Palantir Technology Stock: Should You Invest Before May 5th? Expert Analysis

Table of Contents

Palantir's Recent Performance and Financial Health

Analyzing Palantir's recent financial performance is crucial for any potential investor. Key metrics to consider include revenue growth, profitability, cash flow, and debt levels. Comparing these metrics to competitors in the big data and analytics market provides valuable context.

- Recent Quarterly Earnings: Examining the recent quarterly earnings reports reveals trends in revenue growth and profitability. A consistent upward trend suggests positive momentum, while a decline may warrant caution. Look for details on revenue breakdown across government and commercial sectors.

- Profitability and Path to Sustainability: Is Palantir profitable? If not, what is its strategy for achieving sustained profitability? Investors should assess the company's margins and operating expenses to gauge its ability to generate profits. Analyzing the pace of growth in relation to its spending is vital.

- Cash Flow and Debt: Strong positive cash flow indicates financial health and the ability to fund growth initiatives. High debt levels, however, could pose risks. Checking the company's debt-to-equity ratio offers a crucial measure of financial stability.

- Competitive Benchmarking: How does Palantir's performance compare to competitors like Databricks, Snowflake, and others in the big data and analytics space? This comparison helps to understand Palantir’s competitive position and market share. Relevant charts and graphs illustrating key financial metrics like revenue growth, operating margin, and free cash flow are particularly useful.

