MicroStrategy Vs. Bitcoin: Which Is The Better Investment In 2025?

Table of Contents

2. MicroStrategy's Bitcoin Strategy: A Deep Dive

2.1 MicroStrategy's Business Model and Bitcoin Holdings: MicroStrategy, primarily known for its business intelligence software, has made a bold strategic shift, becoming one of the largest corporate holders of Bitcoin. As of [insert latest data], they hold approximately [insert number] Bitcoin, significantly impacting their balance sheet and overall valuation. This strategic move reflects their belief in Bitcoin's long-term potential as a store of value and a hedge against inflation.

- Rationale: MicroStrategy's management views Bitcoin as a superior alternative to traditional assets, expecting long-term appreciation and a potential hedge against inflation.

- Risks: The company's valuation is inherently tied to Bitcoin's price volatility. A significant drop in Bitcoin's price would directly impact MicroStrategy's financial health and stock price. This represents a considerable risk for investors.

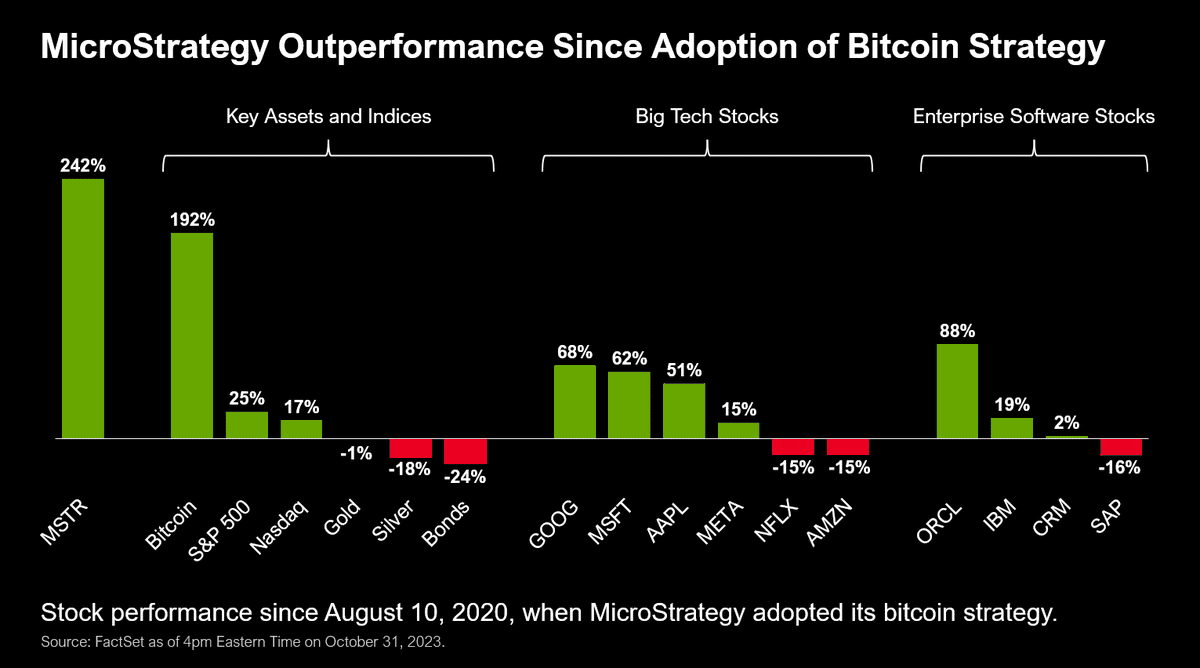

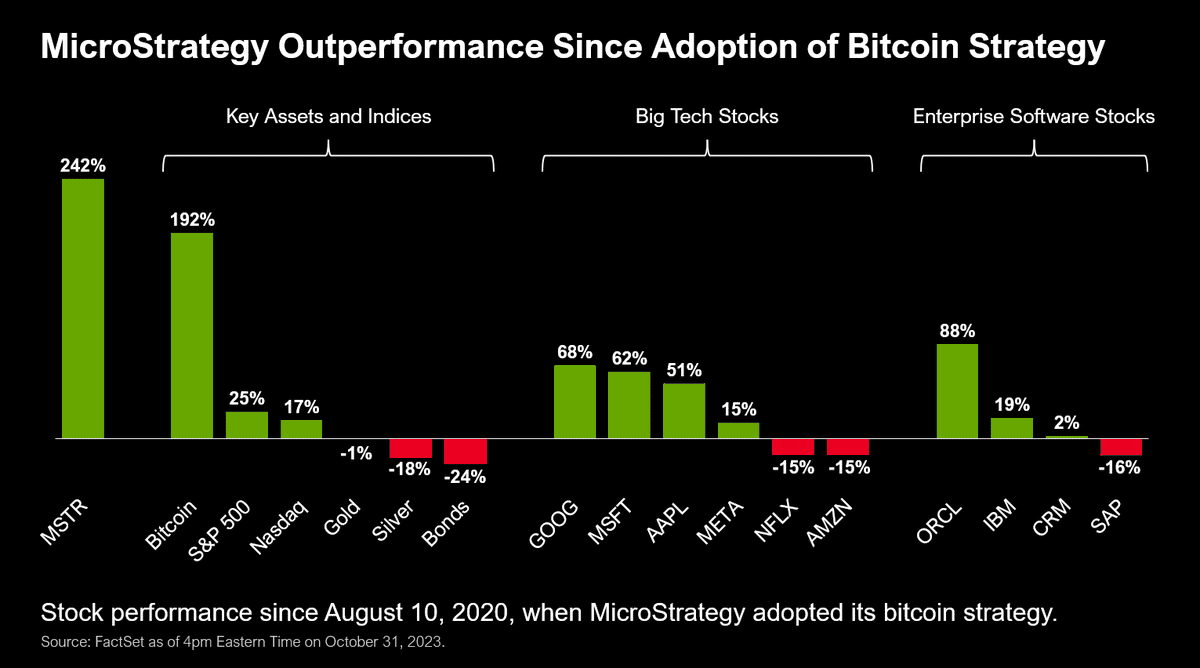

2.2 Analyzing MicroStrategy's Stock Performance: MicroStrategy's stock price has historically shown a strong correlation with Bitcoin's price movements. When Bitcoin's price rises, MicroStrategy's stock often follows suit, and vice-versa. However, other factors influence its performance, such as overall market sentiment towards tech stocks and the company's success in its core business segments. [Include a chart here showing the correlation between Bitcoin price and MicroStrategy's stock price, if possible].

- Correlation: A clear positive correlation exists, but it's not always perfectly linear. Other market factors can influence MicroStrategy's stock independently of Bitcoin’s price.

- Influencing Factors: Macroeconomic conditions, software sales performance, and investor sentiment regarding the company's Bitcoin strategy all impact its stock price.

2.3 Risks and Rewards of Investing in MicroStrategy Stock: Investing in MicroStrategy offers the potential for significant returns if Bitcoin’s price appreciates substantially. However, it also comes with considerable risk.

- High Risk, High Reward: The significant volatility inherent in both Bitcoin and MicroStrategy stock makes this a high-risk, high-reward investment.

- Dependence on Bitcoin: MicroStrategy's success is heavily reliant on Bitcoin's price performance; any significant downturn in the cryptocurrency market could severely impact the company.

