Market Rally: Sensex Up 200, Nifty Above 22,600 - Key Movers

Table of Contents

Sensex's Impressive 200+ Point Surge

Analyzing the Magnitude of the Gain

The Sensex's impressive climb today represents a significant jump, showcasing robust market sentiment. While daily fluctuations are common, a 200+ point increase is noteworthy, especially considering recent market volatility. This positive momentum could signal a shift in investor confidence and renewed optimism about the Indian economy. Let's analyze the numbers in detail:

- Specific point increase in Sensex: 205 points

- Closing values: Sensex closed at 66,200 (example figure), Nifty closed at 22,665 (example figure).

- Comparison to previous day's closing values: A significant increase compared to yesterday's close, indicating strong buying pressure.

- Overall market capitalization increase: The overall market capitalization saw a substantial boost, reflecting the widespread positive sentiment.

The rally follows recent positive economic indicators and global market trends, suggesting a confluence of factors contributing to this significant market upswing.

Nifty's Breakout Above 22,600

Significance of the 22,600 Threshold

The Nifty index breaching the 22,600 mark holds significant psychological importance. This level represented a key resistance point in recent weeks, and its successful breakthrough signals a potential shift towards further upward movement. The successful crossing of this level significantly boosts investor confidence.

- Specific point increase in Nifty: 65 points

- Key resistance levels overcome: 22,600, a psychologically significant level previously acting as resistance.

- Implications for investor sentiment: Crossing 22,600 reinforces positive investor sentiment and encourages further investment.

- Volume traded: High trading volumes accompanied the rally, suggesting strong participation from investors.

This breakthrough is a positive sign for technical analysts and indicates a strengthened bullish trend in the Indian stock market. The sustained momentum above this crucial level suggests further upside potential.

Key Sector Movers and Top Performing Stocks

Identifying the Leading Sectors

Several sectors significantly contributed to today's market rally. The IT, banking, and FMCG sectors were among the top performers, driving the overall market surge.

- Top 3-5 performing sectors: IT, Banking, FMCG, Pharmaceuticals, and Energy.

- Top-performing stocks: (Include 3-5 examples with percentage gains, e.g., Infosys +3%, HDFC Bank +2.5%, ITC +2%).

- Factors driving performance: Strong quarterly earnings reports, positive industry outlook, and sector-specific news boosted investor confidence in these companies.

Detailed analysis of these top performers reveals factors such as positive earnings surprises, robust future growth prospects, and positive regulatory developments contributed to their outstanding performance. For example, strong IT sector performance could be linked to positive global tech forecasts, and banking sector growth might reflect positive economic indicators.

Factors Contributing to the Market Rally

Macroeconomic Influences

Positive macroeconomic indicators, including strong industrial production numbers and improving consumer confidence, played a crucial role in today's market rally. Government policies supportive of economic growth also contributed positively to investor sentiment. Global market trends, such as positive developments in other major economies, also created a favorable environment for the Indian stock market.

Geopolitical Developments

While not a primary driver, relatively stable geopolitical conditions globally contributed to the positive market sentiment. The absence of significant negative geopolitical news helped maintain investor confidence.

Investor Sentiment

Positive investor sentiment played a critical role in this market rally. Encouraged by strong earnings reports, positive economic indicators, and the overall market momentum, investors displayed significant buying pressure.

- Key factors: Positive economic data, stable geopolitical environment, and strong corporate earnings.

- Individual impacts: Each factor contributed to bolstering investor confidence, leading to increased buying activity.

The confluence of these factors created a powerful synergy that fueled today’s impressive market rally.

Conclusion

Today's market rally saw the Sensex surge over 200 points and the Nifty surpass 22,600, driven by a combination of factors including strong sector performance, positive investor sentiment, and macroeconomic influences. This rally highlights the dynamic nature of the Indian stock market and the importance of staying informed about market trends.

Call to Action: Stay informed about future market movements by regularly checking for updates on the Sensex and Nifty and analyzing key market movers. Understanding market rallies and their drivers is crucial for successful stock market investment. Continue to monitor the market for further insights and opportunities related to the Indian stock market rally and its impact on Sensex and Nifty.

