Mali's Attempt To Take Over Barrick Gold Mine: Lack Of Legal Basis Claimed

Table of Contents

The Malian Government's Actions and Their Justification

The Malian government's attempt to seize the Loulo-Gounkoto mine stemmed from escalating disagreements with Barrick Gold. The stated justifications centered on disputes over revenue sharing, alleged breaches of contract by Barrick Gold, and claims of insufficient contributions to the Malian economy. These claims, however, have been met with significant skepticism from international observers and legal experts.

- Timeline of events: The dispute escalated over several months, marked by increasingly assertive statements from the Malian government and attempts to renegotiate the mining agreement. The culmination was the government's direct intervention, attempting to take control of the mine's operations.

- Specific government actions: This involved the issuance of decrees and directives aimed at limiting Barrick Gold's operational authority and ultimately transferring control to a state-owned entity.

- Official statements: Malian officials publicly justified their actions by emphasizing the need to maximize the economic benefits derived from the country's natural resources, often framing the situation as a struggle for national sovereignty over its resources.

- Analysis of claims: A closer examination reveals inconsistencies and potential legal flaws in the government's arguments, raising concerns about due process and the rule of law.

Barrick Gold's Response and Legal Arguments

Barrick Gold has vehemently rejected the Malian government's actions, asserting that they constitute a clear breach of contract and a violation of international investment treaties. The company has initiated legal action, primarily focusing on international arbitration to protect its rights and investments.

- Barrick Gold's official statements: The company has consistently emphasized its commitment to operating within the framework of the law and its adherence to the terms of its mining agreement with the Malian government. Public statements highlight the illegality of the seizure and the potential damage to investor confidence.

- Legal action: Barrick Gold has launched international arbitration proceedings, relying on existing bilateral investment treaties to challenge the legality of the government's actions and seek compensation for damages.

- Contractual clauses: Specific clauses within the original mining contract, pertaining to dispute resolution, operational rights, and revenue-sharing mechanisms, form the core of Barrick Gold's legal arguments.

- Expert opinions: Legal experts specializing in international investment law widely concur that the Malian government’s actions are highly problematic and likely violate numerous international legal principles.

International Implications and the Impact on Foreign Investment

The Mali-Barrick Gold dispute carries significant implications for foreign investment across Africa. The incident has severely damaged Mali's reputation as a stable and predictable investment destination within the mining industry. The risk profile associated with mining investments in the country has undeniably increased, potentially deterring future projects.

- Impact on Mali's reputation: The seizure casts a long shadow on Mali's ability to attract future foreign direct investment (FDI), particularly in resource-intensive sectors.

- Ramifications for other African countries: Similar actions by other governments could trigger a domino effect, discouraging foreign investment across the continent and undermining efforts to promote sustainable economic development.

- Risk assessment: International investors are likely to reassess the risks associated with mining projects in Mali and similar jurisdictions, demanding higher returns or seeking greater legal protection.

- Expert commentary: Analysts warn of a potential "resource curse" effect, where the abundance of natural resources fuels political instability and discourages long-term economic growth due to unreliable legal frameworks.

Analysis of the Legal Basis: Is the Seizure Legitimate?

A thorough examination of the legal arguments reveals a significant lack of a clear legal basis for Mali's actions. International law, particularly principles of contract law, due process, and international investment treaties, strongly suggest the seizure was illegitimate.

- International investment treaties: Relevant treaties likely grant Barrick Gold specific protections against arbitrary government actions and ensure fair treatment under Malian law.

- Malian mining law: Even under Malian domestic mining law, the government's actions are likely to be deemed unlawful, lacking the required procedural safeguards and justifications.

- Procedural fairness: The Malian government's actions lacked due process, failing to provide Barrick Gold with adequate opportunity to address the issues before resorting to seizure.

- Legal opinions: Legal experts predict a strong likelihood of success for Barrick Gold in its legal challenges due to the apparent violations of international law and the lack of a sound legal basis for the seizure.

Conclusion

Mali's attempt to seize Barrick Gold's Loulo-Gounkoto gold mine highlights a critical juncture in the relationship between African nations and foreign investors. The apparent lack of a robust legal basis for the seizure raises serious concerns about the rule of law and its impact on investor confidence. This case serves as a cautionary tale, underscoring the importance of transparent and predictable legal frameworks for fostering sustainable economic development in resource-rich nations. The ongoing legal battles will undoubtedly shape the future of mining investment in Mali and across Africa. Stay updated on the evolving situation surrounding Mali's controversial seizure of the Barrick Gold mine, and learn more about the complex legal issues surrounding international mining investments in Africa. Understanding these complexities is crucial for mitigating risks and promoting responsible resource management.

