Navigating Crypto Exchange Regulations In India: 2025 Compliance Guide

Table of Contents

Understanding the Current Regulatory Landscape in India

The legal framework governing cryptocurrencies in India is constantly evolving, creating both opportunities and challenges for crypto exchanges. Understanding this dynamic environment is crucial for compliance.

The Evolving Legal Framework for Cryptocurrencies in India

The Indian government's stance on cryptocurrencies remains fluid. While not explicitly banned, they are not yet fully recognized as legal tender. Several government bodies play a crucial role:

- Reserve Bank of India (RBI): The RBI has issued circulars expressing concerns about the risks associated with cryptocurrencies, impacting banking services for crypto exchanges.

- Ministry of Finance: This ministry is responsible for formulating tax policies related to cryptocurrencies and is actively involved in shaping the regulatory framework.

- Parliament: Discussions regarding potential legislation specifically addressing cryptocurrencies are ongoing, potentially leading to significant changes in the future.

Keywords: Indian crypto regulations, cryptocurrency laws India, RBI crypto guidelines, Indian government crypto stance, crypto regulation India.

Taxation of Cryptocurrency Transactions in India

Cryptocurrency transactions in India are subject to taxes, including:

- Goods and Services Tax (GST): Currently, a 18% GST is levied on the supply of cryptocurrency.

- Income Tax: Profits from cryptocurrency trading are considered income and are taxed accordingly. This includes short-term and long-term capital gains.

- Capital Gains Tax: Long-term capital gains from cryptocurrencies (held for more than 24 months) are taxed at a lower rate than short-term gains.

Understanding these tax implications is critical for accurate reporting and compliance. Proper accounting practices are vital for avoiding penalties.

Keywords: Crypto tax India, GST on cryptocurrency, capital gains tax on crypto, Indian crypto tax laws, crypto taxation India.

Key Compliance Requirements for Crypto Exchanges in India

Crypto exchanges operating in India must adhere to various compliance requirements to ensure legal operation and maintain user trust.

Know Your Customer (KYC) and Anti-Money Lauering (AML) Compliance

KYC/AML compliance is paramount for crypto exchanges in India. This involves stringent verification processes to identify users and prevent money laundering activities.

- Documentation Requirements: Exchanges need to collect and verify identity documents, such as PAN cards, Aadhaar cards, and proof of address.

- Verification Processes: Robust verification systems are necessary, utilizing technologies such as biometric authentication and facial recognition.

- Penalties for Non-Compliance: Failure to comply with KYC/AML regulations can lead to significant penalties, including hefty fines and legal repercussions. The Prevention of Money Laundering Act (PMLA) sets out the penalties and procedures.

Keywords: KYC crypto India, AML crypto India, KYC compliance India, anti-money laundering crypto, KYC regulations India.

Data Security and Privacy Regulations

Protecting user data is crucial for maintaining trust and complying with Indian data protection laws.

- Data Protection Act: India's data protection laws are still evolving. However, adherence to general data protection principles is important.

- Secure Data Handling: Implementing robust cybersecurity measures to safeguard sensitive user information (e.g., personal details, transaction history) from breaches is non-negotiable.

- Data Encryption: Employing strong encryption protocols is essential for protecting data both in transit and at rest.

Keywords: Crypto data security India, data privacy crypto India, cybersecurity crypto India, data protection regulations crypto, data security crypto exchange India.

Reporting and Transparency Requirements

Crypto exchanges may face reporting obligations to regulatory bodies, such as:

- Transaction Reporting: This may involve submitting records of transactions exceeding certain thresholds.

- Financial Reporting: Regular financial reporting and audits may be required to ensure transparency and accountability.

- Auditing Requirements: Regular audits by independent auditors may be required to ensure compliance.

Keywords: Crypto reporting India, crypto transparency India, financial reporting crypto, crypto auditing India, crypto compliance reporting India.

Strategies for Maintaining Compliance in a Changing Regulatory Environment

Maintaining compliance in the dynamic Indian crypto regulatory landscape requires proactive measures.

Staying Updated with Regulatory Changes

Staying informed about changes in crypto regulations is vital. Methods include:

- Subscribing to Legal Newsletters: Stay updated on legal and regulatory developments through reputable legal publishers.

- Attending Industry Conferences: Network with peers and legal experts to stay abreast of the latest developments.

- Consulting Legal Experts: Seek advice from legal professionals specializing in cryptocurrency law.

Keywords: Crypto regulation updates India, Indian crypto legal updates, crypto compliance updates, crypto regulatory changes India.

Building a Robust Compliance Framework

Establishing a robust compliance framework is essential. This involves:

- Appointing a Compliance Officer: Designating a dedicated compliance officer responsible for overseeing compliance matters.

- Establishing Internal Controls: Implementing internal controls to ensure adherence to regulations and best practices.

- Conducting Regular Audits: Regular internal and external audits are crucial for identifying potential compliance gaps.

