Trade War Intensifies: Amsterdam Stock Market Suffers 7% Plunge

Table of Contents

Causes of the Amsterdam Stock Market Plunge

The sharp decline in the Amsterdam Stock Exchange can be attributed to a confluence of factors, all interconnected and mutually reinforcing.

Escalating Trade Tensions

The recent intensification of trade disputes between major global economies, particularly the ongoing US-China trade war, is a primary driver of the market downturn. Increased tariffs on key exports are significantly impacting Dutch businesses heavily reliant on international trade. This uncertainty surrounding future trade policies creates significant investor anxiety and prompts widespread sell-offs.

- Increased Tariffs: Higher tariffs on Dutch goods exported to key markets reduce competitiveness and profitability, impacting sectors like agriculture and technology.

- Supply Chain Disruptions: Trade wars disrupt global supply chains, leading to increased costs and delays for Dutch companies.

- Investor Sentiment: The uncertainty surrounding future trade policies erodes investor confidence, leading to a flight to safety and a sell-off in riskier assets.

- Affected Industries: The agricultural sector, a cornerstone of the Dutch economy, is particularly vulnerable, with exports of dairy products and flowers facing significant headwinds. The technology sector, dependent on global supply chains, is also suffering. Data on specific export declines would further illustrate the severity of the impact.

Global Economic Slowdown Concerns

The trade war is exacerbating existing anxieties about a potential global economic slowdown. Reduced consumer and business confidence leads to decreased spending and investment, further fueling the downturn in the Amsterdam Stock Market. Fears of a recession are contributing to market volatility and prompting investors to seek safer assets.

- Decreased Consumer Spending: Uncertainty about the future impacts consumer confidence and reduces spending.

- Reduced Business Investment: Companies postpone investment decisions due to economic uncertainty.

- Flight to Safety: Investors move capital into safer assets like government bonds, reducing demand for stocks.

- Economic Indicators: A decline in global GDP growth forecasts and rising inflation rates amplify these concerns and contribute to the market's negative sentiment.

Impact of Brexit Uncertainty

Lingering uncertainties surrounding Brexit continue to negatively impact investor sentiment towards European markets, including Amsterdam. The ongoing political and economic turmoil related to the UK’s departure from the EU is creating instability and uncertainty for businesses.

- Trade Disruptions: Concerns about potential trade disruptions between the UK and the Netherlands are weighing on market performance.

- Political Instability: Brexit-related political uncertainty further undermines investor confidence.

- Economic Uncertainty: The economic consequences of Brexit for both the UK and the EU remain unclear, adding to the overall uncertainty.

- Trade Statistics: Analyzing trade figures between the Netherlands and the UK before and after Brexit will reveal the magnitude of the impact.

Sectors Most Affected by the Drop

The recent plunge in the Amsterdam Stock Market has disproportionately impacted certain sectors.

Technology Sector

The technology sector, heavily reliant on global supply chains and international trade, experienced significant losses. The increased costs and complexities associated with navigating trade restrictions negatively impacted profitability and investor confidence.

- Global Supply Chains: Disruptions to global supply chains increase production costs and lead to delays.

- Tariff Impacts: Tariffs on imported components or exported goods reduce competitiveness.

- Affected Companies: Specific examples of affected technology companies listed on the Amsterdam Stock Exchange would illustrate the sector's vulnerability.

Financial Services

The financial services sector also witnessed a considerable decline due to increased market volatility and decreased investor confidence. The uncertainty surrounding the global economy and trade wars has increased risk aversion among investors.

- Market Volatility: Increased market fluctuations lead to higher risks for financial institutions.

- Decreased Investor Confidence: Uncertainty about the future impacts investment decisions.

- Affected Institutions: Identifying specific financial institutions affected will highlight the impact on this crucial sector.

Agriculture and Export-Oriented Industries

Dutch agricultural exports and other export-oriented industries have been particularly hard hit by the trade war's increased tariffs and reduced global demand. This has led to lower prices and reduced profitability for many businesses.

- Tariff Impacts on Exports: Higher tariffs reduce the competitiveness of Dutch agricultural products in foreign markets.

- Reduced Global Demand: Economic slowdown in other countries reduces overall demand for Dutch exports.

- Economic Impact on Farmers: The resulting lower prices and reduced demand impact the incomes of Dutch farmers and businesses significantly.

Potential Future Scenarios for the Amsterdam Stock Market

Predicting the future of the Amsterdam Stock Market requires careful consideration of various factors.

Short-Term Outlook

The short-term outlook remains uncertain, with potential for further volatility depending on developments in the trade war and global economic conditions. A de-escalation of trade tensions could lead to a market rebound, while further escalation could result in more significant losses.

Long-Term Implications

The long-term impact of the trade war will depend on the resolution of trade disputes and the overall global economic climate. A successful resolution could lead to a strong recovery, while prolonged trade tensions could result in sustained economic weakness and market underperformance. Government policies aimed at supporting the economy and fostering investor confidence will play a crucial role.

Opportunities Amidst Uncertainty

Despite the challenges, opportunities may arise for strategic investors who can navigate the uncertainties and identify undervalued assets. Sectors less exposed to global trade or those with strong domestic demand may offer better prospects.

Conclusion

The 7% plunge in the Amsterdam Stock Market underscores the serious impact of the intensifying global trade war. The escalating tensions, combined with global economic slowdown fears and Brexit uncertainty, have created a volatile environment for investors. While the short-term outlook remains uncertain, understanding the causes and implications of this market downturn is crucial for navigating the challenges ahead. Stay informed about the latest developments affecting the Amsterdam Stock Market and carefully consider your investment strategies in light of these significant events. Monitoring the evolving situation regarding the Amsterdam Stock Exchange is vital for making informed financial decisions.

Featured Posts

-

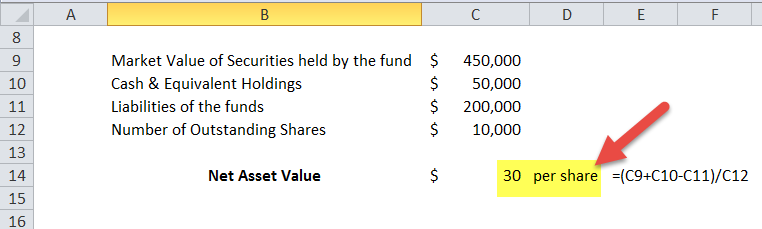

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

France To Reassess Dreyfus Case Proposal For Posthumous Military Promotion

May 25, 2025

France To Reassess Dreyfus Case Proposal For Posthumous Military Promotion

May 25, 2025 -

M6 Traffic Delays Accident Causing Significant Congestion

May 25, 2025

M6 Traffic Delays Accident Causing Significant Congestion

May 25, 2025 -

Sean Penns Allegiance To Woody Allen A Me Too Case Study

May 25, 2025

Sean Penns Allegiance To Woody Allen A Me Too Case Study

May 25, 2025 -

Joy Crookes New Single I Know You D Kill A Deeper Look

May 25, 2025

Joy Crookes New Single I Know You D Kill A Deeper Look

May 25, 2025

Latest Posts

-

Will Elon Musk Continue To Support Dogecoin

May 25, 2025

Will Elon Musk Continue To Support Dogecoin

May 25, 2025 -

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 25, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 25, 2025 -

Elon Musks Dogecoin Stance An Analysis

May 25, 2025

Elon Musks Dogecoin Stance An Analysis

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025 -

Dogecoins Future Elon Musks Involvement

May 25, 2025

Dogecoins Future Elon Musks Involvement

May 25, 2025