Palantir Stock: A Pre-May 5th Investment Analysis Based On Wall Street's View

Table of Contents

Wall Street's Current Sentiment Towards Palantir

The consensus among Wall Street analysts regarding Palantir stock appears to be cautiously optimistic. While not universally positive, a significant number of analysts hold a "buy" or "overweight" rating, indicating a belief in the company's long-term growth potential. However, this optimism is tempered by concerns about profitability and valuation.

- Analyst firm A (Example: Morgan Stanley): Rating: Overweight; Target Price: $XX; Rationale: Strong government contract pipeline and expanding commercial business.

- Analyst firm B (Example: Goldman Sachs): Rating: Buy; Target Price: $YY; Rationale: Positive outlook for Palantir's Foundry platform and increasing adoption rates.

- Overall Average Target Price (Example): $ZZ

- Percentage of analysts with a "Buy" rating (Example): 60%

It's important to note that these are hypothetical examples. Always refer to the most up-to-date information from reputable financial news sources for the most accurate data.

Key Factors Influencing Wall Street's Opinion

Several key factors shape Wall Street's assessment of Palantir's stock. Understanding these influences is critical for any investor considering a position in PLTR.

- Recent financial performance: Revenue growth, while impressive, needs to translate into consistent profitability. Investors are scrutinizing operating margins and net income.

- New contract wins and partnerships: Securing substantial government and commercial contracts is vital for Palantir's continued growth. Major contract announcements often impact the stock price positively.

- Competition in the data analytics market: Palantir faces competition from established tech giants and agile startups. Its ability to differentiate its offerings and maintain a competitive edge is a key consideration.

- Market conditions: The overall economic climate and performance of the broader technology sector significantly influence investor sentiment toward growth stocks like Palantir. Economic downturns can lead to reduced investment in data analytics solutions.

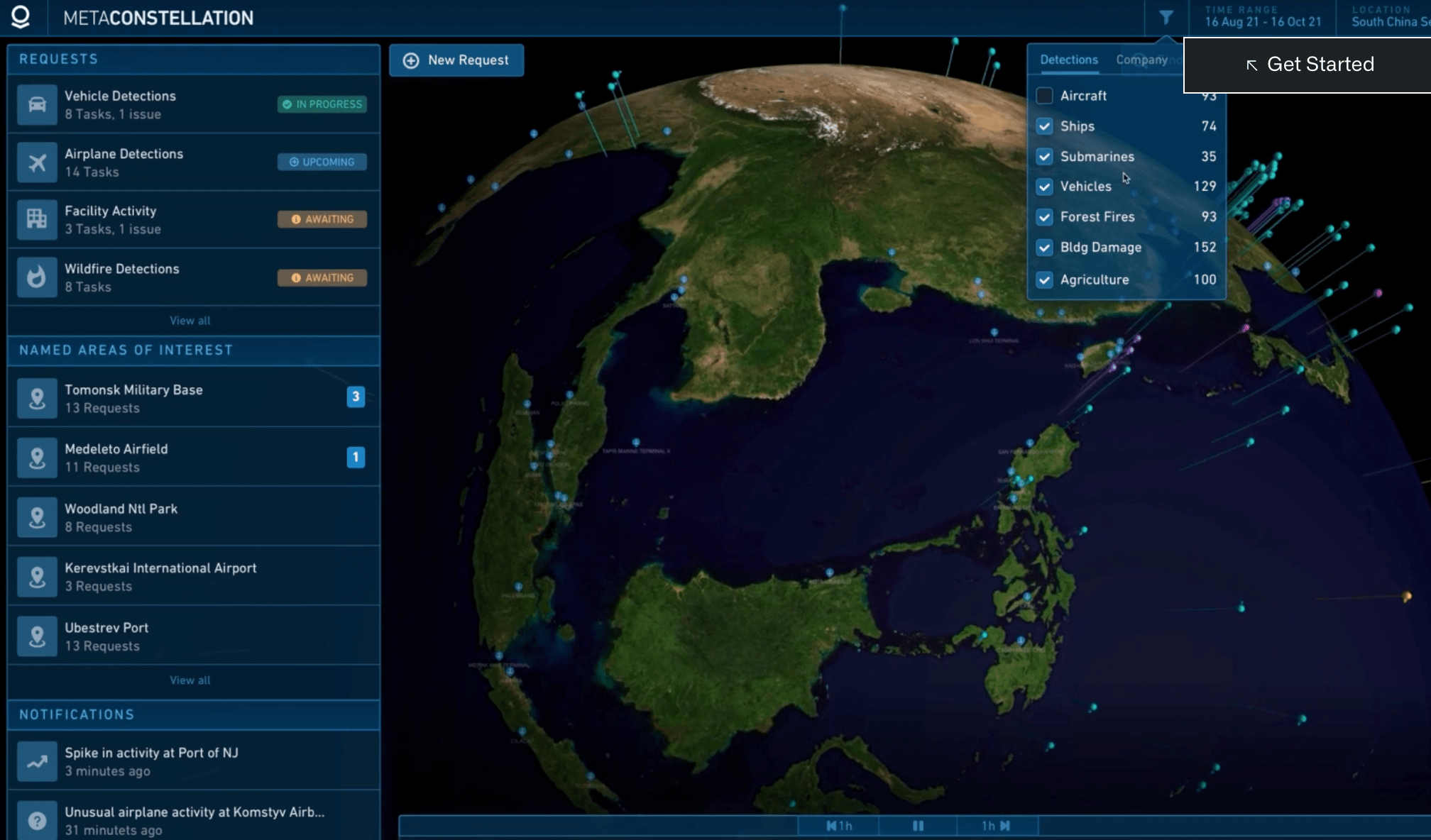

- Palantir's long-term growth strategy and potential: Investors are evaluating Palantir's long-term vision, its ability to innovate, and its potential to expand into new markets and verticals.