- Diversification: While MicroStrategy offers exposure to Bitcoin, it lacks the diversification of holding Bitcoin directly.

2. Direct Bitcoin Investment: Understanding the Risks and Potential

2.1 Bitcoin's Price Volatility and Long-Term Potential: Bitcoin’s price has been famously volatile throughout its history. However, many investors believe in its long-term potential as a digital gold or a decentralized store of value, citing its limited supply and increasing adoption. Analysts offer diverse predictions, with some projecting significantly higher prices in the coming years while others warn of potential corrections.

- Upside Potential: The potential for exponential gains is significant, drawing many investors to this asset class.

- Downside Risk: Investors need to be prepared for substantial price fluctuations and the possibility of significant losses.

- Adoption and Technology: Widespread adoption and advancements in blockchain technology will likely influence Bitcoin's future price.

2.2 Bitcoin's Role as a Hedge Against Inflation: A common argument for Bitcoin investment is its potential as a hedge against inflation. The limited supply and its decentralized nature could make it an attractive alternative to traditional fiat currencies, particularly during periods of high inflation.

- Arguments For: Bitcoin's fixed supply contrasts with potentially inflationary fiat currencies, suggesting it could maintain or increase its value during inflationary periods.

- Arguments Against: Bitcoin's price is still influenced by speculation and market sentiment, making its inflation-hedging properties not fully proven.

2.3 Security and Storage Considerations for Bitcoin: Securing your Bitcoin investment is crucial. This involves understanding different storage methods, each carrying different security levels and costs.

- Cold Storage: Offline wallets provide the highest level of security but require careful management.

- Exchanges: Exchanges are convenient but carry risks associated with hacking and platform vulnerabilities.

- Custodial Solutions: Using third-party services to manage your Bitcoin offers convenience but introduces counterparty risk.

2.3 MicroStrategy vs. Bitcoin: A Comparative Analysis

2.1 Comparing Risk Profiles: Direct Bitcoin investment carries higher volatility and therefore higher risk than investing in MicroStrategy. However, MicroStrategy's dependence on Bitcoin also introduces considerable risk.