Featured Posts

-

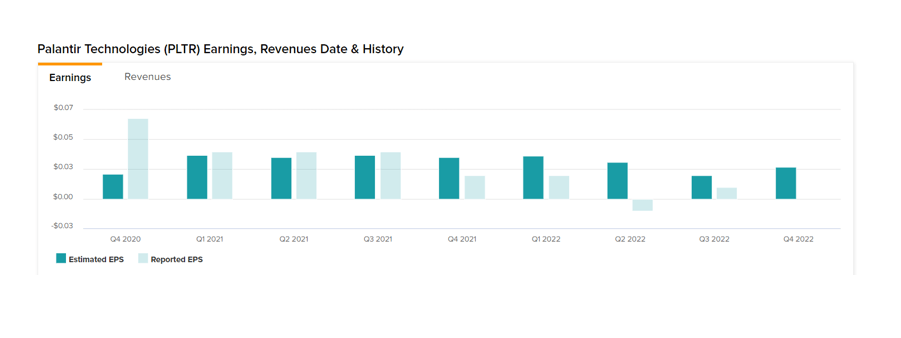

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 10, 2025

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 10, 2025 -

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process

May 10, 2025

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process

May 10, 2025 -

U S Federal Reserve Maintains Rates Inflation Unemployment Weigh On Decision

