Trade War Uncertainty Causes 7% Fall In Amsterdam Stock Market

Table of Contents

Impact of Trade Wars on Global Markets

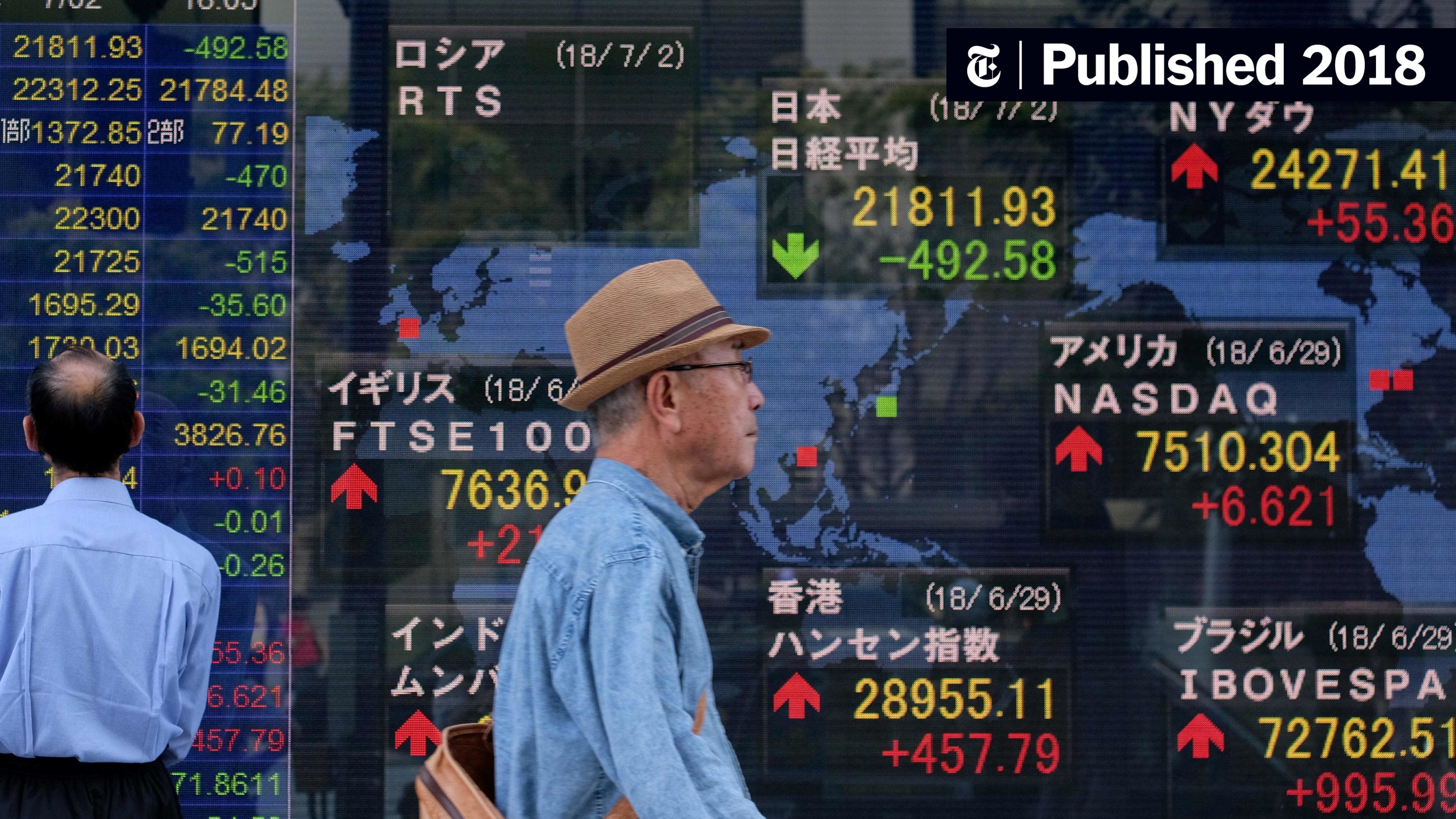

Trade wars, characterized by escalating tariffs and trade restrictions, cast a long shadow over global markets. The interconnectedness of modern economies means that trade disputes rarely remain isolated incidents. What starts as a bilateral disagreement can quickly ripple outwards, impacting seemingly unrelated markets. The recent tensions between major economic powers have served as a stark reminder of this interconnectedness. We've seen similar market downturns in other global markets, reflecting the pervasive nature of trade tensions.

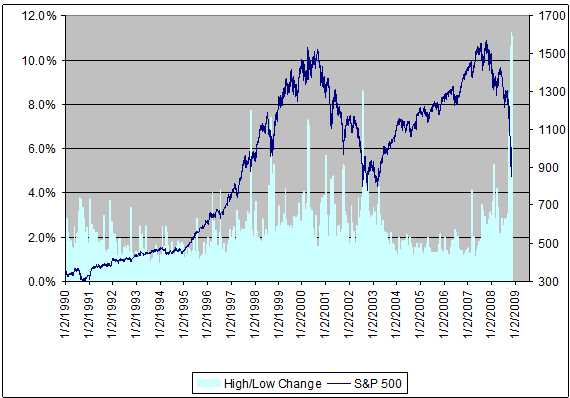

- Increased volatility in global markets: Trade war uncertainty creates a climate of fear and uncertainty, leading to unpredictable price swings and increased market volatility.

