Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

How NAV is Calculated for the Amundi Dow Jones Industrial Average UCITS ETF

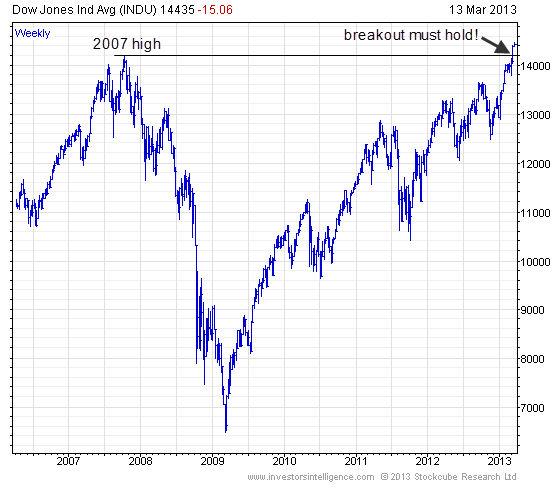

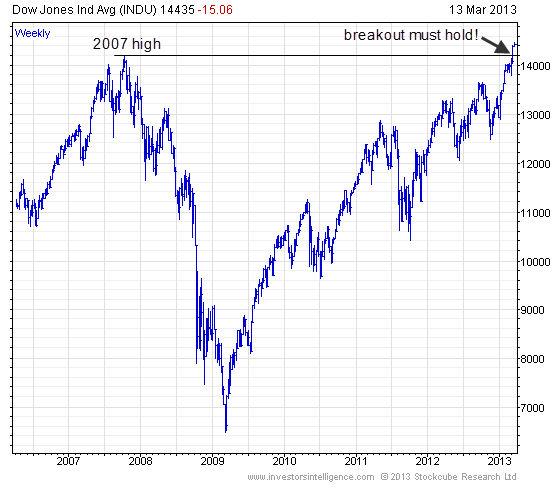

The Net Asset Value (NAV) of an ETF represents the net value of its underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, calculating the NAV involves a precise process. This ETF tracks the Dow Jones Industrial Average, meaning its holdings consist of the 30 major US companies comprising that index.

The calculation considers several key components:

- Market Value of Holdings: The first step is determining the current market value of each of the 30 constituent stocks in the Dow Jones Industrial Average held by the ETF. This is done using the closing prices of these stocks on a given trading day.

- Summing the Market Values: The market values of all 30 holdings are then added together to arrive at the total value of the ETF's assets.

- Accounting for ETF Expenses: Any expenses associated with running the ETF, such as management fees and administrative costs, are deducted from the total asset value.

- Dividing by Outstanding Shares: Finally, the resulting net asset value is divided by the total number of outstanding ETF shares to arrive at the NAV per share.

Here's a simplified breakdown of the steps involved in the NAV calculation:

- Determine the market value of each holding in the Amundi Dow Jones Industrial Average UCITS ETF.

- Sum the market values of all holdings.

- Deduct the ETF's expenses for the period.

- Divide the result by the total number of outstanding shares.

Understanding this "NAV calculation" process allows investors to grasp the true value of their investment in the Amundi Dow Jones Industrial Average UCITS ETF. The keywords "Amundi Dow Jones Industrial Average UCITS ETF holdings" and "market value" are essential for accurate understanding.

NAV vs. Market Price: Understanding the Difference

While the NAV represents the intrinsic value of the ETF's assets, the market price reflects the actual price at which the ETF is currently trading on the exchange. These two figures are not always identical. Several factors can contribute to discrepancies between the NAV and market price:

- Supply and Demand: Like any traded asset, the market price of the Amundi Dow Jones Industrial Average UCITS ETF is subject to the forces of supply and demand. High demand can push the market price above the NAV, and low demand can drive it below.

- Trading Volume: High trading volume generally leads to a closer alignment between NAV and market price, while low volume can exacerbate price discrepancies.

- Market Sentiment: Investor sentiment and broader market trends can also influence the market price, creating temporary deviations from the NAV.

Here's a quick comparison:

- NAV: Reflects the intrinsic value of the ETF's assets.

- Market Price: Reflects the current trading price of the ETF.

- Arbitrage Opportunities: Significant differences between NAV and market price can create arbitrage opportunities for sophisticated traders. This involves buying low (when market price is below NAV) and selling high (when market price exceeds NAV).

Keywords like "ETF market price," "NAV price difference," and "arbitrage" highlight the nuances of ETF pricing.

Importance of Monitoring NAV for the Amundi Dow Jones Industrial Average UCITS ETF

Regularly checking the NAV of your Amundi Dow Jones Industrial Average UCITS ETF investment offers several key advantages:

- Performance Tracking: Monitoring NAV allows you to track the ETF's performance against its benchmark, the Dow Jones Industrial Average, providing insights into its effectiveness.

- Market Fluctuation Assessment: NAV changes reveal the impact of market fluctuations on your investment. This helps understand the volatility of your holdings.

- Informed Investment Decisions: By analyzing NAV trends, you can make more informed decisions regarding buying, selling, or holding your ETF shares.

