Is Apple Stock A Buy Ahead Of Its Q2 Earnings Report?

Table of Contents

Apple's Recent Performance and Market Trends

Analyzing Q1 2024 Results

Apple's Q1 2024 results provided a mixed bag. While the company exceeded expectations in some areas, others fell short. Understanding this performance is critical to predicting Q2's outcome for Apple stock.

- Revenue: [Insert actual Q1 revenue figures here]. While this showed [growth/decline] compared to the same period last year, it [met/exceeded/fell short of] analyst expectations.

- Earnings Per Share (EPS): [Insert actual Q1 EPS figures here]. This reflected [positive/negative] trends in profitability for Apple.

- Significant News: [Mention any major product launches, supply chain issues, or other relevant news impacting Q1 performance].

Current Market Conditions and Their Impact

The broader economic landscape significantly influences investor sentiment towards Apple stock. Current market conditions present both opportunities and challenges.

- Inflation: High inflation rates can impact consumer spending, potentially affecting demand for Apple products.

- Interest Rates: Rising interest rates increase borrowing costs for businesses and consumers, potentially impacting investment in technology, including Apple products.

- Consumer Spending Trends: [Discuss current consumer spending trends – are consumers tightening their belts or still spending freely? How does this impact demand for premium tech products like Apple's offerings?]

- Geopolitical Factors: Global uncertainties and geopolitical events can create volatility in the stock market, impacting the price of Apple shares.

Competitor Analysis

Competition in the tech industry is fierce. Analyzing the performance of Apple's key rivals is essential for assessing the future of Apple stock.

- Samsung: Samsung continues to be a strong competitor, particularly in the smartphone market. Their latest offerings and market share will influence Apple's performance.

- Google: Google's Pixel phones and Android operating system present ongoing challenges to Apple's iOS ecosystem. Their success can affect Apple's market share.

- [Add other relevant competitors and their impact].

Key Factors to Watch in the Q2 Earnings Report

iPhone Sales and Demand

iPhone sales remain the backbone of Apple's revenue. The performance of this segment will be crucial in determining the overall success of Q2.

- New Product Launches: Any new iPhone models launched during the quarter will significantly impact sales figures.

- Anticipated Sales Figures: Analyst predictions for iPhone sales will provide a benchmark against which to measure actual performance.

- Supply Chain Concerns: Any ongoing supply chain issues could constrain production and affect sales.

Services Revenue Growth

Apple's services segment is increasingly crucial for its growth and profitability. Its performance is a key indicator for investing in Apple.

- Subscription Growth: The growth rate of subscriptions to Apple Music, iCloud, Apple TV+, and other services is a vital metric.

- Average Revenue Per User (ARPU): Increasing ARPU demonstrates higher engagement and spending by Apple's user base.

- New Service Offerings: Any new service launches or expansions could significantly influence revenue growth.

Mac and Wearables Performance

The performance of Apple's other product categories will provide a broader picture of the company's health.

- Sales Trends: Tracking sales trends for Macs, iPads, Apple Watch, and AirPods will reveal the strength of these segments.

- Market Share: Analyzing market share gains or losses will illustrate Apple's competitive position in these areas.

- New Product Launches: The success of any new product launches in these categories could drive further growth.

