NNPC Petrol Prices And The Dangote Refinery: Current Market Dynamics

Table of Contents

The Nigerian National Petroleum Corporation (NNPC) has long been the dominant player in Nigeria's petroleum sector, controlling a significant portion of the country's fuel supply. However, the imminent launch of the Dangote Refinery, Africa's largest, promises to be a game-changer, potentially disrupting the existing market equilibrium and significantly impacting NNPC's pricing power. This analysis aims to unpack the current market situation and explore the potential ramifications of this monumental development.

H2: Current NNPC Petrol Pricing Structure and its Challenges

Nigeria's petrol prices, largely dictated by NNPC, are subject to a complex interplay of factors. Understanding these influences is crucial to predicting the market's future trajectory.

H3: Factors influencing NNPC prices:

Several key elements contribute to NNPC's pricing decisions:

- International Crude Oil Prices: Global crude oil prices, heavily influenced by OPEC decisions and geopolitical events, directly impact the cost of importing refined petroleum products. A surge in global prices inevitably translates to higher petrol prices at the pump in Nigeria.

- Forex Exchange Rates: The fluctuating value of the Naira against major currencies like the US dollar significantly affects the cost of importing refined petroleum products, impacting NNPC's pricing strategy. Naira devaluation often leads to higher petrol prices.

- Transportation Costs: The cost of transporting refined petroleum products from refineries to filling stations across the vast Nigerian landscape adds another layer of complexity to the pricing equation. Pipeline maintenance issues, for example, can disrupt supply and drive up prices.

- Government Regulations: Government policies, including subsidy removal and tax regulations, play a crucial role in determining the final price consumers pay at the pump. Subsidy removal, although intended to rationalize pricing, can lead to immediate price shocks.

H3: Impact on Consumers and the Economy:

Fluctuations in NNPC petrol prices have profound socio-economic consequences:

- Increased Transportation Fares: Higher petrol prices directly translate to increased transportation costs, affecting commuters, businesses, and the overall cost of living.

- Impact on Businesses: Businesses, especially those reliant on transportation, face increased operational costs, potentially impacting profitability and competitiveness.

- Effects on Low-Income Households: The burden of higher petrol prices disproportionately affects low-income households, who spend a larger percentage of their income on transportation and essential goods.

H2: The Dangote Refinery: A Potential Game Changer?

The Dangote Refinery, with its massive refining capacity, holds the potential to revolutionize Nigeria's petroleum landscape.

H3: Refinery Capacity and Potential Output:

The refinery is projected to have a refining capacity of 650,000 barrels per day, significantly exceeding the current NNPC refining capacity. This could:

- Overtake current NNPC refining capacity: Leading to a substantial increase in domestic petrol supply.

- Allow for petrol export: Potentially transforming Nigeria into a net exporter of refined petroleum products.

- Create numerous jobs: Boosting employment opportunities across various sectors.

H3: Expected Impact on NNPC Petrol Prices:

The Dangote Refinery's operation is expected to significantly alter the dynamics of NNPC petrol prices:

- Increased Competition: Introducing more competition in the market and potentially leading to lower prices for consumers.

- Potential for Price Wars: Competition could trigger price wars, benefiting consumers in the short-term.

- Improved Fuel Supply Reliability: Reducing reliance on imports and ensuring a more stable supply of petrol.

H3: Challenges and Uncertainties:

Despite its promise, several challenges could hinder the refinery's full impact:

- Pipeline Capacity Constraints: Inadequate pipeline infrastructure may limit the refinery's distribution capabilities.

- Distribution Network Challenges: Efficient distribution across the country will require significant investment in infrastructure.

- Potential for Price Fixing: Market manipulation or collusion could undermine the intended benefits of increased competition.

H2: Market Dynamics and Future Projections

Analyzing the short-term and long-term impacts of the Dangote Refinery is crucial for understanding the future of the Nigerian petroleum sector.

H3: Short-Term Market Outlook:

In the near term, the Dangote Refinery's influence will likely be gradual:

- Gradual Price Reductions: Prices may gradually decline as domestic supply increases and competition intensifies.

- Initial Market Adjustments: The market will require time to adjust to the new dynamics created by the refinery's operation.

- Impact on Fuel Importation: Nigeria's reliance on fuel imports is expected to decrease significantly.

H3: Long-Term Market Implications:

The long-term consequences of increased domestic refining capacity are far-reaching:

- Reduced Reliance on Fuel Imports: Boosting Nigeria's energy security and reducing its vulnerability to global price fluctuations.

- Foreign Exchange Savings: Saving the country valuable foreign exchange reserves currently spent on fuel imports.

- Stimulation of Downstream Industries: Creating a ripple effect across related industries and driving economic growth.

3. Conclusion:

The interplay between NNPC petrol prices and the Dangote Refinery is shaping the future of Nigeria's petroleum landscape. While NNPC's pricing currently reflects the complexities of global crude oil prices, forex rates, transportation costs, and government regulations, the Dangote Refinery presents a potential paradigm shift. Increased domestic refining capacity promises to introduce greater competition, potentially stabilizing prices and enhancing Nigeria's energy security. However, challenges related to infrastructure and market regulation need careful consideration. To stay abreast of these significant developments, regularly follow updates on NNPC petrol prices and the Dangote Refinery from official government sources and reputable news outlets. The successful integration of the Dangote Refinery holds immense potential to reshape Nigeria's energy future and improve its economic trajectory.