- Decline in investor confidence: When the future of trade relations is unclear, investors become hesitant, leading to a decline in overall investor confidence and a reluctance to commit capital.

- Uncertainty regarding future trade relations: The lack of predictability makes it difficult for businesses to plan for the future, impacting investment decisions and hindering long-term growth strategies.

- Potential for supply chain disruptions: Trade wars can lead to delays and disruptions in global supply chains, further impacting business operations and increasing costs. This uncertainty affects investor sentiment significantly, contributing to market downturns. Keywords like "global trade," "trade tensions," "market volatility," and "investor sentiment" are crucial for SEO purposes in this section.

Specific Factors Affecting the Amsterdam Stock Market

The Amsterdam Stock Exchange (AEX), while generally resilient, is not immune to the effects of global trade wars. The Netherlands' strong reliance on international trade makes its economy particularly vulnerable to trade disruptions. The AEX index is heavily weighted towards export-oriented businesses, making it especially sensitive to shifts in global trade patterns.

- Netherlands' reliance on international trade: The Dutch economy is heavily reliant on exports, making it susceptible to trade wars that restrict or impede the free flow of goods.

- Exposure of Dutch companies to US and Chinese markets: Many Dutch multinationals have significant operations and markets in both the US and China, making them directly affected by trade tensions between these two economic giants.

- Impact on specific Dutch multinational corporations: Companies in sectors like logistics, technology and agriculture have felt the direct impact, experiencing decreased profits and increased uncertainty.

- Potential for decreased foreign direct investment: Trade war uncertainty can deter foreign investors from committing capital to the Dutch economy, leading to a decrease in foreign direct investment and hindering economic growth. The keywords "AEX index," "Dutch economy," "export-oriented businesses," and "foreign direct investment" are specifically targeted here.

Investor Response and Market Reactions

The 7% drop in the Amsterdam Stock Market triggered a swift and significant response from investors. The immediate reaction was a wave of selling, as investors sought to reduce their exposure to risk. This selling pressure further exacerbated the market decline.

- Increased selling of Dutch equities: Investors rushed to offload their holdings in Dutch companies, contributing to the sharp decline in the AEX index.

- Shift towards safer assets (e.g., bonds, gold): Many investors sought refuge in safer assets like government bonds and gold, considered less risky during periods of market uncertainty.

- Impact on investment strategies and portfolio diversification: The market turmoil forced many investors to reassess their investment strategies, focusing on portfolio diversification and risk management.

- Analysis of trading volume and market liquidity: The increased trading volume indicated a high level of investor activity and anxiety. Market liquidity, while generally maintained, was tested under the pressure of widespread selling. The keywords "investor behavior," "market sentiment," "risk aversion," and "portfolio management" are essential here.

Government Response and Future Outlook

The Dutch government has acknowledged the impact of trade war uncertainty on the Amsterdam Stock Market and the broader economy. While specific policy interventions remain to be seen, fiscal stimulus measures and proactive communication strategies aimed at reassuring investors are under consideration.

- Government statements and policy announcements: Public statements emphasizing the government's commitment to supporting the economy and addressing the challenges posed by trade wars are crucial for restoring confidence.

- Potential fiscal or monetary policy responses: Fiscal stimulus packages aimed at boosting economic activity and monetary policy adjustments could play a vital role in mitigating the negative effects of trade tensions.

- Predictions for future market performance: The future outlook for the Amsterdam Stock Market remains uncertain and dependent on several factors, including the resolution of global trade disputes.

- Long-term implications for the Dutch economy: The long-term impact on the Dutch economy hinges on the duration and intensity of trade wars, along with the effectiveness of government responses. Keywords such as "economic policy," "fiscal stimulus," "monetary policy," and "economic outlook" are used for better SEO.

Conclusion: Navigating the Uncertainties in the Amsterdam Stock Market

The 7% fall in the Amsterdam Stock Market starkly illustrates the significant impact of global trade war uncertainty on even robust economies. The Netherlands' reliance on international trade and the exposure of Dutch companies to global markets highlight the specific vulnerabilities of the Amsterdam stock exchange. Investor reactions, including increased selling and a shift towards safer assets, further underscore the severity of the situation.

Understanding the Amsterdam stock market fluctuations and managing risks in the Amsterdam Stock Market is critical for investors. Staying informed about global trade developments and their effect on the AEX index is crucial for making informed investment decisions and navigating the Amsterdam stock market's challenges. Continuous monitoring of global trade news and adapting investment strategies accordingly are key to successfully navigating the complexities of the current market climate.

Featured Posts

-

Escape To The Country Finding Your Perfect Rural Haven

May 24, 2025

Escape To The Country Finding Your Perfect Rural Haven

May 24, 2025 -

Claim Your Bbc Radio 1 Big Weekend 2025 Tickets Now Full Lineup Inside

May 24, 2025

Claim Your Bbc Radio 1 Big Weekend 2025 Tickets Now Full Lineup Inside

May 24, 2025 -

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025 -

Analisi Dei Prezzi Moda Negli Stati Uniti Dopo L Introduzione Dei Dazi

May 24, 2025

Analisi Dei Prezzi Moda Negli Stati Uniti Dopo L Introduzione Dei Dazi

May 24, 2025 -

Glastonbury 2024 Unannounced Us Band Teases Festival Slot

May 24, 2025

Glastonbury 2024 Unannounced Us Band Teases Festival Slot

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025