Is Bitcoin's Rebound Just The Beginning? A Market Analysis

Table of Contents

Analyzing Bitcoin's Recent Price Performance

Short-term Volatility and Long-term Trends

Bitcoin's price, notorious for its volatility, has experienced significant fluctuations in recent months. Analyzing Bitcoin's price prediction requires a nuanced approach, considering both short-term volatility and long-term trends. We need to look beyond the daily noise to identify meaningful patterns.

- Recent Price Fluctuations: The past few months have witnessed both sharp increases and declines in Bitcoin's price, highlighting the inherent risk associated with this asset class. Understanding these fluctuations requires careful consideration of market sentiment and trading volume.

- Support and Resistance Levels: Technical analysis identifies key support and resistance levels that can indicate potential price reversals. Observing how Bitcoin interacts with these levels provides insights into potential future price movements. A break above a significant resistance level could signal the start of a new uptrend.

- Overall Market Sentiment: The overall sentiment among Bitcoin investors and traders plays a significant role in price dynamics. Positive news and increased adoption often lead to bullish sentiment and price increases, while negative news or regulatory uncertainty can trigger sell-offs. Analyzing Bitcoin chart analysis tools can aid in gauging market sentiment.

[Insert relevant chart/graph showing Bitcoin's price history here.] This chart illustrates the recent price volatility and potential support/resistance levels. For a deeper dive into Bitcoin technical analysis, consult reputable charting platforms.

Impact of Macroeconomic Factors

Bitcoin's price is also heavily influenced by macroeconomic factors. Its performance is often correlated with broader economic trends, making macroeconomic analysis an essential component of any Bitcoin price prediction.

- Inflation: As a decentralized, scarce asset, Bitcoin is often viewed as a hedge against inflation. Periods of high inflation may drive investors towards Bitcoin as a store of value, increasing demand and potentially pushing prices higher. Understanding Bitcoin and the economy is key to understanding this interplay.

- Interest Rates: Changes in interest rates can significantly impact investment flows into Bitcoin. Higher interest rates can make other investment options more attractive, potentially leading to capital outflows from Bitcoin.

- Global Economic Events: Global economic uncertainty, geopolitical events, and financial crises can influence investor risk appetite, impacting Bitcoin's price. Significant global events often lead to increased volatility in the cryptocurrency market.

[Cite reputable sources for economic data and analysis here, e.g., IMF, World Bank, etc.]

Assessing Bitcoin's Underlying Fundamentals

Network Growth and Adoption

Beyond price fluctuations, the underlying fundamentals of Bitcoin are crucial for assessing its long-term potential. Examining network growth and adoption provides a more robust picture of Bitcoin's health and future prospects.

- Bitcoin Network Growth: Metrics like transaction volume and the number of active addresses indicate the overall usage and health of the Bitcoin network. A growing network suggests increasing adoption and potentially higher demand.

- Institutional Adoption: The growing interest from institutional investors, including corporations and hedge funds, signals increasing legitimacy and a potential influx of capital into the Bitcoin market.

- Bitcoin Lightning Network: The Lightning Network, a layer-2 scaling solution, addresses Bitcoin's scalability challenges and enables faster, cheaper transactions. Its growth indicates improvement in the usability of Bitcoin for everyday transactions.

[Insert statistics on transaction volume, active addresses, and Lightning Network capacity here.] These data points highlight the ongoing growth and development of the Bitcoin network.

Regulatory Landscape and Institutional Investment

The regulatory landscape and institutional investment play significant roles in shaping Bitcoin's future. Favorable regulations and increased institutional involvement can drive price appreciation, while stricter regulations or negative sentiment can lead to price drops.

- Bitcoin Regulation: The regulatory stance of different governments and jurisdictions significantly impacts Bitcoin's adoption and price. Clearer regulatory frameworks can foster greater institutional participation and investor confidence. The prospect of a Bitcoin ETF is a major catalyst for institutional involvement.

- Bitcoin Institutional Investment: Institutional investors are increasingly incorporating Bitcoin into their portfolios, adding to its legitimacy and potentially driving up demand. Their entry represents a significant shift in the perception and adoption of Bitcoin.

[Provide examples of recent regulatory developments and institutional investments in Bitcoin here.]

Potential Catalysts for Further Growth

Technological Advancements

Technological advancements within the Bitcoin ecosystem are constantly improving its efficiency, security, and scalability, potentially driving further adoption and price growth.

- Bitcoin Scaling Solutions: Layer-2 solutions, beyond the Lightning Network, are constantly being developed to address scalability limitations and improve transaction speeds.

- Bitcoin Privacy: Efforts to improve Bitcoin's privacy features, such as using privacy-enhancing technologies, can attract more users concerned about privacy and anonymity.

- Bitcoin Applications: The development of new applications and use cases for Bitcoin, beyond simply a store of value, such as decentralized finance (DeFi) applications built on Bitcoin, can expand its utility and drive adoption.

[Cite examples of promising technological advancements in the Bitcoin ecosystem here.]

Growing Institutional Adoption and Mainstream Acceptance

Increased institutional adoption and growing mainstream acceptance are key factors that could fuel Bitcoin's future growth. Wider acceptance as a store of value and a medium of exchange will likely lead to increased demand and higher prices.

