Is An Ethereum Price Breakout On The Horizon? Analyzing Recent Resilience

Table of Contents

Ethereum's Recent Price Performance and Resilience

Ethereum's price has demonstrated remarkable resilience amidst broader market fluctuations. While experiencing dips, it has consistently shown signs of recovery, suggesting underlying strength. This resilience can be attributed to several factors, including significant network upgrades, the continued growth of the DeFi ecosystem, and increasing institutional interest.

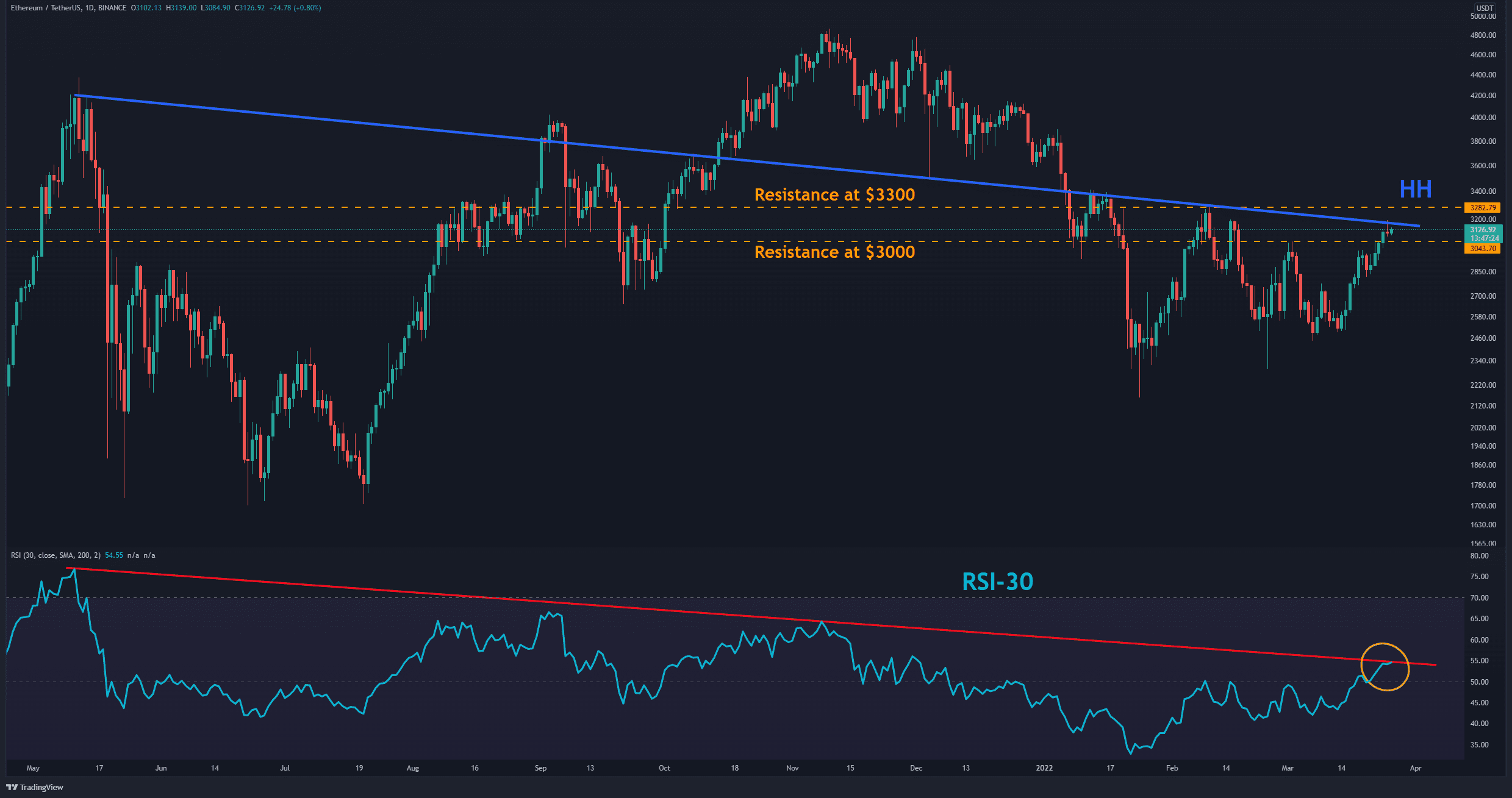

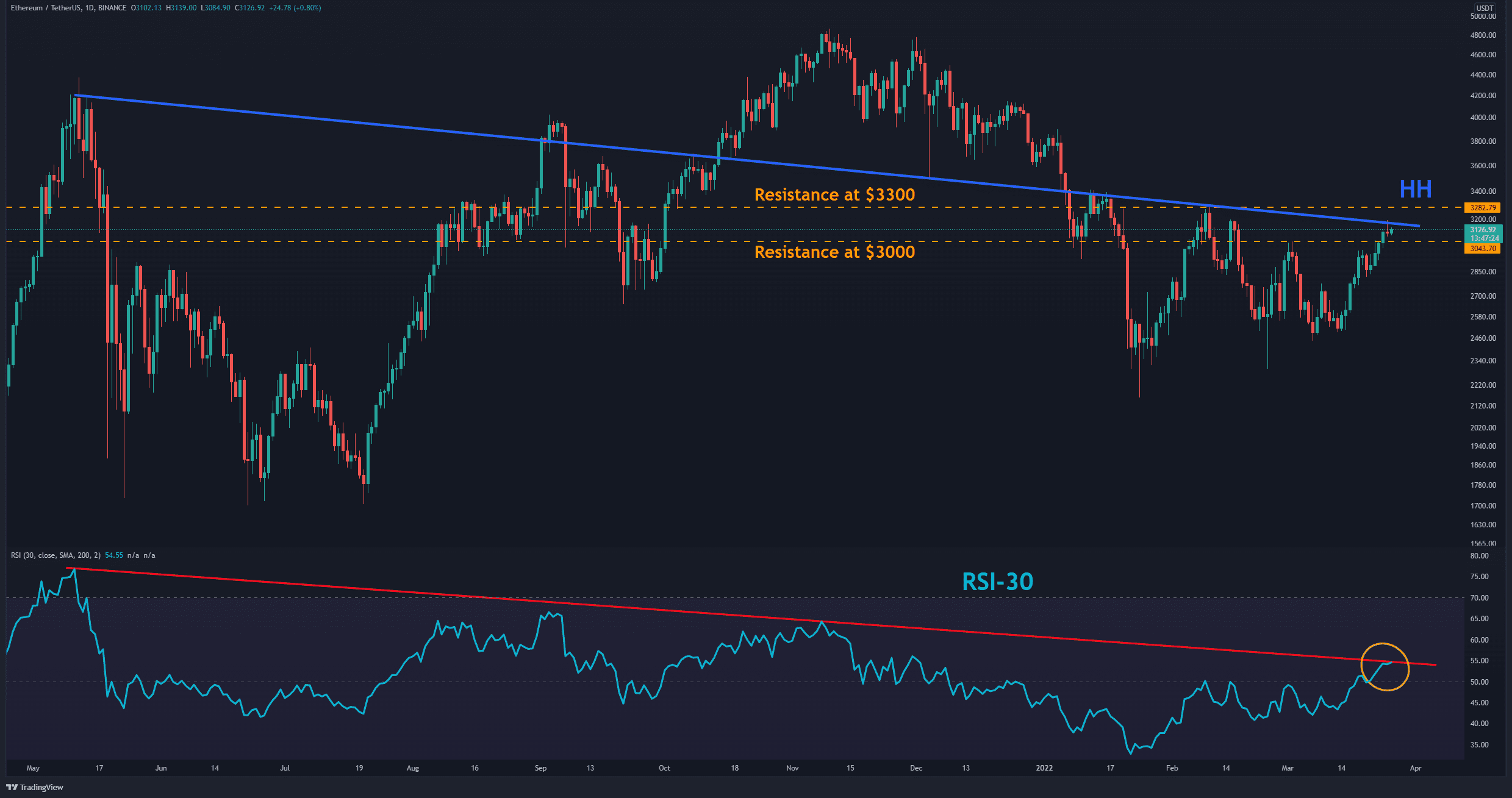

- Price Movements: Over the past [insert time period, e.g., quarter], Ethereum's price fluctuated between [low price] and [high price], showcasing a [percentage change] overall. This compares to Bitcoin's [percentage change] during the same period, indicating relative strength. Key support levels were observed around [price] while resistance was encountered at [price].

- Contributing Factors: Network upgrades like [mention specific upgrades] have improved scalability and efficiency, attracting developers and users. The thriving DeFi ecosystem continues to drive demand, with [mention key DeFi applications and their TVL]. Finally, growing institutional adoption, with significant investments from [mention examples of institutional investors], contributes to price stability and potential future growth. This confluence of positive factors significantly strengthens the case for a potential Ethereum price breakout.

[Insert chart or graph visualizing Ethereum's price performance over the specified period, clearly labeled and with key support/resistance levels marked.]

Analyzing Key On-Chain Metrics

On-chain data provides valuable insights into the underlying health and activity of the Ethereum network, offering clues about potential price movements. Examining key metrics helps us gauge the strength of the network and predict future trends.

