Japan Trading Houses See Share Price Increase Following Berkshire Investment

Table of Contents

Berkshire Hathaway's Investment Strategy and its Impact

Berkshire Hathaway's investment strategy is renowned for its long-term, passive approach. Warren Buffett's philosophy centers on identifying fundamentally sound companies with strong management and investing for the long haul. This long-term investment strategy minimizes the impact of short-term market fluctuations. The significance of Buffett's endorsement cannot be overstated; it serves as a powerful vote of confidence, bolstering investor sentiment and attracting significant capital inflows. The sheer size of Berkshire's investment in each trading house—a substantial stake in each of Sumitomo, Mitsubishi, Itochu, Marubeni, and Mitsui—further amplified this effect. This strategic move signals a positive outlook not only on the future performance of these individual companies but also on the broader Japanese equity market and the Japanese economy as a whole.

- Berkshire's long-term, value investing approach: This contrasts with short-term speculative trading, offering stability and confidence to the market.

- Buffett's endorsement: The "Oracle of Omaha's" investment carries immense weight, attracting other investors and driving up demand.

- Investment size: While the exact figures may vary, the significant percentage stake acquired by Berkshire in each trading house demonstrated a strong belief in their long-term prospects.

- Positive outlook: The investment suggests Berkshire sees substantial growth potential within these companies and the Japanese economy.

Analysis of Share Price Increases in Individual Trading Houses

Following Berkshire Hathaway's investment announcement, share prices of the major Japanese trading houses experienced a remarkable surge. While precise percentage increases fluctuate with daily market movements, all five companies (Sumitomo, Mitsubishi, Itochu, Marubeni, and Mitsui) saw significant gains. This outperformance compared favorably against broader market indices such as the Nikkei 225, indicating that the investment's impact transcended general market trends. The increased trading volume and positive investor sentiment further validate the significance of Berkshire's involvement. The potential for further price increases exists, dependent on continued strong performance, favorable economic conditions, and sustained investor confidence.

- Sumitomo share price: [Insert data on percentage increase]

- Mitsubishi share price: [Insert data on percentage increase]

- Itochu share price: [Insert data on percentage increase]

- Marubeni share price: [Insert data on percentage increase]

- Mitsui share price: [Insert data on percentage increase]

- Comparison to Nikkei 225: [Insert data comparing performance against the Nikkei 225]

- Investor sentiment & trading volume: [Insert data reflecting increased trading activity and positive sentiment]

Factors Beyond Berkshire's Investment Contributing to the Rise

While Berkshire Hathaway's investment is a crucial factor, other elements contributed to the share price increases. The global economic recovery, especially in sectors related to commodity trading, played a significant role. Rising commodity prices directly boosted the profitability of these trading houses. Furthermore, the companies' own strategic initiatives, including improvements in operational efficiency and supply chain resilience, enhanced their overall performance and attractiveness to investors. The increasing resilience of Japanese supply chains, a significant factor after global disruptions, also added to investor confidence.

- Global economic recovery: Positive global growth fuels demand for goods and services, benefiting trading houses.

- Commodity price increases: Higher prices for raw materials translate directly into increased profits for trading companies.

- Operational efficiency & strategic initiatives: Internal improvements contribute to stronger financial results.

- Supply chain resilience: Improved supply chain management mitigates risks and strengthens investor confidence.

Future Outlook and Implications for Investors

The future outlook for these Japanese trading houses appears promising, presenting attractive investment opportunities. Their long-term growth potential hinges on several factors, including sustained global economic growth, further diversification into new markets, and successful implementation of their strategic plans. However, investors should also acknowledge potential risks, such as global economic downturns, fluctuations in commodity prices, and geopolitical instability. A thorough risk assessment is crucial before making any investment decisions.

- Growth opportunities: Expansion into new sectors and markets offers considerable potential.

- Long-term investment potential: Strong fundamentals and strategic positioning suggest long-term growth.

- Risk assessment: Investors should consider potential macroeconomic risks and market volatility.

- Investment advice: Thorough research and a comprehensive understanding of market conditions are essential before investing.

Conclusion

The Berkshire Hathaway investment has undeniably triggered a significant surge in the share prices of major Japanese trading houses. This increase reflects not only the confidence in these specific companies but also a positive outlook on the Japanese economy and global markets. Factors beyond the investment, such as global economic recovery and the companies’ own strategic initiatives, have also contributed to this success. The increased interest in Japanese trading houses presents exciting investment opportunities. Learn more about these companies and their potential for continued growth by researching their individual financial reports and market analyses. Understanding the impact of Berkshire Hathaway's investment and the broader economic context is crucial before making informed decisions regarding investments in Japanese trading houses.

Featured Posts

-

Sno Og Vanskelige Kjoreforhold I Sor Norske Fjell

May 08, 2025

Sno Og Vanskelige Kjoreforhold I Sor Norske Fjell

May 08, 2025 -

Major Polluters Get Breathing Space From Singapores Dbs Bank

May 08, 2025

Major Polluters Get Breathing Space From Singapores Dbs Bank

May 08, 2025 -

Realistic Wwii Movies A Military Historians Pick

May 08, 2025

Realistic Wwii Movies A Military Historians Pick

May 08, 2025 -

Significant Rise In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025

Significant Rise In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025 -

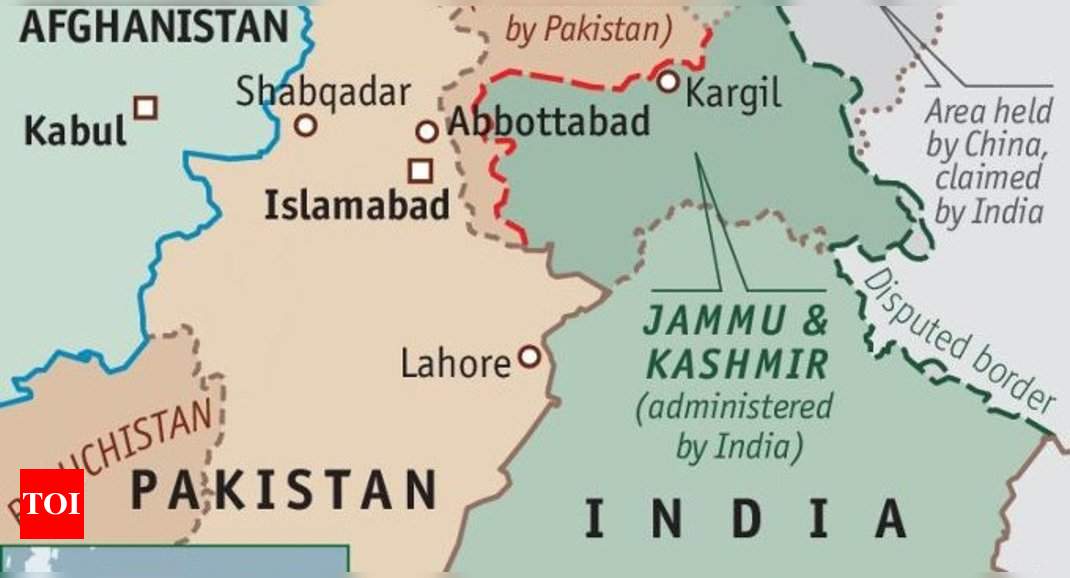

The India Pakistan Border 50 Years Of Conflict And The Latest Escalation

May 08, 2025

The India Pakistan Border 50 Years Of Conflict And The Latest Escalation

May 08, 2025