Net Asset Value (NAV) Explained: Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the intrinsic value of each share in an ETF. It's calculated daily by subtracting the ETF's total liabilities from its total assets and then dividing by the number of outstanding shares. This calculation provides a snapshot of the ETF's holdings at a specific point in time.

The formula is straightforward:

NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

Total assets include the market value of all the securities held within the ETF, such as stocks and bonds. Total liabilities encompass expenses such as management fees and other operational costs. The number of outstanding shares represents the total number of ETF shares currently in circulation. This calculation is typically performed at the close of the market each day and the NAV is then published.

Several factors influence the daily NAV fluctuations. These include:

- Market fluctuations: Changes in the prices of the underlying assets directly impact the NAV. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

- Dividend payments: When underlying holdings pay dividends, the ETF receives these payments, increasing its assets and subsequently its NAV.

- Currency fluctuations: For internationally diversified ETFs like the Amundi MSCI World II UCITS ETF, changes in exchange rates can affect the NAV.

Key takeaways about NAV calculation:

- NAV reflects the intrinsic value of the ETF, representing the actual value of its holdings.

- NAV is crucial for determining the fair market price of the ETF shares.

- Changes in NAV demonstrate the ETF's performance over time.

NAV vs. Market Price of Amundi MSCI World II UCITS ETF

While NAV represents the theoretical value of an ETF share, the market price is the actual price at which the ETF is traded on the exchange. These two figures can, and often do, differ. This difference arises due to market forces of supply and demand.

- Market price can be higher or lower than the NAV. If the market price is higher than the NAV, the ETF trades at a premium. Conversely, if the market price is lower than the NAV, it trades at a discount.

- The premium or discount reveals market sentiment towards the ETF. A premium may indicate high investor demand, while a discount might suggest less interest.

- Understanding this difference aids in making informed investment decisions. A significant deviation between market price and NAV might signal an opportunity or a potential risk, depending on the context.

Tracking the NAV of Amundi MSCI World II UCITS ETF

Tracking the daily NAV of your Amundi MSCI World II UCITS ETF is crucial for monitoring its performance. You can find this information from several sources:

- Amundi's official website: The ETF provider will usually publish the daily NAV on its website.

- Financial data providers: Reputable financial data providers such as Bloomberg, Yahoo Finance, and Google Finance provide real-time or delayed NAV data.

- Brokerage platforms: Most brokerage platforms display the NAV of ETFs held in your investment portfolio.

Regularly checking the NAV allows you to monitor the ETF's performance against its benchmark and make informed decisions about your investment strategy.

The Importance of NAV for Amundi MSCI World II UCITS ETF Investors

Understanding NAV is paramount for investors in the Amundi MSCI World II UCITS ETF. It's a key indicator for:

- Investment performance: Track your ETF's performance against its benchmark index using NAV changes.

- ETF comparison: Compare the NAV performance of the Amundi MSCI World II UCITS ETF against similar ETFs to assess relative value.

- Buy/sell decisions: While not the sole factor, NAV helps in forming informed buy and sell decisions. A significant and sustained deviation from the NAV can influence your investment strategy.

- Long-term portfolio management: Long-term investors should regularly monitor NAV to ensure their investment aligns with their long-term financial goals.

Key uses of NAV for informed investment decisions:

- Monitor performance against benchmarks.

- Compare against similar ETFs.

- Make informed buy/sell decisions.

- Essential for long-term portfolio management.

Conclusion: Mastering Net Asset Value (NAV) for Your Amundi MSCI World II UCITS ETF Investments

Understanding Net Asset Value (NAV) is crucial for successful investing in the Amundi MSCI World II UCITS ETF. By regularly monitoring the NAV, comparing it to the market price, and understanding its role in performance evaluation, you can make more informed investment decisions. Regularly monitor the NAV of your Amundi MSCI World II UCITS ETF and make informed investment decisions based on its fluctuations. Understanding Net Asset Value is crucial for maximizing your returns. Learn more about [link to relevant resource on Amundi MSCI World II UCITS ETF].

