The CoreWeave (CRWV) Investment Case: A Look Through Jim Cramer's Lens

Table of Contents

CoreWeave's (CRWV) Business Model and Competitive Advantage

CoreWeave's unique selling proposition lies in its specialization in high-performance computing (HPC) and the burgeoning field of artificial intelligence (AI). Unlike more generalist cloud providers, CoreWeave focuses on providing superior infrastructure specifically tailored to the demanding computational needs of AI workloads and large-scale data processing. Their target market includes large enterprises, AI developers, and research institutions requiring substantial computational power.

This niche focus provides a competitive advantage. While giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) offer broad cloud services, CoreWeave can offer more specialized, optimized solutions. Their differentiation stems from:

- Superior infrastructure for AI and HPC workloads: CoreWeave leverages cutting-edge hardware and software to deliver unparalleled performance for computationally intensive tasks.

- Strong partnerships with key technology players: Collaborations with leading hardware and software vendors enhance their offerings and expand their reach.

- Scalable and cost-effective solutions: Their infrastructure is designed to scale efficiently, offering clients the ability to adjust resources based on their needs, minimizing wasted spending.

- Focus on sustainability and efficiency: CoreWeave is committed to environmentally responsible practices, reducing its carbon footprint and appealing to environmentally conscious clients.

Financial Performance and Growth Prospects of CoreWeave (CRWV)

Analyzing CoreWeave's financial performance requires careful consideration of its relatively young age as a publicly traded company. While detailed historical data is limited, examining revenue growth projections, and key financial metrics offer insight into its future potential. The explosive growth of the AI market presents a significant tailwind for CoreWeave.

- Year-over-year revenue growth projections: Analysts’ estimates for CoreWeave's revenue growth are generally positive, reflecting the substantial demand for their specialized services.

- Key financial metrics and their implications: Careful monitoring of metrics like gross margins, operating expenses, and cash flow is crucial for assessing the company's financial health and long-term sustainability.

- Potential for future profitability: CoreWeave's path to profitability hinges on sustaining rapid revenue growth and managing operational costs efficiently.

- Market analysis and growth predictions: The overall growth of the AI and HPC markets directly influences CoreWeave's growth trajectory. Positive market forecasts translate to increased demand for their services.

Jim Cramer's Investing Style and its Relevance to CRWV

Jim Cramer's investing style is characterized by a blend of aggressive growth investing and a keen eye for disruptive technologies. He often favors companies poised for significant expansion in rapidly growing markets. Whether CoreWeave aligns with his typical investment criteria requires analysis.

- Cramer's view on growth stocks: Cramer often champions high-growth stocks with strong potential, even if they are not yet profitable. CoreWeave's high-growth prospects might resonate with his investment philosophy.

- Alignment of CRWV with Cramer's investment criteria: The key question is whether CoreWeave's risk-reward profile fits Cramer's preferences. His preference for companies with strong competitive advantages and significant growth potential makes CoreWeave a potentially interesting candidate.

- Potential risks and rewards from a Cramerian perspective: Cramer emphasizes identifying both the potential upside and downside risks before investing. For CoreWeave, the high growth potential is balanced against the risks associated with competition and market volatility.

- Comparison with similar companies Cramer has discussed: Comparing CoreWeave to other cloud computing companies or AI infrastructure providers that Cramer has discussed on "Mad Money" could provide valuable insights.

Risks and Potential Downsides of Investing in CoreWeave (CRWV)

Despite its promising prospects, investing in CoreWeave (CRWV) presents inherent risks:

- Competition from established cloud providers: The intense competition from established players like AWS, Azure, and GCP poses a significant challenge.

- Dependence on specific technologies or partnerships: CoreWeave's reliance on specific hardware or software could impact its flexibility and adaptability.

- Potential regulatory hurdles: Changes in regulations related to data privacy or cloud computing could negatively affect CoreWeave's operations.

- Market sensitivity and economic factors: Economic downturns often lead to reduced spending on cloud services, potentially impacting CoreWeave's revenue growth.

Conclusion: Should You Invest in CoreWeave (CRWV)? A Final Verdict

CoreWeave (CRWV) presents a compelling investment opportunity within the rapidly expanding AI and HPC cloud computing sectors. Its specialized focus, strong growth potential, and strategic partnerships offer significant upside. However, the risks associated with competition, market volatility, and regulatory changes shouldn't be overlooked.

Through a Jim Cramer lens, the investment would likely be viewed as a high-risk, high-reward proposition. While the explosive growth potential is undeniable, the competitive landscape and potential economic headwinds present significant challenges. A cautious, perhaps even selectively bullish approach, might be warranted.

Call to Action: Before making any investment decisions, conduct thorough due diligence, including reviewing CoreWeave's financial statements, studying industry reports, and consulting with a financial advisor. Remember, responsible investing involves careful research and understanding the risks involved in any CoreWeave investment. Further research into CoreWeave stock and CRWV investment options is crucial for informed decision-making. Utilize reputable financial resources such as the SEC's EDGAR database and financial news websites to inform your investment strategy.

