Is This Ethereum Buy Signal Real? Weekly Chart Analysis

Table of Contents

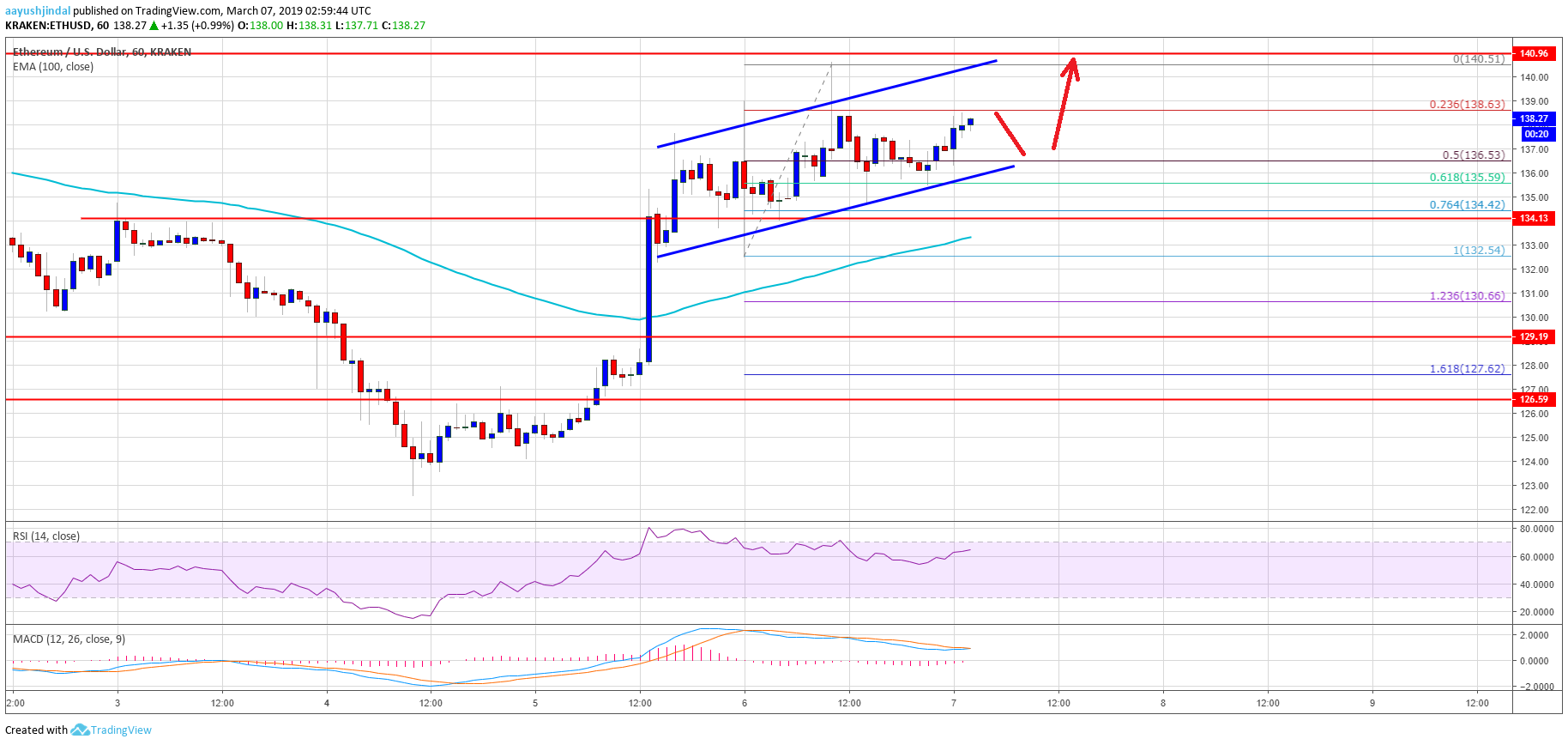

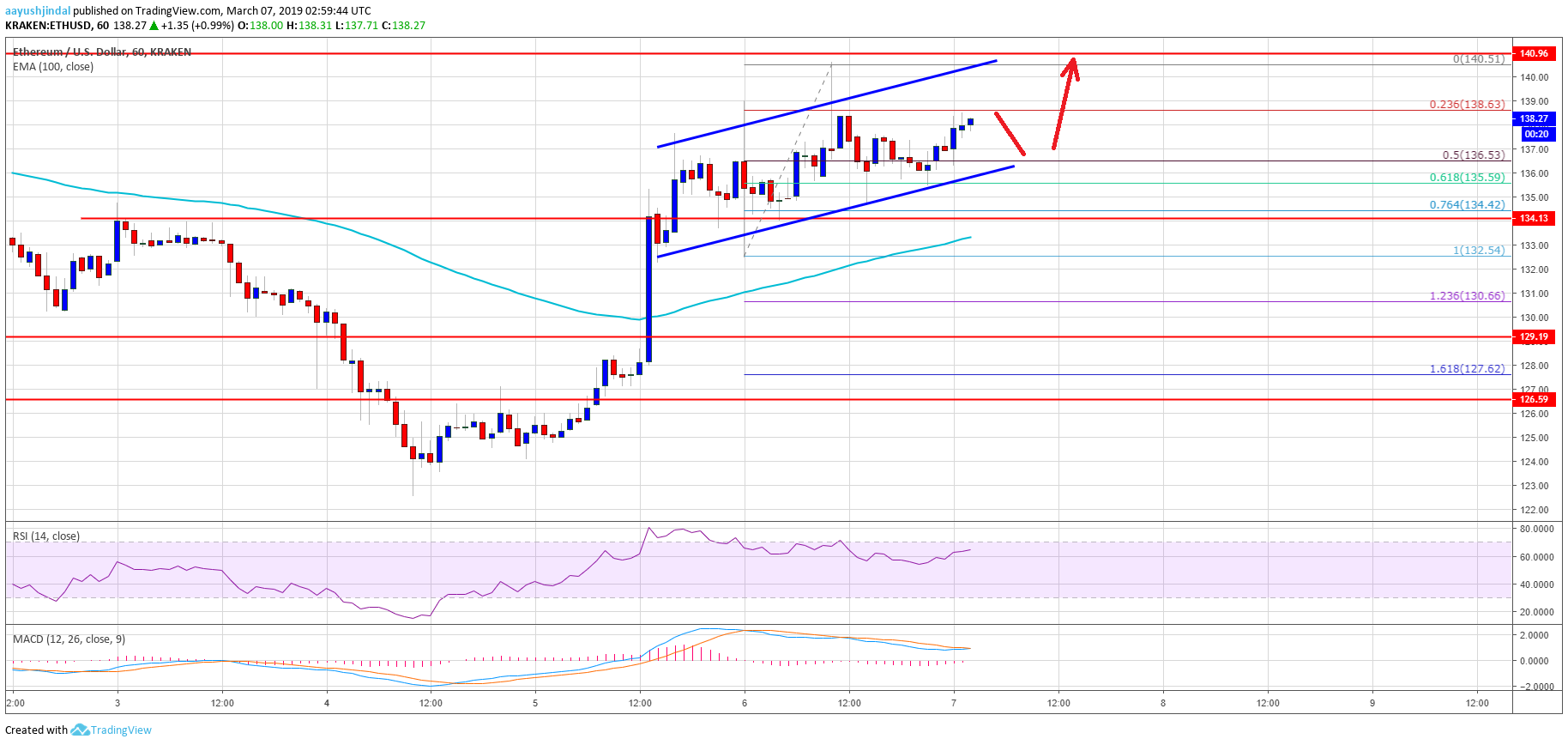

Technical Analysis: Examining Key Indicators for an Ethereum Buy Signal

Technical analysis offers valuable insights into price movements and potential trend reversals. Let's examine several key indicators to determine if an Ethereum buy signal is present.

-

Moving Averages (MA): Analyzing the 50-day, 100-day, and 200-day moving averages (MAs) helps identify potential support levels and significant trend changes. A "golden cross," where the 50-day MA crosses above the 200-day MA, is often interpreted as a bullish signal, suggesting a potential uptrend. Conversely, a "death cross," where the 50-day MA crosses below the 200-day MA, is generally viewed as bearish. While MA crossovers can be helpful, they shouldn't be relied upon solely for investment decisions. [Insert chart showing MA crossovers here].

-

Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI below 30 generally suggests an oversold market, potentially indicating a bounce back. Conversely, an RSI above 70 suggests an overbought market, potentially signaling a price correction. While RSI can be a useful tool, its limitations lie in its inability to predict the duration or magnitude of price changes. It should be used in conjunction with other indicators.

