Last-Minute Tweaks: House Votes To Approve Trump Tax Legislation

Table of Contents

Key Provisions of the Trump Tax Legislation

The Trump tax legislation encompasses sweeping changes to various aspects of the US tax system. Understanding these changes is vital for effective financial planning.

-

Individual Tax Rates: The bill modifies individual income tax brackets, resulting in [State specific changes, e.g., lower rates for some brackets and higher rates for others]. This means many individuals will see a change in their tax liability, either an increase or decrease, depending on their income level. Specific changes include:

- [Specific change to bracket 1, e.g., A reduction in the tax rate for the lowest income bracket from 10% to 5% for incomes up to $10,000.]

- [Specific change to bracket 2, e.g., A slight increase in the tax rate for the second income bracket from 12% to 15% for incomes between $10,001 and $40,000.]

- [And so on for other brackets]

-

Corporate Tax Rate Reduction: A central feature of the legislation is a significant reduction in the corporate tax rate from [Old rate]% to [New rate]%. This decrease aims to stimulate business investment and economic growth. The lower rate is projected to [State expected outcome, e.g., benefit large corporations and potentially lead to increased job creation].

-

Standard Deduction Increases: The standard deduction has been significantly increased for both single and married filers. This change is designed to simplify tax preparation for many Americans and potentially reduce their tax burden. The new standard deduction amounts are:

- Single filers: [Dollar amount]

- Married couples filing jointly: [Dollar amount]

-

Child Tax Credit Adjustments: The child tax credit has also undergone adjustments, with [Explain changes, e.g., an increase in the maximum credit amount and expansion of eligibility criteria]. These changes aim to provide greater tax relief for families with children.

-

State and Local Taxes (SALT): The bill includes [Explain changes to SALT deductions, e.g., a cap on deductions for state and local taxes, potentially impacting high-tax states]. This provision has generated considerable controversy.

-

Pass-Through Businesses: The legislation contains provisions impacting pass-through businesses, such as [Explain how the bill affects pass-through businesses, e.g., changes to qualified business income deductions].

The Role of Last-Minute Tweaks and Amendments

The final version of the Trump tax legislation underwent several last-minute amendments, significantly altering its original form. These changes reflect the intense political negotiations leading up to the House vote.

- Specific Amendments: [Describe key amendments and their purpose, e.g., One notable amendment addressed concerns about the impact on small businesses by adjusting the qualified business income deduction.]

- Political Pressure: The last-minute alterations were largely driven by [Explain the reasons for the changes, e.g., lobbying efforts from various interest groups and political pressure to secure votes].

- Impact on Different Segments: These changes had varied impacts across different demographics. [Explain, e.g., some amendments aimed to mitigate the negative effects on low-income families, while others favored higher-income earners].

- Compromises: Many compromises were made during the amendment process, resulting in a bill that satisfied, to some extent, the competing interests of different factions. [Give examples].

- Unintended Consequences: It's crucial to acknowledge that last-minute changes may have unintended consequences, some of which may only become apparent over time.

Analysis of the Voting Process

The House vote on the Trump tax legislation followed a highly partisan pattern.

- Party Lines: The bill largely passed along party lines, with [Percentage]% of [Party] members voting in favor and [Percentage]% of [Party] members voting against.

- Significant Speeches: [Mention key speeches and their impact on the debate].

- Key Figures: [Highlight the roles played by prominent members of Congress].

- Margin of Victory: The bill passed by a [Margin] vote.

Potential Economic Impacts of the Trump Tax Legislation

The economic effects of this legislation are complex and subject to debate.

- GDP Growth: Proponents argue that the tax cuts will stimulate economic growth, leading to increased GDP. However, critics contend that the benefits will be limited and largely accrue to the wealthy.

- Job Creation and Investment: The corporate tax cut is expected to boost business investment and potentially lead to job creation. However, the extent of this impact is uncertain.

- Inflation: The increased spending resulting from tax cuts could lead to inflationary pressures.

- National Debt: The bill is expected to significantly increase the national debt. [Quantify the potential increase].

- Income Inequality: The tax cuts are likely to exacerbate income inequality, with the wealthy receiving a disproportionate share of the benefits.

Next Steps and Future Implications

The Trump tax legislation still needs Senate approval and the President's signature to become law.

- Senate Approval: The bill's passage in the Senate is [State the probability of success or challenges ahead].

- Senate Challenges: [Explain the expected challenges in the Senate, e.g., potential filibusters or amendments].

- Presidential Action: President [President's name] is expected to [State the President's stance on the bill, e.g., sign the bill into law].

- Long-Term Impact on Tax Revenue: The long-term impact on tax revenue remains uncertain, with differing predictions from various economic experts.

- Future Tax Reforms: This legislation is likely to shape future tax reforms and debates in the US.

Conclusion

The House vote on the Trump tax legislation marks a significant turning point in US tax policy. This article highlighted the key provisions, last-minute amendments, and potential economic implications of this landmark bill. Understanding the intricacies of the Trump tax legislation, including its numerous last-minute changes, is crucial for individuals and businesses to plan for the future. Stay informed about the Senate's deliberations and the ultimate fate of this transformative legislation. Continue to follow developments on the Trump tax legislation for further updates and analysis. Understanding the implications of the Trump tax legislation is key to navigating the changes in your financial planning.