Featured Posts

-

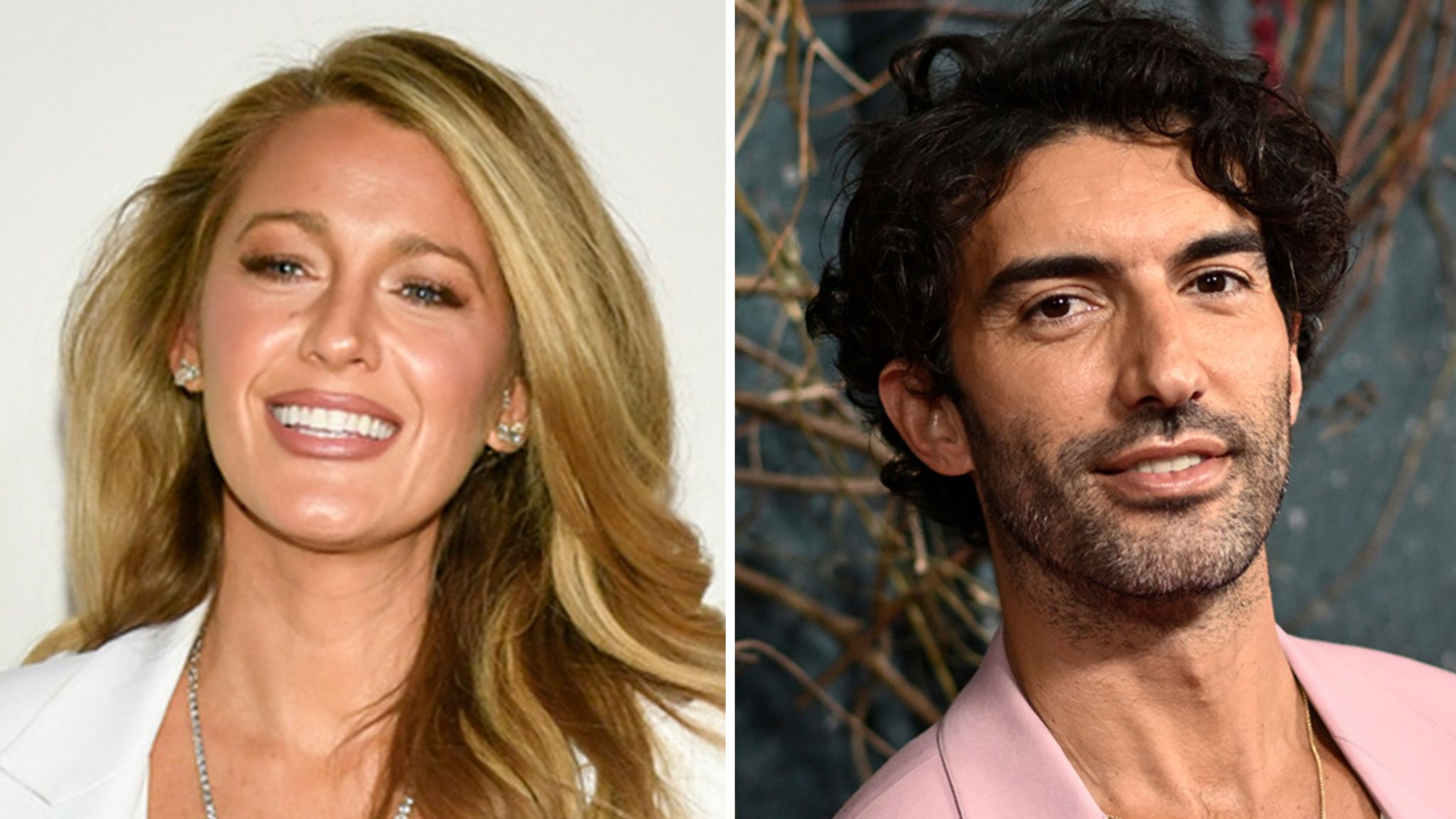

Allegations Against Ryan Reynolds The Justin Baldoni Case

May 28, 2025

Allegations Against Ryan Reynolds The Justin Baldoni Case

May 28, 2025 -

Bethlehem Mayor And Councilwoman Races Targeted By Opposition Mailers

May 28, 2025

Bethlehem Mayor And Councilwoman Races Targeted By Opposition Mailers

May 28, 2025 -

Dangerous Climate Whiplash A Report On Its Global City Impacts

May 28, 2025

Dangerous Climate Whiplash A Report On Its Global City Impacts

May 28, 2025 -

The Latest News Pictures And Videos Of Nicolas Anelka

May 28, 2025

The Latest News Pictures And Videos Of Nicolas Anelka

May 28, 2025 -

Jejak Awal Akp Djauhari Sebagai Kasatlantas Polresta Balikpapan Imam Sholat Subuh

May 28, 2025

Jejak Awal Akp Djauhari Sebagai Kasatlantas Polresta Balikpapan Imam Sholat Subuh

May 28, 2025

Latest Posts

-

Stock Market Valuation Concerns Why Bof A Remains Optimistic

May 30, 2025

Stock Market Valuation Concerns Why Bof A Remains Optimistic

May 30, 2025 -

Addressing Investor Concerns Bof As Analysis Of Current Stock Market Valuations

May 30, 2025

Addressing Investor Concerns Bof As Analysis Of Current Stock Market Valuations

May 30, 2025 -

Bof As Take On Stretched Stock Market Valuations A Guide For Investors

May 30, 2025

Bof As Take On Stretched Stock Market Valuations A Guide For Investors

May 30, 2025 -

Understanding Stock Market Valuations Bof As View And Investor Implications

May 30, 2025

Understanding Stock Market Valuations Bof As View And Investor Implications

May 30, 2025 -

High Stock Market Valuations A Bof A Perspective For Investors

May 30, 2025

High Stock Market Valuations A Bof A Perspective For Investors

May 30, 2025