- Bitcoin Institutional Adoption: As more institutional investors allocate a portion of their assets to Bitcoin, the demand will increase, putting upward pressure on the price.

- Bitcoin Mainstream Adoption: Greater public understanding and acceptance of Bitcoin as a legitimate asset class will contribute to broader adoption and potentially higher prices. Increased awareness through media coverage and educational initiatives can play a significant role.

- Bitcoin as a Store of Value: Bitcoin's scarcity and its potential as a hedge against inflation continue to attract investors seeking to preserve their purchasing power.

[Provide examples of recent trends in institutional adoption and public opinion surveys here.]

Conclusion: Is Bitcoin's Rebound the Beginning of a New Era?

Our analysis suggests that while Bitcoin's rebound is promising, it's crucial to acknowledge both the potential for further growth and the inherent risks associated with this volatile asset class. The factors driving Bitcoin's rebound include improved network fundamentals, increasing institutional adoption, and the potential for further technological advancements. However, macroeconomic conditions and regulatory uncertainty remain significant considerations.

We've examined Bitcoin's price performance, its underlying fundamentals, and potential future catalysts. This analysis shows both the significant potential for continued growth and the need for caution. Bitcoin's long-term trajectory remains subject to a multitude of factors.

While Bitcoin's future remains uncertain, understanding the factors driving its rebound is crucial. Continue your research into Bitcoin's potential and make informed investment choices based on your own risk assessment. Thorough due diligence is essential before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

Indonesias Foreign Exchange Reserves Plunge Rupiah Weakness Takes Toll

May 09, 2025

Indonesias Foreign Exchange Reserves Plunge Rupiah Weakness Takes Toll

May 09, 2025 -

Kaitlin Olson And High Potential Repeats Abcs Programming Strategy For March 2025

May 09, 2025

Kaitlin Olson And High Potential Repeats Abcs Programming Strategy For March 2025

May 09, 2025 -

The Snl Impression That Left Harry Styles Heartbroken

May 09, 2025

The Snl Impression That Left Harry Styles Heartbroken

May 09, 2025 -

Chinas Canola Search New Sources After Canada Rift

May 09, 2025

Chinas Canola Search New Sources After Canada Rift

May 09, 2025 -

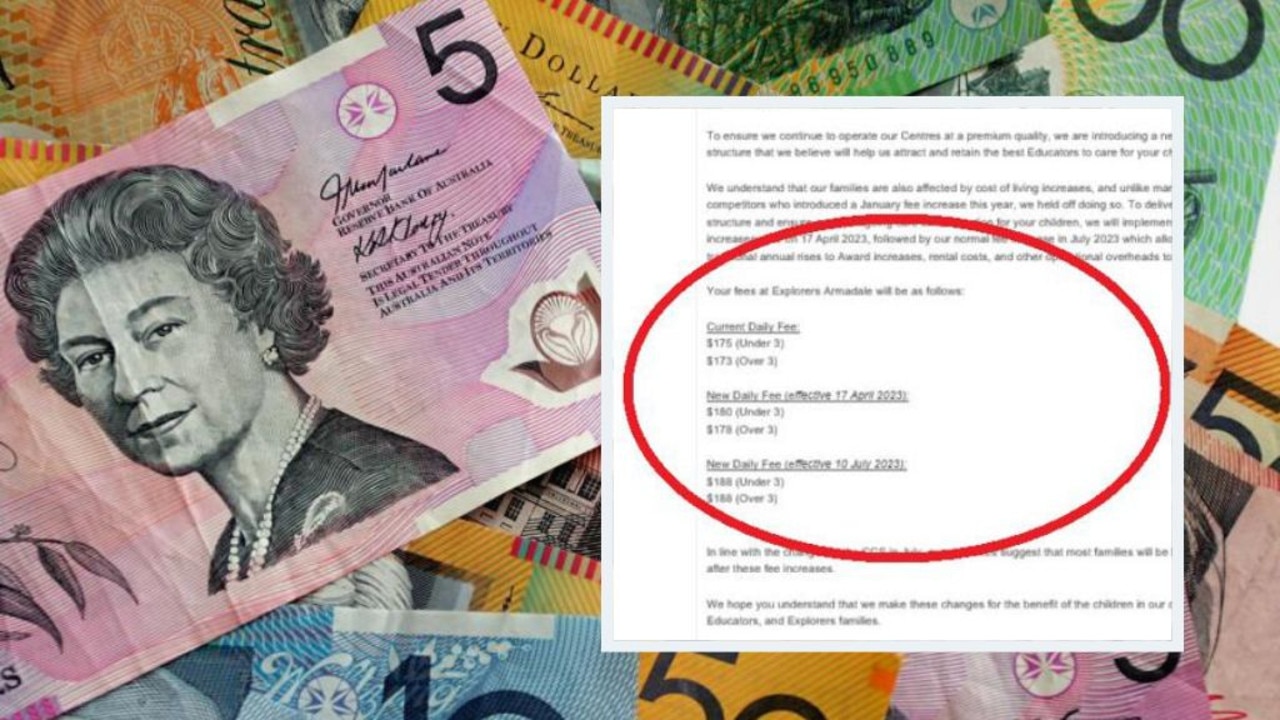

Daycare Costs Explode After Initial 3 000 Babysitter Payment

May 09, 2025

Daycare Costs Explode After Initial 3 000 Babysitter Payment

May 09, 2025