Private Lender Refinancing: A Guide To Federal Student Loans

Table of Contents

Understanding Federal Student Loan Refinancing

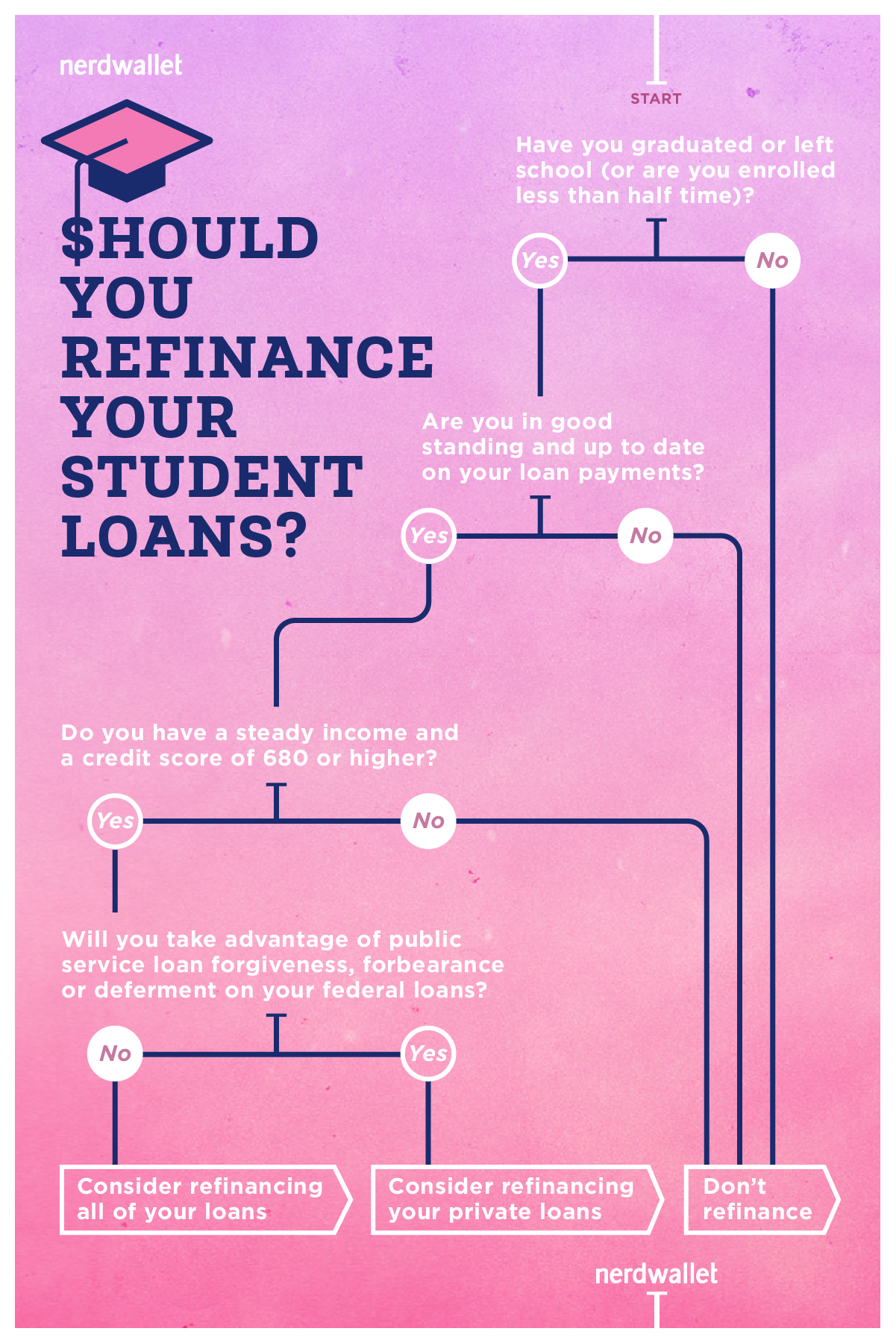

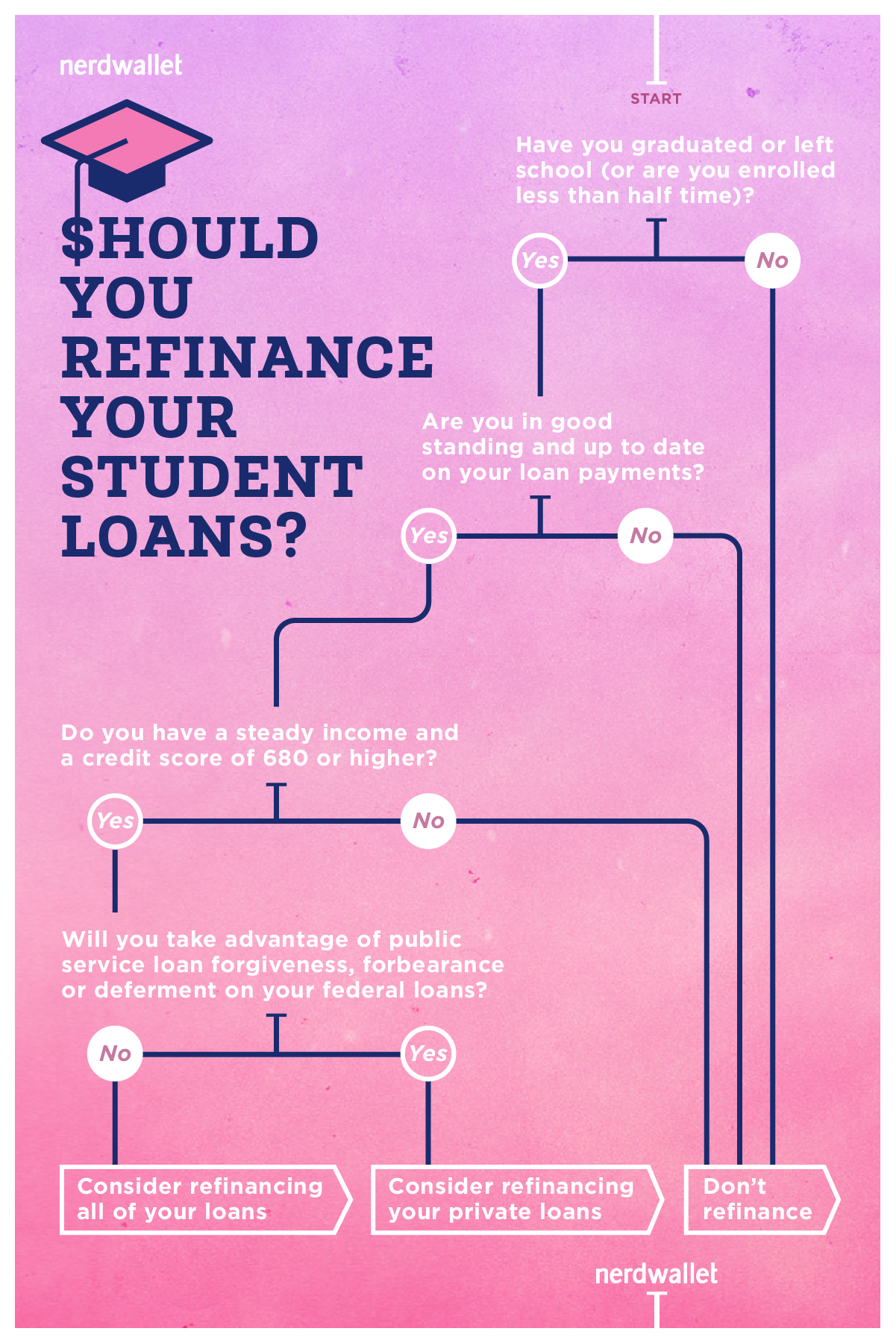

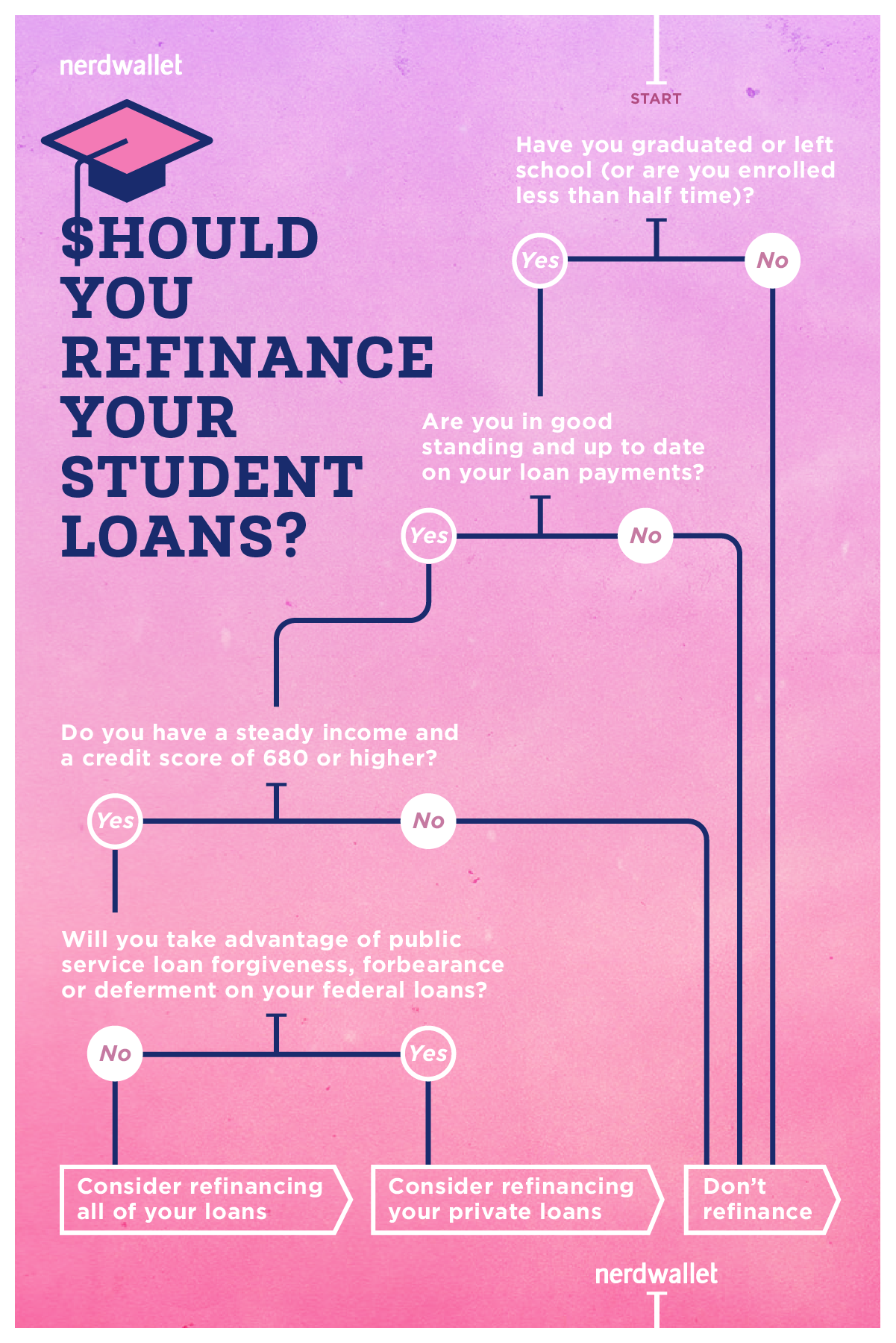

Federal student loan refinancing involves replacing your existing federal student loans with a new private loan from a private lender. This is different from consolidating your federal loans, which keeps them under the federal government's umbrella. Federal student loans are backed by the U.S. government and offer important borrower protections, while private student loans do not.

- Federal loans offer benefits like income-driven repayment plans (IDR), which adjust your monthly payments based on your income, and deferment or forbearance options, allowing temporary pauses in payments during financial hardship.

- Private loans generally lack these protections. They typically require consistent, on-time payments, regardless of your financial situation.

- Refinancing replaces your existing federal loans with a new private loan, effectively removing you from the federal loan program and its associated benefits.

The implications of losing these federal loan benefits are significant. You'll lose the safety net provided by the government, putting you at greater risk if you experience unexpected financial difficulties. Careful consideration is crucial before proceeding.

Benefits of Private Lender Refinancing

While losing federal protections is a significant drawback, private lender refinancing can offer some compelling advantages.

Lower Interest Rates

One major benefit is the potential for significantly lower interest rates. This can translate to lower monthly payments and substantial savings over the life of the loan.

- Example: Imagine you have $50,000 in federal student loans at 6% interest. Refinancing to a 4% interest rate could save you thousands of dollars over the repayment period.

