Millions Could Be Owed HMRC Refunds: Check Your Payslip Now

Table of Contents

Understanding Your Payslip and Tax Code

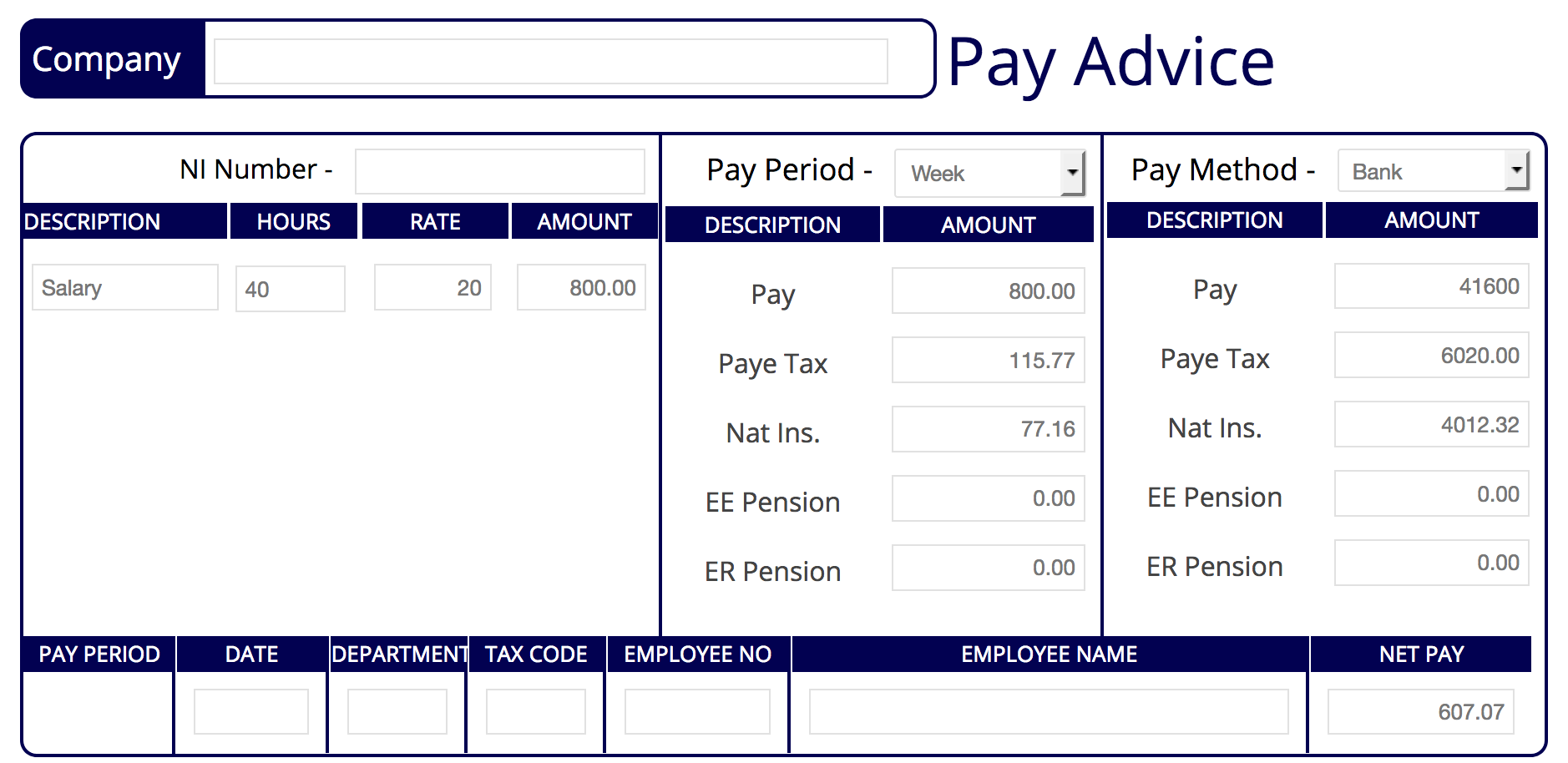

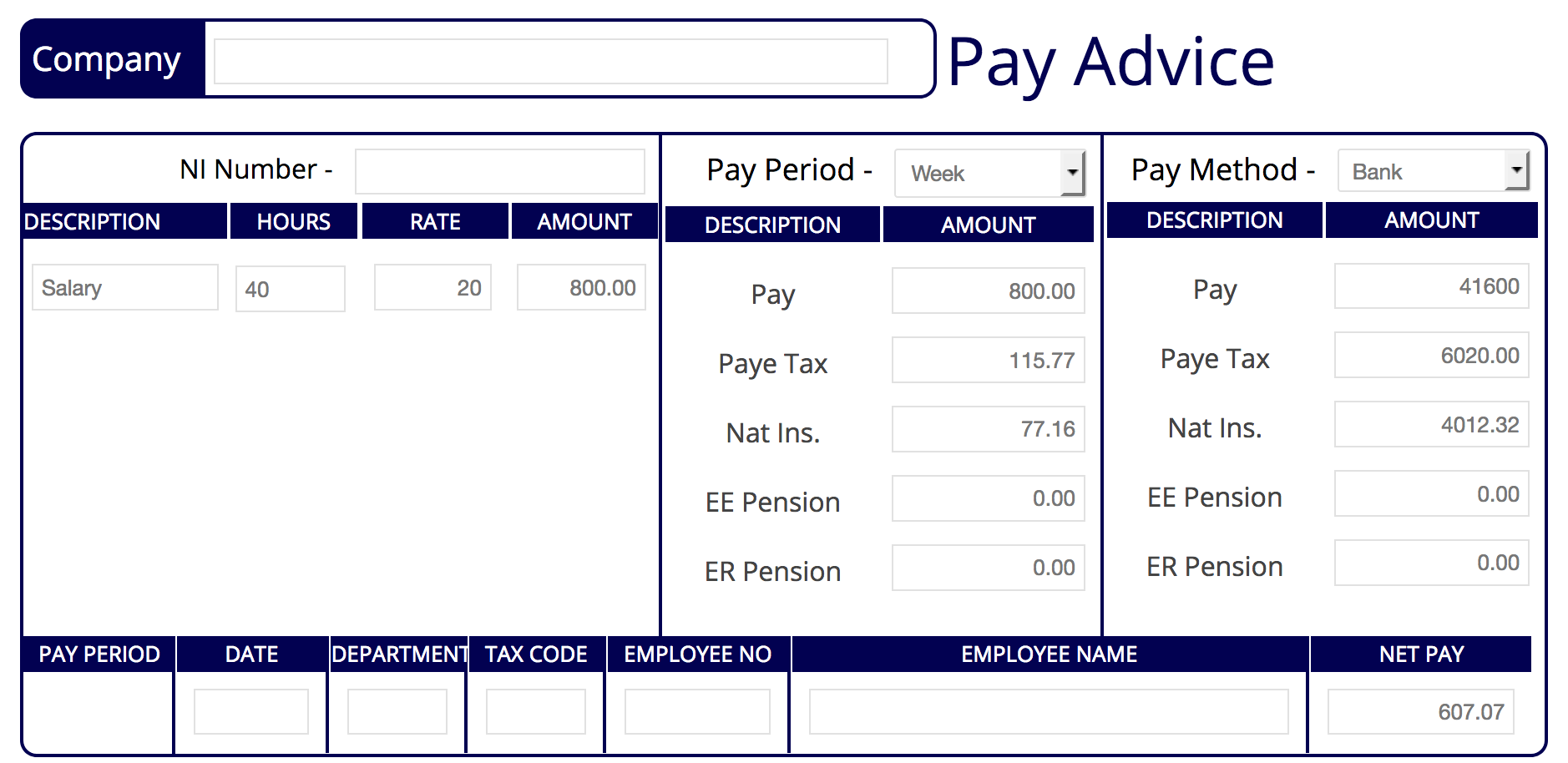

Understanding your payslip is crucial to identifying potential HMRC tax refunds. Your payslip details your earnings and deductions, providing a snapshot of your financial situation and tax liability. Key components include your gross pay (your earnings before deductions), tax deductions (income tax withheld), national insurance contributions (NICs), and, most importantly, your tax code.

Your tax code determines how much income tax is deducted from your earnings. It's a unique code assigned by HMRC, reflecting your personal circumstances and tax allowances. Even a slight error in your tax code can significantly impact your annual tax liability, potentially resulting in an overpayment and a subsequent refund.

-

What is a tax code? Your tax code represents your personal tax allowance. It determines the amount of income you can earn tax-free.

-

Common Tax Code Errors: Incorrect digits, missing letters, or outdated codes are common mistakes that can lead to incorrect tax deductions.

