One Crypto Survivor: Navigating The Trade War's Impact

Table of Contents

Understanding the Trade War's Ripple Effect on Crypto

Geopolitical instability, especially in the form of trade wars, significantly impacts the cryptocurrency market. The ripple effect is far-reaching and affects investor sentiment, regulatory landscapes, and market liquidity.

Global Market Instability

Trade tensions create global market uncertainty, impacting investor confidence and leading to increased crypto volatility. This uncertainty stems from several factors:

- Decreased investor appetite for risk: Trade wars often signal broader economic instability, causing investors to move away from riskier assets, including cryptocurrencies. This leads to sell-offs and price drops.

- Capital flight from emerging markets: Trade disputes can destabilize emerging markets, causing capital flight to safer havens. This can indirectly reduce liquidity in the crypto market, as many investors in these regions participate in cryptocurrency trading.

- Impact on fiat currencies and their correlation with crypto: The value of fiat currencies is often influenced by trade wars. Since cryptocurrencies are often correlated with fiat currencies (especially the US dollar), fluctuations in fiat values can directly impact crypto prices.

Regulatory Uncertainty and its Impact

Trade wars can also exacerbate regulatory uncertainty within the crypto space. Governments may react to economic pressures by tightening regulations or introducing new laws impacting cryptocurrency trading and adoption.

- Increased scrutiny from financial authorities: In times of economic uncertainty, financial regulators often increase their scrutiny of the cryptocurrency market, potentially leading to stricter compliance requirements.

- Potential for new regulations and restrictions: Governments may introduce new regulations or restrictions on crypto trading, ICOs, and other crypto-related activities in an attempt to stabilize their economies and protect investors.

- Impact on Initial Coin Offerings (ICOs): The regulatory environment surrounding ICOs is already complex. Trade wars can further complicate this, leading to greater uncertainty and potentially reducing the appeal of ICO investments.

Strategies for Crypto Survival During Trade Wars

While trade wars present challenges, savvy investors can employ several strategies to mitigate risk and even profit during periods of uncertainty.

Diversification and Risk Management

Diversifying your crypto holdings across various assets and implementing effective risk management techniques is crucial for survival during volatile periods.

- Diversification across different cryptocurrencies: Don't put all your eggs in one basket. Invest in a mix of cryptocurrencies with different use cases, technologies, and market caps to reduce your overall portfolio risk.

- Using stop-loss orders: Stop-loss orders automatically sell your crypto assets when they reach a predetermined price, limiting potential losses.

- Hedging strategies: Explore hedging strategies using instruments like futures or options contracts to protect against potential price declines.

Fundamental Analysis and Due Diligence

Thorough research and due diligence are essential before investing in any cryptocurrency, especially during uncertain times.

- Analyzing the technology, team, use case, and market potential of a cryptocurrency: Understand the underlying technology, the team behind the project, the problem it solves, and its potential for market adoption.

- Checking whitepapers and tokenomics: Carefully review the project's whitepaper for information about its technology, goals, and team. Analyze its tokenomics to understand how the cryptocurrency's value is created and distributed.

- Understanding the project's roadmap: Evaluate the project's long-term vision and its progress towards achieving its goals.

Long-Term Investment Strategy

A long-term investment approach can help you weather the storms of market volatility caused by trade wars and other global events.

- Averaging down during dips: Use periods of market downturn to buy more cryptocurrencies at lower prices, reducing your average cost basis.

- Focusing on projects with strong fundamentals and long-term growth potential: Invest in projects with a solid foundation and a clear path to long-term success, rather than chasing short-term gains.

- Ignoring short-term market fluctuations: Focus on the long-term potential of your investments and avoid making impulsive decisions based on short-term price movements.

Case Studies of Successful Crypto Navigation

While specific details of individual investor strategies are often confidential, observing broader market trends helps illustrate successful navigation. For example, investors who focused on established, large-cap cryptocurrencies like Bitcoin and Ethereum during periods of heightened trade war uncertainty often fared better than those investing in newer, smaller-cap projects. Furthermore, those employing dollar-cost averaging strategies were able to mitigate the impact of sudden price drops.

Conclusion

The crypto market, while volatile, presents opportunities even amidst global challenges like trade wars. By understanding the impact of these conflicts, employing robust risk management strategies, and focusing on long-term growth, investors can increase their chances of success. Diversification, thorough due diligence, and a well-defined investment strategy are crucial to becoming a One Crypto Survivor. Don't let the trade war scare you away – learn to navigate its impact and reap the rewards. Start building your resilient crypto portfolio today! Learn more about navigating the impact of [link to relevant resource/another article].