- Transaction Volume: Recent transaction volume has [increased/decreased/remained stable], averaging [number] transactions per day. This indicates [interpretation – e.g., increased network activity suggesting bullish sentiment].

- Active Addresses: The number of active addresses has [increased/decreased/remained stable], suggesting [interpretation – e.g., growing user base is a positive indicator].

- Gas Fees: Gas fees have [increased/decreased/remained stable], reflecting [interpretation – e.g., high fees can indicate network congestion but also strong demand]. The trend in gas fees correlates [positively/negatively/weakly] with the price of Ethereum.

Analyzing these metrics together provides a comprehensive picture of the network's activity and health, crucial for assessing the potential for an Ethereum price breakout.

The Role of Ethereum Development and Upgrades

Ethereum's ongoing development and planned upgrades are pivotal for its long-term growth and price appreciation. These improvements address scalability and efficiency challenges, making the network more attractive to developers and users.

- Sharding: The implementation of sharding is expected to significantly improve transaction throughput and reduce congestion, lowering gas fees and boosting overall network efficiency.

- Layer-2 Solutions: The proliferation of Layer-2 scaling solutions like [mention examples, e.g., Optimism, Arbitrum] further enhances scalability and user experience.

- Timeline: While precise timelines vary, many of these upgrades are expected to be implemented within the next [timeframe], potentially catalyzing a significant Ethereum price breakout.

These advancements contribute to Ethereum's long-term value proposition, making it a more attractive investment and potentially driving up its price.

Market Sentiment and Institutional Investment

Market sentiment and institutional investment play a crucial role in shaping Ethereum's price. Positive sentiment and increased institutional participation can fuel price rallies, while negative sentiment can lead to price corrections.

- Sentiment Indicators: Social media sentiment, news coverage, and analyst predictions currently indicate a [bullish/bearish/neutral] outlook on Ethereum.

- Institutional Investors: Major institutional players like [mention examples] have shown increased interest in Ethereum, indicating growing confidence in its long-term prospects.

- Recent News: Recent news events, such as [mention specific news events and their impact], have influenced market sentiment and investor confidence.

The interplay between market sentiment and institutional investment significantly influences the likelihood of an Ethereum price breakout.

Technical Analysis: Predicting an Ethereum Price Breakout

Technical analysis provides another lens through which to assess the potential for an Ethereum price breakout. By studying charts and key indicators, we can identify potential breakout patterns and price targets.

- Moving Averages: The [50-day/200-day] moving average is currently [above/below] the price, suggesting [bullish/bearish] momentum.

- RSI/MACD: The RSI and MACD indicators show [overbought/oversold/neutral] conditions, indicating potential for a [price increase/price decrease/continuation of the current trend].

- Chart Patterns: The chart exhibits [mention specific chart patterns, e.g., head and shoulders, cup and handle], which may suggest an upcoming [breakout/breakdown]. Potential price targets based on these patterns are [price range].

Technical analysis, combined with fundamental analysis, enhances our understanding of the potential for an Ethereum price breakout.

Conclusion: Is an Ethereum Price Breakout Imminent? A Final Look

Our analysis suggests a strong potential for an Ethereum price breakout, driven by Ethereum's resilience, positive on-chain metrics, significant development upgrades, improving market sentiment, and supportive technical indicators. However, it’s crucial to remember that the cryptocurrency market remains volatile, and both bullish and bearish scenarios are possible.

The confluence of factors examined – on-chain activity, network improvements, investor sentiment, and technical signals – paints a compelling picture of Ethereum’s potential. To make informed decisions regarding your Ethereum price prediction, it's vital to continue researching the market, stay updated on the latest developments, and conduct your own thorough Ethereum price analysis. Don't rely solely on this article; utilize diverse resources to create your own comprehensive Ethereum price forecast.

Featured Posts

-

Fqdan Alasnan Qst Barbwza Fy Merkt Marakana

May 08, 2025

Fqdan Alasnan Qst Barbwza Fy Merkt Marakana

May 08, 2025 -

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025 -

Realistic Wwii Movies Better Than Saving Private Ryan A Historians Perspective

May 08, 2025

Realistic Wwii Movies Better Than Saving Private Ryan A Historians Perspective

May 08, 2025 -

67 M Ethereum Liquidation Understanding The Risks And Potential Outcomes

May 08, 2025

67 M Ethereum Liquidation Understanding The Risks And Potential Outcomes

May 08, 2025 -

Microsoft Surface Pro 12 Inch A Compact Powerhouse

May 08, 2025

Microsoft Surface Pro 12 Inch A Compact Powerhouse

May 08, 2025