Navigate The Private Credit Boom: 5 Do's And Don'ts To Secure Your Next Role

Table of Contents

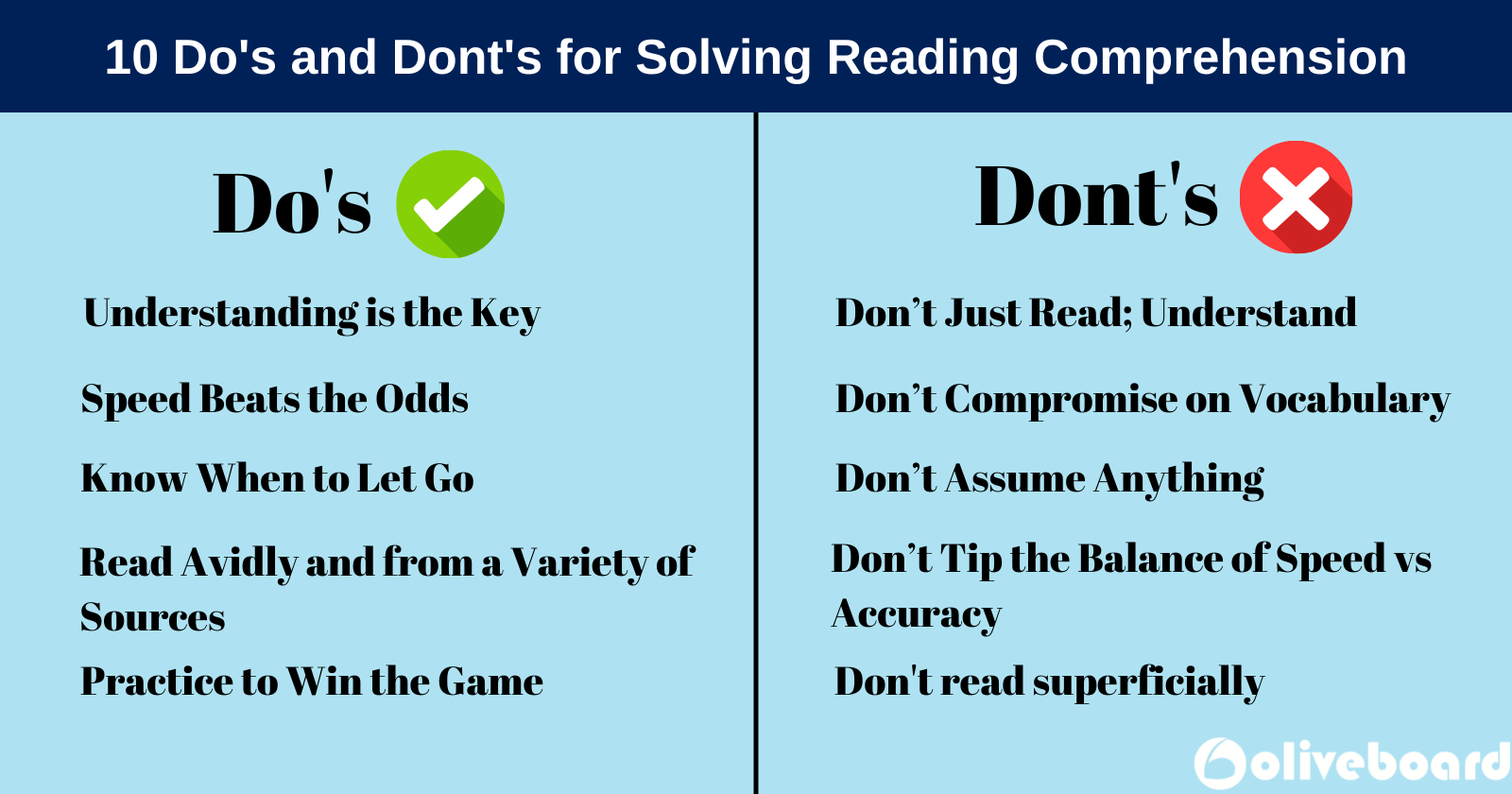

Do's to Secure Your Next Private Credit Role

Successfully navigating the private credit market requires proactive strategies. Here are five essential "do's" to enhance your job search:

1. Network Strategically

Networking is paramount in the private credit industry. Building relationships with professionals in the field opens doors to unadvertised opportunities and provides invaluable insights.