Featured Posts

-

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 09, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 09, 2025 -

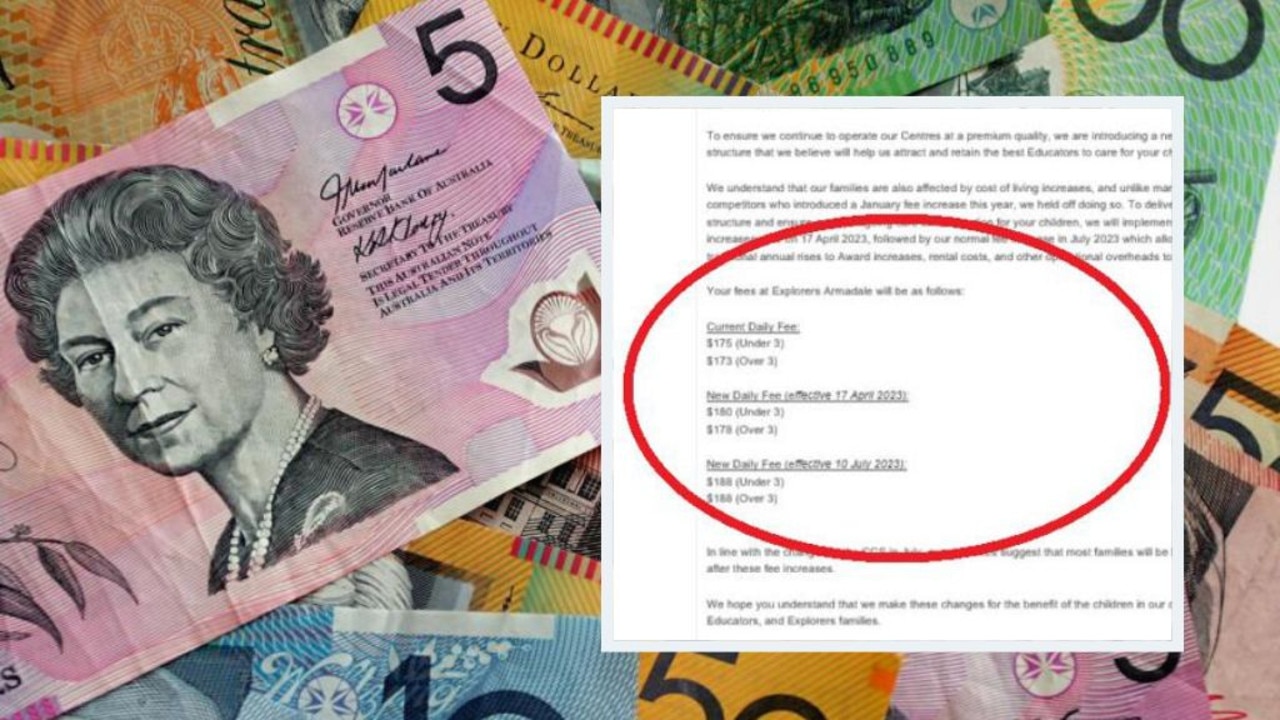

Daycare Costs Explode After Initial 3 000 Babysitter Payment

May 09, 2025

Daycare Costs Explode After Initial 3 000 Babysitter Payment

May 09, 2025 -

Sensex Live Updates Market Rally Adani Ports Gain Eternal Decline

May 09, 2025

Sensex Live Updates Market Rally Adani Ports Gain Eternal Decline

May 09, 2025 -

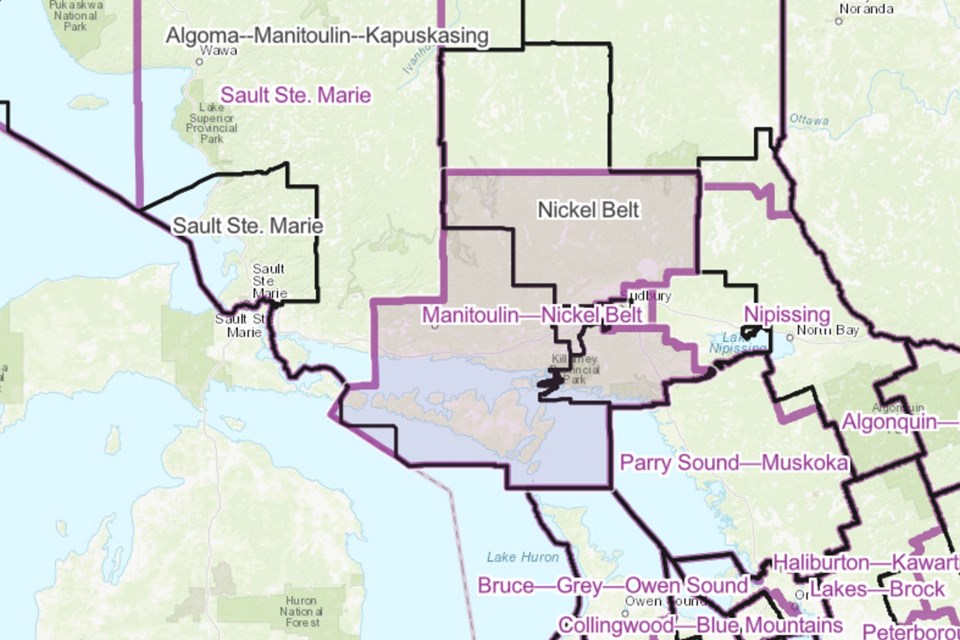

Understanding The Impact Of Federal Riding Boundary Changes In Edmonton

May 09, 2025

Understanding The Impact Of Federal Riding Boundary Changes In Edmonton

May 09, 2025 -

Liga Chempionov 2024 2025 Polniy Prognoz Na Polufinaly I Final S Raspisaniem I Statistikoy

May 09, 2025

Liga Chempionov 2024 2025 Polniy Prognoz Na Polufinaly I Final S Raspisaniem I Statistikoy

May 09, 2025