- Comparison is key: Always compare interest rates from multiple private lenders to find the best deal. Don't settle for the first offer you receive.

- Lower rates are not guaranteed: Your eligibility for lower rates depends on your credit score, income, and other factors.

Simplified Repayment

Refinancing can simplify your repayment process by consolidating multiple loans into a single, streamlined monthly payment.

- Convenience: Managing one payment instead of several is significantly more convenient.

- Longer repayment terms: Refinancing might offer a longer repayment term, resulting in lower monthly payments. However, this will increase the total interest paid over the life of the loan. Carefully weigh the pros and cons.

Potential for a Fixed Interest Rate

If you currently have variable-rate federal student loans, refinancing to a fixed-rate private loan offers stability and predictability.

- Stability: A fixed interest rate protects you from interest rate fluctuations, providing budgeting certainty during economic uncertainty.

- Predictability: Knowing your exact monthly payment amount helps with financial planning and reduces the risk of unexpected increases.

Drawbacks of Private Lender Refinancing

Despite the potential benefits, refinancing federal student loans with a private lender comes with significant risks.

Loss of Federal Loan Benefits

As previously mentioned, the most significant drawback is the loss of crucial federal loan benefits.

- Default consequences: Defaulting on a private loan can severely damage your credit score and lead to wage garnishment or lawsuits. Federal loans offer more lenient default processes.

- Careful consideration: Thoroughly evaluate your financial situation and risk tolerance before refinancing. Are you confident you can maintain consistent payments even during unexpected financial hardship?

Credit Score Requirements

Private lenders have stringent credit score requirements for refinancing.

- Impact of low credit score: A low credit score can significantly impact your chances of approval and result in higher interest rates.

- Improve your credit score: Before applying, work on improving your credit score by paying bills on time, reducing debt, and monitoring your credit report.

Potential for Higher Fees

Private lenders often charge fees associated with refinancing.

- Origination fees: These are upfront fees charged for processing your loan application.

- Prepayment penalties: Some lenders charge penalties if you pay off your loan early.

- Compare fees: Carefully compare fees across different lenders to minimize the overall cost of refinancing.

Finding the Right Private Lender

Choosing the right private lender is crucial for a successful refinancing experience.

Comparing Lenders

Don't just settle for the first offer. Compare interest rates, fees, and repayment terms from multiple private lenders.

- Online comparison tools: Use reputable online comparison tools to streamline the process.

- Lender reviews: Read reviews and ratings from other borrowers to gauge lender reputation and customer service.

Understanding the Application Process

The application process typically involves providing documentation like your credit report, income verification, and details of your existing student loans.

- Required documentation: Gather all necessary documents before applying to speed up the process.

- Approval process: Understand the lender's approval process and timelines to manage your expectations.

Conclusion

Refinancing your federal student loans with a private lender can offer significant benefits, such as lower interest rates and simplified repayment. However, it's crucial to carefully weigh the potential drawbacks, including the loss of federal loan benefits and stricter credit requirements. Before making a decision, thoroughly research different private lenders, compare their offerings, and ensure you fully understand the terms and conditions. Make an informed choice by carefully considering all aspects of private lender refinancing and its impact on your financial future. Don't hesitate to seek professional financial advice before refinancing your federal student loans.

Featured Posts

-

Luxury Carmakers Face Headwinds In China A Market Analysis Of Bmw Porsche And Competitors

May 17, 2025

Luxury Carmakers Face Headwinds In China A Market Analysis Of Bmw Porsche And Competitors

May 17, 2025 -

Private Lender Refinancing A Guide To Federal Student Loans

May 17, 2025

Private Lender Refinancing A Guide To Federal Student Loans

May 17, 2025 -

Reta Nba Teisejo Klaida Pistons Ir Knicks Rungtyniu Pabaiga

May 17, 2025

Reta Nba Teisejo Klaida Pistons Ir Knicks Rungtyniu Pabaiga

May 17, 2025 -

Novak Djokovic 37 Ve Hala En Iyilerden Biri

May 17, 2025

Novak Djokovic 37 Ve Hala En Iyilerden Biri

May 17, 2025 -

Resultado Final Everton Vina 0 0 Coquimbo Unido Analisis Del Partido

May 17, 2025

Resultado Final Everton Vina 0 0 Coquimbo Unido Analisis Del Partido

May 17, 2025