Japan Trading House Shares Surge: Berkshire Hathaway's Long-Term Investment

Table of Contents

Berkshire Hathaway's Strategic Investment in Japanese Trading Houses

Berkshire Hathaway, renowned for its long-term value investing approach, made a significant strategic decision to invest heavily in five major Japanese sogo shosha (general trading companies): Itochu, Mitsubishi Corporation, Sumitomo Corporation, Marubeni Corporation, and Mitsui & Co. This wasn't a fleeting market play; it reflects a deliberate, long-term strategy built on the belief in the resilience and future potential of these established entities.

- Significant Investments: Berkshire Hathaway acquired substantial stakes in each of these trading houses, demonstrating a considerable commitment to their long-term growth.

- Long-Term Horizon: Warren Buffett's approach is famously patient. This investment underscores his belief in the enduring value of these companies, emphasizing a commitment that transcends short-term market volatility.

- Focus on Stability and Dividends: These sogo shosha are known for their consistent profitability and regular dividend payouts, providing a reliable income stream for investors.

- Global Reach and Diversification: The global networks and diversified business portfolios of these trading houses offer inherent resilience against economic downturns in any single sector.

The attractiveness of Japanese sogo shosha as investments stems from their unique characteristics:

- Diversified Portfolios: They operate across a wide spectrum of industries, from energy and resources to infrastructure and consumer goods, mitigating risk.

- Extensive Global Networks: Their established global networks provide access to a vast range of markets and opportunities.

- Consistent Profitability: Their long history of consistent profitability and dividend payouts offers investors a degree of stability and predictability.

Analysis of the Recent Share Price Surge

The share prices of these Japanese trading houses have experienced a significant upward trend following Berkshire Hathaway's investment. This surge is attributable to several converging factors:

- Berkshire Hathaway's Seal of Approval: The involvement of such a respected and successful investor as Berkshire Hathaway signaled a strong vote of confidence in the companies' future prospects, attracting other investors.

- Undervalued Assets: Many analysts believe that Japanese stocks, including these trading houses, were previously undervalued in the global market, creating an attractive entry point for investors seeking long-term growth.

- Strengthening Japanese Economy: The relatively robust performance of the Japanese economy, coupled with increasing global demand for commodities, has boosted the performance of these companies.

- Global Commodity Demand: The sogo shosha's significant involvement in the global trade of resources and commodities has positioned them to benefit from increasing global demand.

- Future Growth Potential: Ongoing global trade and the companies’ strategic diversification position them for further growth in the coming years.

Implications for Investors: Long-Term Strategies in the Japanese Market

Berkshire Hathaway's success with its Japanese trading house investments offers valuable lessons for other investors:

- Long-Term Vision Pays Off: The investment underscores the significant potential rewards of a long-term investment strategy focused on fundamentally sound companies.

- Thorough Due Diligence: Successful investing requires meticulous research and understanding of a company's fundamentals, financial health, and market position.

- Identifying Undervalued Opportunities: The Japanese market may still hold many undervalued companies with substantial growth potential for patient investors.

- Diversification is Key: Diversifying investments across different sectors within the Japanese market can help mitigate risk and enhance overall portfolio performance.

- Managing Currency Risk: Investors need to be aware of and manage the potential risks associated with currency fluctuations between the Japanese yen and their home currency.

Alternative Investment Opportunities in the Japanese Market

Beyond trading houses, other sectors of the Japanese economy offer compelling long-term investment opportunities. These include:

- Technology: Japan boasts a thriving technology sector, with companies at the forefront of innovation in areas like robotics, artificial intelligence, and semiconductors.

- Renewable Energy: With a growing emphasis on sustainability, investment in Japanese renewable energy companies presents a promising avenue for growth.

- Consumer Goods: Japan's robust domestic consumer market, combined with its export capabilities, makes consumer goods companies an attractive investment option.

Conclusion

Berkshire Hathaway's strategic investment in Japanese trading houses and the subsequent surge in share prices offer a compelling case study in the potential rewards of long-term investing. The success highlights the attractiveness of the Japanese market for discerning investors who are willing to conduct thorough due diligence and adopt a patient, long-term approach. The lessons learned emphasize the importance of identifying fundamentally strong companies, managing risk through diversification, and recognizing the potential for significant returns from undervalued assets.

Call to Action: Are you interested in exploring long-term investment opportunities in Japanese trading houses or other sectors of the Japanese economy? Learn more about diversifying your portfolio with strategic investments in Japanese companies and similar stable growth opportunities. Start your research today and unlock the potential of the Japanese market.

