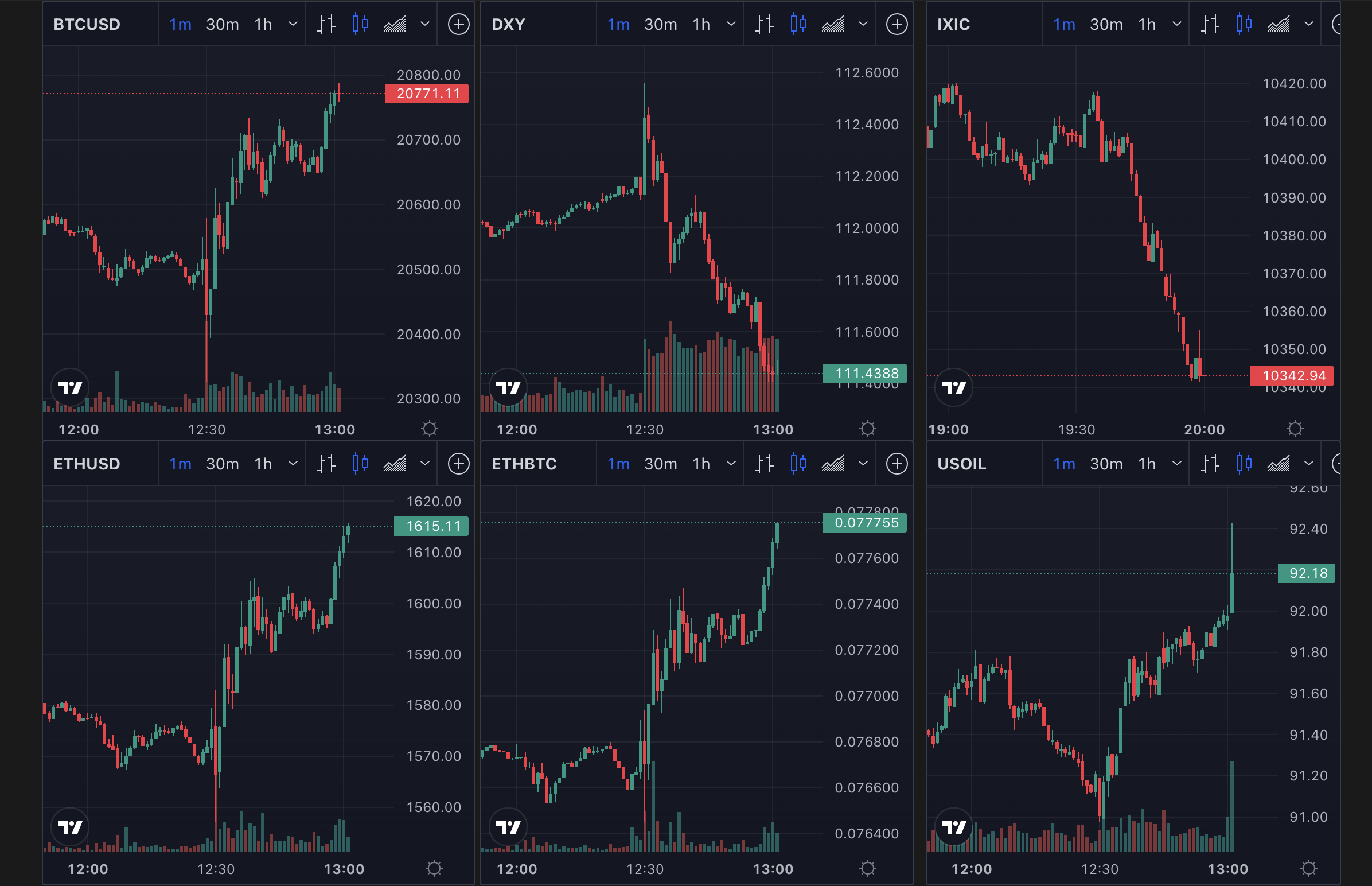

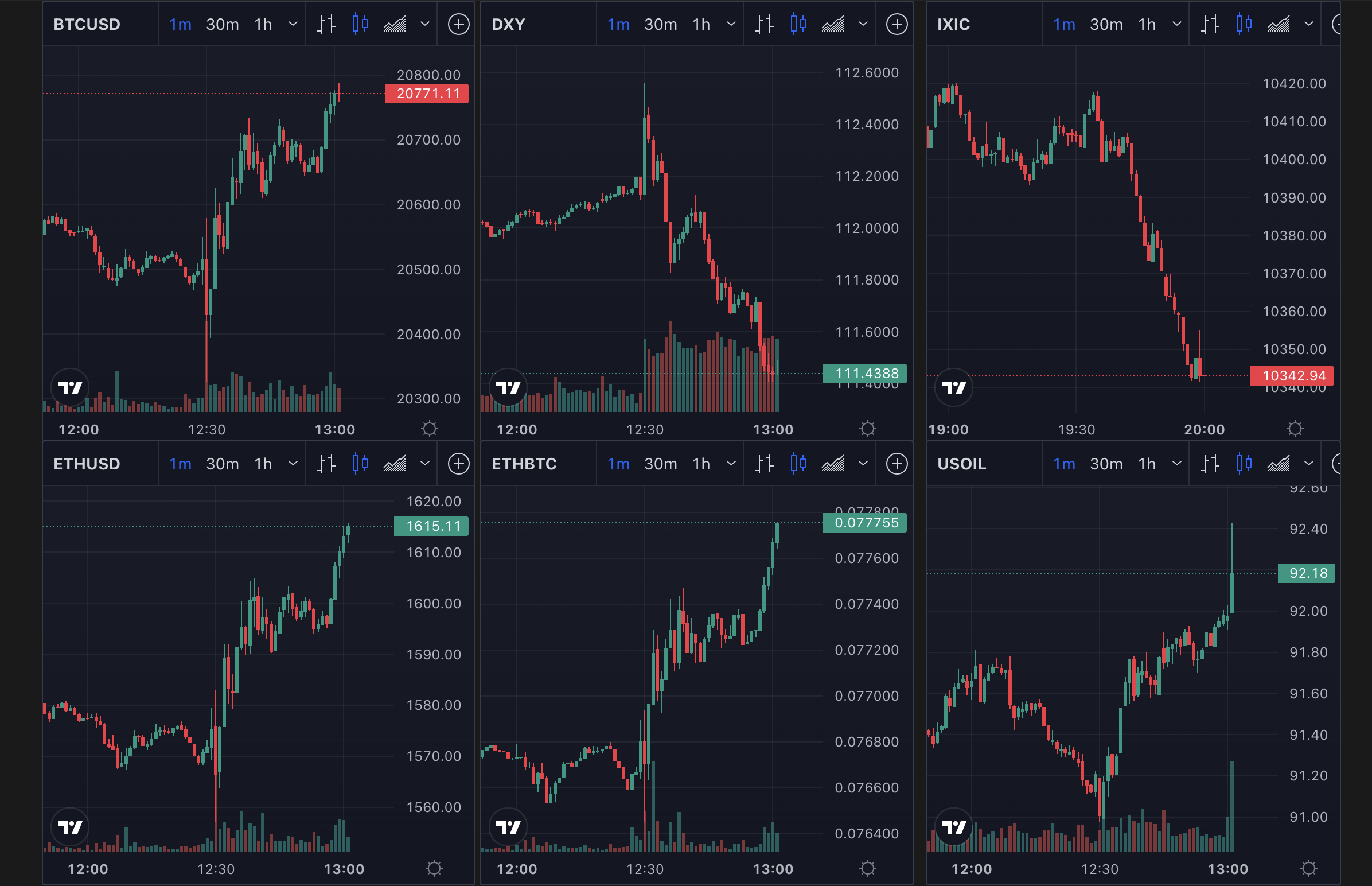

Is The Recent Bitcoin Rebound Sustainable?

Table of Contents

Factors Contributing to the Recent Bitcoin Rebound

Several factors have contributed to Bitcoin's recent price increase. Understanding these factors is crucial to assessing the sustainability of this rebound.

Institutional Investment and Adoption

The growing acceptance of Bitcoin by institutional investors is a significant bullish signal. Large corporations and investment firms are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and a diversifying asset.

- Examples of institutional investments: Several major corporations, including MicroStrategy and Tesla, have made substantial Bitcoin purchases, demonstrating a growing confidence in its long-term value. Investment firms are also creating Bitcoin-focused funds, making it more accessible to institutional investors.

- Impact on market liquidity: Increased institutional involvement improves market liquidity, making it easier to buy and sell Bitcoin without significantly impacting the price. This stability contributes to a more sustainable price increase.

- Long-term holding strategies: Many institutional investors adopt a long-term "hodling" strategy, meaning they intend to hold their Bitcoin for an extended period, reducing the likelihood of short-term price fluctuations driven by panic selling.

Macroeconomic Factors and Inflation

Global economic uncertainty and rising inflation rates have driven investors towards alternative assets, including Bitcoin. Bitcoin's limited supply and decentralized nature make it an attractive hedge against inflation, potentially contributing to the recent price increase.

- Correlation between inflation rates and Bitcoin price: Historically, there's been a correlation between rising inflation and increased Bitcoin demand. As traditional currencies lose purchasing power, investors seek alternative stores of value.