Featured Posts

-

Top 3 Financial Errors Women Make And How To Fix Them

May 22, 2025

Top 3 Financial Errors Women Make And How To Fix Them

May 22, 2025 -

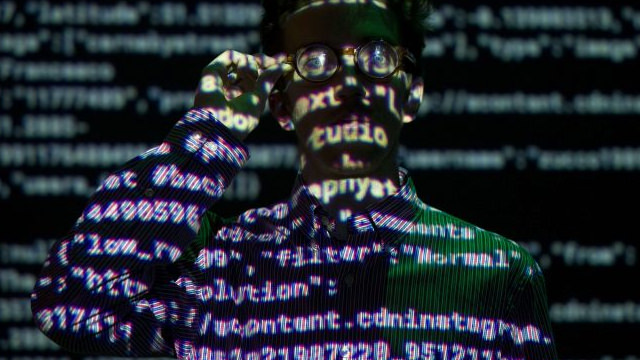

Exclusive Ford Nissan Battery Plant Partnership Implications For The Ev Industry

May 22, 2025

Exclusive Ford Nissan Battery Plant Partnership Implications For The Ev Industry

May 22, 2025 -

Home Depots Q Quarter Earnings Disappointing Results Tariff Guidance Maintained

May 22, 2025

Home Depots Q Quarter Earnings Disappointing Results Tariff Guidance Maintained

May 22, 2025 -

Lancaster County Pa Police Investigating Recent Shooting

May 22, 2025

Lancaster County Pa Police Investigating Recent Shooting

May 22, 2025 -

Betalbaarheid Nederlandse Woningen Analyse Van Abn Amro En Geen Stijls Standpunten

May 22, 2025

Betalbaarheid Nederlandse Woningen Analyse Van Abn Amro En Geen Stijls Standpunten

May 22, 2025

Latest Posts

-

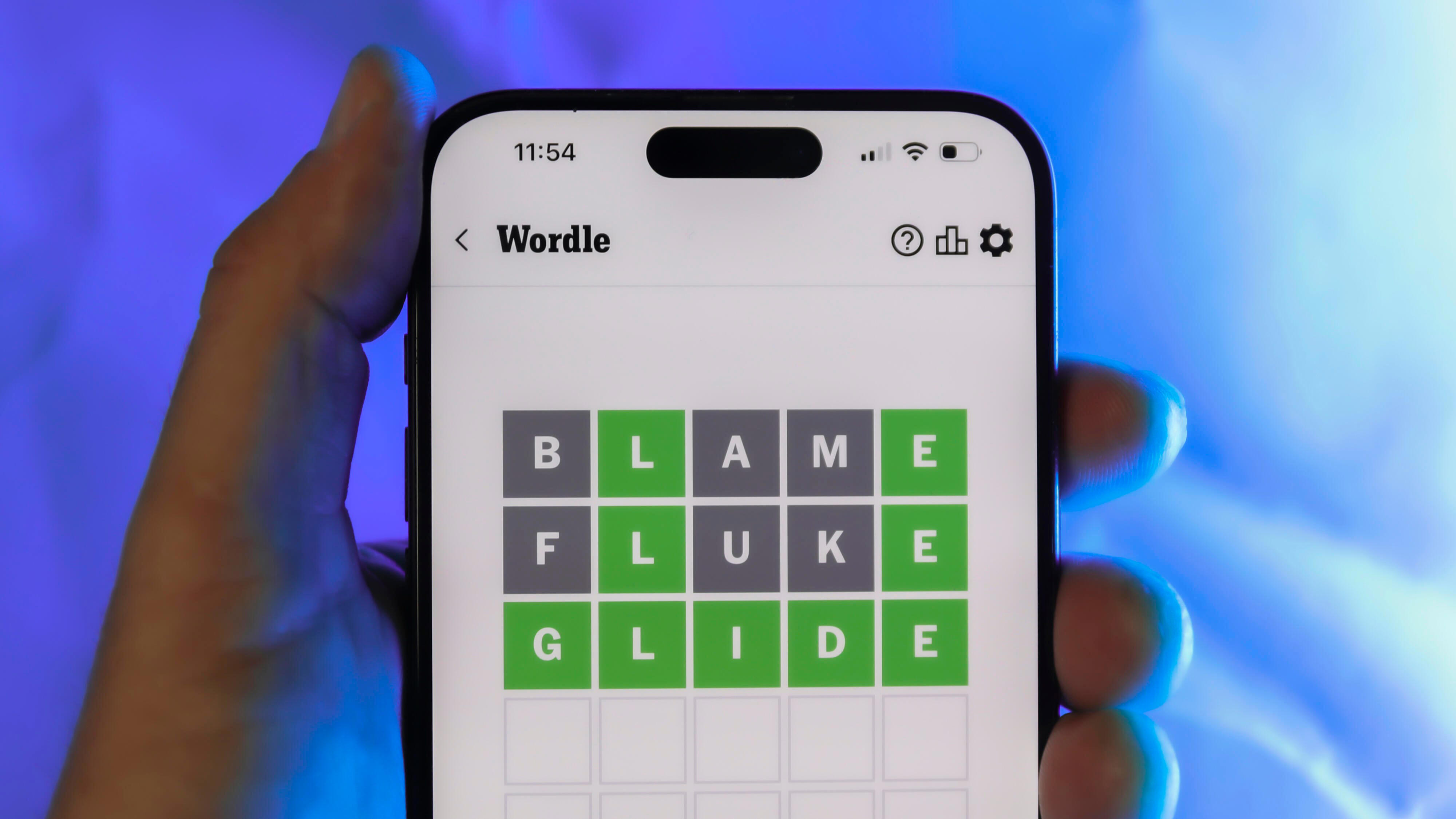

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025 -

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025 -

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025