Analyzing Palantir's Financials Pre-May 5th

Examining Palantir's key financial metrics provides further insight into the investment opportunity. Investors should focus on the following:

- Revenue growth: Year-over-year and quarter-over-quarter growth rates indicate the trajectory of Palantir's business. Consistent, high growth is a positive sign.

- Profitability: Analyzing gross margin, operating margin, and net income reveals Palantir's ability to generate profits from its revenue. Improving profitability is crucial for long-term sustainability.

- Cash flow and debt levels: Strong cash flow and manageable debt levels demonstrate the company's financial health and ability to fund future growth initiatives.

- Key performance indicators (KPIs): Specific KPIs relevant to Palantir's business model, such as customer acquisition cost and customer churn, provide a deeper understanding of its operational efficiency.

Risks and Potential Downsides of Investing in Palantir Stock

While Palantir offers significant potential, investors must acknowledge the inherent risks:

- Competition: Intense competition from established players like AWS, Microsoft, and Google could limit market share and hinder growth.

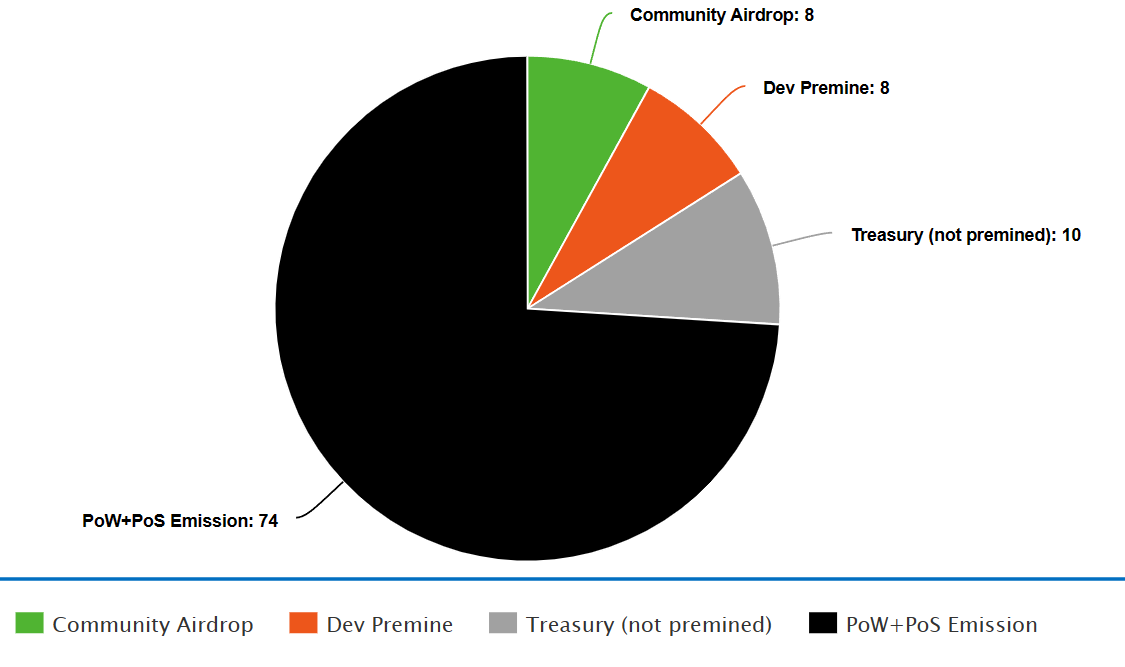

- Government contract dependence: A significant portion of Palantir's revenue comes from government contracts, which can be subject to political and budgetary uncertainties.

- Valuation: Palantir's current valuation relative to its revenue and profitability might be considered high by some investors, posing a risk of a price correction.

- Market disruptions: Unforeseen economic downturns or shifts in the technology landscape could negatively impact Palantir's stock performance.

Conclusion: Making Informed Decisions on Palantir Stock

Our pre-May 5th analysis reveals a cautiously optimistic Wall Street sentiment towards Palantir stock. While analysts see potential for growth, concerns remain regarding profitability and valuation. Key factors influencing this sentiment include Palantir's financial performance, contract wins, competitive landscape, and overall market conditions. The potential rewards are considerable, but the identified risks must be carefully considered.

Therefore, while the current Wall Street view offers some support for investing in Palantir before May 5th, it is crucial to conduct thorough due diligence before making any investment decision. Consult a financial advisor to assess your risk tolerance and investment goals. Remember, staying informed about Palantir's performance and market trends is crucial for making informed decisions about Palantir stock. Don't rely solely on this analysis; conduct your own in-depth research to determine whether investing in Palantir aligns with your personal financial strategy.

Featured Posts

-

Wall Streets Resurgence Upending Bear Market Predictions

May 10, 2025

Wall Streets Resurgence Upending Bear Market Predictions

May 10, 2025 -

Stiven King Na X Noviy Konflikt S Ilonom Maskom

May 10, 2025

Stiven King Na X Noviy Konflikt S Ilonom Maskom

May 10, 2025 -

Selling Sunset Star Speaks Out Allegations Of Price Gouging In Wake Of La Fires

May 10, 2025

Selling Sunset Star Speaks Out Allegations Of Price Gouging In Wake Of La Fires

May 10, 2025 -

Teslas Market Volatility And Its Ripple Effect On Cryptocurrency Including Dogecoin

May 10, 2025

Teslas Market Volatility And Its Ripple Effect On Cryptocurrency Including Dogecoin

May 10, 2025 -

Trump To Announce Major Trade Deal With Britain

May 10, 2025

Trump To Announce Major Trade Deal With Britain

May 10, 2025