May 10, 2025

U S Federal Reserve Maintains Rates Inflation Unemployment Weigh On Decision

May 10, 2025 -

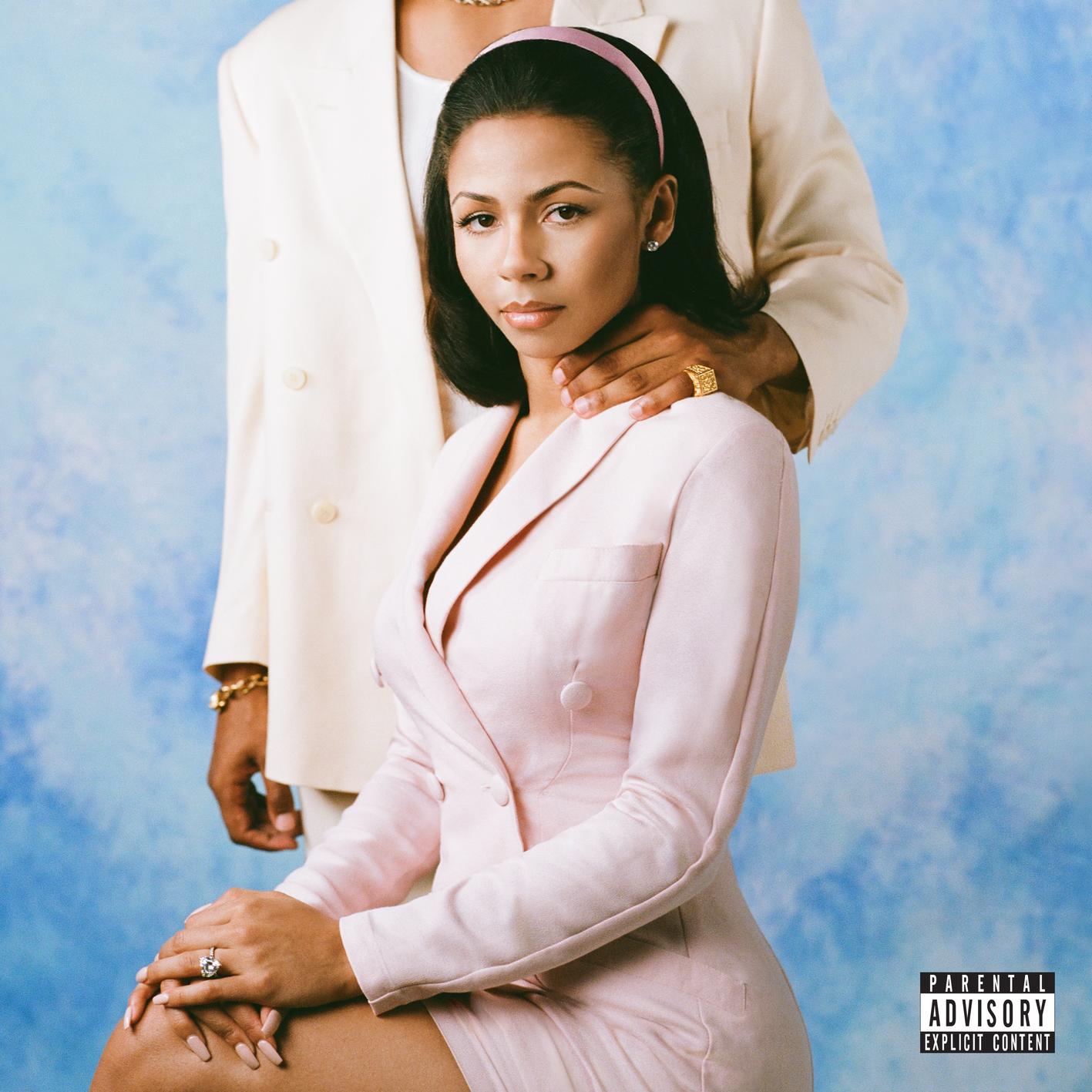

Mariah The Scientist Returns With New Music Burning Blue

May 10, 2025

Mariah The Scientist Returns With New Music Burning Blue

May 10, 2025 -

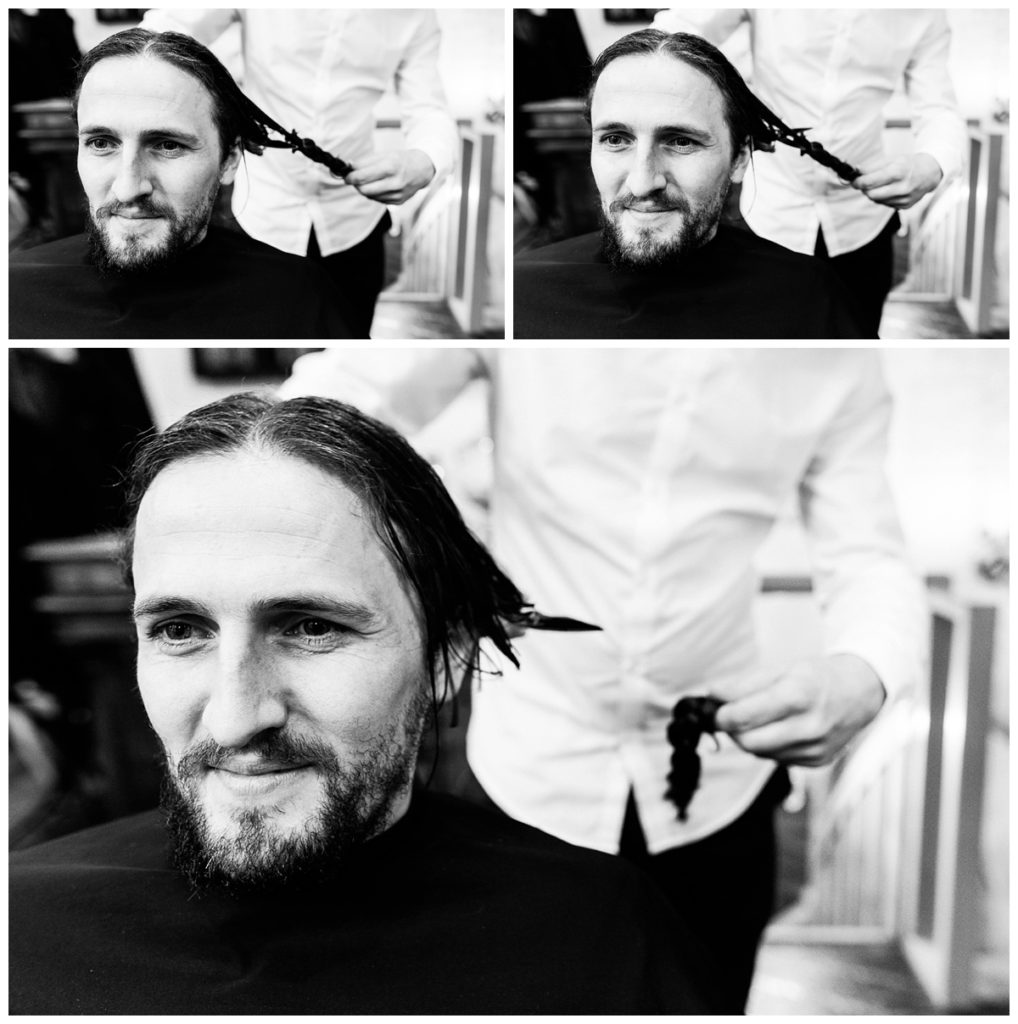

Dijon Ou Donner Ses Cheveux

May 10, 2025

Dijon Ou Donner Ses Cheveux

May 10, 2025