

Trumps Legacy A New Trade Pact With Britain

May 10, 2025 -

Accelerating Sea Level Rise Threats To Coastal Cities And Towns

May 10, 2025

Accelerating Sea Level Rise Threats To Coastal Cities And Towns

May 10, 2025 -

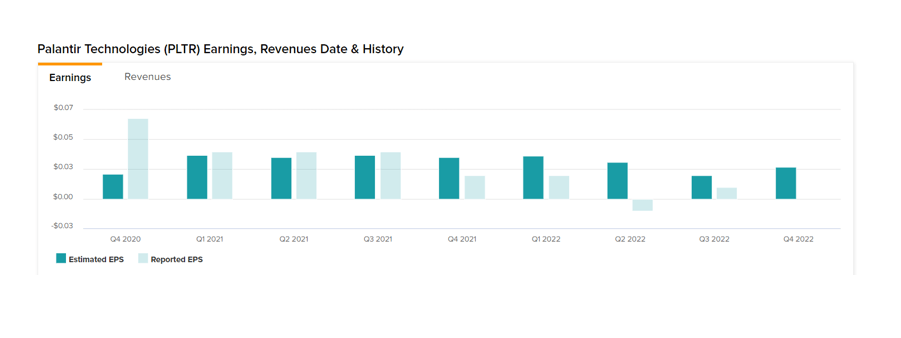

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 10, 2025

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 10, 2025