-

Impact of Incorrect Tax Codes: An incorrect tax code can lead to either overpayment or underpayment of tax throughout the year, impacting your annual tax return and potentially leading to a significant HMRC tax refund or unexpected tax bill.

-

Further Information: For a comprehensive understanding of payslips and tax codes, consult the official HMRC guide: [Insert Link to HMRC Guide Here]

Identifying Potential HMRC Refund Indicators on Your Payslip

Several indicators on your payslip can signal a potential underpayment and entitlement to an HMRC refund. Carefully review your payslips for the following:

-

Consistently High Tax Deductions: If your tax deductions are consistently higher than expected compared to previous years or to colleagues with similar incomes, it's worth investigating.

-

Discrepancies between Payslip and Tax Return: If the figures on your payslip don't match the information on your self-assessment tax return, you may be entitled to a refund.

-

Unexpected Tax Code Changes: Any unexpected changes to your tax code without prior notification from HMRC should be investigated.

-

Low Income Tax, High National Insurance: A low income tax deduction coupled with relatively high national insurance contributions might indicate an error.

(Include a visual aid here, such as an example payslip with key areas highlighted to illustrate potential areas of concern.)

How to Check Your Payslips for HMRC Refund Eligibility

To check your eligibility for an HMRC refund, systematically review your payslips. We recommend reviewing payslips for the last three to five tax years.

-

Gather Your Payslips: Collect all your payslips for the relevant tax years. Ensure you have accurate records for each period.

-

Compare Tax Deductions: Compare your actual tax deductions to what you expect based on your income and tax code. Use online tax calculators or seek professional advice if needed.

-

Identify Discrepancies: Note down any inconsistencies or discrepancies you find. Keep detailed records of your findings.

-

Digital Payslip Management: If you receive digital payslips, ensure they are properly stored and readily accessible.

Claiming Your HMRC Refund: A Simple Guide

Once you've identified a potential underpayment, you can claim your HMRC refund. The process is relatively straightforward through HMRC's online services.

-

Online Claim: Follow the steps on the HMRC website to submit your online refund claim.

-

Required Documentation: You'll need to provide supporting documentation, such as your payslips and P60s (if applicable).

-

Processing Time: HMRC usually processes refund claims within several weeks, though this can vary.

-

Contact HMRC: If you encounter issues or have questions during the process, contact HMRC customer service for assistance. [Insert Link to HMRC Contact Information Here]

Don't Miss Out – Claim Your HMRC Refund Today!

Checking your payslips for potential errors could result in a significant HMRC refund. Don't delay! Many people are unknowingly leaving money unclaimed. Millions are owed – don't miss out! Check your payslips now and claim your HMRC refund today. Click here to learn more about the HMRC refund process and start your claim. [Insert Link to Relevant HMRC Page Here]

Featured Posts

-

Hmrc Letters To High Earners What You Need To Know

May 20, 2025

Hmrc Letters To High Earners What You Need To Know

May 20, 2025 -

Los Angeles Wildfires A Reflection Of Our Times Through Betting Markets

May 20, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Betting Markets

May 20, 2025 -

The Impact Of The Us Typhon Missile System On Regional Security In The Philippines

May 20, 2025

The Impact Of The Us Typhon Missile System On Regional Security In The Philippines

May 20, 2025 -

Suki Waterhouses North American Tour A Disco Dream With Surface

May 20, 2025

Suki Waterhouses North American Tour A Disco Dream With Surface

May 20, 2025 -

Gaite Lyrique Occupation Illegale Et Demande D Intervention De La Mairie

May 20, 2025

Gaite Lyrique Occupation Illegale Et Demande D Intervention De La Mairie

May 20, 2025

Latest Posts

-

The China Factor How It Affects Global Automakers Like Bmw And Porsche

May 20, 2025

The China Factor How It Affects Global Automakers Like Bmw And Porsche

May 20, 2025 -

Clean Energy Under Siege Threats To A Booming Industry

May 20, 2025

Clean Energy Under Siege Threats To A Booming Industry

May 20, 2025 -

Gambling On Calamity The Los Angeles Wildfires And The Ethics Of Disaster Betting

May 20, 2025

Gambling On Calamity The Los Angeles Wildfires And The Ethics Of Disaster Betting

May 20, 2025 -

Chat Gpt And Open Ai Under The Ftc Microscope

May 20, 2025

Chat Gpt And Open Ai Under The Ftc Microscope

May 20, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Others

May 20, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Others

May 20, 2025