- Volatility: Bitcoin is inherently more volatile than MicroStrategy stock, meaning potentially higher gains but also greater losses.

- Correlation Risk: Investing in MicroStrategy introduces correlation risk – if Bitcoin's price falls, MicroStrategy's stock will likely fall as well.

2.2 Return Potential and Time Horizon: The potential returns for both options vary drastically depending on the time horizon and market conditions. Long-term perspectives are generally more favorable for both.

- Short-Term: Both investments carry significant short-term volatility, making short-term gains uncertain.

- Long-Term: Long-term projections depend on many factors, including Bitcoin's adoption rate and MicroStrategy's overall business performance.

2.3 Diversification Considerations: Both Bitcoin and MicroStrategy stock can play a role in a diversified portfolio, but in different ways. Bitcoin offers exposure to a new asset class, while MicroStrategy offers a more indirect and potentially less volatile path to Bitcoin exposure.

- Portfolio Allocation: The appropriate allocation to either asset will depend on your overall investment strategy and risk tolerance.

3. Conclusion: MicroStrategy or Bitcoin – Making the Right Investment Choice in 2025

Investing in either MicroStrategy or Bitcoin involves significant risk. MicroStrategy offers a less volatile path to Bitcoin exposure but still carries considerable risk due to its dependence on Bitcoin's performance. Direct Bitcoin investment offers higher potential returns but also much higher volatility. The optimal choice depends heavily on your risk tolerance, investment timeline, and overall portfolio diversification strategy. There is no one-size-fits-all answer.

Investment Recommendation: Conservative investors should likely avoid both, while more aggressive investors might consider allocating a small percentage of their portfolio to either, carefully considering the potential risks and rewards.

Call to Action: Before making any investment decisions regarding MicroStrategy or Bitcoin, conduct thorough research, understand your risk tolerance, and consult with a qualified financial advisor. Remember, careful consideration of individual risk tolerance is paramount when making an investment choice between MicroStrategy and Bitcoin.

