Lowest Personal Loan Interest Rates Today: Top Lender Options

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several key factors influence the interest rate you'll receive on a personal loan. Understanding these factors is crucial for securing the lowest personal loan interest rates. Your interest rate isn't just a number; it directly impacts your overall loan cost.

-

Your credit score: This is the single most significant factor. Lenders use your credit score (FICO score or similar) to assess your creditworthiness. A higher credit score (750 or above is generally considered excellent) significantly increases your chances of qualifying for low interest personal loans. A lower score will likely result in higher interest rates or loan denial.

-

Loan amount: Generally, larger loan amounts may come with slightly higher interest rates. Lenders perceive a higher risk with larger sums.

-

Loan term: The length of your loan (e.g., 24 months, 36 months, 60 months) affects your monthly payments and the total interest paid. Shorter loan terms result in higher monthly payments but lower overall interest charges because you pay off the principal faster. Longer terms mean lower monthly payments but higher total interest costs.

-

Debt-to-income ratio (DTI): Your DTI is the percentage of your gross monthly income that goes towards debt repayment. A lower DTI indicates you can comfortably manage additional debt, leading to better interest rates. Lenders prefer a DTI below 43%.

-

Your income and employment history: Stable income and a consistent employment history demonstrate your ability to repay the loan. Lenders prefer borrowers with verifiable and reliable income streams.

-

Type of loan: Secured loans (backed by collateral, like a car or savings account) typically offer lower interest rates than unsecured loans because they represent less risk to the lender.

Top Lender Options for Low Interest Personal Loans

Choosing the right lender is crucial for obtaining low interest personal loans. While specific rates change constantly, we can explore some lender categories and what to look for. Always compare multiple offers before committing.

-

National Banks: Large national banks often offer personal loans, but their rates can vary depending on your creditworthiness and the specific branch. Consider their established reputation and customer service options. They may have higher minimum loan amounts.

-

Credit Unions: Credit unions are member-owned financial institutions that often offer competitive rates and personalized service. Membership requirements may apply.

-

Online Lenders: Online lenders are becoming increasingly popular due to their convenience and often competitive rates. Carefully review fees and APR (Annual Percentage Rate) before applying. They usually offer a streamlined application process.

-

Peer-to-Peer Lending Platforms: These platforms connect borrowers with individual investors, sometimes resulting in unique loan terms.

Comparing Loan Offers and APR

Don't just focus on the advertised interest rate. The Annual Percentage Rate (APR) provides a more comprehensive picture of the total cost of your loan, including interest and any fees. Always compare the APR across different lenders. Hidden fees, such as origination fees or prepayment penalties, can significantly impact the overall cost. Use online loan comparison tools to streamline this process and ensure you’re getting the best deal.

How to Improve Your Chances of Getting the Lowest Rates

Taking proactive steps can significantly improve your chances of securing the lowest personal loan interest rates.

-

Check and correct your credit report: Errors on your credit report can negatively impact your score. Review your reports from all three major credit bureaus (Equifax, Experian, and TransUnion) annually and dispute any inaccuracies.

-

Reduce your debt: Paying down existing debt lowers your DTI, improving your creditworthiness. Focus on high-interest debts first.

-

Improve your credit score: Responsible credit management is key. Pay bills on time, maintain low credit utilization (the amount of credit you're using compared to your total available credit), and avoid applying for too much new credit in a short period.

-

Shop around and compare: Obtain pre-qualification offers from multiple lenders to see what rates you qualify for without affecting your credit score. Compare APRs and fees carefully.

-

Pre-qualify for a loan: Several lenders allow you to pre-qualify for a loan, providing an estimate of your interest rate without impacting your credit score. This allows you to compare offers before formally applying.

Conclusion

Finding the lowest personal loan interest rates today requires careful research and comparison. Factors like your credit score, loan amount, and term significantly impact the interest rate you qualify for. By understanding these factors and comparing offers from various reputable lenders, you can secure the most favorable loan terms. Don't rush the process; take your time to find the best deal for your financial situation. Remember, even small differences in interest rates can accumulate to substantial savings over the life of your loan.

Start your search for the lowest personal loan interest rates today! Use our guide to compare lenders and find the best deal to fit your financial needs. Don't settle for high interest rates – secure a low-interest personal loan that works for you.

Featured Posts

-

Pirates Opening Day Skenes Gets The Nod

May 28, 2025

Pirates Opening Day Skenes Gets The Nod

May 28, 2025 -

65 Billion Dutch Investor Issues Strong Warning To Us Money Managers

May 28, 2025

65 Billion Dutch Investor Issues Strong Warning To Us Money Managers

May 28, 2025 -

Blue Jays Padres Trade Could It Save Vladdy Jr S Season

May 28, 2025

Blue Jays Padres Trade Could It Save Vladdy Jr S Season

May 28, 2025 -

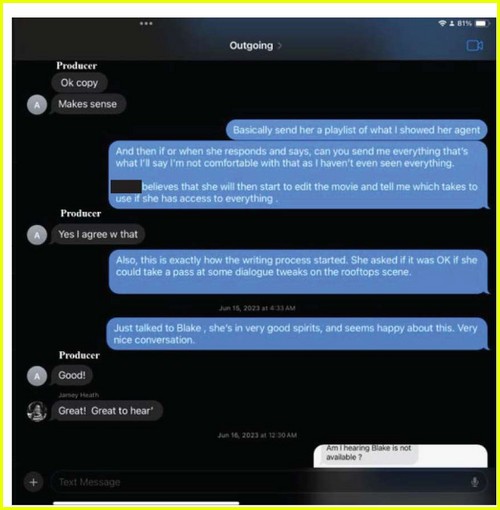

Dispute Between Ryan Reynolds And Justin Baldoni Legal Battle Ensues

May 28, 2025

Dispute Between Ryan Reynolds And Justin Baldoni Legal Battle Ensues

May 28, 2025 -

Green Home Loan Program Expands Cabinet Commits E750 Million Leverages Eu Funding

May 28, 2025

Green Home Loan Program Expands Cabinet Commits E750 Million Leverages Eu Funding

May 28, 2025

Latest Posts

-

Isere Les Attaques Contre Les Prisons Et La Reponse Gouvernementale

May 30, 2025

Isere Les Attaques Contre Les Prisons Et La Reponse Gouvernementale

May 30, 2025 -

Appel Du Proces Rn Jacobelli Salue La Rapidite De La Justice

May 30, 2025

Appel Du Proces Rn Jacobelli Salue La Rapidite De La Justice

May 30, 2025 -

Arcelor Mittal Et La Russie Decryptage Du 9 Mai 2025 Avec Laurent Jacobelli

May 30, 2025

Arcelor Mittal Et La Russie Decryptage Du 9 Mai 2025 Avec Laurent Jacobelli

May 30, 2025 -

Proces Hanouna Le Pen Appel En 2026 Les Doutes De Laurent Jacobelli

May 30, 2025

Proces Hanouna Le Pen Appel En 2026 Les Doutes De Laurent Jacobelli

May 30, 2025 -

L Age De Depart A La Retraite Les Discussions Entre Le Rn Et La Gauche S Intensifient

May 30, 2025

L Age De Depart A La Retraite Les Discussions Entre Le Rn Et La Gauche S Intensifient

May 30, 2025