New US Solar Duties: How Hanwha And OCI Plan To Expand

Table of Contents

Hanwha's Response to US Solar Duties and Expansion Plans

Hanwha, a global leader in solar technology through its subsidiary Hanwha Q Cells, is taking a multi-pronged approach to solidify its position in the US market.

Increased Domestic Production and Investment

Hanwha is significantly increasing its investment in US-based solar manufacturing facilities. This commitment involves substantial capital expenditure to boost domestic polysilicon production, solar cell technology advancements, and module assembly. Specific details on investment figures are still emerging, but industry analysts predict a considerable increase in their US manufacturing capacity within the next few years. This strategy aims to reduce reliance on imported components and directly address the impact of solar tariffs.

- Expansion of existing facilities: Upgrades and expansions to existing plants are underway to increase output and efficiency.

- New facility construction: Hanwha is exploring options to build entirely new, state-of-the-art manufacturing plants within the US.

- Focus on polysilicon production: A critical component in the solar cell manufacturing process, investing in domestic polysilicon production secures a crucial element of the supply chain.

- Technological advancements: Hanwha is continually investing in R&D to improve efficiency and reduce the cost of its solar cells and modules, making them more competitive in the market.

Strategic Partnerships and Acquisitions

To further strengthen its position, Hanwha is actively pursuing strategic partnerships and acquisitions within the US solar industry. These collaborations offer access to new technologies, distribution networks, and project development opportunities. By partnering with established players, Hanwha can leverage existing infrastructure and expertise to rapidly expand its market reach.

- Joint ventures: Collaboration with other companies to share resources and reduce individual risks associated with the new solar duties.

- Acquisitions of smaller solar companies: Potential acquisitions could provide immediate access to established customer bases and manufacturing capabilities.

- Supply chain partnerships: Securing reliable suppliers of raw materials and components domestically will mitigate supply chain risks arising from the solar tariffs.

Focus on Downstream Market Expansion

While upstream manufacturing is directly impacted by the tariffs, Hanwha is also looking to expand its presence in the downstream solar market. This includes a stronger focus on solar project development, EPC contracts (Engineering, Procurement, and Construction), and expanding into utility-scale and rooftop solar projects. Diversifying into these areas lessens reliance on the tariff-impacted upstream manufacturing segment.

OCI's Strategies for Growth Amidst US Solar Duties

OCI, a major global producer of polysilicon, is focusing on bolstering its US operations to mitigate the effects of the newly implemented duties.

Expansion of US Polysilicon Production

OCI's primary response involves a significant expansion of its US polysilicon production capacity. This strategy directly counters the impact of tariffs by increasing the domestic supply of this crucial raw material. This includes investing in upgrading existing facilities and possibly building new ones to increase the output of solar-grade silicon. The scale of this expansion demonstrates a considerable commitment to the US market.

- Capacity increase: OCI is investing in increasing its polysilicon production capacity to meet the growing demand.

- Technological upgrades: Improving production efficiency and reducing costs through technological advancements in polysilicon manufacturing.

- Strategic location: Choosing strategic locations for new facilities will be critical to minimizing transportation costs and optimizing supply chains.

Diversification of Markets and Products

In addition to strengthening its US presence, OCI is also pursuing a strategy of market diversification. Reducing its reliance on a single market, especially one as heavily affected by tariffs as the US, is key to long-term stability. This involves exploring new markets globally and potentially developing new product lines or services within the broader renewable energy sector.

- Expanding into international markets: Focusing on regions with less restrictive trade policies.

- Developing new products: Exploring innovative solar technologies and expanding into related areas of the renewable energy sector.

- Value-added products: Creating downstream products based on polysilicon, reducing reliance on direct polysilicon sales.

Supply Chain Resilience and Partnerships

OCI is working diligently to build a robust and resilient supply chain. This involves securing reliable sources of raw materials and diversifying its supplier base to minimize disruptions caused by potential future tariff changes or other unforeseen events.

- Long-term contracts: Securing long-term supply agreements with raw material providers to ensure consistent supply.

- Strategic partnerships: Collaborating with other companies to strengthen the overall supply chain and improve resilience.

- Inventory management: Optimizing inventory levels to mitigate risks associated with supply chain disruptions.