Featured Posts

-

The Aoc Fox News Dispute Examining Trumps Media Influence

May 09, 2025

The Aoc Fox News Dispute Examining Trumps Media Influence

May 09, 2025 -

Leon Draisaitl Hart Trophy Contender And Key To Oilers Strong Season

May 09, 2025

Leon Draisaitl Hart Trophy Contender And Key To Oilers Strong Season

May 09, 2025 -

Harry Styles Devastated Reaction To A Poor Snl Impression

May 09, 2025

Harry Styles Devastated Reaction To A Poor Snl Impression

May 09, 2025 -

Elizabeth Arden Products Budget Friendly Options

May 09, 2025

Elizabeth Arden Products Budget Friendly Options

May 09, 2025 -

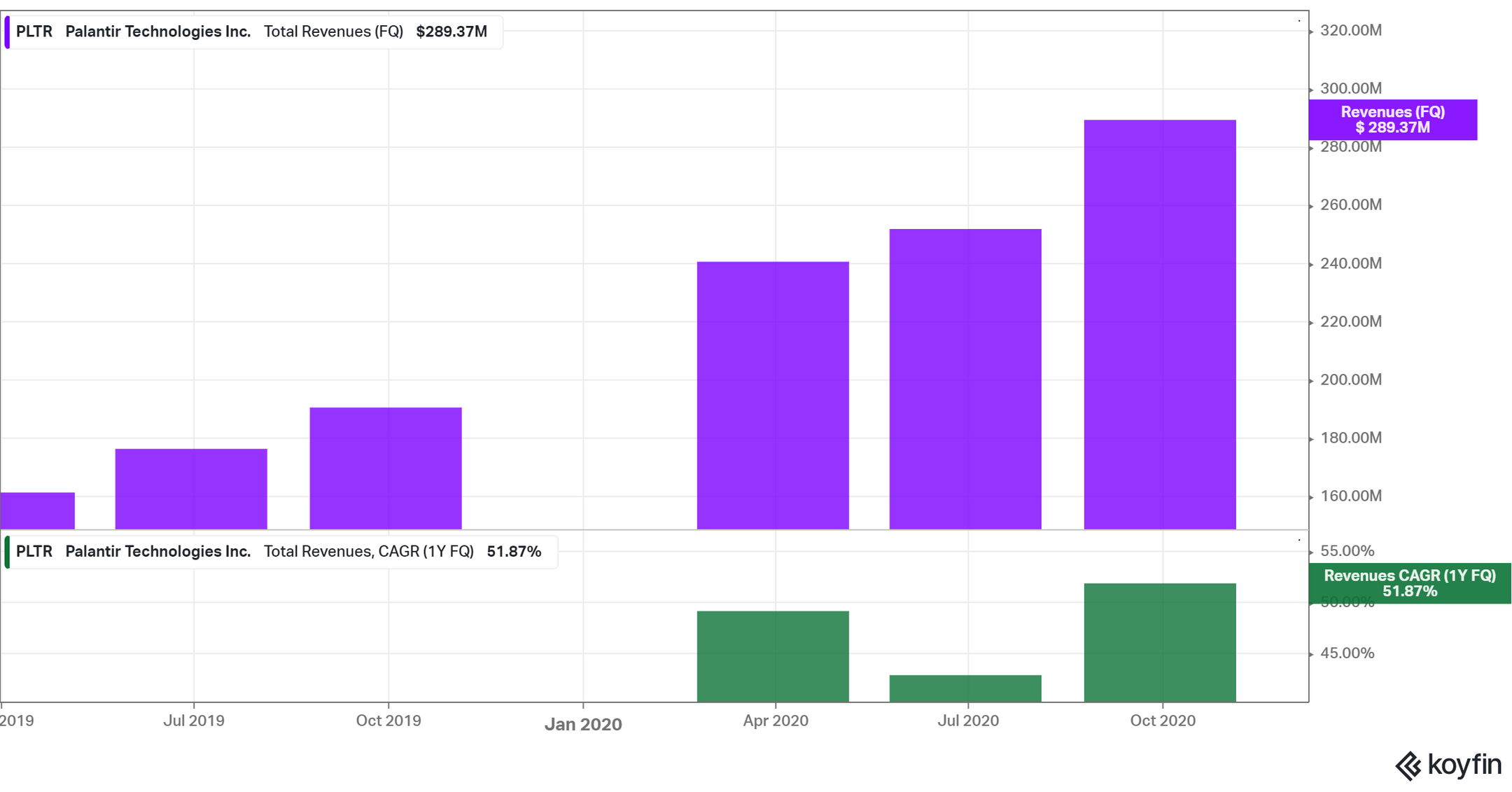

Analyzing Palantir Stock Before The May 5th Earnings Announcement

May 09, 2025

Analyzing Palantir Stock Before The May 5th Earnings Announcement

May 09, 2025