MicroStrategy Stock Vs Bitcoin: A 2025 Investment Comparison

Table of Contents

MicroStrategy Stock (MSTR) Investment Analysis for 2025

Understanding MicroStrategy's Business Model

MicroStrategy is a publicly traded company primarily known for its business intelligence software, providing analytics, mobile software, and cloud-based services to enterprises. However, a defining feature of MicroStrategy's recent history is its significant investment in Bitcoin. This strategy has dramatically impacted its stock price and presents a unique investment proposition. The company's success hinges on both its traditional software business performance and the performance of its Bitcoin holdings.

MSTR Stock Performance and Future Projections

Analyzing MicroStrategy's stock performance requires considering multiple factors. Historically, MSTR's stock price has shown considerable volatility, often mirroring the price fluctuations of Bitcoin. Future projections are complex and depend on several intertwined variables:

- Software Sales Growth: Continued success in selling business intelligence software is crucial for MSTR's independent performance. New product releases, successful market penetration, and customer retention will influence the stock price positively.

- Macroeconomic Conditions: Broad economic trends, including interest rates, inflation, and overall market sentiment, significantly impact MSTR's valuation, especially given its significant Bitcoin exposure.

- Bitcoin Price Movements: As MicroStrategy holds a substantial amount of Bitcoin, the price of BTC directly affects the company's balance sheet and overall market capitalization. A bull run in Bitcoin could significantly boost MSTR's stock price, while a bear market could have the opposite effect.

Potential risks include:

- Competition in the Business Intelligence Market: MicroStrategy faces stiff competition from established players in the business intelligence software sector.

- Bitcoin Price Volatility: The inherent volatility of Bitcoin represents a substantial risk to MSTR's stock price, as a sharp decline in BTC's value could negatively affect the company's valuation.

- Regulatory Uncertainty: Changes in regulations surrounding Bitcoin could impact MicroStrategy's Bitcoin holdings and, consequently, its stock price.

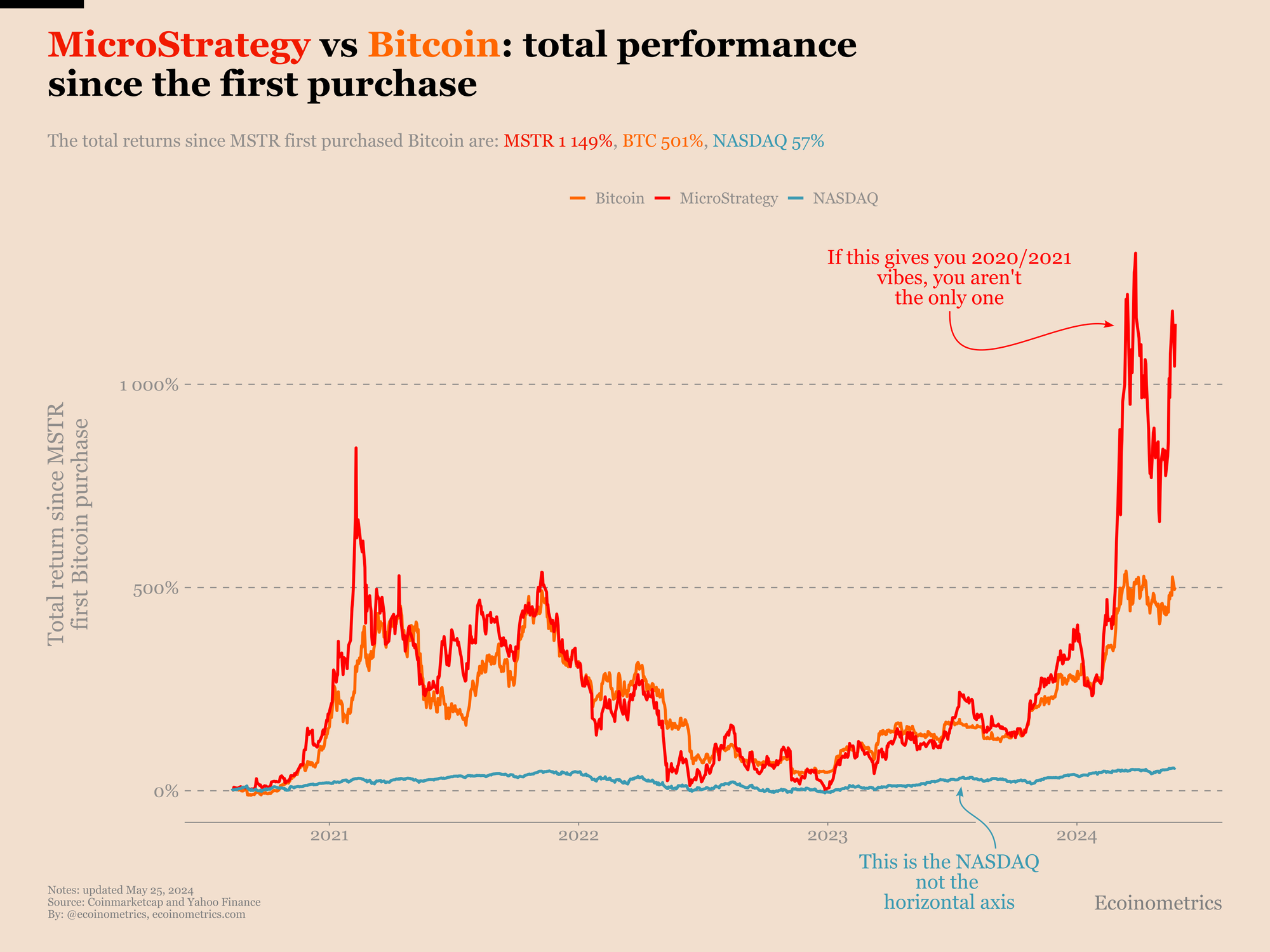

MSTR's Bitcoin Strategy and Its Impact on Stock Price

MicroStrategy's decision to heavily invest in Bitcoin has fundamentally altered its investment profile. While it exposes the company to significant risk from Bitcoin's price volatility, it also attracts investors seeking exposure to the cryptocurrency market through a more traditional stock investment vehicle. The synergy between the software business and the Bitcoin strategy remains to be fully realized, but it is a critical factor in analyzing MSTR's future potential. A successful integration of these two elements could lead to substantial long-term growth.