- Attend Industry Conferences: Participate in conferences like the Private Equity International (PEI) conferences or those hosted by industry associations.

- Join Professional Organizations: Become a member of relevant organizations such as the American Investment Council (AIC) or regional private equity groups.

- Leverage LinkedIn Effectively: Create a compelling LinkedIn profile showcasing your skills and experience, and actively engage with industry professionals.

- Informational Interviews: Reach out to individuals working in private credit for informational interviews to learn about their experiences and gain valuable advice.

2. Tailor Your Resume and Cover Letter

Generic applications rarely succeed in a competitive market like private credit. Customize your resume and cover letter for each specific role and firm.

- Highlight Relevant Keywords: Incorporate keywords specific to private credit, including: financial modeling, credit analysis, due diligence, portfolio management, leveraged lending, distressed debt, underwriting, and capital markets.

- Quantify Achievements: Instead of simply stating your responsibilities, quantify your accomplishments with metrics and demonstrate the impact of your work. For example, instead of "Managed a portfolio of loans," use "Managed a $50 million loan portfolio, resulting in a 15% reduction in non-performing loans."

- Research the Firm: Demonstrate your understanding of the firm's investment strategy and target market in your cover letter.

3. Master the Interview Process

Private credit interviews typically include behavioral, technical, and case study components. Preparation is crucial for success.

- Behavioral Questions: Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result).

- Technical Questions: Brush up on your knowledge of financial modeling, credit analysis, and valuation techniques.

- Case Studies: Prepare for case studies by practicing similar exercises and understanding the firm's typical investment strategies. Research recent market trends in private credit to demonstrate your up-to-date knowledge.

4. Showcase Your Financial Modeling Skills

Proficiency in financial modeling is essential for most private credit roles. Demonstrate your skills throughout the application process.

- Excel Proficiency: Showcase your expertise in Excel, including advanced functions like VBA and pivot tables.

- Financial Modeling Software: Familiarity with specialized software like Argus or comparable platforms is highly valuable.

- Include Portfolio Analysis: If applicable, include a portfolio analysis or financial model in your resume or portfolio to highlight your capabilities. Consider preparing a relevant model to demonstrate your skills during the interview process.

5. Understand the Culture of Private Credit Firms

Researching firms and understanding their cultural fit is critical. Demonstrate alignment with their values and investment strategies.

- Firm Websites: Thoroughly review firm websites to understand their investment focus, team structure, and company culture.

- LinkedIn Profiles: Review employee profiles on LinkedIn to gain insights into the firm's culture and employee experiences.

- News Articles: Stay up-to-date on industry news and research articles about the firms you are targeting.

Don'ts to Avoid During Your Private Credit Job Search

Avoiding common pitfalls can significantly improve your chances of success. Here are five crucial "don'ts":

1. Don't Neglect Your Online Presence

Your online presence reflects your professionalism. Ensure your LinkedIn profile and other online platforms project a positive image.

- Professional LinkedIn Profile: Create a complete and professional LinkedIn profile, highlighting your relevant experience and skills.

- Regular Updates: Keep your profile updated to reflect your current skills and experiences.

- Privacy Settings: Review your privacy settings to ensure that only appropriate information is publicly visible.

2. Don't Submit Generic Applications

Submitting the same resume and cover letter for multiple roles shows a lack of effort and interest.

- Tailored Approach: Customize your application materials to specifically address the requirements and preferences of each role and firm.

- Keyword Optimization: Use keywords relevant to each specific job description.

- Research the Role: Show that you've taken the time to understand the specific responsibilities and requirements of each position.

3. Don't Underestimate the Importance of Networking

Networking isn't just about collecting contacts; it's about building genuine relationships.

- Meaningful Interactions: Focus on building genuine relationships instead of simply collecting business cards.

- Follow-Up: Always follow up after networking events and informational interviews.

- Active Listening: Be a good listener and show genuine interest in others.

4. Don't Be Afraid to Ask Questions

Asking insightful questions demonstrates your curiosity and engagement.

