PBOC's Yuan Intervention Falls Short Of Expectations

Table of Contents

Insufficient Intervention Scale

The PBOC's intervention in the Yuan, aimed at stemming the currency's devaluation, was arguably too small to significantly impact its downward trajectory. The size of the intervention proved insufficient to counteract the substantial selling pressure exerted by international investors. This lack of scale points to several key issues within the Forex market regarding the RMB.

- Limited dollar purchases by the central bank: The PBOC's purchases of US dollars to support the Yuan were reportedly limited, failing to match the magnitude of selling pressure.

- Insufficient to counteract substantial selling pressure from international investors: The volume of Yuan being sold by international investors overwhelmed the PBOC's efforts, resulting in continued depreciation.

- Lack of coordinated intervention with other financial institutions: A more impactful intervention might have involved coordinated efforts with commercial banks and other financial institutions, a strategy not fully employed in this instance.

- Market speculation outweighing the effect of the intervention: The scale of market speculation against the Yuan dwarfed the PBOC's intervention, rendering its impact minimal. This highlights the significant role of investor sentiment in shaping currency exchange rates. The RMB trading volume also reflects this imbalance. The sheer volume of trades against the Yuan simply overwhelmed the PBOC's capacity to effectively manage the currency's value.

Weakening Global Demand for Yuan

The global economic slowdown and the persistent strength of the US dollar are significant contributing factors to the downward pressure on the Yuan, making PBOC interventions less effective. The weakening global demand directly affects the Yuan's value and its stability within the Forex market.

- Declining Chinese exports and weakening trade surplus: Reduced global demand for Chinese goods has weakened the country's trade surplus, putting downward pressure on the Yuan.

- Increased uncertainty due to geopolitical tensions: Geopolitical uncertainty adds to the negative sentiment surrounding the Yuan, leading to capital flight.

- Capital flight as investors seek safer havens like the US dollar: Investors are increasingly moving their assets to perceived safer havens, such as the US dollar, further weakening the Yuan.

- Diminishing foreign exchange reserves: The PBOC's foreign exchange reserves, used to support the Yuan, are gradually declining, limiting its capacity for future interventions.

Market Speculation and Lack of Confidence

Negative market sentiment and a lack of confidence in the Yuan's long-term stability have fueled speculation, directly undermining the effectiveness of the PBOC's intervention. The RMB forecast, widely perceived as negative, exacerbates this issue.

- Widespread belief that the Yuan's devaluation will continue: A prevailing belief among investors that the Yuan will continue its downward trajectory encourages further selling.

- Increased short-selling and betting against the Yuan: The growing prevalence of short-selling and speculative bets against the Yuan amplifies downward pressure.

- Limited effectiveness of policy announcements in boosting investor confidence: Policy announcements from the PBOC have failed to instill confidence in the market, highlighting a credibility gap.

- Uncertainty surrounding future government policies affecting the Yuan: Lack of clarity regarding future government policies further contributes to uncertainty and speculation. Currency hedging strategies are becoming more prevalent as investors seek to protect themselves against potential losses.

Implications for Global Markets

The underperformance of the PBOC's Yuan intervention carries significant implications for global financial stability and international trade. The ripple effect of this situation extends far beyond China's borders.

- Increased volatility in global currency markets: The weakness of the Yuan can trigger increased volatility in global currency markets, affecting other emerging market currencies.

- Potential for further capital flight from emerging markets: Concerns about the Yuan's stability may prompt capital flight from other emerging markets, creating wider instability.

- Impact on international trade due to currency fluctuations: Fluctuations in the Yuan's exchange rate can significantly impact international trade, creating uncertainty for businesses.

- Possible inflationary pressures in countries reliant on Chinese imports: A weaker Yuan can lead to higher import prices for countries heavily reliant on Chinese goods, potentially fueling inflation.

Conclusion

The PBOC's recent Yuan intervention has proven insufficient to counter the downward pressure on the currency due to a combination of factors: a limited intervention scale, weakening global demand for the Yuan, and pervasive negative market sentiment. The consequences of this shortfall could have significant global ramifications. Understanding the intricacies of the PBOC's Yuan intervention and its limitations is crucial for investors and businesses operating in the global market. Stay informed about future developments regarding PBOC's Yuan interventions and their impact on global economic stability. Follow our blog for further analysis on the ongoing PBOC Yuan intervention strategy and its implications for the RMB and the global economy.