- Investor sentiment towards safe haven assets: During times of economic instability, investors often seek "safe haven" assets. Bitcoin, despite its volatility, is increasingly viewed as a potential safe haven by some investors.

- Regulatory changes impacting crypto markets: While regulatory uncertainty remains a concern, some positive regulatory developments in certain jurisdictions could boost investor confidence and contribute to a more stable Bitcoin price.

Technological Developments and Network Upgrades

Ongoing technological advancements and network upgrades within the Bitcoin ecosystem enhance its scalability, security, and efficiency, boosting investor confidence and potentially driving price appreciation.

- Examples of recent upgrades: The Taproot upgrade significantly improved Bitcoin's transaction privacy and efficiency. Ongoing development of scaling solutions continues to address transaction speed and fee concerns.

- Scaling solutions: Layer-2 solutions like the Lightning Network significantly increase Bitcoin's transaction capacity, making it suitable for everyday payments. This improved usability increases its adoption rate.

- Lightning Network adoption: Increased adoption of the Lightning Network reduces transaction fees and speeds up payments, making Bitcoin more practical for everyday use and thereby potentially increasing demand.

Potential Risks and Challenges to Sustainability

Despite the positive factors, several challenges could hinder the sustainability of Bitcoin's rebound.

Regulatory Uncertainty and Government Intervention

Varying regulatory landscapes across different countries pose a risk to Bitcoin's price stability. Government interventions, including bans or restrictions on cryptocurrency trading, could negatively impact investor confidence and depress the price.

- Examples of recent regulations: Several countries have implemented regulations on cryptocurrency trading, while others are still developing their regulatory frameworks. This uncertainty can cause price volatility.

- Potential for bans or restrictions: The possibility of government bans or severe restrictions on Bitcoin trading remains a significant risk, potentially leading to sharp price drops.

- Impact on investor confidence: Regulatory uncertainty and negative government actions can erode investor confidence, impacting Bitcoin's price.

Market Volatility and Speculative Trading

The cryptocurrency market is inherently volatile, and speculative trading can significantly impact Bitcoin's price. FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) can drive impulsive trading decisions, leading to price swings.

- Historical price volatility: Bitcoin has a history of extreme price volatility, making it a high-risk investment. Past performance doesn't guarantee future results.

- Impact of FOMO and FUD: Emotional trading based on FOMO and FUD can create artificial price bubbles and crashes, undermining the sustainability of any price rebound.

- Role of market manipulation: The possibility of market manipulation by large players cannot be discounted, which could negatively influence Bitcoin price.

Environmental Concerns and Energy Consumption

The energy consumption associated with Bitcoin mining remains a significant concern, potentially leading to increased regulatory scrutiny and negative investor sentiment.

- Bitcoin energy consumption: The energy consumption of Bitcoin mining is a subject of ongoing debate, with concerns about its environmental impact.

- Shift towards renewable energy sources: The Bitcoin mining industry is increasingly adopting renewable energy sources to address environmental concerns.

- Impact of environmental concerns on investor sentiment: Growing awareness of Bitcoin's energy consumption could negatively impact investor sentiment and potentially lead to regulations aimed at curbing its energy use.

Conclusion

The recent Bitcoin rebound is driven by a confluence of factors, including increased institutional adoption, macroeconomic factors, and technological advancements. However, regulatory uncertainty, market volatility, and environmental concerns pose significant risks to its long-term sustainability. While the current upward trend shows promise, investors must carefully weigh both bullish and bearish signals before making investment decisions. Further research and analysis are crucial. Stay informed about the latest developments and continue monitoring the Bitcoin price and relevant market indicators to make informed decisions about your Bitcoin investment strategy. Remember to always conduct your own thorough research before investing in any cryptocurrency, including Bitcoin.

Featured Posts

-

Tnts Hilarious Take On Jayson Tatum For Lakers Vs Celtics Abc Game

May 08, 2025

Tnts Hilarious Take On Jayson Tatum For Lakers Vs Celtics Abc Game

May 08, 2025 -

Perballja E Psg Fitore E Veshtire Por E Merituar Ne Pjesen E Pare

May 08, 2025

Perballja E Psg Fitore E Veshtire Por E Merituar Ne Pjesen E Pare

May 08, 2025 -

Six Goals Fly In Barcelona Inter Milan Champions League Semi Final Clash

May 08, 2025

Six Goals Fly In Barcelona Inter Milan Champions League Semi Final Clash

May 08, 2025 -

India Pakistan Conflict Understanding The Importance Of Kashmir And The Risk Of War

May 08, 2025

India Pakistan Conflict Understanding The Importance Of Kashmir And The Risk Of War

May 08, 2025 -

Glen Powells The Running Man Transformation Diet Fitness And Character

May 08, 2025

Glen Powells The Running Man Transformation Diet Fitness And Character

May 08, 2025