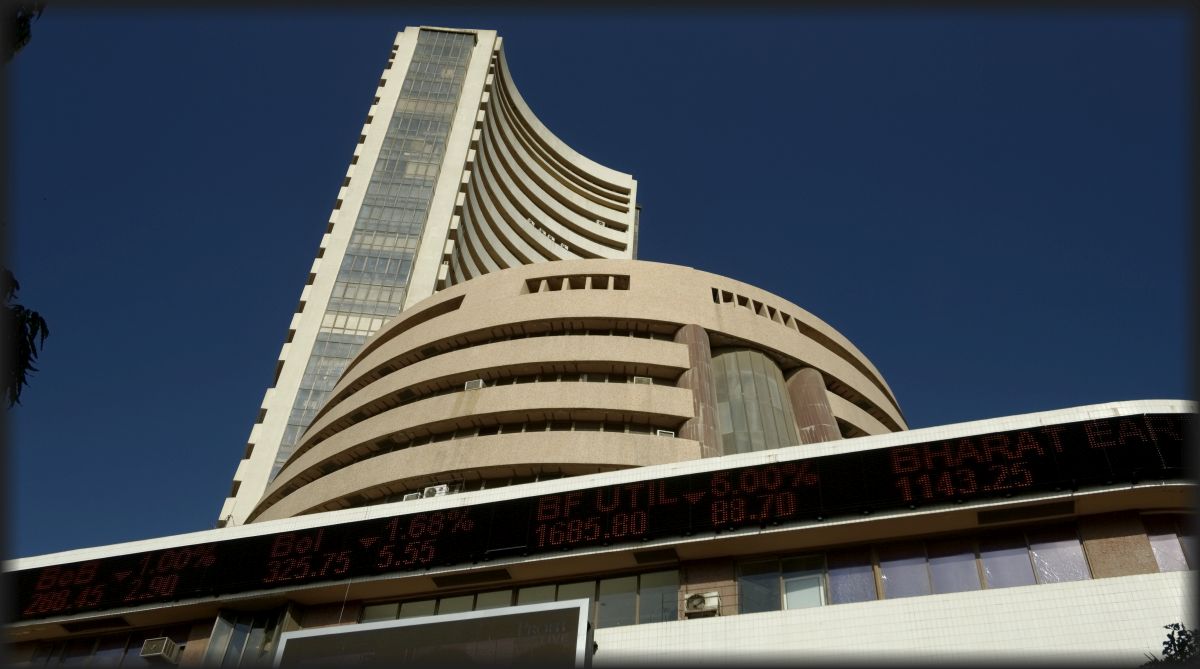

Stocks Up Over 10% On BSE: Sensex's Significant Increase

Table of Contents

Analyzing the Sensex's 10%+ Surge: Key Contributing Factors

Several key factors converged to propel the Sensex to such remarkable heights. Understanding these drivers is crucial for navigating the current market landscape and making informed investment decisions.

Positive Economic Indicators

Positive economic indicators significantly boosted investor confidence, fueling the Sensex's surge. These included:

- Robust GDP Growth: The latest GDP figures revealed [Insert GDP growth percentage and period], exceeding expectations and signaling a strong economic recovery. This positive outlook encouraged greater investment.

- Controlled Inflation: A decline in inflation to [Insert inflation percentage and period] eased concerns about rising prices, creating a more stable environment for investment.

- Improved Manufacturing PMI: A rise in the Purchasing Managers' Index (PMI) for manufacturing indicated increased industrial activity and growth prospects.

Influx of Foreign and Domestic Investment

A substantial influx of both Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) played a pivotal role in driving up stock prices.

- FIIs Net Buying: FIIs injected [Insert amount] into the Indian stock market during [period], demonstrating strong confidence in the country's economic future.

- DIIs Increased Participation: Domestic institutional investors also significantly increased their participation, contributing to the overall market buoyancy. [Insert statistics on DII investment].

Global Market Trends

Positive global market trends also contributed to the Sensex's upward trajectory.

- Positive Global Sentiment: A generally positive global market sentiment, fueled by [mention specific global events or factors], positively impacted investor confidence in emerging markets like India.

- Strong Performance of Global Indices: The robust performance of major global indices like the Dow Jones and Nasdaq provided further impetus for the Indian stock market.

Sector-Specific Growth

Certain sectors performed exceptionally well, contributing significantly to the Sensex's rise.