Featured Posts

-

Former French Prime Minister Critiques Macrons Policies

May 24, 2025

Former French Prime Minister Critiques Macrons Policies

May 24, 2025 -

Frankfurt Stock Exchange Dax Ends Day Below 24 000 Points

May 24, 2025

Frankfurt Stock Exchange Dax Ends Day Below 24 000 Points

May 24, 2025 -

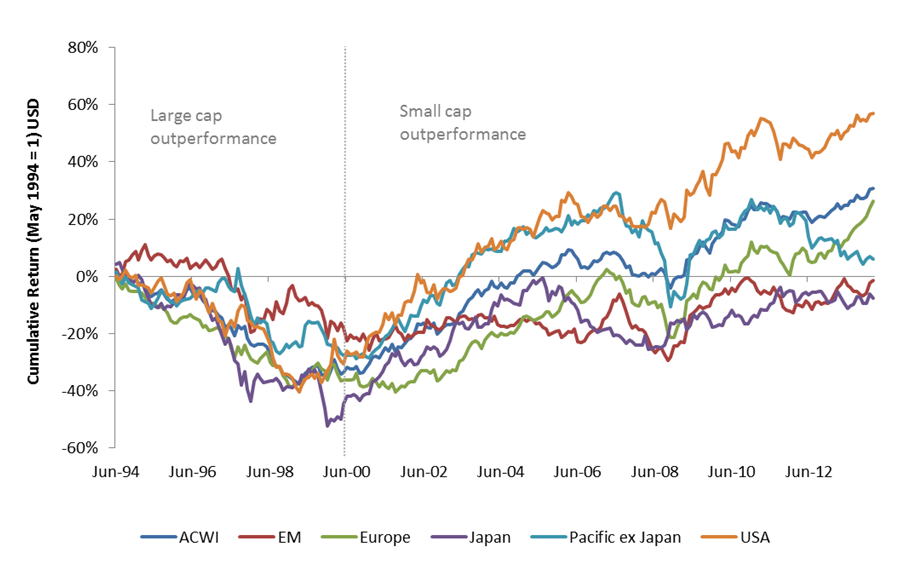

Pertimbangan Investasi Mtel And Mbma Di Msci Small Cap Index

May 24, 2025

Pertimbangan Investasi Mtel And Mbma Di Msci Small Cap Index

May 24, 2025 -

Emergency Services Respond To M56 Crash Car Overturn Injuries Reported

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturn Injuries Reported

May 24, 2025 -

Alfred Dreyfus French Lawmakers Seek To Right A Historical Wrong

May 24, 2025

Alfred Dreyfus French Lawmakers Seek To Right A Historical Wrong

May 24, 2025

Latest Posts

-

Tariffe Trump Del 20 Analisi Dell Effetto Sui Brand Di Moda Europei E Americani

May 24, 2025

Tariffe Trump Del 20 Analisi Dell Effetto Sui Brand Di Moda Europei E Americani

May 24, 2025 -

L Impatto Delle Tariffe Trump Del 20 Sul Settore Moda Analisi Di Caso Nike E Lululemon

May 24, 2025

L Impatto Delle Tariffe Trump Del 20 Sul Settore Moda Analisi Di Caso Nike E Lululemon

May 24, 2025 -

Crisi Moda L Effetto Delle Tariffe Trump Del 20 Sull Unione Europea

May 24, 2025

Crisi Moda L Effetto Delle Tariffe Trump Del 20 Sull Unione Europea

May 24, 2025 -

Dazi Trump Come Il 20 Sui Prodotti Ue Ha Colpito Nike E Lululemon

May 24, 2025

Dazi Trump Come Il 20 Sui Prodotti Ue Ha Colpito Nike E Lululemon

May 24, 2025 -

Dazi Trump Sul 20 L Impatto Negativo Sul Settore Moda

May 24, 2025

Dazi Trump Sul 20 L Impatto Negativo Sul Settore Moda

May 24, 2025