Government Contracts and Future Growth Potential

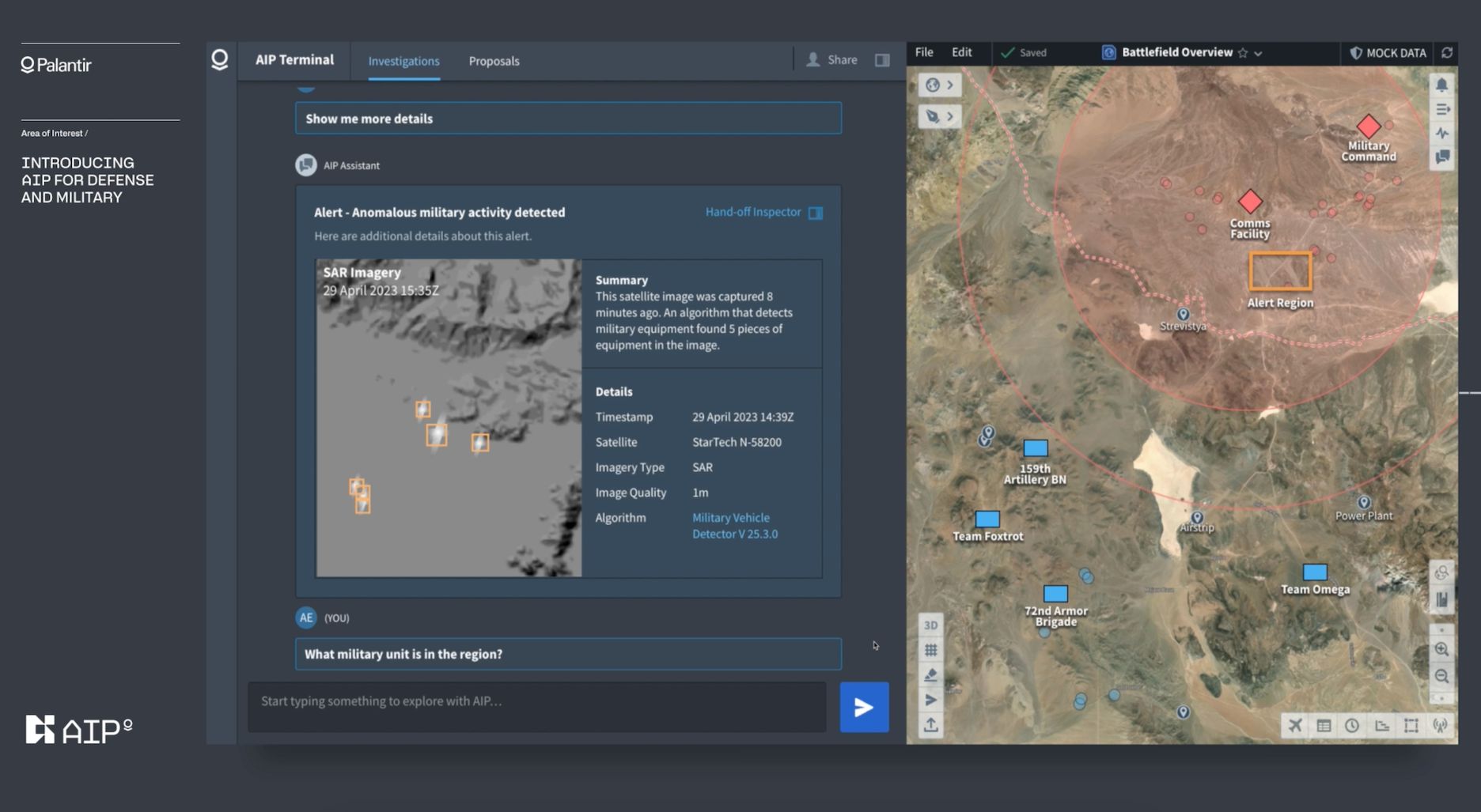

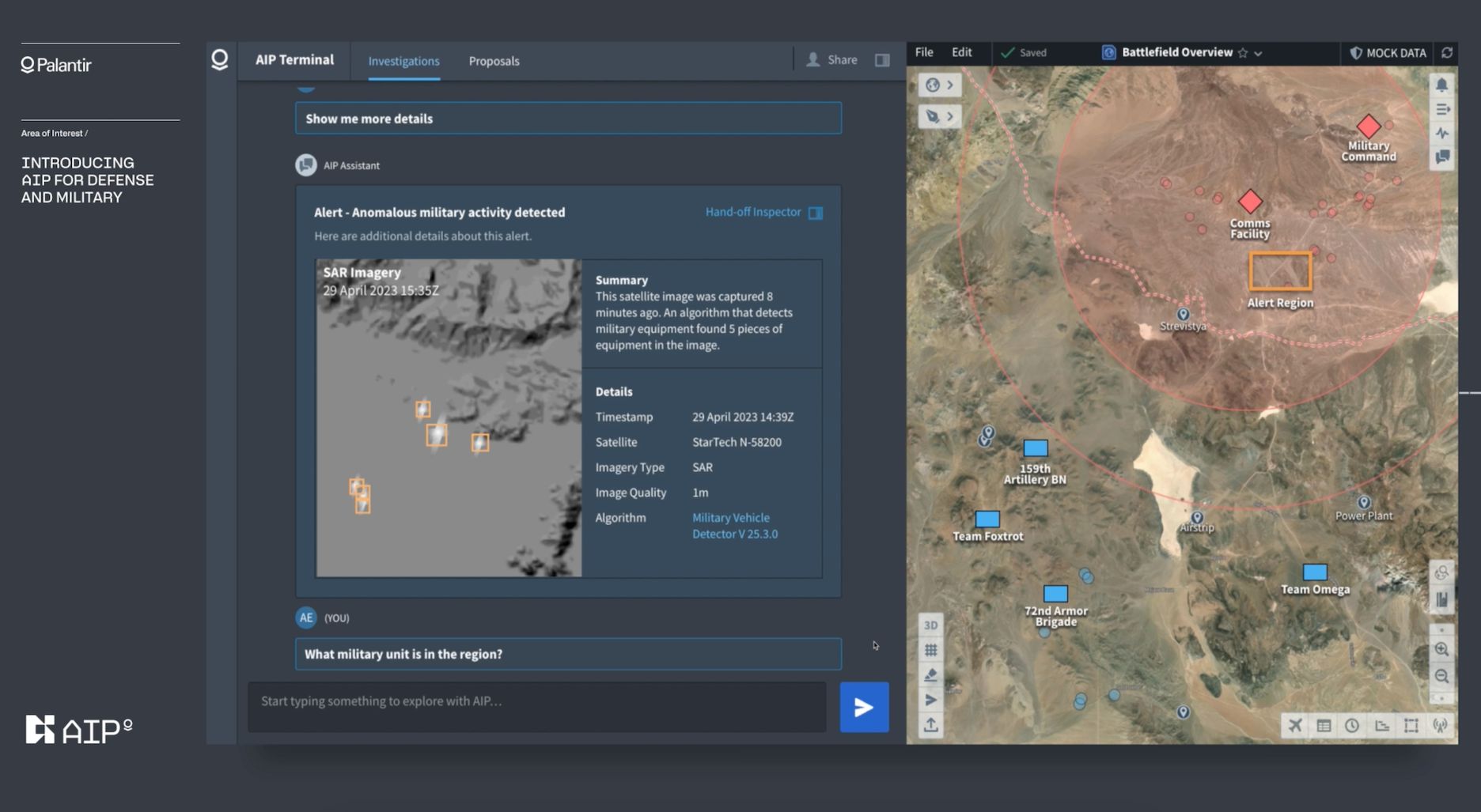

Palantir's substantial reliance on government contracts, particularly within the defense sector, significantly impacts its revenue and future prospects. However, its expansion into the commercial sector is also a vital factor for long-term growth.

