Philips Shareholders' Meeting: Recap And Analysis

Table of Contents

Key Announcements and Decisions Made at the Philips Shareholders' Meeting

The Philips Shareholders' Meeting unveiled several key announcements that will shape the company's future. These announcements impacted investor sentiment and provided a clearer picture of Philips' strategic priorities.

Restructuring Plans and Strategic Initiatives

Philips announced significant restructuring plans aimed at streamlining operations and focusing on key growth areas. These initiatives included:

- Divestment of underperforming business units: The company confirmed its commitment to divesting from certain business segments that are not core to its long-term strategy. This Philips divestment strategy aims to improve profitability and resource allocation.

- Strategic acquisitions in high-growth markets: Philips outlined plans for strategic acquisitions to expand its presence in promising markets like telehealth and connected care. This aggressive Philips acquisitions approach signals its ambition to dominate in these growth sectors.

- Increased investment in R&D: A significant portion of the restructuring involves boosting investment in research and development to drive innovation and maintain a competitive edge. This focus on innovation is a key component of the overall Philips strategy.

The impact of these Philips restructuring plans on the share price remains to be seen, but initial market reaction suggests a degree of investor confidence in the company's revised strategy.

Financial Performance Review and Future Outlook

The meeting included a comprehensive review of Philips' financial performance. Key highlights included:

- Revenue growth in specific segments: While overall revenue was impacted by previous challenges, certain segments showcased promising growth, demonstrating the potential of its strategic focus. Philips revenue figures were closely scrutinized by investors.

- Improved profitability margins: Philips reported improvements in profitability margins, reflecting the effectiveness of cost-cutting measures and operational efficiencies. Philips profit margins were a key discussion point.

- Positive outlook for the coming year: Management expressed a cautiously optimistic outlook for the next fiscal year, highlighting potential growth opportunities and ongoing challenges. The Philips outlook was met with a mix of optimism and caution from analysts.

The financial performance review provided clarity on Philips' financial health and its ability to navigate current market conditions.

Dividend Announcement and Shareholder Returns

The Philips Shareholders' Meeting also addressed shareholder returns. While the exact details varied based on the class of shares, the meeting confirmed:

- Dividend payment: A dividend payment was announced, maintaining a commitment to returning value to shareholders. The Philips dividend announcement was well-received by many investors.

- No share buyback program announced: Unlike some previous years, no share buyback program was announced at this time. The absence of a Philips share buyback program was noted by some analysts.

The dividend announcement demonstrated Philips’ continued commitment to providing Philips shareholder returns.

Analysis of Shareholder Questions and Concerns

The Q&A session provided valuable insights into shareholder concerns and management’s responses.

Key Themes Emerging from Q&A Session

Several key themes emerged during the Q&A session:

- Concerns regarding the long-term impact of previous product recalls: Shareholders expressed concerns about the lingering effects of past product recalls on the company’s reputation and financial performance.

- Questions surrounding the effectiveness of the restructuring plan: Many shareholders inquired about the timeline and anticipated results of the announced restructuring initiatives.

- Inquiries about future investment in specific market segments: Shareholders sought clarity on Philips’ investment priorities in emerging technologies and high-growth markets.

Management addressed these Philips shareholder questions thoroughly, providing detailed explanations and outlining their strategic responses.

Assessment of Management's Performance and Communication

Management's performance during the Philips Shareholders' Meeting was generally well-received. Their responses to Philips shareholder questions were seen as informative and transparent. The clear communication regarding the Philips strategy and Philips restructuring efforts contributed to a positive overall impression. The level of Philips transparency was praised by many attendees. The clarity of Philips communication was considered a key success factor. The performance of Philips management during this Q&A session was largely viewed favorably.

Impact on Philips Stock Price and Investor Sentiment

The Philips Shareholders' Meeting had a noticeable impact on the company’s stock price and overall investor sentiment.

Short-Term Market Reaction

Following the meeting, the Philips share price experienced a moderate increase, suggesting a generally positive market reaction to the announcements. [Insert chart or graph illustrating the stock price movement here]. This positive Philips market reaction demonstrated a degree of confidence in the company's future outlook. The initial Philips stock price reaction was positive.

Long-Term Implications for Investors

The long-term implications for investors are complex and depend on the successful execution of Philips’ strategic plans. The Philips long-term outlook remains positive, provided the company effectively manages the risks associated with its restructuring and continues to innovate in key markets. While opportunities abound, potential risks remain, requiring a thorough Philips investment analysis before making any decisions. The Philips future hinges on successful implementation of the discussed initiatives.

Conclusion: Key Takeaways from the Philips Shareholders' Meeting and Call to Action

The Philips Shareholders' Meeting provided essential information for investors and stakeholders. Key announcements included restructuring plans, a financial performance review, and the declaration of a dividend. Shareholder questions focused on past recalls and the effectiveness of the restructuring. The meeting resulted in a positive short-term stock market reaction. The Philips long-term outlook depends on the successful execution of the outlined strategy. To stay informed about future developments, including upcoming Philips Shareholders' Meetings and important company updates, subscribe to Philips' investor relations newsletter and follow their official social media channels. Staying updated on Philips shareholder communications is crucial for informed investment decisions. Understanding the nuances of future Philips meetings will be key for investors.

