Amsterdam Stock Market Suffers 7% Plunge: Trade War Weighs In

Table of Contents

The Amsterdam stock market suffered a dramatic 7% plunge today, sending shockwaves through the Dutch and European economies. This sharp decline is largely attributed to the intensifying global trade war, highlighting the vulnerability of even robust markets to international economic uncertainty. This article will delve into the key factors contributing to this significant market downturn and explore its potential ramifications.

The Role of the Trade War in the Amsterdam Market Decline

Trade wars create significant uncertainty in global markets. Tariffs and trade restrictions disrupt established supply chains, increase production costs, and reduce consumer purchasing power. This ripple effect impacts businesses globally, leading to decreased profits and investor anxieties. The Amsterdam Stock Exchange (AEX), while relatively diversified, is not immune to these global pressures.

- Specific Trade Disputes Impacting the Netherlands: The ongoing EU-US trade dispute, particularly concerning agricultural products and industrial goods, directly affects Dutch exporters. Tariffs on Dutch cheese, for instance, reduce competitiveness in the US market. Similarly, trade tensions between the EU and China impact Dutch companies involved in technology and manufacturing.

- Companies Experiencing Significant Losses: Companies heavily reliant on exports, particularly within the agricultural and manufacturing sectors, have suffered the most significant losses. For example, [insert name of a real or hypothetical Dutch company in the agricultural sector] saw its share price drop by [percentage] due to reduced export volumes to the US. Similarly, [insert name of a real or hypothetical Dutch technology company] experienced losses due to supply chain disruptions related to US-China trade tensions.

- Interconnectedness of Global Markets: The Amsterdam market is deeply intertwined with global financial systems. Negative news and uncertainty in one market, such as a sudden escalation of trade tensions between major economies, can trigger a sell-off in other markets, including Amsterdam. This interconnectedness amplifies the impact of global economic shocks.

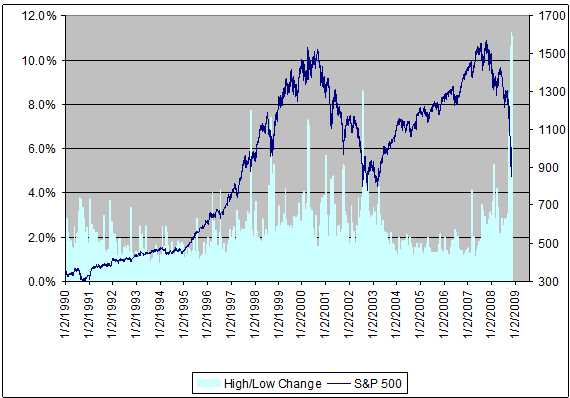

Investor Sentiment and Market Volatility

Negative news related to the trade war significantly impacts investor confidence. The uncertainty surrounding future trade policies and their economic consequences leads to risk aversion. Investors tend to move their investments away from riskier assets like stocks, seeking safer havens like government bonds.

- Indicators of Investor Anxiety: The 7% plunge in the AEX is a clear indicator of widespread investor anxiety. Other indicators include increased market volatility (measured by the VIX index), decreased trading volume reflecting a reluctance to engage in risky transactions, and a flight to safety as investors move capital into less volatile investments.

- Speculation and Market Psychology: Market psychology plays a crucial role in exacerbating declines. Negative news can trigger panic selling, further driving down prices in a self-fulfilling prophecy. Speculation about the potential for further trade escalations contributes to market volatility and uncertainty.

- Flight to Safety: Investors often move their funds to safer assets perceived as less vulnerable to global economic uncertainties during periods of heightened risk aversion. This "flight to safety" contributes to the decline in stock markets like the AEX.

Potential Long-Term Consequences for the Dutch Economy

The market plunge has significant implications for the Dutch economy. A prolonged period of economic uncertainty could negatively affect business investment, consumer spending, and employment.

- Potential Consequences: Decreased business investment stemming from uncertainty; potential job losses in export-oriented sectors; reduced consumer spending due to lower confidence and higher prices; a slowdown in overall economic growth.

- Government Revenue and Spending: The market decline can impact government revenue through decreased corporate tax collections and potentially increased social security spending if unemployment rises. This might necessitate government intervention to stimulate the economy.

- Government Intervention: The Dutch government might implement fiscal or monetary policies to mitigate the negative impact. This could include tax cuts, increased government spending on infrastructure projects, or adjustments to interest rates by the central bank (De Nederlandsche Bank).

Analyzing the Amsterdam Exchange (AEX) Performance

The AEX index, a benchmark for the Amsterdam Stock Exchange, tracks the performance of the 25 largest listed companies in the Netherlands. The recent decline reflects broad-based selling across most sectors.

- Sectoral Performance: Sectors heavily reliant on international trade, such as technology, manufacturing, and agriculture, experienced steeper declines than sectors with a more domestic focus. The financial sector, while also sensitive to global economic conditions, may exhibit relatively more resilience.

- Unusual Trading Activity: During the market plunge, there might have been unusually high trading volumes in certain stocks, indicating increased speculative activity or attempts by investors to quickly liquidate their positions.

- Comparison with Other European Indices: It's important to compare the AEX's performance with other major European stock market indices (like the DAX, CAC 40, FTSE 100) to determine whether the decline is specific to the Netherlands or reflects broader European market trends.

Conclusion:

The 7% plunge in the Amsterdam stock market underscores the significant impact of the escalating global trade war on even strong and diversified economies. The interconnectedness of global markets and investor sentiment played a crucial role in this sharp decline, highlighting the potential for long-term economic consequences for the Netherlands. The performance of the AEX index and the various sectors within it will be closely watched in the coming weeks and months.

Call to Action: Stay informed about the evolving trade situation and its impact on the Amsterdam stock market. Monitor the AEX index and other key economic indicators for further insights into the Amsterdam stock market’s future performance and the continuing effects of the trade war. Understand the risks and opportunities presented by the volatile Amsterdam stock market.

Featured Posts

-

The Woody Allen Controversy Sean Penns Backing And The Public Reaction

May 24, 2025

The Woody Allen Controversy Sean Penns Backing And The Public Reaction

May 24, 2025 -

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025 -

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025 -

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Pound Strengthens As Traders Reduce Expectations Of Boe Interest Rate Cuts

May 24, 2025

Pound Strengthens As Traders Reduce Expectations Of Boe Interest Rate Cuts

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025