- Government Contract Portfolio: Analyzing the size and composition of Palantir's government contracts provides insight into its revenue stability. Long-term contracts offer predictability, while reliance on short-term contracts can increase volatility. The potential for future contract wins and renewals is a key consideration.

- Commercial Market Penetration: Palantir's success in expanding its commercial customer base is crucial for its long-term growth. The company's ability to leverage its technology in diverse commercial sectors will be a strong indicator of its future potential. Focus on the growth in this sector and adoption rates of its AI and data analytics solutions.

- Competitive Advantages: What are Palantir's competitive advantages in the data analytics market? Does it possess proprietary technologies or unique capabilities that set it apart from competitors? Assessing its technological edge and ability to innovate is essential.

- Geopolitical Impacts: Geopolitical events can significantly impact government spending and, consequently, Palantir's revenue streams. Potential disruptions caused by global instability need to be considered.

Risks and Challenges Facing Palantir

Despite its potential, Palantir faces several risks and challenges that potential investors must consider.

- Economic Downturns: How vulnerable is Palantir to economic downturns? Government budgets are often subject to cuts during recessions, impacting contract awards. Similarly, reduced commercial spending could negatively affect its growth.

- Competitive Landscape: The data analytics market is highly competitive. Analyzing the strengths and weaknesses of key competitors is vital to understanding the challenges Palantir faces in maintaining its market share. Assessing its ability to defend its position is important.

- Regulatory Risks: Palantir operates in a regulated industry, and regulatory changes or legal challenges could significantly impact its business. Analyzing the regulatory environment and potential legal risks is essential.

- Reliance on Government Contracts: Palantir’s substantial reliance on government contracts exposes it to potential risks associated with changes in government priorities or procurement policies. Diversification into the commercial sector is critical to mitigate this risk.

- Valuation Concerns: Is Palantir currently overvalued? A thorough analysis of its valuation compared to its performance and future projections is essential for making informed investment decisions.

Expert Opinion and Analyst Forecasts

Understanding the opinions of leading financial analysts provides valuable insights. However, remember that analyst forecasts are not guarantees of future performance.

- Analyst Ratings and Price Targets: Summarizing the consensus view of leading financial analysts on PLTR stock provides an overall market sentiment. Note the range of price targets offered by different analysts.

- Sentiment Shifts: Have there been any significant changes in analyst sentiment recently? Analyzing shifts in ratings and price targets can help to identify changing market perceptions of Palantir.

- Disclaimer: Remember that stock market predictions are inherently uncertain. Past performance is not indicative of future results, and investment decisions should be based on thorough due diligence and careful consideration of risk.

Conclusion

This analysis of Palantir Technologies stock before May 5th considered its financial health, growth potential, risks, and expert opinions. While Palantir presents exciting opportunities in the burgeoning data analytics market, potential investors should carefully weigh the risks alongside the potential rewards. The company's growth trajectory depends heavily on successful commercial expansion alongside its continued success in securing government contracts. Furthermore, careful consideration should be given to the competitive landscape and the potential impact of geopolitical events.

Call to Action: Ultimately, the decision of whether or not to invest in Palantir stock before May 5th is a personal one. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to Palantir Technologies (PLTR) stock. Remember to carefully analyze the Palantir stock market performance and future prospects before investing in PLTR stock.

Featured Posts

-

Easter Weekend In Lake Charles Live Music Events And Entertainment

May 10, 2025

Easter Weekend In Lake Charles Live Music Events And Entertainment

May 10, 2025 -

Understanding The Iron Ore Price Decline Chinas Steel Industry Role

May 10, 2025

Understanding The Iron Ore Price Decline Chinas Steel Industry Role

May 10, 2025 -

Pentagons Book Review Directive Impact On Military Academy Curricula

May 10, 2025

Pentagons Book Review Directive Impact On Military Academy Curricula

May 10, 2025 -

Ivan Barbashevs Ot Goal Wins Game 4 For Vegas Golden Knights

May 10, 2025

Ivan Barbashevs Ot Goal Wins Game 4 For Vegas Golden Knights

May 10, 2025 -

The Private Credit Job Market 5 Dos And Don Ts For Success

May 10, 2025

The Private Credit Job Market 5 Dos And Don Ts For Success

May 10, 2025