Understanding these implications through "NAV monitoring" and analyzing "ETF performance" is crucial for effective investment management.

Where to Find the NAV for the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Reliable sources include:

- Amundi's Website: The official Amundi website is the primary source for this information.

- Financial News Websites: Major financial news outlets often publish ETF NAV data.

- Brokerage Platforms: Your brokerage account will typically display the latest NAV for all your holdings, including this ETF.

The NAV is usually published at the end of the trading day, reflecting the closing prices of the underlying assets. This "NAV data" is readily accessible, making it easy to track your investment.

Conclusion: The Significance of NAV in your Amundi Dow Jones Industrial Average UCITS ETF Investment

Understanding Net Asset Value is paramount for successful ETF investing. This article has detailed the NAV calculation for the Amundi Dow Jones Industrial Average UCITS ETF, highlighting the differences between NAV and market price and the importance of monitoring NAV changes. Remember, while market price fluctuates throughout the day, the NAV provides a snapshot of the underlying asset value. Staying informed about your ETF's Net Asset Value is crucial for making sound investment decisions. Understanding your Amundi Dow Jones Industrial Average UCITS ETF's NAV empowers you to track performance, assess risk, and optimize your investment strategy.

Featured Posts

-

Crisi Moda L Effetto Delle Tariffe Trump Del 20 Sull Unione Europea

May 24, 2025

Crisi Moda L Effetto Delle Tariffe Trump Del 20 Sull Unione Europea

May 24, 2025 -

Trade War Uncertainty Causes 7 Fall In Amsterdam Stock Market

May 24, 2025

Trade War Uncertainty Causes 7 Fall In Amsterdam Stock Market

May 24, 2025 -

Konchita Vurst Zhizn Posle Evrovideniya 2014 Kaming Aut I Ambitsii

May 24, 2025

Konchita Vurst Zhizn Posle Evrovideniya 2014 Kaming Aut I Ambitsii

May 24, 2025 -

French Election 2027 Jordan Bardellas Path To Power

May 24, 2025

French Election 2027 Jordan Bardellas Path To Power

May 24, 2025 -

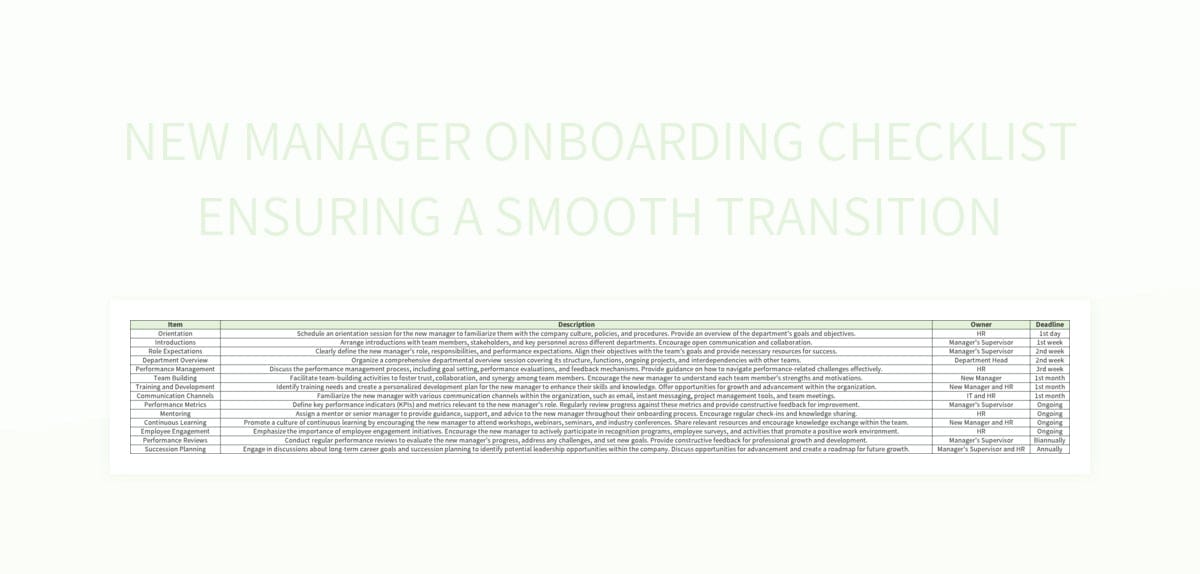

Escape To The Country The Ultimate Checklist For A Smooth Transition

May 24, 2025

Escape To The Country The Ultimate Checklist For A Smooth Transition

May 24, 2025

Latest Posts

-

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025 -

Vervolg Snelle Markt Draai Europese Aandelen Tegenover Wall Street

May 24, 2025

Vervolg Snelle Markt Draai Europese Aandelen Tegenover Wall Street

May 24, 2025 -

Philips Shareholders Updates On The 2025 Annual General Meeting

May 24, 2025

Philips Shareholders Updates On The 2025 Annual General Meeting

May 24, 2025 -

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025 -

Philips 2025 Agm Key Announcements And Shareholder Information

May 24, 2025

Philips 2025 Agm Key Announcements And Shareholder Information

May 24, 2025