Moody's Downgrade Of US Debt: Criticism Mounts From The White House

Table of Contents

The Rationale Behind Moody's Downgrade

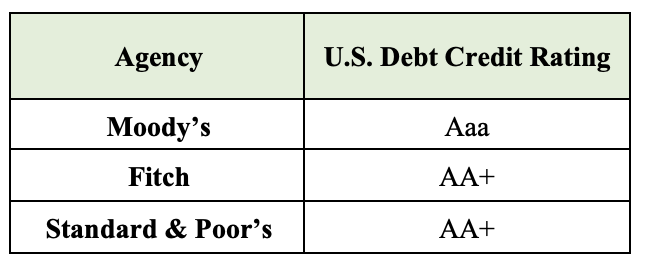

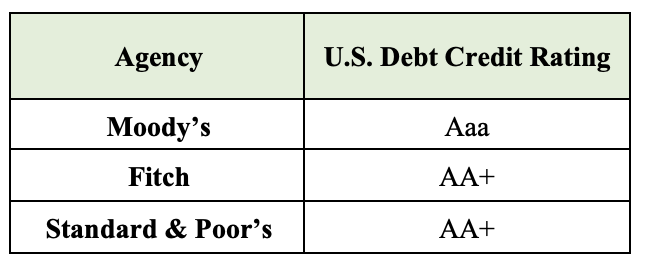

Moody's decision to downgrade the US government's credit rating from AAA to Aa1 wasn't arbitrary. The credit rating agency cited a confluence of factors contributing to increased fiscal stress and a weakening of governance. Their assessment points towards a trajectory of increasing national debt coupled with a lack of progress in addressing long-term fiscal challenges. The political gridlock in Washington, characterized by intense partisan divisions, was also highlighted as a significant contributing factor hindering effective solutions.

Key factors cited by Moody's include:

- Increased national debt: The soaring national debt, driven by persistent budget deficits and increased spending, is a major concern. This unsustainable trajectory poses a significant long-term risk to the US economy.

- Erosion of governance strength: The inability of Congress to reach bipartisan agreements on crucial fiscal matters, leading to repeated debt ceiling crises, has significantly weakened the perceived strength of US governance.

- Fiscal challenges and their projected impact: Moody's projections indicate a continuation of substantial fiscal deficits over the coming years, further exacerbating the debt burden and potentially leading to higher interest rates and reduced economic growth.

- Comparison with other countries' debt ratings: The downgrade positions the US comparatively lower than other countries with similar economic strengths, highlighting the severity of its fiscal challenges.

The White House's Counterarguments and Response

The White House has strongly criticized Moody's assessment, rejecting the downgrade as unwarranted and overly pessimistic. The administration argues that Moody's analysis failed to adequately account for the strength of the US economy and the positive impact of recent policy initiatives. They maintain that the nation's fiscal health is stronger than the rating suggests and emphasize the potential for economic growth to offset the rising debt.

Specific points of the White House's counterargument include:

- Specific points of disagreement with Moody's methodology: The administration has questioned the methodology used by Moody's, suggesting that certain factors were overemphasized while others were overlooked.

- Emphasis on economic growth projections and positive indicators: The White House highlighted positive economic indicators such as job growth and falling unemployment rates as evidence of the economy's underlying strength.

- Defense of the administration's fiscal policies: The administration has defended its fiscal policies, arguing that they are designed to promote long-term economic growth and stability.

- Discussion of bipartisan efforts to address the debt: While acknowledging the political challenges, the administration pointed to some bipartisan efforts to find solutions for the long-term debt.

Economic and Market Reactions to the Downgrade

The Moody's downgrade immediately triggered noticeable market reactions. US Treasury yields rose, reflecting increased borrowing costs for the government. The value of the US dollar experienced some volatility, although the impact was less dramatic than some had predicted. Investor confidence, while not completely shattered, was undoubtedly impacted, leading to some capital flight.

Key economic and market reactions:

- Changes in interest rates and borrowing costs: The downgrade increased borrowing costs for the US government, potentially impacting future spending plans and economic stimulus measures.

