Sensex Live Updates: Market Rally, Adani Ports Gain, Eternal Decline

Table of Contents

Sensex Live Updates: A Detailed Market Analysis

The Market Rally: Causes and Contributors

Today's market rally was fueled by a confluence of factors, creating a bullish sentiment across several sectors. Positive global cues, driven by encouraging economic data from major economies, played a significant role. Strong domestic economic data, particularly in key sectors like manufacturing and services, further boosted investor confidence. Sector-specific news also contributed to the overall positive momentum.

- Significant Gains: The IT sector saw a surge of 2.5%, driven by positive global tech earnings. The FMCG sector also registered a notable increase of 1.8%, fueled by strong consumer spending. The banking sector showed gains of 1.5%, reflecting positive sentiment regarding credit growth.

- Market Gains Drivers: Beyond Adani Ports, companies like Reliance Industries and HDFC Bank contributed significantly to the overall market surge, reflecting a broad-based rally. The increased foreign institutional investor (FII) inflow further contributed to this positive trend. This indicates strong bullish sentiment in the market.

- Stock Market Surge: The overall stock market surge was a result of a combination of positive domestic and international developments, creating a positive feedback loop among investors.

Adani Ports' Stellar Performance: A Deep Dive

Adani Ports experienced a remarkable day, with its stock price surging by 4%. This significant increase was driven by a number of factors, including increased trading volume and positive news regarding a major infrastructure project. This exceptional performance contributed significantly to the broader market rally.

- Stock Price Surge: The Adani Ports stock price surge reflects strong investor confidence in the company's future prospects and its position within the burgeoning Indian logistics sector.

- Investment Opportunity: Many analysts see this as a potentially lucrative investment opportunity, citing the company's strategic expansion plans and robust growth trajectory.

- Market Position: Adani Ports' strong performance reinforces its position as a key player within the Indian stock market and the broader logistics industry. Its future outlook appears promising given the ongoing growth in India's infrastructure sector.

Persistent Declines: Identifying Vulnerable Sectors

Despite the overall market rally, several sectors experienced persistent declines, indicating a degree of market correction. Profit-booking, following recent gains, contributed to the sell-off in some areas. Global headwinds, such as rising interest rates in other major economies, also exerted downward pressure. Sector-specific challenges further impacted certain industries.

- Market Correction: The declines serve as a reminder of the inherent volatility of the stock market and the need for careful risk management.

- Bearish Sentiment: Certain sectors, including pharmaceuticals (-1.2%) and energy (-0.8%), experienced a bearish sentiment, reflecting sector-specific concerns.

- Stock Market Downturn: These sectors' underperformance contrasts with the overall market positivity, highlighting the varied factors influencing individual sectors. Analyzing these downturns is crucial for understanding broader market trends.

Expert Opinions and Predictions

Market analysts offer mixed opinions on the Sensex's trajectory. While some remain optimistic, citing the strong domestic fundamentals and positive global cues, others caution against excessive exuberance. Many suggest a period of consolidation might follow the recent rally, before any sustained upward trend can be established.

- Market Outlook: Experts suggest maintaining a diversified portfolio and adopting a strategic approach to investments, given the ongoing market volatility.

- Analyst Predictions: Predictions vary widely regarding the short and long-term outlook for the Sensex, highlighting the uncertain nature of the market.

- Investment Strategies: Analysts emphasize the importance of thoroughly researching individual stocks before making any investment decisions and staying informed about market trends.

Conclusion

Today's Sensex Live Updates reveal a mixed picture: a robust market rally driven by positive domestic and global cues, Adani Ports’ stellar performance, and persistent declines in specific sectors. This highlights the dynamic and often unpredictable nature of the Indian stock market. The volatility underscores the importance of continuous monitoring and informed decision-making.

To stay ahead of the curve and make well-informed investment decisions, keep checking back for regular Sensex Live Updates. We provide timely updates on significant market movements and vital stock market data. Subscribe to our notifications to receive the latest BSE Sensex tracking information and gain valuable insights into the live stock market data affecting your portfolio. Stay informed with our continuous Sensex updates!