Featured Posts

-

Strategi Investasi Memaksimalkan Potensi Mtel And Mbma Di Msci Small Cap

May 24, 2025

Strategi Investasi Memaksimalkan Potensi Mtel And Mbma Di Msci Small Cap

May 24, 2025 -

Planned M62 Westbound Closure Manchester Warrington Resurfacing

May 24, 2025

Planned M62 Westbound Closure Manchester Warrington Resurfacing

May 24, 2025 -

16 Mart Ta Dogmus Olanlarin Burcu Ve Kisilik Oezellikleri

May 24, 2025

16 Mart Ta Dogmus Olanlarin Burcu Ve Kisilik Oezellikleri

May 24, 2025 -

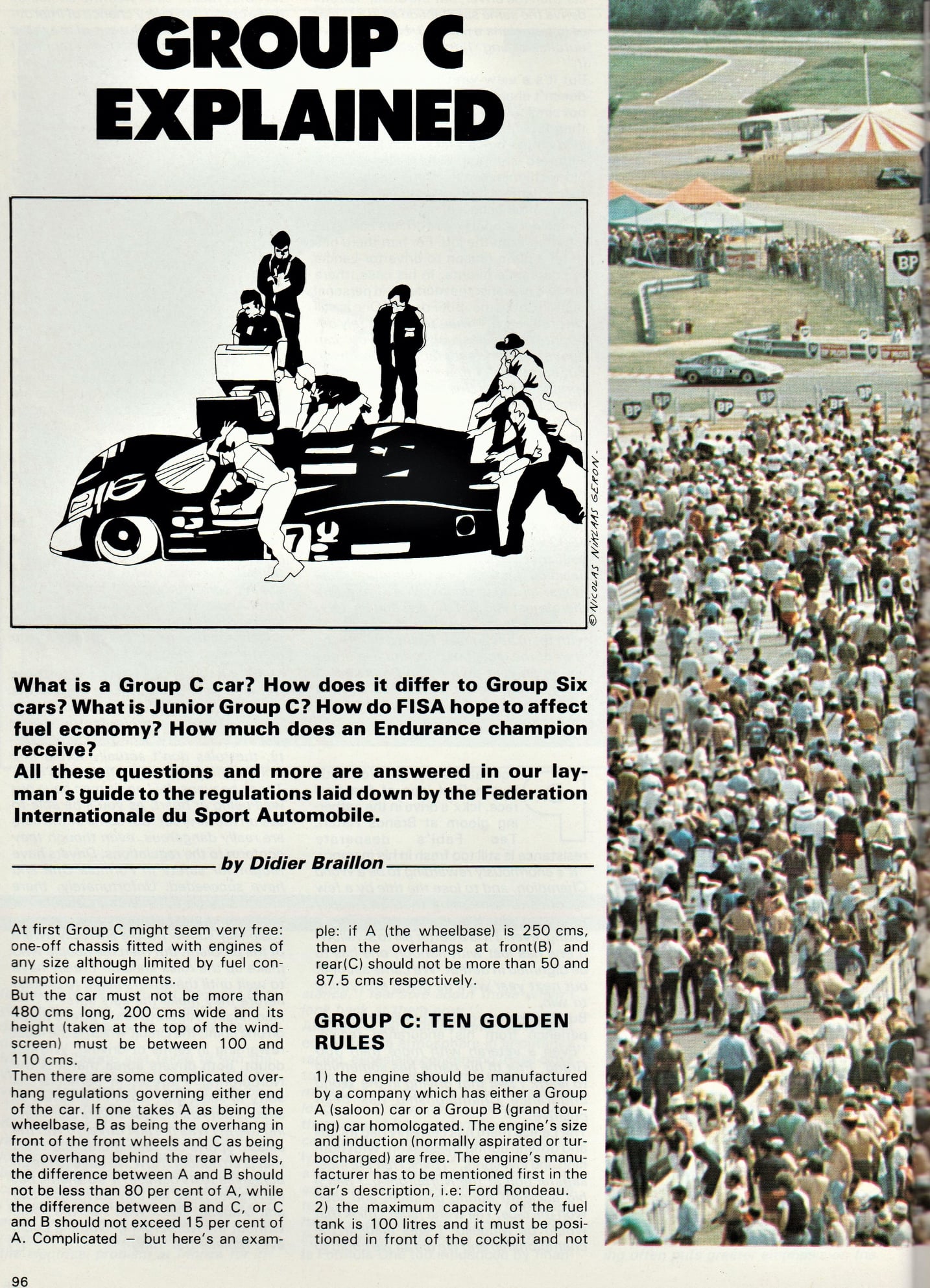

Porsche 956 Nin Tavan Asili Sergilenmesinin Nedenleri

May 24, 2025

Porsche 956 Nin Tavan Asili Sergilenmesinin Nedenleri

May 24, 2025 -

Dutch Stocks Slump Amidst Escalating Us Trade War

May 24, 2025

Dutch Stocks Slump Amidst Escalating Us Trade War

May 24, 2025

Latest Posts

-

Sandy Point Rehoboth Ocean City Beaches Memorial Day 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day 2025 Weather Prediction

May 24, 2025 -

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Kermits Commencement Speech Inspiring Maryland Graduates

May 24, 2025

Kermits Commencement Speech Inspiring Maryland Graduates

May 24, 2025