Market Update: Caesar's Las Vegas Properties Show Small Value Shift

Table of Contents

Slight Decrease in Property Values

Recent data reveals a small, yet noticeable, decrease in the value of several Caesar's Las Vegas properties. While not a dramatic downturn, the shift represents a noteworthy adjustment in the luxury hotel sector. The average decrease sits around 2-3% across key properties, representing a slight dip in value per square foot.

-

Specific Data Points: Analysis of recent sales and appraisals suggests an average decrease of approximately $50-$75 per square foot across properties like the Caesars Palace and The LINQ. This is a smaller decrease than the overall market average which saw a 5% dip.

-

Comparison to Previous Quarters: Compared to the previous quarter, this represents a slowdown in the previously robust appreciation seen in Caesar's properties. However, when compared to the same period last year, the current figures still show a positive growth trajectory, albeit a moderated one.

-

Exceptions: Interestingly, some smaller, more boutique properties within the Caesar's portfolio have shown resilience, experiencing a less significant decrease or even a slight uptick in value, indicating some sector-specific variations.

Factors Contributing to the Value Shift

Several interconnected factors have influenced this recent value shift in Caesar's Las Vegas properties.

Post-Pandemic Tourism Recovery

While Las Vegas tourism has rebounded significantly post-pandemic, the recovery hasn't been entirely uniform.

-

Occupancy Rates: While occupancy rates at Caesar's properties are strong, they haven't yet reached pre-pandemic peak levels consistently across all properties.

-

Tourism Figures: Current tourism figures are encouraging but remain below the record-breaking numbers seen before COVID-19. The lingering impact of economic uncertainty on discretionary spending continues to affect travel patterns.

-

Lingering Pandemic Effects: The lingering impact of the pandemic on international travel and corporate events continues to present challenges to the full recovery of the luxury hospitality market.

Interest Rate Hikes and Inflation

Rising interest rates and persistent inflation are creating headwinds for the entire real estate market, including luxury properties in Las Vegas.

-

Impact on Investment Decisions: Increased borrowing costs make investments in real estate, including hotel properties, less attractive for potential buyers and developers.

-

Interest Rate and Inflation Data: The recent increase in the federal funds rate and stubbornly high inflation rates have directly influenced property valuations across the board.

-

Future Impact: The potential for further interest rate hikes and continued inflation could further suppress property values in the near term.

Competition in the Las Vegas Market

The Las Vegas market remains highly competitive, with new developments and existing resorts continually vying for market share.

-

Competing Properties: New luxury resorts and ongoing renovations at existing competitors are placing pressure on occupancy rates and pricing strategies across the sector.

-

Supply and Demand: While demand remains strong, the increased supply of hotel rooms is impacting pricing power.

-

Luxury Hotel Market Competitiveness: The luxury hotel market in Las Vegas is fiercely competitive, making it crucial for properties to offer unique experiences and amenities to attract high-spending clientele.

Long-Term Outlook for Caesar's Las Vegas Properties

Despite the recent slight decrease, the long-term outlook for Caesar's Las Vegas properties remains largely positive.

-

Optimistic Scenarios: Continued tourism recovery, coupled with controlled inflation and stable interest rates, could lead to a resurgence in property values in the coming years.

-

Pessimistic Scenarios: Persistent inflation, further interest rate hikes, or a significant economic downturn could prolong the period of subdued growth or even lead to further price adjustments.

-

Overall Assessment: While a temporary dip is apparent, the fundamental strengths of the Las Vegas market and the enduring appeal of Caesar's brand suggest a positive long-term trajectory, particularly as renovations and strategic improvements are implemented.

Conclusion: Understanding the Nuances of Caesar's Las Vegas Property Value Shift

This market update highlights a minor decrease in the value of some Caesar's Las Vegas properties, influenced by the interplay of post-pandemic tourism recovery, interest rate hikes, and market competition. While the current shift is modest, understanding these contributing factors is crucial for investors and stakeholders. The long-term outlook remains largely positive, contingent on macroeconomic stability and continued tourism growth. Stay informed about future developments in the Las Vegas real estate market by subscribing to our updates for further analysis on Caesar's Las Vegas properties and other relevant market trends. Further research into the broader Las Vegas real estate market is recommended for a more comprehensive understanding.