Featured Posts

-

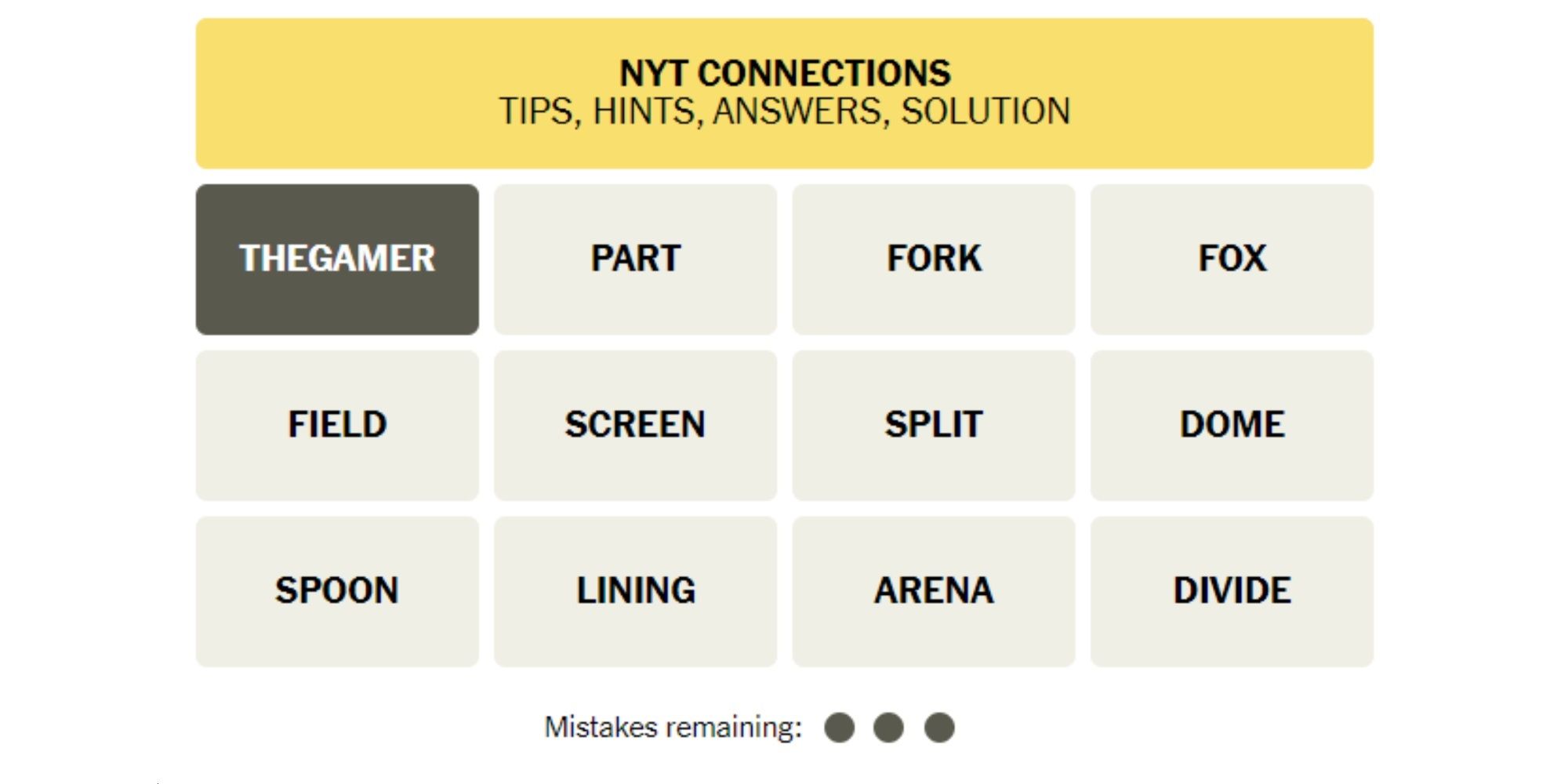

March 18 2025 New York Times Connections Puzzle 646 Help And Answers

May 25, 2025

March 18 2025 New York Times Connections Puzzle 646 Help And Answers

May 25, 2025 -

Europese Aandelen Vs Wall Street Vervolg Snelle Marktdraai

May 25, 2025

Europese Aandelen Vs Wall Street Vervolg Snelle Marktdraai

May 25, 2025 -

Daks Alalmany Ytkhta Dhrwt Mars Mwshr Awrwby Rayd

May 25, 2025

Daks Alalmany Ytkhta Dhrwt Mars Mwshr Awrwby Rayd

May 25, 2025 -

Trade War Intensifies Amsterdam Stock Market Suffers 7 Plunge

May 25, 2025

Trade War Intensifies Amsterdam Stock Market Suffers 7 Plunge

May 25, 2025 -

300 Million Cyberattack Impact Marks And Spencers Financial Fallout

May 25, 2025

300 Million Cyberattack Impact Marks And Spencers Financial Fallout

May 25, 2025

Latest Posts

-

Rio Tinto Rebuts Forrests Wasteland Claims Pilbaras Future Defended

May 25, 2025

Rio Tinto Rebuts Forrests Wasteland Claims Pilbaras Future Defended

May 25, 2025 -

China Market Troubles Beyond Bmw And Porsche

May 25, 2025

China Market Troubles Beyond Bmw And Porsche

May 25, 2025 -

Invest Smart A Guide To The Countrys Busiest New Business Areas

May 25, 2025

Invest Smart A Guide To The Countrys Busiest New Business Areas

May 25, 2025 -

Hollywood Production Halts As Sag Aftra Joins Wga On Strike

May 25, 2025

Hollywood Production Halts As Sag Aftra Joins Wga On Strike

May 25, 2025 -

Delayed Promotions Accenture To Upgrade 50 000 Staff Members

May 25, 2025

Delayed Promotions Accenture To Upgrade 50 000 Staff Members

May 25, 2025