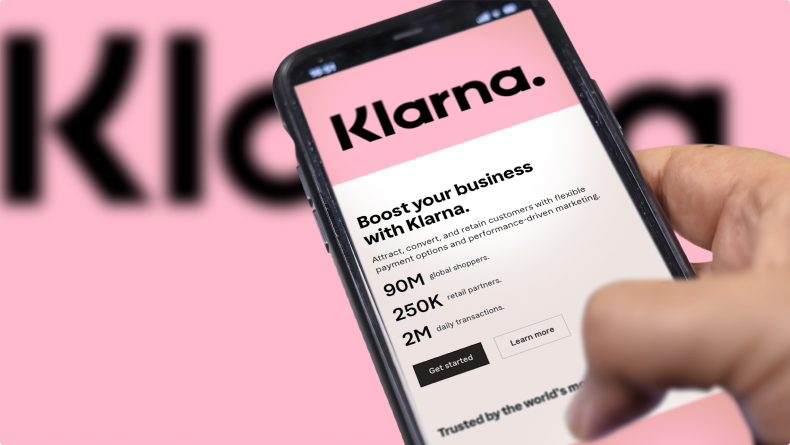

Klarna IPO: $1 Billion Filing Imminent

Table of Contents

Klarna's Path to the IPO

Klarna's journey to the IPO reflects a remarkable success story in the rapidly evolving fintech sector. Its rise to prominence is a testament to its innovative business model and strategic execution.

Rapid Growth and Market Dominance

Klarna's impressive growth trajectory has cemented its position as a leading player in the global BNPL market. The company has achieved remarkable milestones, fueled by aggressive user acquisition strategies and strategic expansion into new markets.

- Key Milestones: Klarna secured significant funding rounds, attracting substantial investment from prominent venture capitalists. Their user base has expanded exponentially, reaching millions of customers globally.

- Market Share Statistics: Klarna boasts a significant market share in key regions, demonstrating its dominance in the BNPL sector. Precise figures fluctuate, but they consistently position Klarna among the top players.

- Geographical Reach: Klarna's global footprint continues to expand, reaching consumers and merchants across Europe, North America, and beyond. This international reach contributes significantly to its overall valuation and growth potential. Klarna expansion into new markets is a key driver of its success. The global fintech growth is further boosted by companies like Klarna.

Financial Performance and Profitability

Analyzing Klarna's financials provides critical insights into its IPO readiness. While specific figures are often kept confidential before an official filing, publicly available information offers some clues.

- Revenue Figures: Klarna has reported substantial revenue growth year-over-year, demonstrating a strong and consistent performance.

- Profitability Margins: Profitability remains a key area of focus for Klarna. While the BNPL model often involves short-term losses as they scale up rapidly, their ability to manage costs and optimize their operations will be a decisive factor in their IPO valuation and investor confidence.

- Debt Levels and KPIs: A clear understanding of Klarna's debt levels and key performance indicators (KPIs) is crucial for evaluating the overall financial health and potential risks associated with investing in the Klarna IPO.

IPO Details and Valuation

The upcoming Klarna IPO is shrouded in anticipation, with investors eager to understand the details and associated risks.

Expected Valuation and Timing

The estimated valuation for the Klarna IPO is significant, reflecting the company's rapid growth and market position. However, the final valuation will depend on several factors, including market conditions and investor demand.

- Projected Valuation Range: Analysts have provided various estimates for the Klarna valuation, with figures often exceeding $1 billion.

- Anticipated IPO Date: The precise timing of the IPO filing and listing remains uncertain, though announcements are expected soon.

- Potential Stock Exchange Listing: While the exact exchange isn't confirmed, major stock exchanges are likely contenders for the Klarna stock listing.

Investment Opportunities and Risks

The Klarna IPO presents a significant investment opportunity for those seeking exposure to the rapidly growing BNPL and fintech sectors. However, it also carries inherent risks.

- Potential Returns: Successful BNPL companies have demonstrated impressive returns for early investors. Klarna’s IPO has the potential for substantial returns, but this is not guaranteed.

- Competitive Landscape: The BNPL market is becoming increasingly competitive, with established players and new entrants vying for market share. This competition presents both opportunities and challenges for Klarna.

- Regulatory Risks: The BNPL sector is subject to evolving regulatory scrutiny, which could impact Klarna's operations and profitability. Regulatory changes are a risk factor to consider in any Klarna investment.

- Market Volatility: The stock market's inherent volatility is a risk factor for all IPOs, including Klarna.

Impact on the BNPL and Fintech Sectors

Klarna's IPO will have a significant ripple effect on both the BNPL and broader fintech sectors.

Market Disruption and Competition

Klarna has played a pivotal role in disrupting the traditional payment industry, challenging established players with its innovative BNPL model.

- Key Competitors: Klarna faces competition from other established BNPL providers such as Afterpay and Affirm. The competitive landscape is dynamic and intense.

- Market Trends: The BNPL market is experiencing rapid growth, driven by increasing consumer demand for flexible payment options.

- Technological Innovations: Klarna continues to innovate, leveraging technology to enhance its services and improve the customer experience. This technological edge is crucial in the competitive fintech landscape.

Future Outlook and Predictions

The future prospects for Klarna and the BNPL sector appear promising, though challenges remain.

- Long-Term Growth Potential: The continued growth of e-commerce and the increasing adoption of BNPL services suggest significant long-term growth potential for Klarna.

- Regulatory Changes: Regulatory changes and potential stricter guidelines could impact the BNPL industry's growth trajectory.

- Technological Advancements: Technological advancements, such as advancements in AI and data analytics, will continue to shape the future of the BNPL market and Klarna's position within it.

- Consumer Adoption Trends: Consumer adoption rates are a critical factor in the success of BNPL companies. Klarna's ability to adapt to evolving consumer preferences will determine its long-term competitiveness.

Conclusion

The Klarna IPO is a significant event with the potential to reshape the landscape of the BNPL and fintech industries. The company’s impressive growth, substantial valuation, and innovative business model make it an attractive investment opportunity. However, potential investors must carefully consider the associated risks, including competition, regulatory changes, and market volatility. Understanding Klarna's financials, its competitive positioning within the BNPL market, and its future growth prospects is crucial for making an informed investment decision.

Call to Action: Stay updated on the Klarna IPO and the broader BNPL market by following reputable financial news sources and conducting thorough due diligence. Learn more about the Klarna initial public offering by visiting their investor relations page (link to be inserted here, if available). Invest wisely in the Klarna IPO (after thorough due diligence).

Featured Posts

-

U S China Truce Fuels Global Stock Market Rally

May 14, 2025

U S China Truce Fuels Global Stock Market Rally

May 14, 2025 -

Mission Impossibles Dead Reckoning A Look At The Ignored Sequels

May 14, 2025

Mission Impossibles Dead Reckoning A Look At The Ignored Sequels

May 14, 2025 -

Maya Jama And Ruben Dias The Next Chapter In Their Romance

May 14, 2025

Maya Jama And Ruben Dias The Next Chapter In Their Romance

May 14, 2025 -

Tennis Branding A Case Study Of Sinners Fox And Federers Rf

May 14, 2025

Tennis Branding A Case Study Of Sinners Fox And Federers Rf

May 14, 2025 -

Eurovision 2024 Estonias Absurd Italian Inspired Act

May 14, 2025

Eurovision 2024 Estonias Absurd Italian Inspired Act

May 14, 2025