Posthaste Analysis: Looming Crisis In The Bond Market?

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. As interest rates rise, the yields on newly issued bonds increase, making existing bonds with lower yields less attractive. This leads to a decline in the price of existing bonds to compensate for the lower return. Aggressive interest rate hikes by central banks worldwide, primarily aimed at combating persistent inflation, have significantly amplified this effect.

- Impact on Existing Bond Yields: Rising rates directly reduce the value of fixed-income investments. A bond purchased at a fixed rate will see its value decrease if newer bonds offer higher returns.

- Implications for Bond Investors: For bond investors, this translates to potential capital losses. Investors holding bonds to maturity will still receive the face value, but those needing to sell before maturity will likely incur losses.

- Yield Curve Inversion: A closely watched indicator, the yield curve inversion (when short-term yields exceed long-term yields), often precedes economic recessions. This is because it reflects investor expectations of future interest rate cuts, typically in response to an economic slowdown. The current flattening yield curve is a major cause for concern.

Escalating Inflation and its Effect on Bond Market Stability

Persistent high inflation significantly erodes the purchasing power of fixed-income investments. When inflation rises faster than the fixed interest rate on a bond, the real return – the return after accounting for inflation – becomes negative. This reduces the attractiveness of bonds, driving down demand and potentially pushing yields higher.

- Nominal vs. Real Interest Rates: The nominal interest rate is the stated interest rate, while the real interest rate adjusts for inflation. A high nominal rate can still yield a negative real return during periods of high inflation.

- Inflation-Protected Securities (TIPS): TIPS are designed to protect investors from inflation risk. Their principal adjusts with inflation, ensuring a positive real return. Demand for these securities tends to increase during inflationary periods.

- Impact of Unexpected Inflation Spikes: Unexpected surges in inflation can trigger significant volatility in the bond market as investors reassess the real value of their fixed-income holdings and demand higher yields to compensate for inflation risk.

The Role of Geopolitical Uncertainty

Geopolitical uncertainty plays a significant role in shaping investor sentiment towards bonds. Events such as wars, sanctions, and trade disputes create uncertainty about the future, often leading to increased risk aversion. This increased risk aversion can drive investors towards "safe haven" assets, such as government bonds of stable economies, pushing down yields and potentially inflating prices in some sectors, while simultaneously causing volatility in others.

- Past Geopolitical Events: Past instances of geopolitical instability have demonstrably affected bond markets, leading to increased volatility and shifts in investor preferences. The 2008 financial crisis and the early days of the COVID-19 pandemic are notable examples.

- Safe Haven Assets: During periods of global uncertainty, investors often flock to government bonds of countries perceived as politically and economically stable, leading to decreased yields on these “safe haven” assets.

Assessing Credit Risk and Default Probabilities

High debt levels across corporations and sovereign nations, coupled with a potential economic slowdown, increase the risk of defaults. This credit risk is a major concern for the bond market, as defaults can trigger cascading effects throughout the financial system.

- Credit Ratings: Credit rating agencies assess the creditworthiness of bond issuers, providing an indication of the likelihood of default. Downgrades can lead to lower demand and higher yields for affected bonds.

- Credit Spreads: The difference between the yield on a corporate bond and a similar-maturity government bond (the credit spread) reflects the default risk premium. Wider spreads indicate higher perceived default risk.

- Debt Sustainability: The ability of borrowers to service their debt obligations is critical. Factors such as economic growth, government fiscal policy, and corporate profitability heavily influence debt sustainability. High levels of debt relative to economic output increase the risk of defaults and overall market instability.

Conclusion

In summary, a confluence of factors – rising interest rates, persistent inflation, geopolitical instability, and escalating credit risk – creates a volatile environment in the bond market. These combined elements significantly increase the probability of a significant correction, potentially even a full-blown crisis, with potentially far-reaching economic repercussions. The interconnected nature of global finance means instability in the bond market could easily ripple outward.

Understanding the risks involved in the current bond market landscape is crucial for making informed investment decisions. Proactive risk management, including portfolio diversification, careful selection of bonds based on credit quality and duration, and potentially seeking professional financial advice, is essential for navigating these challenging times. Stay informed and protect your portfolio by continually monitoring bond market trends and adapting your investment strategy accordingly.