Featured Posts

-

Jimmy Butler Vs Kevin Durant What The Warriors Really Need

May 15, 2025

Jimmy Butler Vs Kevin Durant What The Warriors Really Need

May 15, 2025 -

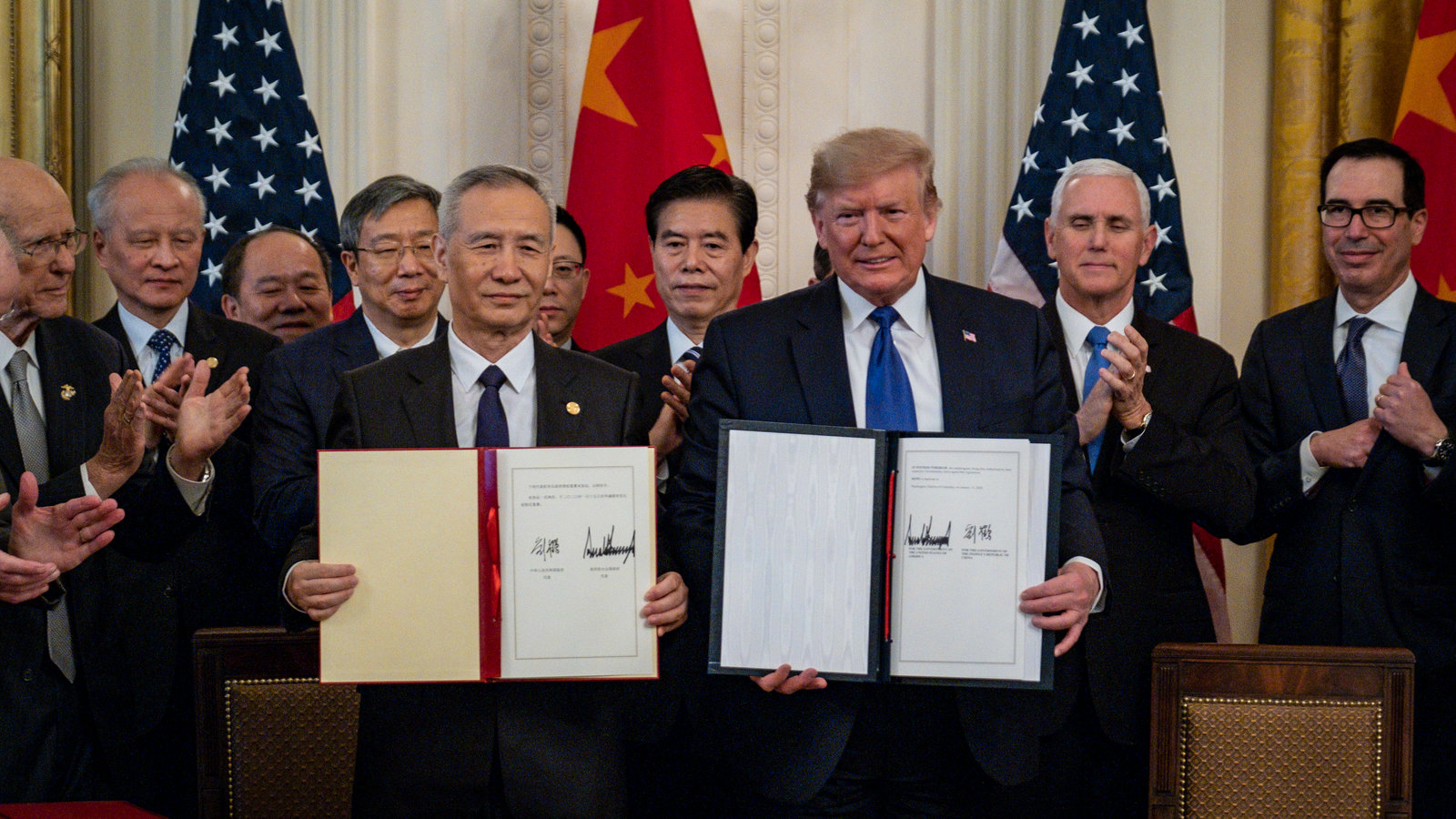

The Us And China Trade Deal Analyzing The Concessions And Compromises

May 15, 2025

The Us And China Trade Deal Analyzing The Concessions And Compromises

May 15, 2025 -

Ai Therapy Balancing Mental Health Care With Privacy In A Potential Police State

May 15, 2025

Ai Therapy Balancing Mental Health Care With Privacy In A Potential Police State

May 15, 2025 -

Creatine Benefits Side Effects And How To Use It

May 15, 2025

Creatine Benefits Side Effects And How To Use It

May 15, 2025 -

Herstel Van Vertrouwen College Van Omroepen En De Toekomst Van De Npo

May 15, 2025

Herstel Van Vertrouwen College Van Omroepen En De Toekomst Van De Npo

May 15, 2025

Latest Posts

-

San Diego Padres Vs New York Yankees A Comprehensive Game Prediction

May 15, 2025

San Diego Padres Vs New York Yankees A Comprehensive Game Prediction

May 15, 2025 -

Rockies Vs Padres Colorado Looks To End 7 Game Losing Streak

May 15, 2025

Rockies Vs Padres Colorado Looks To End 7 Game Losing Streak

May 15, 2025 -

Padres Vs Pirates Expert Mlb Predictions And Todays Game Odds

May 15, 2025

Padres Vs Pirates Expert Mlb Predictions And Todays Game Odds

May 15, 2025 -

Padres Vs Yankees Predicting The Outcome In New York

May 15, 2025

Padres Vs Yankees Predicting The Outcome In New York

May 15, 2025 -

Can The Rockies Break Their 7 Game Skid Against The Padres

May 15, 2025

Can The Rockies Break Their 7 Game Skid Against The Padres

May 15, 2025