- Information Technology (IT): The IT sector witnessed robust growth, driven by [mention specific reasons, e.g., increased demand for technology services].

- Pharmaceuticals: The pharmaceutical sector also showed strong performance due to [mention specific factors, e.g., increased demand for drugs].

Implications of the Sensex's Significant Increase for Investors

The significant increase in the Sensex has diverse implications for different investor profiles.

Opportunities and Challenges for Long-Term Investors

A bullish market presents numerous opportunities for long-term investors, such as potential for higher returns and wealth creation. However, it's crucial to avoid over-exuberance and maintain a diversified portfolio to mitigate risks.

- Strategic Asset Allocation: Long-term investors should maintain a well-diversified portfolio across different asset classes.

- Dollar-Cost Averaging: Consider using dollar-cost averaging to mitigate the risk of investing a lump sum at market highs.

Short-Term Trading Strategies

While short-term trading offers the potential for quick gains, it's essential to be aware of the increased risk involved due to market volatility. Short-term traders must have a robust understanding of market dynamics and risk management strategies.

- Technical Analysis: Employ technical analysis tools to identify potential entry and exit points.

- Risk Tolerance: Carefully assess your risk tolerance before engaging in short-term trading.

Risk Management and Portfolio Adjustments

Regardless of investment horizon, risk management is paramount. The recent market surge underscores the need for regular portfolio adjustments based on changing market conditions.

- Diversification: Maintain a diversified investment portfolio to mitigate risk.

- Regular Monitoring: Regularly monitor your investments and adjust your portfolio as needed.

Future Outlook: Sustained Growth or Temporary Surge?

Predicting the future of the Sensex is challenging, but analyzing current trends and potential risks helps in formulating informed investment strategies.

Potential for Continued Growth

Continued growth is possible if positive economic indicators persist, global markets remain supportive, and domestic investments continue to flow.

- Government Policies: Supportive government policies and reforms could contribute to sustained growth.

- Corporate Earnings: Strong corporate earnings will also play a vital role in sustaining the upward trend.

Risks and Potential Corrections

Several factors could lead to a market correction or reverse the upward trend.

- Global Uncertainty: Geopolitical instability or unexpected global economic events can negatively impact the market.

- Inflationary Pressures: A resurgence of inflationary pressures could dampen investor sentiment.

Conclusion

The Sensex's remarkable increase of over 10% on the BSE highlights the dynamic nature of the Indian stock market. This surge is attributable to a confluence of factors, including positive economic indicators, strong investment flows, and favorable global market trends. While this presents opportunities, it also underscores the importance of informed investment decisions, encompassing risk management and portfolio diversification. Stay updated on the latest Sensex movements and other key market indicators to capitalize on the opportunities and mitigate risks within the dynamic Indian stock market.

Featured Posts

-

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025 -

Leeflang Kwestie Bruins Dringt Aan Op Gesprek Met Npo Toezichthouder

May 15, 2025

Leeflang Kwestie Bruins Dringt Aan Op Gesprek Met Npo Toezichthouder

May 15, 2025 -

Fiu Ind Imposes R5 45 Crore Penalty On Paytm Payments Bank Money Laundering Lapses

May 15, 2025

Fiu Ind Imposes R5 45 Crore Penalty On Paytm Payments Bank Money Laundering Lapses

May 15, 2025 -

Herstel Van Vertrouwen College Van Omroepen En De Toekomst Van De Npo

May 15, 2025

Herstel Van Vertrouwen College Van Omroepen En De Toekomst Van De Npo

May 15, 2025 -

Ledra Palace Ta Dijital Isguecue Piyasasi Veri Tabani Tanitimi

May 15, 2025

Ledra Palace Ta Dijital Isguecue Piyasasi Veri Tabani Tanitimi

May 15, 2025

Latest Posts

-

Onderzoek Naar Angstcultuur Bij De Npo Na Klachten Van Medewerkers Over Leeflang

May 15, 2025

Onderzoek Naar Angstcultuur Bij De Npo Na Klachten Van Medewerkers Over Leeflang

May 15, 2025 -

Npo Werknemers Melden Angstcultuur Onder Leiding Van Leeflang

May 15, 2025

Npo Werknemers Melden Angstcultuur Onder Leiding Van Leeflang

May 15, 2025 -

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025 -

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025 -

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025