Analyst Predictions and Price Targets for Apple Stock

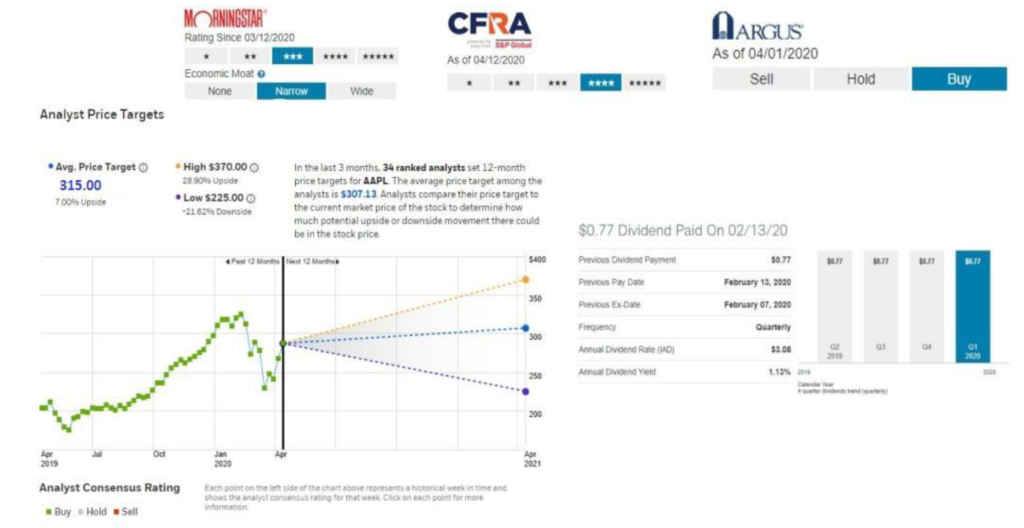

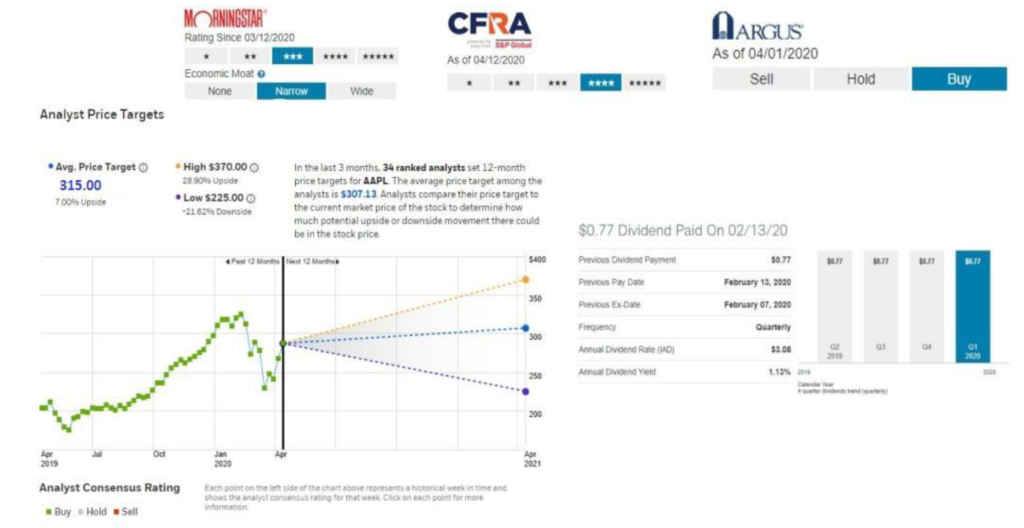

Consensus Estimates

Financial analysts provide valuable insights into Apple's expected performance. Understanding the consensus estimates is crucial for evaluating investment opportunities in Apple stock.

- EPS Estimates: The average EPS forecast from analysts for Q2 provides a baseline for assessing the actual results.

- Revenue Forecasts: Analyst revenue forecasts provide a target for Apple's overall financial performance.

- Overall Outlook: The general sentiment from analysts concerning Apple's prospects will shape investor expectations.

Price Target Range

Analysts also provide price targets, indicating their predictions for the future price of Apple stock.

- High and Low Price Targets: The range of price targets offers a perspective on the potential upside and downside for Apple shares.

- Reasons Behind Variations: Understanding the reasons behind differing predictions can help investors assess the risks involved.

Risk Assessment

Investing in Apple stock, like any investment, involves risks. Understanding these risks is essential for making informed decisions.

- Economic Downturns: Economic downturns can significantly affect consumer spending and demand for Apple products.

- Supply Chain Disruptions: Unexpected supply chain disruptions could constrain production and impact revenue.

- Increased Competition: Intensifying competition from rivals could erode Apple's market share and profitability.

- Regulatory Changes: Changes in regulations could impact Apple's operations and financial performance.

Conclusion: Should You Buy Apple Stock Before Q2 Earnings?

The decision of whether to buy Apple stock before its Q2 earnings report requires careful consideration of the factors discussed above. While Apple’s consistent performance and strong brand loyalty offer positive indicators, potential risks associated with the global economic climate and competition must be carefully weighed. The upcoming earnings report will be crucial in clarifying the near-term outlook for AAPL stock. Analyzing the iPhone sales figures, the growth of the services segment, and the overall performance against analyst predictions will ultimately shape the investment narrative.

Recommendation: Based on the current information, [insert your cautious recommendation – buy, hold, or sell – and justify it clearly]. This isn’t financial advice; conduct your due diligence.

Call to Action: Assess your risk tolerance and make informed decisions regarding Apple stock. Learn more about Apple's Q2 earnings and consider adding Apple stock to your portfolio after carefully reviewing the results and your own financial goals.

Featured Posts

-

Ecb Faiz Indirimi Avrupa Borsalarinda Guencel Durum Ve Gelecek Tahminleri

May 24, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Guencel Durum Ve Gelecek Tahminleri

May 24, 2025 -

Gucci Supply Chain Shake Up Massimo Vians Departure And Its Implications

May 24, 2025

Gucci Supply Chain Shake Up Massimo Vians Departure And Its Implications

May 24, 2025 -

Amsterdam Stock Market Suffers 7 Plunge Trade War Weighs In

May 24, 2025

Amsterdam Stock Market Suffers 7 Plunge Trade War Weighs In

May 24, 2025 -

Explaining The Recent Events Surrounding Kyle Walker Annie Kilner And Mystery Women