Conclusion: The Future of Hanwha and OCI in the US Solar Market

Both Hanwha and OCI are demonstrating a proactive and strategic approach to navigating the challenges presented by the new US solar duties. Their investments in domestic manufacturing, strategic partnerships, and market diversification signal a commitment to maintaining and expanding their presence in the US solar market. While challenges remain, such as the continued volatility of polysilicon prices and the potential for further tariff adjustments, their multifaceted strategies position them well for long-term success. To learn more about the evolving landscape of the US solar industry and the implications of solar tariffs, further research into the strategies of key players like Hanwha and OCI is encouraged. Understanding the US solar industry outlook and the future of solar energy requires keeping a close eye on how companies adapt to changing market conditions and solar tariff implications.

Featured Posts

-

Pete Muntean On Cnn A Pilots Perspective On Air Traffic Control Blackouts

May 30, 2025

Pete Muntean On Cnn A Pilots Perspective On Air Traffic Control Blackouts

May 30, 2025 -

The Algorithmic Influence On Mass Shooters A Call For Corporate Responsibility

May 30, 2025

The Algorithmic Influence On Mass Shooters A Call For Corporate Responsibility

May 30, 2025 -

Alcaraz Claims Monaco Crown After Thrilling Rally

May 30, 2025

Alcaraz Claims Monaco Crown After Thrilling Rally

May 30, 2025 -

Ticketmaster Caida Informacion Actualizada 8 De Abril Grupo Milenio

May 30, 2025

Ticketmaster Caida Informacion Actualizada 8 De Abril Grupo Milenio

May 30, 2025 -

Illegal Hunting Operation Discovered Near Manitoba Nunavut Border Rcmp Report

May 30, 2025

Illegal Hunting Operation Discovered Near Manitoba Nunavut Border Rcmp Report

May 30, 2025

Latest Posts

-

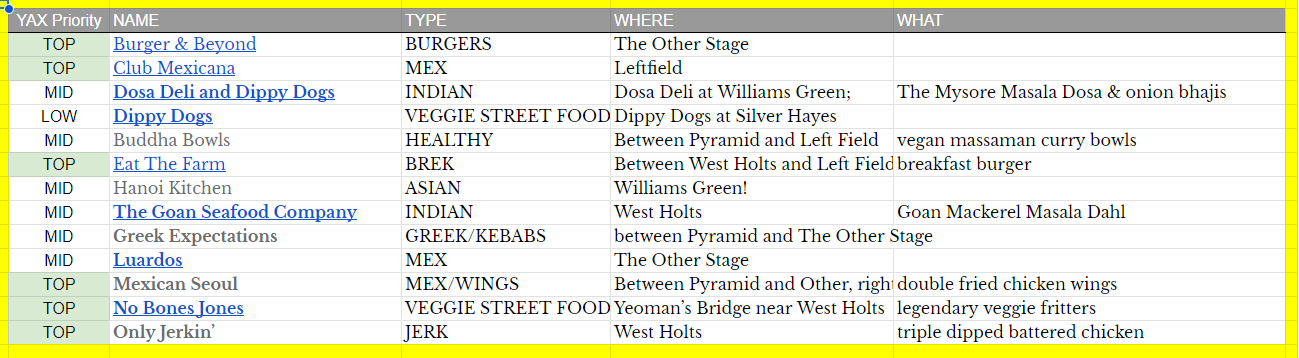

Iconic Rock Bands Glastonbury Future Life Or Death Decides

May 31, 2025

Iconic Rock Bands Glastonbury Future Life Or Death Decides

May 31, 2025 -

Glastonbury Festival Veterans One Essential Item To Save You Money

May 31, 2025

Glastonbury Festival Veterans One Essential Item To Save You Money

May 31, 2025 -

Glastonbury Festival An Iconic Rock Bands Return A Life Or Death Scenario

May 31, 2025

Glastonbury Festival An Iconic Rock Bands Return A Life Or Death Scenario

May 31, 2025 -

East London Shop Blaze 125 Firefighters Battle Large Fire

May 31, 2025

East London Shop Blaze 125 Firefighters Battle Large Fire

May 31, 2025 -

Life Or Death The Only Condition For An Iconic Rock Bands Glastonbury Return

May 31, 2025

Life Or Death The Only Condition For An Iconic Rock Bands Glastonbury Return

May 31, 2025