- Thoughtful Inquiries: Prepare thoughtful questions about the firm's investment strategy, culture, and future plans.

- Show Genuine Interest: Your questions should reflect your genuine interest in the role and the firm.

- Clarification Questions: Don't hesitate to ask clarifying questions if something is unclear.

5. Don't Neglect Due Diligence on Potential Employers

Researching potential employers is crucial for making informed career decisions.

- Company Websites: Review company websites to understand their mission, values, and culture.

- Employee Review Sites: Use sites like Glassdoor to gain insights into employee experiences.

- News and Financial Reports: Research recent news and financial reports to understand the firm's financial health and industry position.

Conclusion: Successfully Navigating the Private Credit Boom

By following these do's and don'ts, you can significantly improve your chances of successfully navigating the private credit boom and landing your dream private credit job. Remember, strategic job searching, coupled with strong networking and preparation, is key to succeeding in this competitive sector. Implement these strategies today and increase your chances to succeed in the booming private credit sector and land your dream private credit job!

Featured Posts

-

Increased Alcohol Use In Women Health Risks And Expert Concerns

May 15, 2025

Increased Alcohol Use In Women Health Risks And Expert Concerns

May 15, 2025 -

What Makes A Crypto Exchange Compliant In India A Simple Guide For 2025

May 15, 2025

What Makes A Crypto Exchange Compliant In India A Simple Guide For 2025

May 15, 2025 -

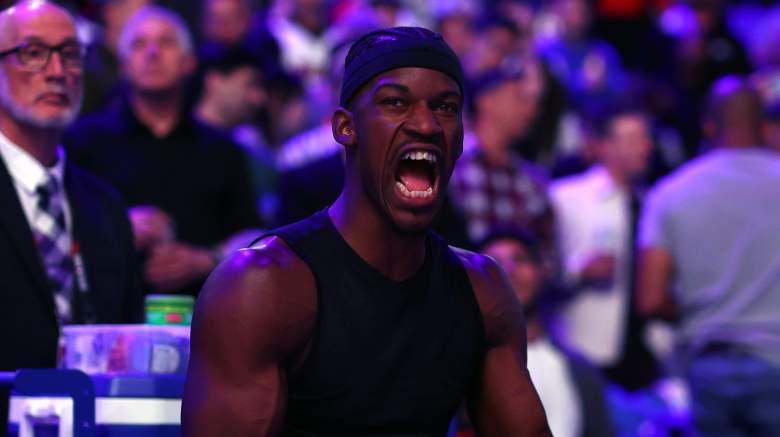

Warriors Defeat Jimmy Butler Suffers Pelvic Contusion Future Games In Jeopardy

May 15, 2025

Warriors Defeat Jimmy Butler Suffers Pelvic Contusion Future Games In Jeopardy

May 15, 2025 -

Middle Managers Essential For Organizational Efficiency And Employee Development

May 15, 2025

Middle Managers Essential For Organizational Efficiency And Employee Development

May 15, 2025 -

Snelle Actie Beloofd Na Gesprek Over Frederieke Leeflang En De Npo

May 15, 2025

Snelle Actie Beloofd Na Gesprek Over Frederieke Leeflang En De Npo

May 15, 2025

Latest Posts

-

Padres Vs Pirates Prediction Picks And Odds For Todays Mlb Game

May 15, 2025

Padres Vs Pirates Prediction Picks And Odds For Todays Mlb Game

May 15, 2025 -

Will Jimmy Butler Play Game 3 Warriors Offer Encouraging News

May 15, 2025

Will Jimmy Butler Play Game 3 Warriors Offer Encouraging News

May 15, 2025 -

Jimmy Butlers Injury Pelvic Contusion And Uncertain Return For The Heat

May 15, 2025

Jimmy Butlers Injury Pelvic Contusion And Uncertain Return For The Heat

May 15, 2025 -

Draymond Greens Respect For Jimmy Butler Post Game Analysis Following Kings Win

May 15, 2025

Draymond Greens Respect For Jimmy Butler Post Game Analysis Following Kings Win

May 15, 2025 -

San Diego Padres The Unexpected Obstacle To The Dodgers Domination

May 15, 2025

San Diego Padres The Unexpected Obstacle To The Dodgers Domination

May 15, 2025