Featured Posts

-

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket And Golden Belt Sale

May 23, 2025

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket And Golden Belt Sale

May 23, 2025 -

Analysis Of Ing Groups 2024 Annual Report On Form 20 F

May 23, 2025

Analysis Of Ing Groups 2024 Annual Report On Form 20 F

May 23, 2025 -

7 Eleven Canada Partners With Odd Burger For Nationwide Vegan Expansion

May 23, 2025

7 Eleven Canada Partners With Odd Burger For Nationwide Vegan Expansion

May 23, 2025 -

How Jesse Eisenberg Cast Kieran Culkin For A Real Pain A Casual Approach

May 23, 2025

How Jesse Eisenberg Cast Kieran Culkin For A Real Pain A Casual Approach

May 23, 2025 -

The Witkoff Deception An Emissarys Story Of Hamas

May 23, 2025

The Witkoff Deception An Emissarys Story Of Hamas

May 23, 2025

Latest Posts

-

Skandal An Der Uni Duisburg Essen Notenmanipulation Fuer 900 Euro

May 23, 2025

Skandal An Der Uni Duisburg Essen Notenmanipulation Fuer 900 Euro

May 23, 2025 -

Aktuelle Entwicklungen Grosser Protest Der Essener Taxifahrer

May 23, 2025

Aktuelle Entwicklungen Grosser Protest Der Essener Taxifahrer

May 23, 2025 -

Nrw Eis Favorit Diese Eissorte In Essen Hat Alle Ueberrascht

May 23, 2025

Nrw Eis Favorit Diese Eissorte In Essen Hat Alle Ueberrascht

May 23, 2025 -

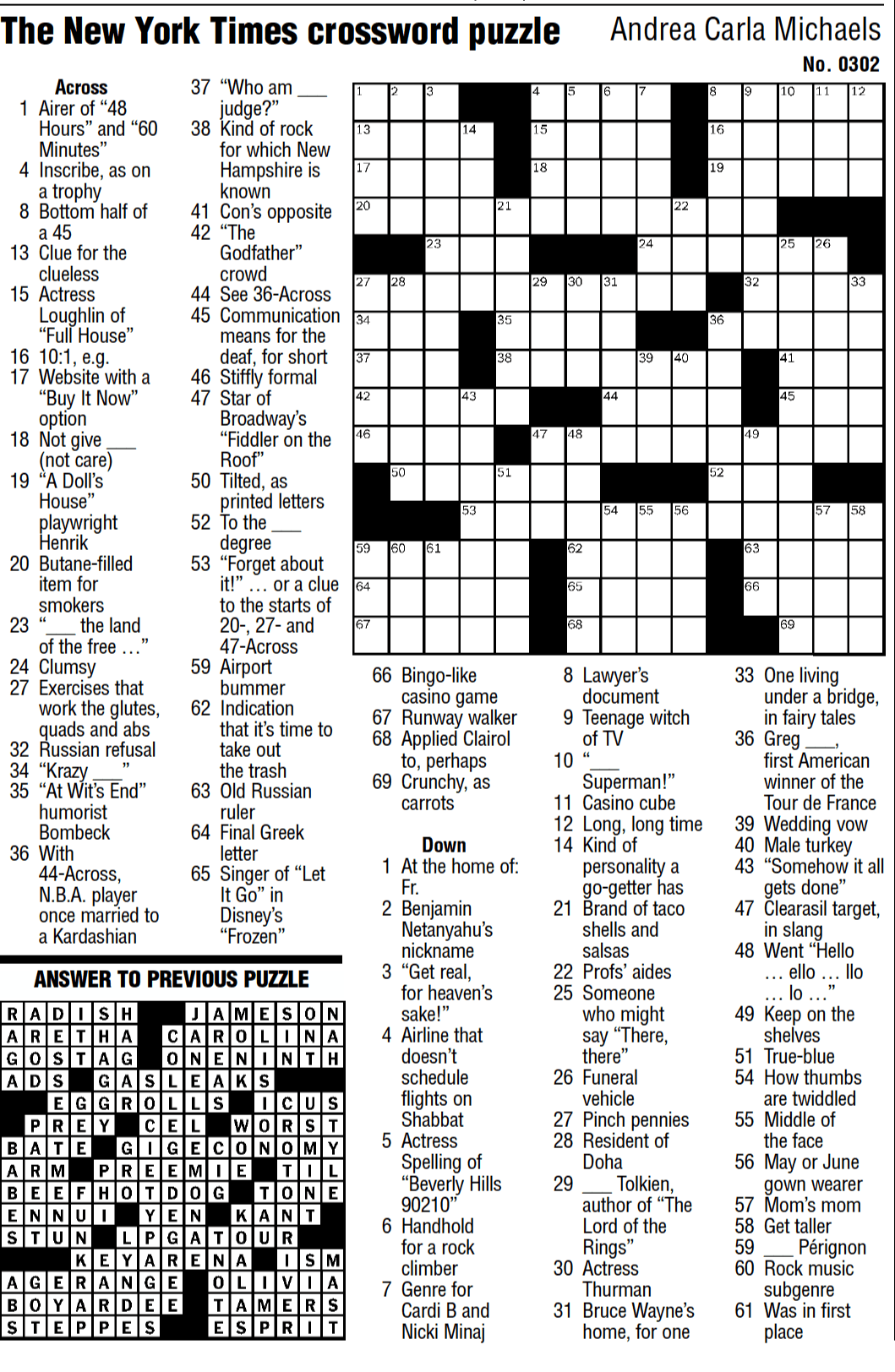

Nyt Mini Crossword Help April 18 2025 Answers And Clues

May 23, 2025

Nyt Mini Crossword Help April 18 2025 Answers And Clues

May 23, 2025 -

Essener Festival San Hejmo Line Up Enthuellt Komplette Kuenstlerliste

May 23, 2025

Essener Festival San Hejmo Line Up Enthuellt Komplette Kuenstlerliste

May 23, 2025