Dutch Stocks Slump Amidst Escalating US Trade War

Table of Contents

The Impact of US Tariffs on Dutch Exports

The US trade war's impact on Dutch exports is substantial, particularly affecting key sectors like agriculture and manufacturing. US tariffs have significantly hampered the competitiveness of Dutch goods in the American market, leading to a decline in export volumes and revenue.

- Agricultural Exports: Dutch agricultural exports, renowned for their quality, have faced steep tariffs on products like dairy and horticultural goods. This has resulted in a noticeable decrease in export volume to the US, impacting farmers' incomes and potentially leading to job losses within the sector. Estimates suggest a decline of X% in agricultural exports to the US since the imposition of tariffs.

- Manufacturing Exports: Dutch manufacturers, particularly those specializing in high-tech equipment and precision engineering, have also been affected. Increased tariffs on imported components and finished goods have reduced their competitiveness, leading to decreased sales and potential factory closures. The impact is particularly noticeable in sectors like [mention specific sectors].

- Trade Deficit: The reduced export volume directly contributes to a widening trade deficit for the Netherlands, potentially slowing economic growth and putting pressure on the national currency. The scale of this impact is expected to be further analyzed in the upcoming economic reports from the Central Bank of the Netherlands.

These tariffs have severely impacted Dutch businesses’ ability to compete effectively in the global market, as US-based competitors now enjoy a price advantage. The resulting loss of market share represents a serious challenge to the Dutch economy.

Uncertainty and Investor Sentiment

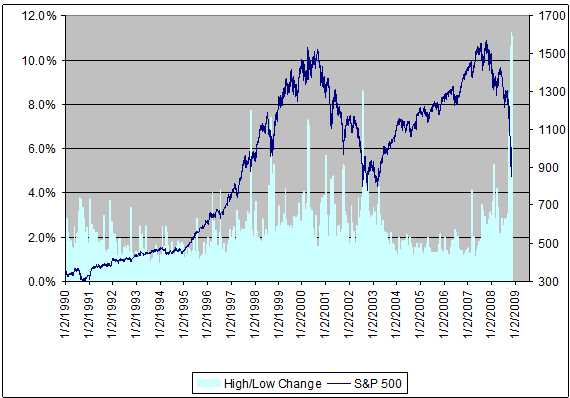

The escalating trade war has created significant uncertainty, severely impacting investor sentiment. The unpredictable nature of trade policy changes fosters a climate of risk aversion, causing investors to withdraw from the market or shift their investments to safer assets.

- Decreased Investment: Investment in several key sectors, particularly those heavily reliant on exports to the US, has noticeably slowed. This has directly contributed to the decline in Dutch stock prices, as investors seek to minimize risk.

- Stock Market Decline: Major Dutch stock market indices reflect this negative sentiment, demonstrating a clear downward trend. [Mention specific indices and their percentage drop]. This decline reflects investors' concerns about future earnings and the overall health of the Dutch economy.

- Expert Opinions: Financial experts widely attribute the recent market volatility to the uncertainty surrounding the trade war, with many advising caution and a more conservative investment approach.

This uncertainty makes investment decisions increasingly difficult, affecting not only individual investors but also larger institutional investors, hindering economic growth and job creation.

Potential Responses from the Dutch Government

The Dutch government faces the challenge of mitigating the negative economic consequences of the US trade war. Several policy interventions are being considered to support affected businesses and stimulate economic growth.

- Fiscal Stimulus: Implementing a fiscal stimulus package could provide a much-needed boost to the economy, potentially offsetting some of the losses incurred by businesses. This might include tax cuts or increased government spending on infrastructure projects.

- Trade Negotiations: The Dutch government, alongside the EU, is actively involved in trade negotiations with the US, striving for a resolution to the trade conflict. Successful negotiations could alleviate the pressure on Dutch exporters.

- Support for Businesses: Targeted support packages for affected businesses, such as subsidies or loans, could help them navigate the challenges and maintain employment. These measures aim to minimize job losses and economic disruption.

- EU Support: The role of the European Union is vital in providing a unified front against US trade policies and coordinating support measures for member states, including the Netherlands.

The effectiveness of these measures will depend on their scale and timely implementation. The government’s proactive response will play a crucial role in shaping the Netherlands' economic trajectory.

The Role of the European Union

The European Union plays a critical role in mitigating the negative impact of the US trade war on its member states, including the Netherlands. The EU's collective bargaining power allows for more effective negotiations with the US, and its coordinated approach ensures a unified response to the trade disputes. The EU may also implement countermeasures to protect its member states' interests, or provide financial assistance to help buffer the economic impact of the US tariffs. The EU's response is crucial in shaping the outcome of the trade dispute and its effect on the Dutch economy.

Conclusion

The escalating US trade war has significantly impacted Dutch stocks, leading to a noticeable slump and increased market volatility. Key sectors like agriculture and manufacturing are particularly vulnerable to US tariffs, creating uncertainty and impacting investor confidence. The Dutch government, alongside the EU, is exploring various policy responses to mitigate the negative effects, including fiscal stimulus, trade negotiations, and support packages for affected businesses. To effectively navigate this challenging period, it's crucial to stay informed about the evolving situation. Monitor developments related to the US trade war and consult credible financial news sources such as [mention specific websites or reports] to gain insights into the ongoing situation and potential impact on Dutch stocks and the wider Netherlands economy. Developing a robust investment strategy that accounts for this increased market volatility is essential for mitigating potential losses and ensuring long-term financial stability during this Dutch stocks slump fueled by the US trade war.

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

New Diamond Ring Sparks Engagement Speculation For Annie Kilner And Kyle Walker

May 24, 2025

New Diamond Ring Sparks Engagement Speculation For Annie Kilner And Kyle Walker

May 24, 2025 -

Uitstel Trump Leidt Tot Herstel Op De Beurzen Aex In Positief Gebied

May 24, 2025

Uitstel Trump Leidt Tot Herstel Op De Beurzen Aex In Positief Gebied

May 24, 2025 -

2025 Memorial Day Flights The Least And Most Crowded Days

May 24, 2025

2025 Memorial Day Flights The Least And Most Crowded Days

May 24, 2025 -

Amsterdam Stock Market Three Day Losing Streak 11 Drop

May 24, 2025

Amsterdam Stock Market Three Day Losing Streak 11 Drop

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025