May 27 Stock Market Update: Dow, S&P 500, And Nasdaq Performance

Table of Contents

Dow Jones Performance on May 27th

The Dow Jones Industrial Average (DJIA) concluded May 27th with a relatively flat performance. While exhibiting some early volatility, it managed to largely recover by the closing bell.

- Opening Price: [Insert Opening Price - Requires Data Input]

- Closing Price: [Insert Closing Price - Requires Data Input]

- Percentage Change: [Insert Percentage Change - Requires Data Input] (compared to the previous day's closing price)

- High: [Insert High - Requires Data Input]

- Low: [Insert Low - Requires Data Input]

Key factors influencing the Dow's movement included:

- Mixed corporate earnings reports: Several Dow components released earnings reports on May 27th, with varying results impacting their respective stock prices and the overall index.

- Concerns about inflation: Ongoing inflationary pressures continue to weigh on investor sentiment, leading to cautious trading throughout the day.

- Sectoral performance: The energy sector showed strength, while technology stocks experienced some pressure, contributing to the Dow's mixed performance.

Major Movers within the Dow (May 27th):

- [Insert Top Performing Stock - Requires Data Input] - [Insert Percentage Change and Reason - Requires Data Input]

- [Insert Bottom Performing Stock - Requires Data Input] - [Insert Percentage Change and Reason - Requires Data Input]

S&P 500 Performance on May 27th

The S&P 500 index followed a similar trend to the Dow, ending the day with [Insert Percentage Change - Requires Data Input] movement. This broader market index mirrored the Dow's cautious trading, reflecting the overall uncertainty in the market.

- Opening Price: [Insert Opening Price - Requires Data Input]

- Closing Price: [Insert Closing Price - Requires Data Input]

- Percentage Change: [Insert Percentage Change - Requires Data Input]

- High: [Insert High - Requires Data Input]

- Low: [Insert Low - Requires Data Input]

Sector-Specific Trends within the S&P 500:

- Top Performing Sectors: [Insert Top Performing Sectors and Reasons - Requires Data Input]

- Bottom Performing Sectors: [Insert Bottom Performing Sectors and Reasons - Requires Data Input]

Best and Worst Performing S&P 500 Stocks (May 27th):

- Best:

- [Insert Stock - Requires Data Input] - [Insert Percentage Change - Requires Data Input]

- [Insert Stock - Requires Data Input] - [Insert Percentage Change - Requires Data Input]

- Worst:

- [Insert Stock - Requires Data Input] - [Insert Percentage Change - Requires Data Input]

- [Insert Stock - Requires Data Input] - [Insert Percentage Change - Requires Data Input]

Nasdaq Performance on May 27th

The Nasdaq Composite, heavily weighted with technology and growth stocks, experienced [Insert Percentage Change - Requires Data Input] on May 27th. The performance of tech stocks played a significant role in the Nasdaq's daily movement.

- Opening Price: [Insert Opening Price - Requires Data Input]

- Closing Price: [Insert Closing Price - Requires Data Input]

- Percentage Change: [Insert Percentage Change - Requires Data Input]

- High: [Insert High - Requires Data Input]

- Low: [Insert Low - Requires Data Input]

Influence of Technology Sector on Nasdaq: [Insert Analysis of Tech Stock Performance and its Impact on Nasdaq - Requires Data Input]

Notable Tech Stocks and their Impact:

- [Insert Stock - Requires Data Input] - [Insert Impact on Nasdaq - Requires Data Input]

- [Insert Stock - Requires Data Input] - [Insert Impact on Nasdaq - Requires Data Input]

Overall Market Analysis and Interpretation

The May 27th stock market demonstrated a degree of correlation between the Dow, S&P 500, and Nasdaq, all showing relatively muted performance. However, subtle divergences highlight the influence of sector-specific dynamics. The ongoing uncertainty surrounding inflation and interest rates, coupled with geopolitical factors, contributed to the overall cautious market sentiment.

- Correlations and Divergences: [Insert Analysis Comparing the Three Indices - Requires Data Input]

- Broader Market Context: [Insert Analysis of Economic News and Geopolitical Events - Requires Data Input]

- Implications for Investors: Investors should maintain a cautious approach, closely monitoring economic indicators and corporate earnings. Diversification across various asset classes remains crucial in mitigating risk.

