Palantir Stock: Is It A Good Investment In 2024?

Table of Contents

Palantir's Financial Performance and Growth Prospects

Analyzing Palantir's financial reports is crucial for understanding its investment potential. Key metrics like Palantir revenue growth, Palantir earnings per share (EPS), and the overall health of Palantir financial statements reveal much about the company's trajectory. Examining year-over-year growth in revenue and profitability margins offers insights into its operational efficiency and market penetration.

- Key Financial Metrics: We need to look at recent quarterly and annual reports to determine consistent growth trends. A sustained increase in revenue, coupled with improving profitability margins, signals positive growth. Any significant changes in these metrics warrant further investigation.

- Revenue Streams: Palantir's revenue comes from both government and commercial sectors. Analyzing the contribution of each segment and their respective growth rates is vital. A healthy diversification across these sectors mitigates risk, as reliance on a single sector can be problematic.

- Investments and Acquisitions: Strategic investments and acquisitions can boost a company's growth, but these also carry inherent risks. A thorough assessment of any recent acquisitions or investments is necessary to gauge their impact on the company’s financial performance and future growth.

- Debt and Cash Flow: Palantir's debt levels and cash flow situation are critical indicators of its financial health. High debt levels and negative cash flow can raise concerns, whereas strong cash flow and manageable debt suggest a stable financial foundation. Understanding Palantir's long-term prospects involves a detailed look at these metrics.

Palantir's future growth hinges on its ability to maintain its strong position in the government sector while expanding its commercial client base. Success in these areas will heavily influence the Palantir market share and overall long-term prospects.

Market Position and Competitive Landscape

Palantir operates in the highly competitive big data analytics market. Understanding its competitive advantages and disadvantages is crucial for assessing its investment potential. Keywords like "Palantir competitors," "data analytics market," and "big data competition" highlight the competitive nature of this space.

- Key Competitors: Palantir faces stiff competition from tech giants like AWS, Microsoft Azure, and Google Cloud. These companies offer similar data analytics solutions and have vast resources.

- Technological Differentiation: Palantir's proprietary technology and its focus on complex data analytics provide some differentiation, but its competitors constantly innovate, narrowing the gap.

- Market Share and Growth: Assessing Palantir’s market share within the broader big data market (including growth of the AI market) and the data analytics market size is vital to understanding its potential for expansion. This also helps contextualize Palantir's future growth within a larger market landscape.

- Threats and Opportunities: The market is dynamic. Emerging technologies, changing regulations, and shifts in customer demand represent significant opportunities and threats that could influence Palantir's position.

Risks and Challenges Associated with Investing in Palantir Stock

Investing in Palantir stock, like any investment, involves risks. Understanding these risks is vital for making informed decisions. Keywords like "Palantir stock risk," "Palantir investment risks," and "Palantir volatility" reflect this inherent uncertainty.

- Tech Sector Volatility: The tech sector is inherently volatile, and Palantir is susceptible to market downturns. Sudden shifts in investor sentiment can significantly impact the Palantir stock price.

- Government Contract Dependence: A substantial portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and procurement policies.

- Competition: The intense competition from larger tech firms poses a significant threat to Palantir's growth and market share.

- Regulatory Hurdles: Data privacy and security regulations can impact Palantir's operations and create compliance costs.

Valuation and Investment Considerations

Evaluating Palantir's current valuation is essential for determining whether it's fairly priced. Analyzing metrics like Palantir stock valuation, Palantir P/E ratio, and Palantir market cap provides insights into its relative value.

- Valuation Metrics: Comparing Palantir's P/E ratio to its competitors and industry benchmarks helps to gauge whether it's overvalued or undervalued.

- Investment Strategies: Considering long-term versus short-term investment strategies is crucial. Palantir's long-term prospects might justify a long-term investment, but short-term market fluctuations can lead to significant price swings.

- Time Horizon: Investors should carefully consider their personal investment time horizon and risk tolerance before investing in Palantir.

Conclusion: Is Palantir Stock Right for You in 2024?

Investing in Palantir stock presents both opportunities and challenges. While its innovative technology and strong government presence offer potential for growth, the intense competition, dependence on government contracts, and volatility of the tech sector pose considerable risks. This analysis highlights the importance of conducting thorough due diligence before making any investment decisions. Considering your individual risk tolerance, investment goals, and a comprehensive understanding of the factors discussed above is crucial. Learn more about Palantir investment opportunities and start your Palantir stock research today to make an informed decision about whether Palantir stock aligns with your investment strategy.

Featured Posts

-

Have Trumps Billionaire Pals Lost Money Since Liberation Day A Look At Tariff Impacts

May 09, 2025

Have Trumps Billionaire Pals Lost Money Since Liberation Day A Look At Tariff Impacts

May 09, 2025 -

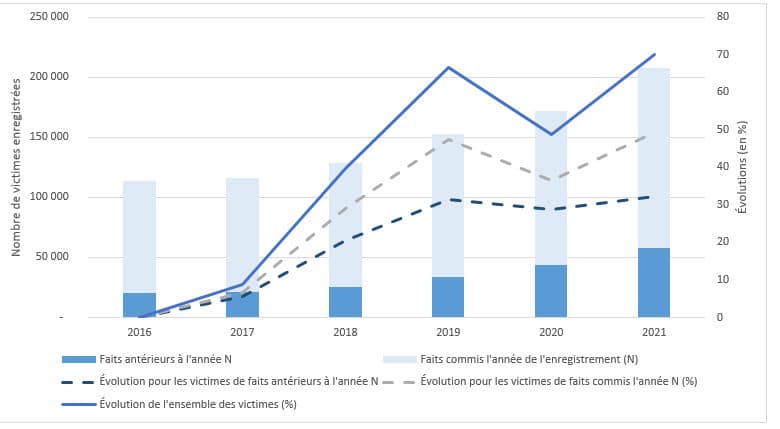

Boxeur De Dijon Accuse De Violences Conjugales Audience En Aout

May 09, 2025

Boxeur De Dijon Accuse De Violences Conjugales Audience En Aout

May 09, 2025 -

Elizabeth Hurleys Bikini Looks A Maldives Holiday

May 09, 2025

Elizabeth Hurleys Bikini Looks A Maldives Holiday

May 09, 2025 -

Brekelmans Inzet Voor India Strategische Partnerschappen En Economische Banden

May 09, 2025

Brekelmans Inzet Voor India Strategische Partnerschappen En Economische Banden

May 09, 2025 -

Elizabeth Line Strikes February And March Service Disruptions

May 09, 2025

Elizabeth Line Strikes February And March Service Disruptions

May 09, 2025