Featured Posts

-

Is High Potential Back Tonight Season 2 Renewal And Episode Count

May 09, 2025

Is High Potential Back Tonight Season 2 Renewal And Episode Count

May 09, 2025 -

Bitcoin Madenciliginin Azalan Karliligi Iste Gercekler

May 09, 2025

Bitcoin Madenciliginin Azalan Karliligi Iste Gercekler

May 09, 2025 -

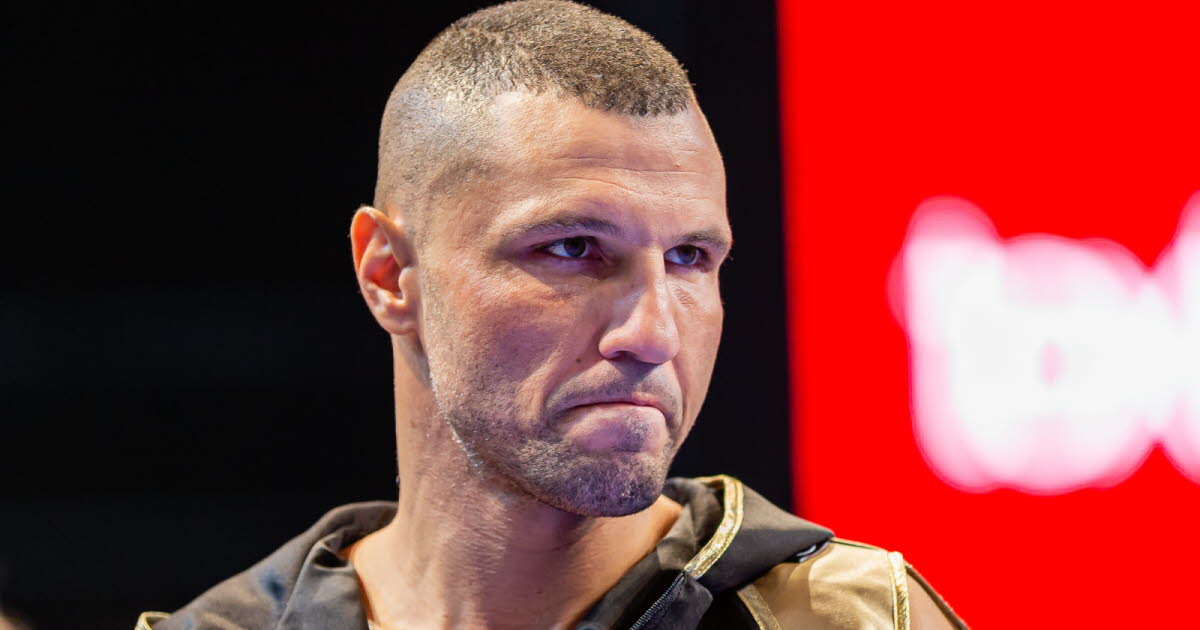

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice En Aout

May 09, 2025

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice En Aout

May 09, 2025 -

Beyonces Renaissance Tour Cowboy Carter Streams Double After Launch

May 09, 2025

Beyonces Renaissance Tour Cowboy Carter Streams Double After Launch

May 09, 2025 -

Analyzing Elon Musks Net Worth Change 100 Days Under Trump

May 09, 2025

Analyzing Elon Musks Net Worth Change 100 Days Under Trump

May 09, 2025

Latest Posts

-

Melanie Griffith And Dakota Johnsons Siblings At Materialist Premiere

May 10, 2025

Melanie Griffith And Dakota Johnsons Siblings At Materialist Premiere

May 10, 2025 -

Family Support For Dakota Johnson At Materialist Film Premiere Photos

May 10, 2025

Family Support For Dakota Johnson At Materialist Film Premiere Photos

May 10, 2025 -

Dakota Johnson And Family At The Los Angeles Premiere Of Materialist

May 10, 2025

Dakota Johnson And Family At The Los Angeles Premiere Of Materialist

May 10, 2025 -

Melanie Griffith And Siblings Attend Dakota Johnsons Materialist Screening

May 10, 2025

Melanie Griffith And Siblings Attend Dakota Johnsons Materialist Screening

May 10, 2025 -

Dakota Johnson Melanie Griffith And Siblings At Materialist Event

May 10, 2025

Dakota Johnson Melanie Griffith And Siblings At Materialist Event

May 10, 2025