May 24, 2025

Explaining The Recent Events Surrounding Kyle Walker Annie Kilner And Mystery Women

May 24, 2025 -

Porsche 956 Neden Havada Sergileniyor

May 24, 2025

Porsche 956 Neden Havada Sergileniyor

May 24, 2025

Latest Posts

-

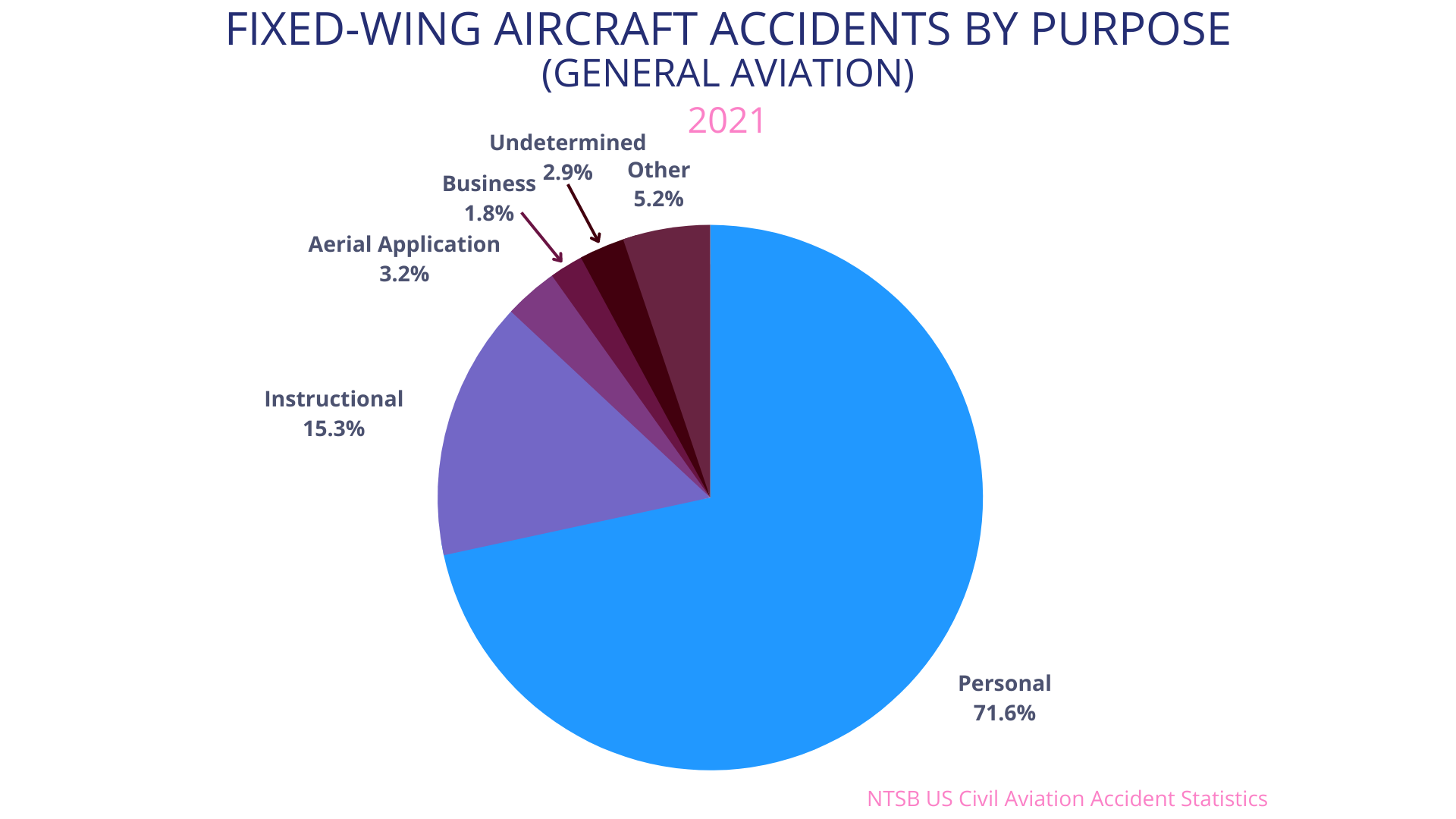

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 24, 2025

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 24, 2025 -

The White House Incident Evaluating President Ramaphosas Actions And Potential Alternatives

May 24, 2025

The White House Incident Evaluating President Ramaphosas Actions And Potential Alternatives

May 24, 2025 -

The Reality Of Airplane Accidents Visualizing Risk And Safety Measures

May 24, 2025

The Reality Of Airplane Accidents Visualizing Risk And Safety Measures

May 24, 2025 -

House Approves Trump Tax Bill After Final Revisions

May 24, 2025

House Approves Trump Tax Bill After Final Revisions

May 24, 2025 -

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 24, 2025

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 24, 2025