Featured Posts

-

Iga Svjontek Trijumf Nad Ukrajinkom Pregled Meca I Reakcije

May 18, 2025

Iga Svjontek Trijumf Nad Ukrajinkom Pregled Meca I Reakcije

May 18, 2025 -

Amazon Warehouse Closures In Quebec Unions Tribunal Fight

May 18, 2025

Amazon Warehouse Closures In Quebec Unions Tribunal Fight

May 18, 2025 -

Your Guide To The Best Bitcoin And Cryptocurrency Casinos Of 2025

May 18, 2025

Your Guide To The Best Bitcoin And Cryptocurrency Casinos Of 2025

May 18, 2025 -

Complete Spring Breakout Rosters 2025

May 18, 2025

Complete Spring Breakout Rosters 2025

May 18, 2025 -

Ubers Self Driving Gamble Etf Investing Opportunities

May 18, 2025

Ubers Self Driving Gamble Etf Investing Opportunities

May 18, 2025

Latest Posts

-

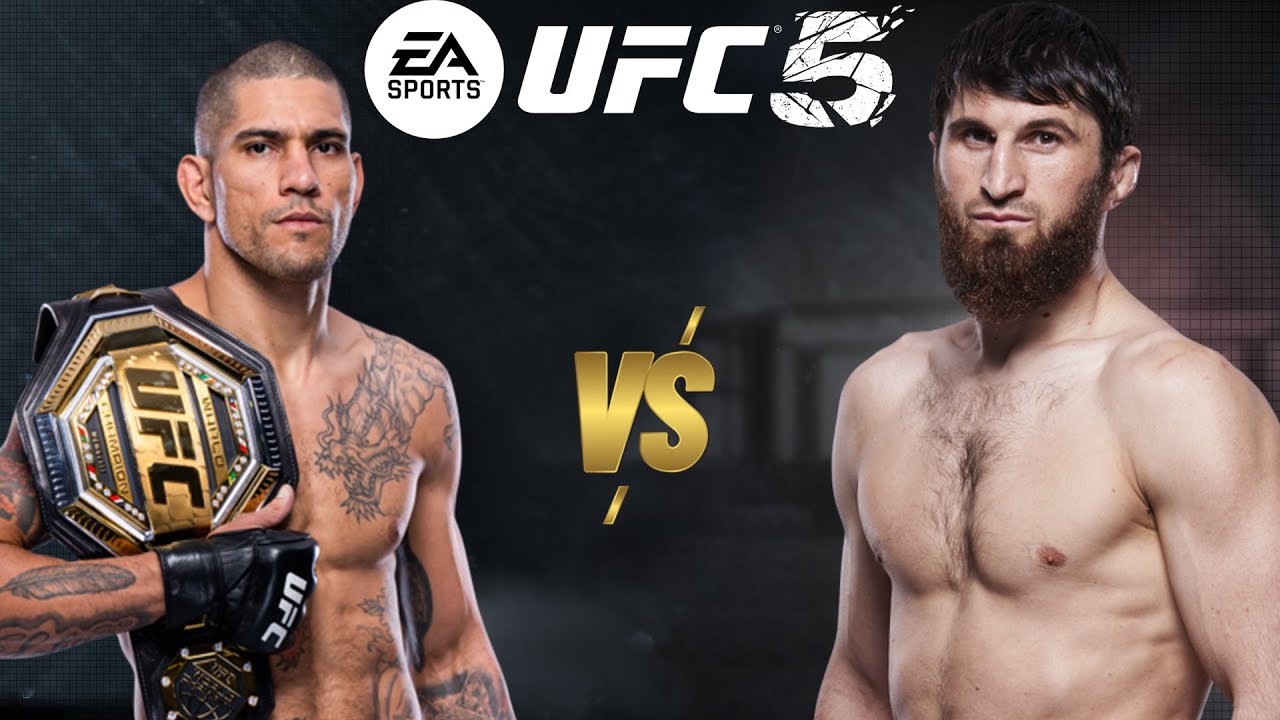

Ufc 313 Alex Pereira Speaks Out After Defeat Announces Future Plans

May 19, 2025

Ufc 313 Alex Pereira Speaks Out After Defeat Announces Future Plans

May 19, 2025 -

Ufc 313 Livestream Guide How To Watch Pereira Vs Ankalaev Online

May 19, 2025

Ufc 313 Livestream Guide How To Watch Pereira Vs Ankalaev Online

May 19, 2025 -

Pereira Vs Ankalaev Ufc 313 Your Guide To The Livestream

May 19, 2025

Pereira Vs Ankalaev Ufc 313 Your Guide To The Livestream

May 19, 2025 -

Ufc 313 Livestream Watch Pereira Vs Ankalaev Fight Online

May 19, 2025

Ufc 313 Livestream Watch Pereira Vs Ankalaev Fight Online

May 19, 2025 -

Ufc 313 Results A Breakdown Of The Best Finishes

May 19, 2025

Ufc 313 Results A Breakdown Of The Best Finishes

May 19, 2025