Bitcoin (BTC) Investment Analysis for 2025

Bitcoin's Price Volatility and Future Predictions

Bitcoin's history is marked by extreme price volatility. Predicting its price in 2025 remains highly speculative, with predictions ranging from extremely bullish to bearish scenarios. Several factors influence Bitcoin's price:

- Adoption Rate: Widespread institutional and individual adoption is a key driver of Bitcoin's price appreciation. Greater acceptance as a payment method and store of value will likely push the price upward.

- Regulatory Changes: Government regulations and legal frameworks surrounding cryptocurrencies will play a significant role. Positive regulations could boost Bitcoin’s price, while restrictive measures could negatively impact it.

- Technological Advancements: Innovations like the Lightning Network aim to improve Bitcoin's scalability and transaction speed, potentially increasing its appeal and value.

- Macroeconomic Factors: Global economic conditions, inflation rates, and geopolitical events can significantly impact Bitcoin's price, often acting as a safe haven asset during times of economic uncertainty.

Potential price scenarios for 2025 include:

- Bull Market: Continued adoption and positive regulatory developments could lead to significant price increases.

- Bear Market: Negative regulatory changes, economic downturns, or competing cryptocurrencies could cause a price decline.

- Sideways Movement: The price may consolidate within a certain range, characterized by periods of both upward and downward movements.

Bitcoin's Role as a Store of Value and Hedge Against Inflation

Many proponents view Bitcoin as a "digital gold," arguing it possesses similar characteristics as gold in terms of scarcity and its potential to act as a store of value. Its decentralized nature and limited supply make it an attractive hedge against inflation, as its value is not tied to traditional financial systems. However, it's important to note that Bitcoin's volatility can make it a less reliable store of value in the short term.

Bitcoin's Technological Advantages and Future Developments

Bitcoin's underlying technology, blockchain, is constantly evolving. Advancements like the Lightning Network aim to address scalability issues, enabling faster and cheaper transactions. Further development and adoption of these technologies could enhance Bitcoin's usability and contribute to price appreciation.

Direct Comparison: MicroStrategy Stock vs Bitcoin (2025)

Risk Tolerance and Investment Goals

The choice between MicroStrategy stock and Bitcoin depends heavily on your risk tolerance and investment goals. Bitcoin presents significantly higher risk but potentially higher rewards. MSTR stock offers a blend of traditional tech stock risk and Bitcoin exposure, but this exposure can amplify risk or reward.

Diversification and Portfolio Allocation

Both MicroStrategy stock and Bitcoin should be considered within the context of a broader investment portfolio. Diversification is key to mitigating risk. Including both MSTR and BTC in a well-diversified portfolio can offer exposure to both the traditional tech sector and the cryptocurrency market, but this must be carefully managed to balance risk and reward.

Taxation and Regulatory Considerations

The tax implications and regulatory landscape surrounding both MicroStrategy stock and Bitcoin vary depending on your jurisdiction. Thorough research and consultation with a financial advisor are necessary to understand the tax implications and potential regulatory risks associated with each investment.

Conclusion: MicroStrategy Stock or Bitcoin: Your 2025 Investment Decision

Choosing between MicroStrategy stock and Bitcoin for a 2025 investment requires careful consideration of individual risk tolerance, investment goals, and a thorough understanding of both assets' inherent volatility and potential. MicroStrategy offers a blend of traditional tech investment and Bitcoin exposure, while Bitcoin itself represents a higher-risk, higher-reward proposition. Remember, both options involve significant uncertainty, and conducting comprehensive research is vital before making any investment decisions. Continue researching "MicroStrategy Stock vs Bitcoin," consult with a qualified financial advisor, and make informed choices that align with your individual financial circumstances and investment objectives. There are many resources available online to further your understanding of both MicroStrategy and Bitcoin investments, allowing you to make the best decision for your portfolio.

Featured Posts

-

Liga Chempioniv 2024 2025 Peredmatcheviy Analiz Arsenal Ps Zh Barselona Inter

May 08, 2025

Liga Chempioniv 2024 2025 Peredmatcheviy Analiz Arsenal Ps Zh Barselona Inter

May 08, 2025 -

James Gunns Superman 5 Minute Krypto The Superdog Preview Released

May 08, 2025

James Gunns Superman 5 Minute Krypto The Superdog Preview Released

May 08, 2025 -

Will Bitcoins 10x Multiplier Shock Wall Street A Market Analysis

May 08, 2025

Will Bitcoins 10x Multiplier Shock Wall Street A Market Analysis

May 08, 2025 -

Analyzing Xrps 400 Rise Future Price Predictions And Analysis

May 08, 2025

Analyzing Xrps 400 Rise Future Price Predictions And Analysis

May 08, 2025 -

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025