Operation Sindoor Impact: KSE 100 Trading Halted Amidst Sharp Decline

Table of Contents

Understanding Operation Sindoor: The Underlying Causes

Operation Sindoor, [insert brief explanation of Operation Sindoor here – e.g., a government crackdown on illegal financial activities, a major corruption investigation, etc.], triggered a chain reaction leading to the KSE 100's sharp decline and subsequent trading halt. The precise triggers remain complex and multifaceted, but several key factors contributed to the market's instability:

- Political Uncertainty: [Explain how political instability, such as policy changes or government announcements, might have fueled investor concerns and triggered selling.] Uncertainty regarding future policy directions often leads to market volatility.

- Economic Downturn: [Detail the economic conditions prevailing in Pakistan prior to the event. Mention factors like inflation, currency devaluation, or external debt concerns.] A struggling economy typically translates into decreased investor confidence.

- Regulatory Changes: [Discuss any recent regulatory changes or announcements that may have impacted investor sentiment. Examples include new tax laws, changes to trading regulations, or investigations into corporate malfeasance.] Sudden shifts in regulations can cause uncertainty and market instability.

- Investor Sentiment: [Describe the prevailing mood among investors before and after the news of Operation Sindoor broke. Explain how fear and panic selling contribute to market crashes.] Negative sentiment can quickly escalate into a sell-off, leading to sharp price declines.

- Specific Company Performance: [Mention specific companies or sectors significantly affected by Operation Sindoor, explaining their contribution to the overall market decline. This could include companies implicated in the operation or those heavily reliant on sectors impacted by the operation.] The performance of key players within the KSE 100 significantly impacts the index's overall health.

The KSE 100 Trading Halt: Immediate Consequences

The KSE 100 trading halt, initiated on [date], lasted for [duration]. This emergency measure by the KSE was a response to the unprecedented market volatility and panic selling triggered by Operation Sindoor. The immediate consequences were severe:

- Investor Losses: [Quantify the losses incurred by investors, if possible. Mention the percentage drop in portfolio values.] Many investors experienced significant financial losses.

- Loss of Market Confidence: [Explain the erosion of trust in the KSE and the Pakistani economy. Describe the impact on both domestic and foreign investors.] The event significantly damaged investor confidence.

- Impact on Foreign Investment: [Detail the effect on foreign direct investment (FDI) and portfolio investment into Pakistan. Discuss the potential for capital flight.] Foreign investors often react negatively to market instability.

- Regulatory Response: [Describe the response of the regulatory bodies, including any measures implemented to restore market stability.] Regulatory intervention is crucial during such crises.

- Potential for Legal Ramifications: [Mention any potential legal actions or investigations related to the events surrounding Operation Sindoor.] Legal repercussions can have long-term effects.

Analysis of the Sharp Decline in KSE 100

The KSE 100 index experienced a [percentage]% decline during the period surrounding Operation Sindoor. This sharp drop was not uniform across all sectors; some were more severely impacted than others.

- Banking: [Explain the impact on the banking sector, mentioning specific banks if possible and quantifying their losses.]

- Energy: [Discuss the impact on energy companies, citing specific examples if data is available.]

- Technology: [Analyze the effect on the technology sector, noting specific companies if possible and their contribution to the overall decline.]

- Cement: [Assess the impact on cement companies, providing specific data where possible.]

- Textiles: [Evaluate the effect on textile companies, mentioning specific examples if data is available.]

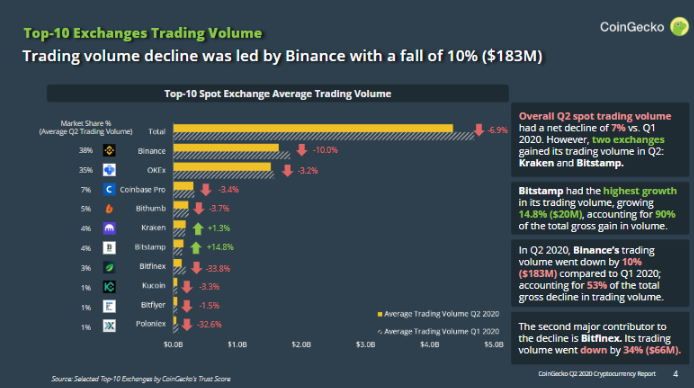

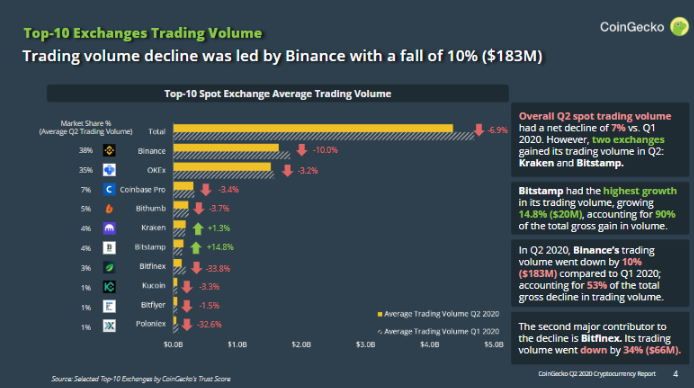

[Insert charts and graphs here to visually represent the decline across different sectors and the overall KSE 100 performance.]

Future Outlook and Potential Long-Term Effects of Operation Sindoor

The long-term consequences of Operation Sindoor on the Pakistani economy and the KSE 100 remain uncertain. However, several potential effects are worth considering:

- Economic Slowdown: [Explain how the market crash could contribute to a wider economic slowdown, impacting GDP growth and employment.]

- Foreign Investment Implications: [Discuss the potential for reduced foreign investment due to the decreased market confidence.]

- Government Intervention: [Analyze the government's response and the effectiveness of any measures taken to stabilize the market.]

- Market Recovery Timeline: [Offer an estimation (with caveats) of how long it might take for the KSE 100 to recover from this downturn.]

- Investor Confidence Rebuilding: [Discuss the challenges involved in restoring investor confidence in the Pakistani stock market.]

Conclusion: The Lasting Impact of Operation Sindoor on KSE 100 Trading

Operation Sindoor's impact on the KSE 100 was profound, resulting in a significant trading halt and sharp decline. The event exposed vulnerabilities in the Pakistani economy and highlighted the impact of political uncertainty, economic factors, and investor sentiment on market stability. The long-term consequences remain to be seen, but the need for robust regulatory measures and government intervention to restore confidence is evident. Stay updated on the evolving situation surrounding Operation Sindoor and its impact on KSE 100 trading by regularly checking our website for the latest news and analysis. Learn more about how Operation Sindoor and similar events affect KSE 100 performance by subscribing to our newsletter.

Featured Posts

-

Gde Smotret Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy I Statistika

May 09, 2025

Gde Smotret Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy I Statistika

May 09, 2025 -

How To Find Cheap Elizabeth Arden Skincare

May 09, 2025

How To Find Cheap Elizabeth Arden Skincare

May 09, 2025 -

Valdo Calocanes Victim Speaks A Nottingham Attack Survivors Testimony

May 09, 2025

Valdo Calocanes Victim Speaks A Nottingham Attack Survivors Testimony

May 09, 2025 -

Tesla Stock Boost Fuels Elon Musks Billions Ceos Doge Decision Impacts Fortune

May 09, 2025

Tesla Stock Boost Fuels Elon Musks Billions Ceos Doge Decision Impacts Fortune

May 09, 2025 -

March 4th Nyt Strands Answers Game 366

May 09, 2025

March 4th Nyt Strands Answers Game 366

May 09, 2025