- Impact on the value of the US dollar: The initial impact on the US dollar was relatively muted, although further long-term consequences remain to be seen.

- Shift in investor sentiment and capital flows: Investor confidence took a hit, leading to some re-evaluation of investments in US assets.

- Potential ripple effects on global markets: The downgrade had a knock-on effect on global markets, highlighting the interconnectedness of the global financial system.

Political Implications and Future Outlook

The political ramifications of the Moody's downgrade are significant. The downgrade has already become a political football, with both sides engaging in blame-shifting. The upcoming elections are likely to be heavily influenced by the public's perception of the nation's fiscal health. This could intensify political polarization and make bipartisan cooperation on fiscal issues even more challenging.

Potential future scenarios include:

- Political fallout and blame-shifting: Expect continued political sparring, with each side attempting to shift the blame for the current fiscal situation.

- Potential for increased political polarization: The downgrade may deepen existing political divisions, making it even more difficult to reach bipartisan consensus on fiscal policy.

- Impact on future legislative efforts: Legislative efforts to address the national debt will be heavily influenced by the political climate and the public’s reaction to the downgrade.

- Long-term implications for US fiscal policy: The long-term implications for US fiscal policy are uncertain, but the downgrade will likely lead to increased scrutiny and pressure to implement fiscal reforms.

Conclusion: Understanding the Implications of Moody's Downgrade of US Debt

The Moody's downgrade of US debt is a significant event with far-reaching consequences for the US economy and global financial markets. While the White House strongly disputes the assessment, the underlying fiscal challenges remain undeniable. The downgrade underscores the urgent need for bipartisan cooperation to address the nation's growing debt and strengthen its governance. Understanding the intricacies of this situation requires continued monitoring of economic indicators and political developments. Stay informed about further developments related to the Moody's downgrade of US debt and its consequences by following reputable news sources and economic analysis. Further research into the long-term effects of this decision on government spending and economic planning is crucial for informed citizens and policymakers alike.

Featured Posts

-

Hong Kong Dining Roucous Cheese Omakase A Detailed Review

May 18, 2025

Hong Kong Dining Roucous Cheese Omakase A Detailed Review

May 18, 2025 -

Eurovision 2025 Damiano David Rumoured As Guest Performer

May 18, 2025

Eurovision 2025 Damiano David Rumoured As Guest Performer

May 18, 2025 -

Uitbreiding Nederlandse Defensie Steun Neemt Toe Door Wereldwijde Onrust

May 18, 2025

Uitbreiding Nederlandse Defensie Steun Neemt Toe Door Wereldwijde Onrust

May 18, 2025 -

Bof A Reassures Investors Why Current Market Valuations Are Not A Cause For Concern

May 18, 2025

Bof A Reassures Investors Why Current Market Valuations Are Not A Cause For Concern

May 18, 2025 -

Will Dry Weather Cancel Easter Bonfire Traditions

May 18, 2025

Will Dry Weather Cancel Easter Bonfire Traditions

May 18, 2025

Latest Posts

-

Kanye West Bianca Censori A Spanish Reunion

May 18, 2025

Kanye West Bianca Censori A Spanish Reunion

May 18, 2025 -

Instruktsiya K Pokhoronam Po Versii Kane Uesta Istoriya Vdokhnoveniya

May 18, 2025

Instruktsiya K Pokhoronam Po Versii Kane Uesta Istoriya Vdokhnoveniya

May 18, 2025 -

Kanye West And Bianca Censori Spotted Together In Spain

May 18, 2025

Kanye West And Bianca Censori Spotted Together In Spain

May 18, 2025 -

Did Kanye West And Bianca Censori Reconcile Spain Dinner Date Sparks Speculation

May 18, 2025

Did Kanye West And Bianca Censori Reconcile Spain Dinner Date Sparks Speculation

May 18, 2025 -

Kane Uest I Pasha Tekhnik Neobychnaya Instruktsiya K Pokhoronam

May 18, 2025

Kane Uest I Pasha Tekhnik Neobychnaya Instruktsiya K Pokhoronam

May 18, 2025