-

Volume Analysis: Examining trading volume provides context to price movements. High volume accompanying a price increase confirms the strength of the move and increases the likelihood of a sustained uptrend. Conversely, low volume breakouts can be less reliable and potentially result in short-lived price changes. Observing volume alongside price action is crucial in confirming potential Ethereum buy signals.

-

Support and Resistance Levels: Identifying key support and resistance levels on the weekly chart is essential for understanding potential price reversals. A breakout above a significant resistance level often confirms a bullish signal, while a break below support suggests a potential downtrend. These levels act as psychological barriers, and their breach can indicate a shift in market sentiment, influencing future price movements.

Fundamental Analysis: Factors Impacting Ethereum's Price

Fundamental analysis focuses on the underlying factors influencing Ethereum's price, adding another layer of assessment to our Ethereum buy signal analysis.

-

Ethereum 2.0 and its impact: The ongoing transition to Ethereum 2.0 is a significant development impacting its value. The shift promises increased scalability, reduced transaction fees, and enhanced security, potentially attracting more users and increasing demand. The introduction of staking rewards further incentivizes participation in the network, potentially influencing token value.

-

Development Activity: Consistent development activity within the Ethereum ecosystem is crucial. Significant upgrades, new integrations, and successful partnerships all positively influence investor sentiment, boosting demand and potentially triggering an Ethereum buy signal. Monitoring the progress of key development projects is vital for fundamental analysis.

-

Market Sentiment and Overall Crypto Market Conditions: The broader cryptocurrency market significantly influences Ethereum's price. Positive sentiment in the overall crypto market tends to boost altcoins like Ethereum. Conversely, negative sentiment, often triggered by regulatory uncertainty or macroeconomic factors, can impact the entire market, including Ethereum's price. Analyzing Bitcoin's price movements and overall market trends is crucial.

Risk Assessment: Potential Downsides and Considerations

Despite promising indicators, it's crucial to acknowledge the risks associated with investing in cryptocurrencies.

-

Volatility Risks: The cryptocurrency market is inherently volatile. Price fluctuations can be significant, leading to substantial gains or losses in short periods. This analysis does not guarantee future price movements, and significant price corrections remain a possibility.

-

Regulatory Uncertainty: Regulatory changes can drastically affect cryptocurrency prices. Governments worldwide are still developing frameworks for regulating cryptocurrencies, creating uncertainty that could lead to price volatility.

-

Market Manipulation: The possibility of market manipulation remains a concern in the cryptocurrency market. Artificial price movements can create false signals, making it crucial to remain vigilant and rely on multiple sources of information.

Conclusion: Is This Ethereum Buy Signal Real? Your Next Steps

Our analysis suggests that certain indicators point toward a potential Ethereum buy signal; however, no single indicator provides a definitive answer. The convergence of bullish technical indicators like potential golden crosses and oversold conditions, coupled with positive fundamental developments around Ethereum 2.0 and ongoing ecosystem growth, presents a compelling case. However, the inherent volatility of the market, regulatory uncertainty, and the possibility of market manipulation demand a cautious approach. Before considering any investment, perform your own due diligence before considering an Ethereum buy signal. Analyze the data independently, assess your own risk tolerance, and consider diversifying your portfolio. Continue your research into Ethereum buy signals and make informed decisions based on your own thorough assessment.

Featured Posts

-

Grand Theft Auto Vi Second Trailer Hints At Bonnie And Clyde Storyline

May 08, 2025

Grand Theft Auto Vi Second Trailer Hints At Bonnie And Clyde Storyline

May 08, 2025 -

Delayed Return Exploring The Reasons Behind Yavin 4s Absence In Star Wars

May 08, 2025

Delayed Return Exploring The Reasons Behind Yavin 4s Absence In Star Wars

May 08, 2025 -

Marriyum Aurangzeb Explains Lahore Zoo Ticket Price Increase

May 08, 2025

Marriyum Aurangzeb Explains Lahore Zoo Ticket Price Increase

May 08, 2025 -

Batman Relaunches New 1 Issue And Costume Revealed

May 08, 2025

Batman Relaunches New 1 Issue And Costume Revealed

May 08, 2025 -

Celtics Game 1 Loss Prompts Sharp Criticism From Colin Cowherd On Tatum

May 08, 2025

Celtics Game 1 Loss Prompts Sharp Criticism From Colin Cowherd On Tatum

May 08, 2025