Featured Posts

-

9 4000 360

May 08, 2025

9 4000 360

May 08, 2025 -

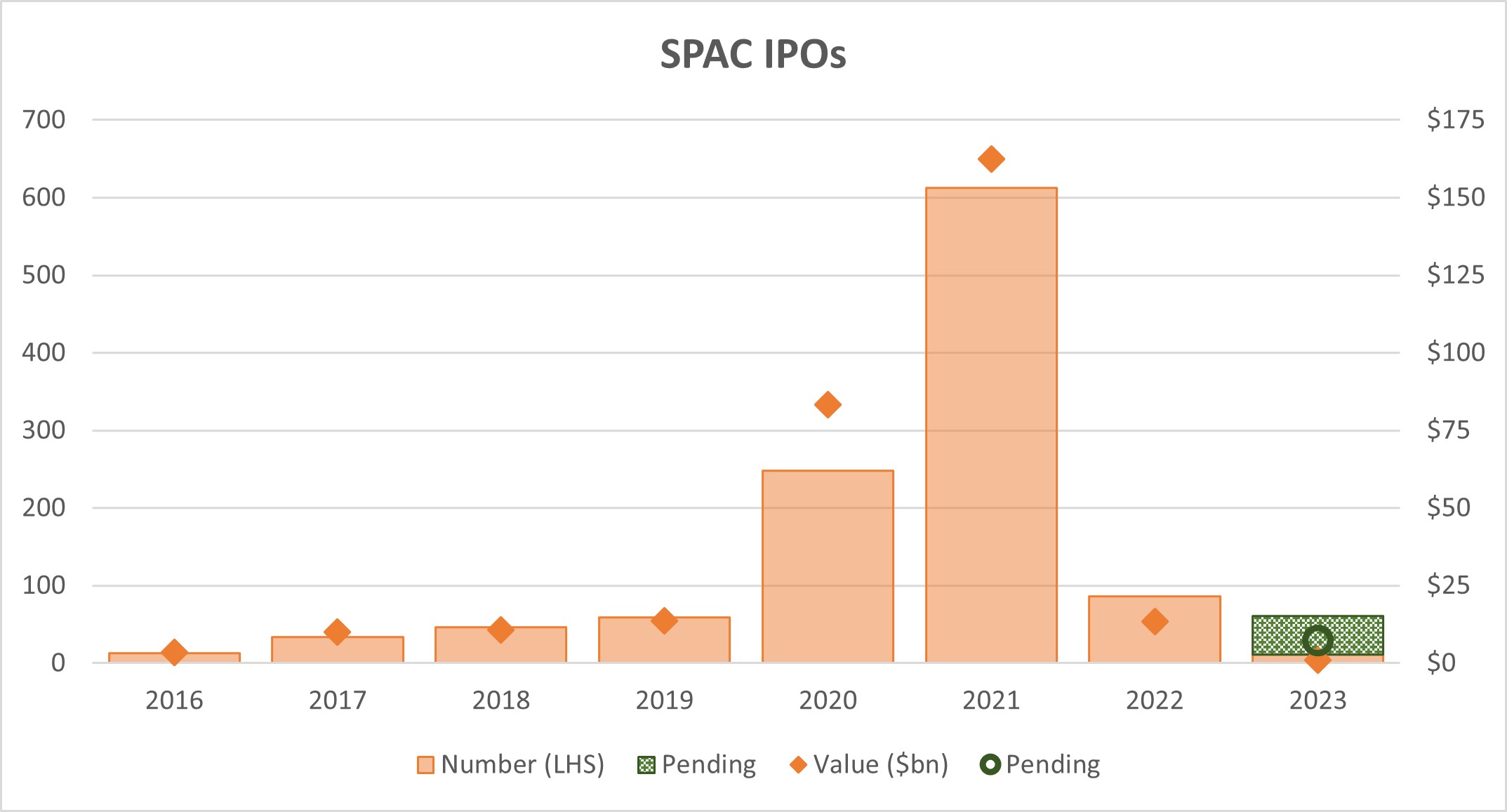

Is This New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025

Is This New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025 -

1 0

May 08, 2025

1 0

May 08, 2025 -

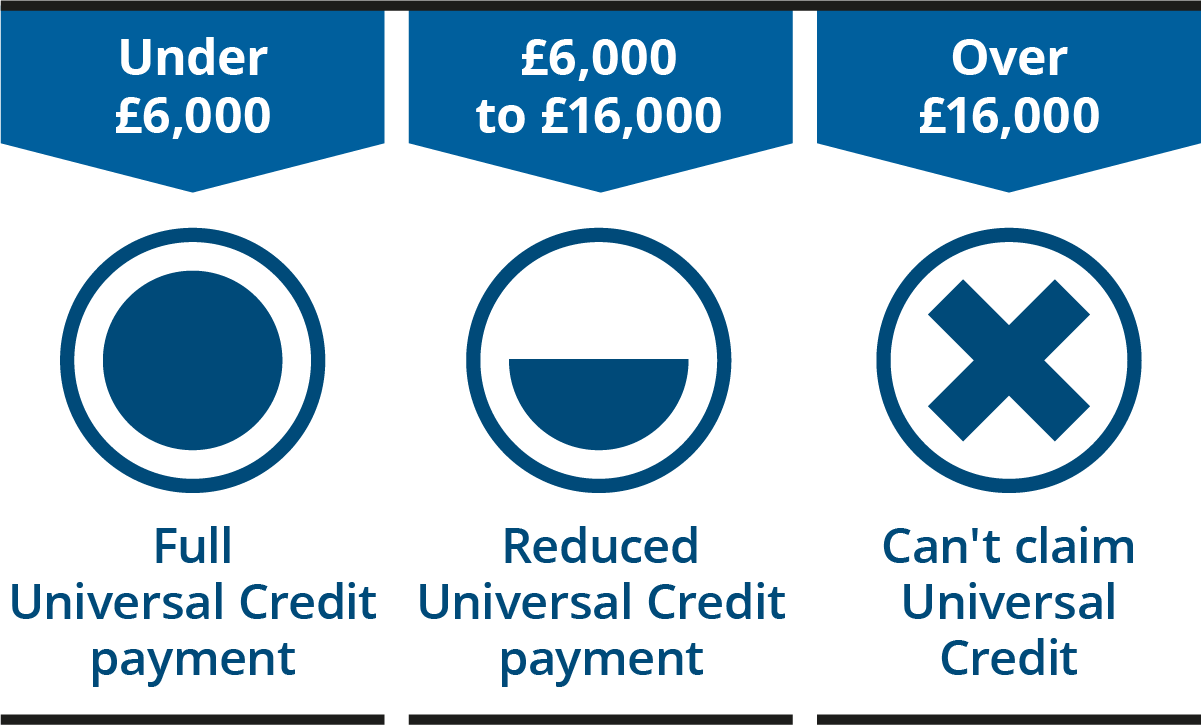

Universal Credit How To Claim Back Hardship Payment Overpayments

May 08, 2025

Universal Credit How To Claim Back Hardship Payment Overpayments

May 08, 2025 -

Chinas Auto Market Why Bmw Porsche And Others Are Facing Headwinds

May 08, 2025

Chinas Auto Market Why Bmw Porsche And Others Are Facing Headwinds

May 08, 2025