XRP Price On The Rise: Grayscale's ETF Application Under SEC Review

Table of Contents

Grayscale's ETF Application and its Impact on XRP Price

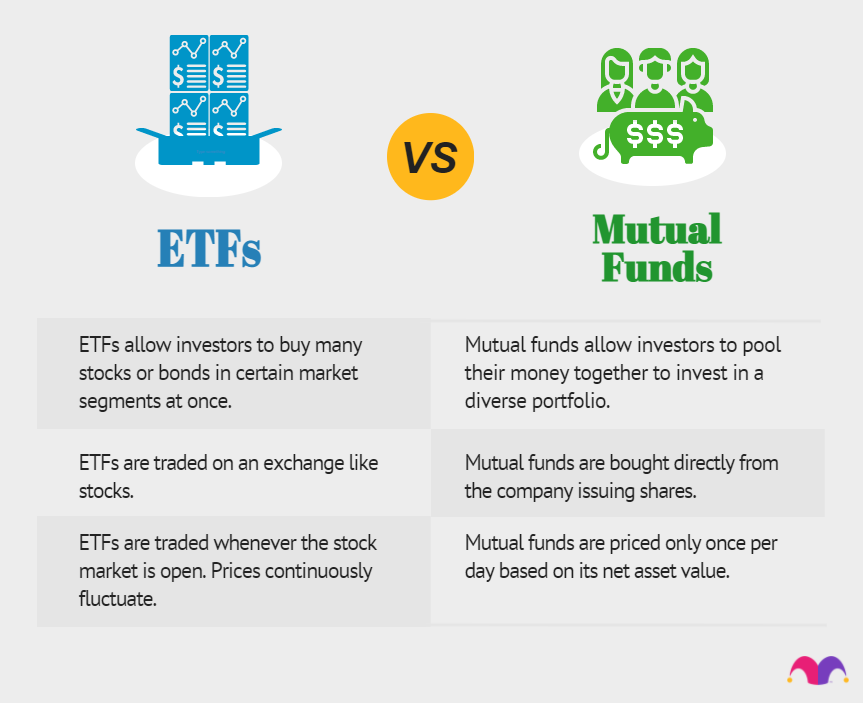

Grayscale Investments, a prominent player in the digital asset management space, has submitted an application to the Securities and Exchange Commission (SEC) for an XRP exchange-traded fund (ETF). This application, following the pattern of their successful Grayscale Bitcoin Trust (GBTC) and their ongoing pursuit of a spot Bitcoin ETF, holds significant weight in the cryptocurrency market. The approval of an XRP ETF would represent a monumental step towards mainstream acceptance of XRP as a legitimate investment asset.

-

Grayscale's History and Influence: Grayscale has established itself as a major player in the crypto investment world. Their success with GBTC, despite its initial challenges, demonstrated the potential for regulated crypto investment vehicles. Their influence on market sentiment is considerable, with announcements and filings often impacting cryptocurrency prices.

-

Specifics of the XRP ETF Application: Grayscale's XRP ETF application outlines a proposed investment vehicle that would allow investors to gain exposure to XRP through a regulated and easily accessible exchange-traded fund. This is a crucial step in increasing liquidity and reducing barriers to entry for potential XRP investors. The application details the fund's management, investment strategy, and risk factors.

-

SEC Review and Potential Timelines: The SEC's review process for ETF applications is notoriously rigorous and can take considerable time. The timeline for a decision remains uncertain, but the ongoing review itself fuels speculation and contributes to the current price volatility of XRP. Precedent set by previous ETF approvals (and rejections) will undoubtedly influence the SEC's decision.

-

Potential Positive Impact of SEC Approval: SEC approval of the XRP ETF could dramatically increase XRP's adoption rate. It would likely boost liquidity, attract institutional investment, and drive significant price appreciation. Increased trading volume and accessibility would make XRP a more attractive asset for a broader range of investors.

-

Potential Negative Scenarios: Conversely, rejection of the application could negatively impact XRP's price and investor sentiment. It would signal continued regulatory uncertainty and potentially hinder broader adoption. Understanding both positive and negative scenarios is crucial for informed investment decisions.

Other Factors Contributing to the XRP Price Increase

While Grayscale's ETF application is a significant catalyst, several other factors are contributing to the recent XRP price increase.

-

Ripple Lawsuit Developments: The ongoing Ripple vs. SEC lawsuit continues to play a vital role in influencing market sentiment. A favorable outcome for Ripple could significantly boost investor confidence and potentially drive a substantial price increase for XRP. Positive legal developments are constantly being monitored by investors.

-

Technological Advancements in the XRP Ecosystem: Improvements in XRP's transaction speed, reduced fees, and increased network scalability enhance its utility and attractiveness. These technological upgrades enhance the overall efficiency and usability of the XRP ledger.

-

Increased Adoption by Businesses and Institutions: Growing adoption of XRP by businesses for cross-border payments and other financial transactions contributes to increased demand and positive price pressure. Examples of real-world applications and partnerships can be key indicators of future price potential.

-

Overall Market Sentiment: The broader cryptocurrency market sentiment also influences XRP's price. Positive developments in the overall crypto market tend to benefit XRP, while negative sentiment can lead to price corrections. Market analysis incorporating other major cryptocurrencies (e.g., Bitcoin, Ethereum) offers valuable context.

Potential Future Price Predictions for XRP

Predicting the future price of XRP with certainty is impossible due to the inherent volatility of the cryptocurrency market. However, we can analyze plausible scenarios based on different outcomes.

-

Cautious Outlook and Volatility: It's crucial to remember that cryptocurrency investments are inherently risky, and significant price fluctuations are common. Past performance is not indicative of future results.

-

Analytical Approaches: Technical analysis, which focuses on price charts and patterns, and fundamental analysis, which considers factors like adoption rate and technological advancements, can offer insights, but they are not foolproof predictors.

-

Price Scenarios: A positive resolution to the Ripple lawsuit coupled with SEC approval of the Grayscale XRP ETF could lead to significant price appreciation. Conversely, a negative outcome in either could result in a price decline. Various scenarios and their associated probabilities should be considered.

-

Risk Management and Diversification: Responsible investment involves carefully managing risk through diversification. Never invest more than you can afford to lose, and always conduct thorough research.

Conclusion

The recent surge in XRP price is largely attributed to Grayscale's ETF application, but other factors like the Ripple lawsuit and technological advancements play significant roles. The SEC's decision regarding the XRP ETF will be pivotal in shaping XRP's future price trajectory. Remember, the cryptocurrency market is inherently volatile. Monitor the XRP price carefully, stay updated on the Grayscale XRP ETF application process, and research XRP investments thoroughly before making any decisions. Learn more about the future of XRP and its potential, but always be mindful of the associated risks. Conduct your own research and make informed decisions about investing in XRP.

Featured Posts

-

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025 -

Fortalezas Y Debilidades De Central Cordoba En El Contexto Del Gigante De Arroyito

May 08, 2025

Fortalezas Y Debilidades De Central Cordoba En El Contexto Del Gigante De Arroyito

May 08, 2025 -

Us Bond Etf Investments A Taiwanese Retreat

May 08, 2025

Us Bond Etf Investments A Taiwanese Retreat

May 08, 2025 -

Grayscale Etf Filing And Its Potential Impact On Xrp Price

May 08, 2025

Grayscale Etf Filing And Its Potential Impact On Xrp Price

May 08, 2025 -

Ethereums Bullish Run Price Analysis And Future Predictions

May 08, 2025

Ethereums Bullish Run Price Analysis And Future Predictions

May 08, 2025