Featured Posts

-

Inter Milan Contract Expirations Key Players Out In 2026

May 08, 2025

Inter Milan Contract Expirations Key Players Out In 2026

May 08, 2025 -

Bitcoin Or Micro Strategy Stock The Best Investment Strategy For 2025

May 08, 2025

Bitcoin Or Micro Strategy Stock The Best Investment Strategy For 2025

May 08, 2025 -

De Andre Hopkins Joins Ravens Contract Terms And Impact

May 08, 2025

De Andre Hopkins Joins Ravens Contract Terms And Impact

May 08, 2025 -

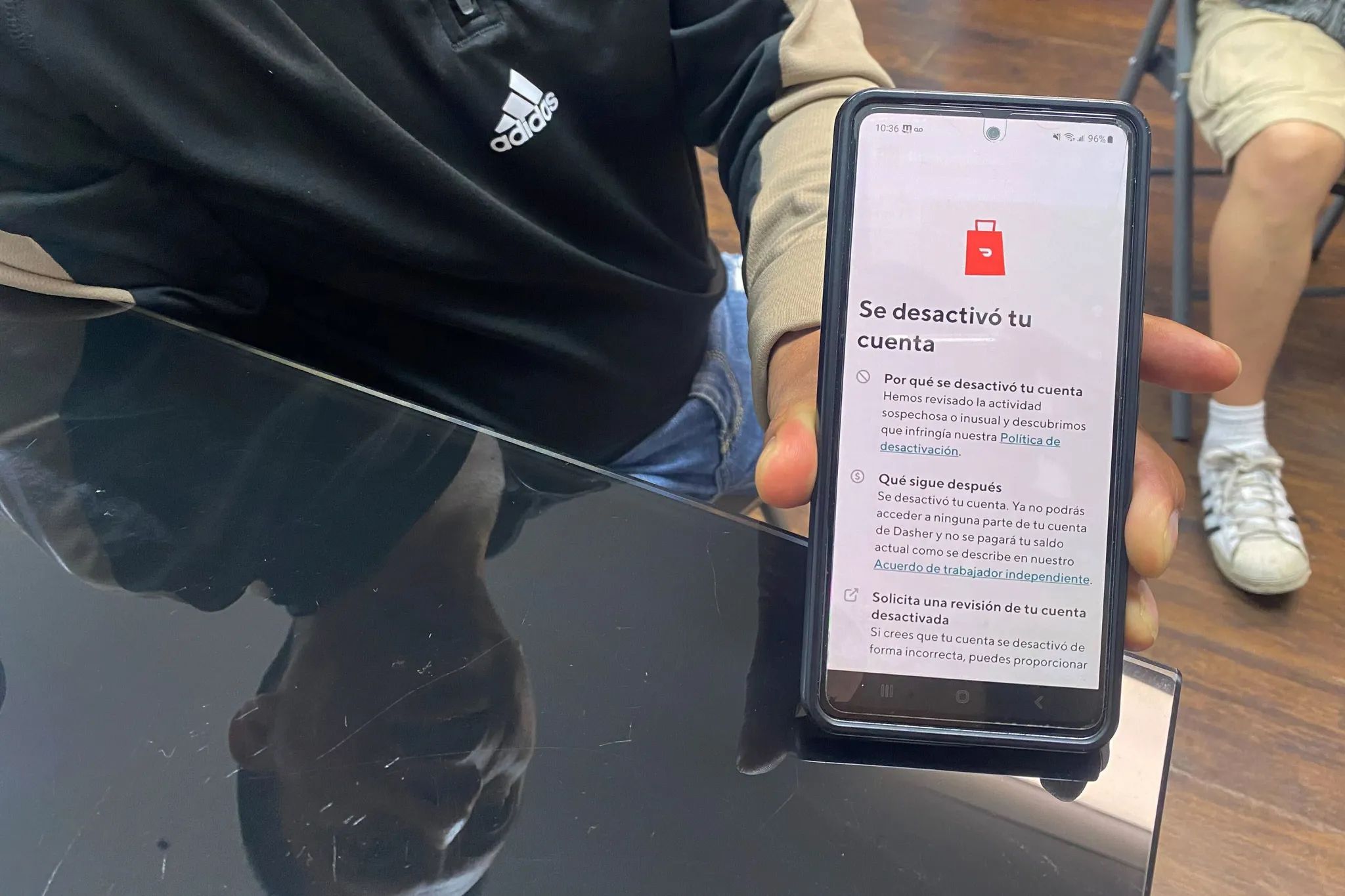

Door Dash Faces Antitrust Accusations From Uber In Fierce Food Delivery Competition

May 08, 2025

Door Dash Faces Antitrust Accusations From Uber In Fierce Food Delivery Competition

May 08, 2025 -

U S China Trade Talks Officials To Meet Amid Ongoing Tensions

May 08, 2025

U S China Trade Talks Officials To Meet Amid Ongoing Tensions

May 08, 2025