- Key Takeaways and Future Predictions (Disclaimer: These are predictions and not financial advice):

- [Insert Key Takeaway 1 - Requires Data Input]

- [Insert Key Takeaway 2 - Requires Data Input]

- [Insert Prediction 1 - Requires Data Input] (with appropriate disclaimers)

- [Insert Prediction 2 - Requires Data Input] (with appropriate disclaimers)

Conclusion: May 27 Stock Market Summary

The May 27th stock market saw a mixed performance across major indices, reflecting ongoing economic and geopolitical uncertainties. The Dow, S&P 500, and Nasdaq exhibited varied responses to these factors, highlighting the importance of sector-specific analysis. Stay updated on the latest market movements with our daily stock market updates. Check back tomorrow for the May 28th stock market report! Remember to conduct your own thorough research before making any investment decisions. This analysis is for informational purposes only and should not be considered financial advice.

Featured Posts

-

Knicks Vs Pacers Game 3 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025

Knicks Vs Pacers Game 3 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025 -

Oecd Economic Outlook Canada To See Stagnant Growth Recession Risks Diminished In 2025

May 28, 2025

Oecd Economic Outlook Canada To See Stagnant Growth Recession Risks Diminished In 2025

May 28, 2025 -

Is Alejandro Garnacho Headed To Chelsea Latest Transfer News

May 28, 2025

Is Alejandro Garnacho Headed To Chelsea Latest Transfer News

May 28, 2025 -

Nintendos Conservative Approach A Winning Formula

May 28, 2025

Nintendos Conservative Approach A Winning Formula

May 28, 2025 -

Ramalan Cuaca Sumatra Utara Medan Karo Nias Toba Dan Daerah Lainnya

May 28, 2025

Ramalan Cuaca Sumatra Utara Medan Karo Nias Toba Dan Daerah Lainnya

May 28, 2025

Latest Posts

-

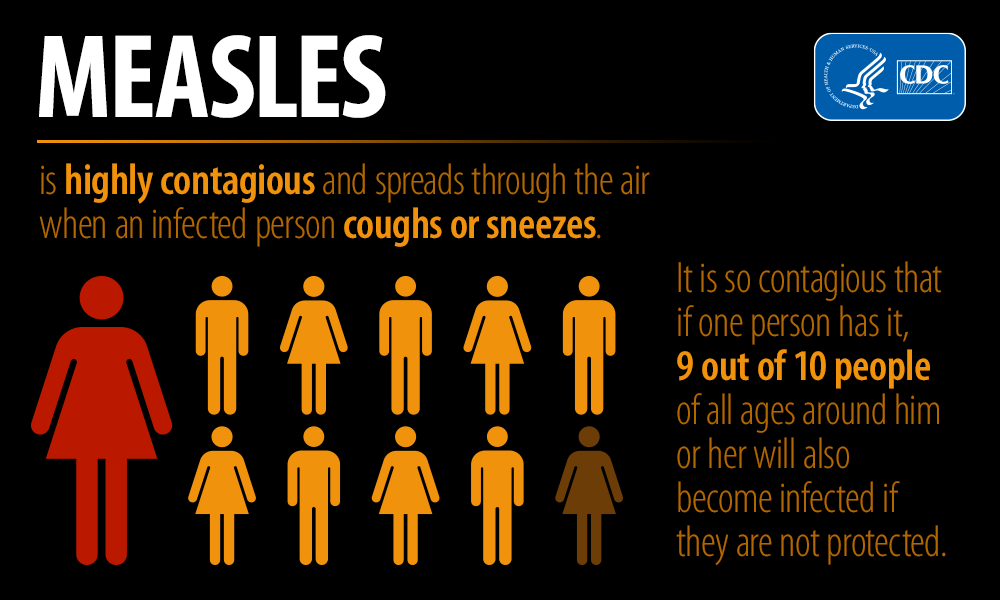

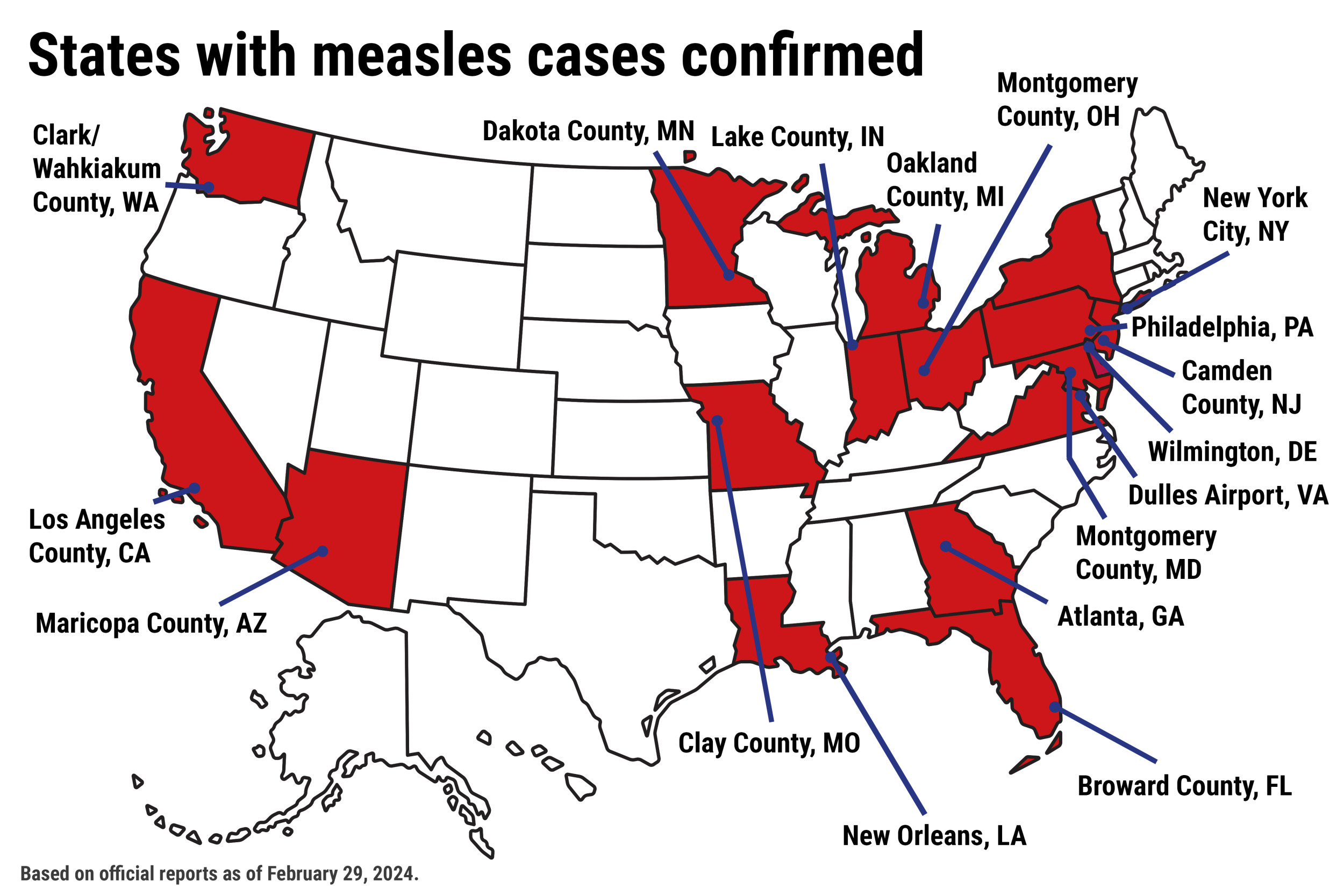

Israel Faces Measles Surge After Texas Outbreak

May 30, 2025

Israel Faces Measles Surge After Texas Outbreak

May 30, 2025 -

The Recent Drop In Us Measles Cases Factors Contributing To The Decline

May 30, 2025

The Recent Drop In Us Measles Cases Factors Contributing To The Decline

May 30, 2025 -

Innovation And Technology Shaping The Vaccine Packaging Market

May 30, 2025

Innovation And Technology Shaping The Vaccine Packaging Market

May 30, 2025 -

Measles Outbreak Alert Canadas Elimination Status At Risk

May 30, 2025

Measles Outbreak Alert Canadas Elimination Status At Risk

May 30, 2025 -

Why Are Measles Cases Decreasing In The Us A Data Driven Analysis

May 30, 2025

Why Are Measles Cases Decreasing In The Us A Data Driven Analysis

May 30, 2025