Keywords: Crypto compliance framework India, crypto risk management India, crypto internal controls, crypto compliance program India.

Navigating the Future of Crypto Exchange Regulations in India

This guide has highlighted key compliance requirements and strategies for navigating crypto exchange regulations in India in 2025. The regulatory landscape continues to evolve. Staying proactive, informed, and adaptable will be crucial for exchanges to thrive in the years to come. Potential future developments may include more specific legislation, clearer guidelines on taxation, and stricter KYC/AML enforcement.

Ensure your crypto exchange remains compliant by staying informed and implementing a comprehensive compliance program. Master the complexities of navigating crypto exchange regulations in India and download our comprehensive guide for detailed insights and best practices.

Featured Posts

-

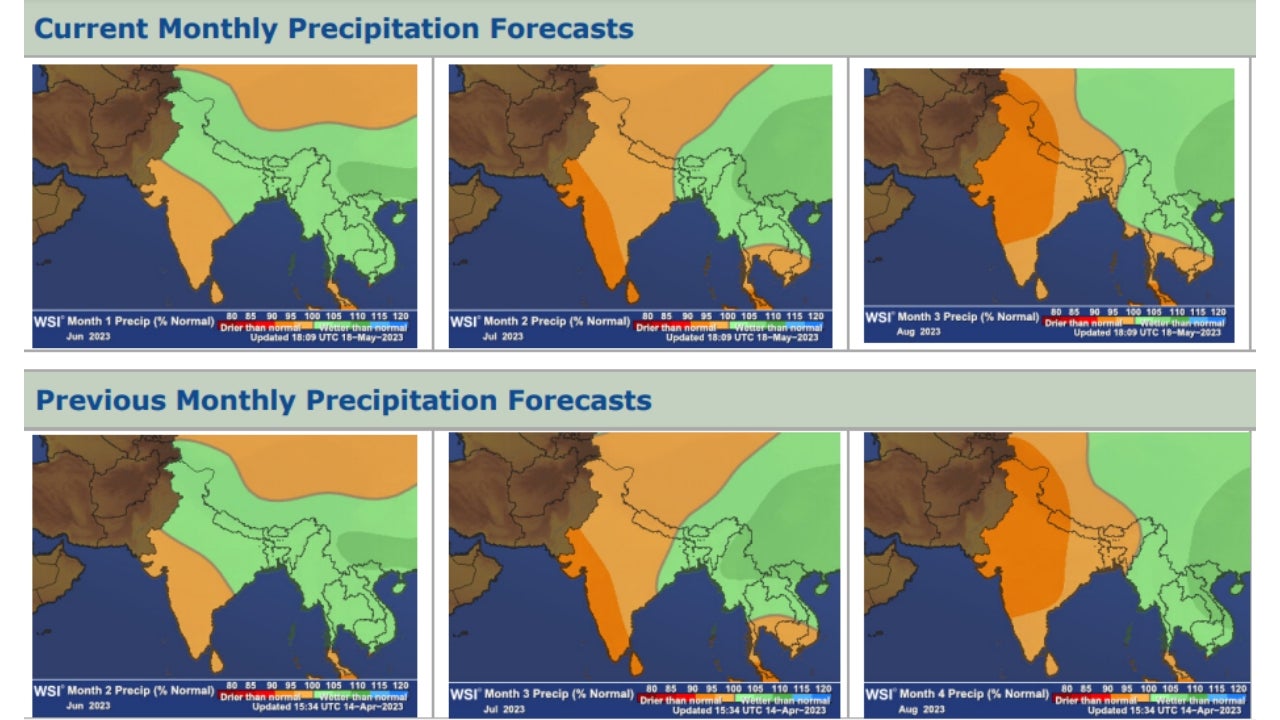

Monsoon Prediction Good News For Indian Farm Sector Growth And Consumption

May 15, 2025

Monsoon Prediction Good News For Indian Farm Sector Growth And Consumption

May 15, 2025 -

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit Tegen Baas

May 15, 2025

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit Tegen Baas

May 15, 2025 -

Understanding Indian Crypto Exchange Compliance A Practical Overview

May 15, 2025

Understanding Indian Crypto Exchange Compliance A Practical Overview

May 15, 2025 -

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025 -

Stocks Up Over 10 On Bse Sensexs Significant Increase

May 15, 2025

Stocks Up Over 10 On Bse Sensexs Significant Increase

May 15, 2025

Latest Posts

-

Onderzoek Naar Angstcultuur Bij De Npo Na Klachten Van Medewerkers Over Leeflang

May 15, 2025

Onderzoek Naar Angstcultuur Bij De Npo Na Klachten Van Medewerkers Over Leeflang

May 15, 2025 -

Npo Werknemers Melden Angstcultuur Onder Leiding Van Leeflang

May 15, 2025

Npo Werknemers Melden Angstcultuur Onder Leiding Van Leeflang

May 15, 2025 -

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025 -

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025 -

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025