Russian Gas Pipeline: Elliott Management's Exclusive Play

Table of Contents

Elliott Management's Investment Strategy in the Russian Gas Pipeline Sector

Elliott Management, known for its activist investing and expertise in distressed assets, employs a multifaceted strategy in the Russian gas pipeline sector. Their approach focuses on identifying undervalued opportunities and mitigating inherent risks to maximize returns.

Identifying Target Assets

Elliott likely targets Russian gas pipeline assets exhibiting signs of underperformance or distress. This could involve:

- Acquisition of distressed debt: Purchasing debt at a discount from struggling pipeline operators, providing leverage for future negotiations and potential control.

- Strategic partnerships with Russian energy companies: Collaborating with existing players to gain access to assets and expertise, sharing risks and potentially benefiting from existing infrastructure.

- Leveraging expertise in restructuring and asset management: Elliott's proven ability to restructure businesses and improve operational efficiency could be crucial in enhancing the value of acquired assets.

- Exploiting opportunities arising from sanctions and geopolitical instability: While risky, such situations can create opportunities for shrewd investors to acquire assets at depressed prices.

Risk Mitigation Strategies

Investing in Russian gas pipelines carries significant geopolitical risks. Elliott likely employs several strategies to mitigate these:

- Diversification of investments within the sector: Spreading investments across multiple assets to reduce the impact of any single negative event.

- Robust legal and financial due diligence: Thorough investigation of assets, contracts, and regulatory compliance to avoid unforeseen liabilities.

- Engagement with relevant government and regulatory bodies: Maintaining open communication with Russian authorities to ensure compliance and potentially navigate potential conflicts.

- Contingency planning for sanctions or political instability: Developing strategies to manage potential disruptions caused by sanctions, political changes, or other unforeseen circumstances.

Potential Returns and Exit Strategies

Elliott's potential returns stem from several avenues:

- Capital appreciation through asset value increase: Improving operational efficiency and resolving financial distress can significantly increase the value of pipeline assets.

- Dividend payouts from pipeline operations: Receiving regular income streams from the operational profits of the pipelines.

- Strategic sale of assets to larger energy companies: Selling the improved assets to larger energy companies or state-owned enterprises at a profit.

- Securitization of future cash flows: Creating financial instruments backed by the future revenue streams of the pipelines.

Geopolitical Factors and their Impact on Elliott's Investment

The geopolitical landscape significantly influences Elliott's investment in Russian gas pipelines.

Sanctions and Regulatory Hurdles

International sanctions against Russia pose a considerable challenge:

- Navigating compliance requirements: Ensuring all investments and operations strictly adhere to all applicable sanctions regulations.

- Adapting strategies in response to changing sanctions regimes: Remaining flexible and responsive to potential changes in sanctions policy.

- Assessing the likelihood of further sanctions: Continuously evaluating the risk of additional or intensified sanctions impacting their investments.

Relationship with the Russian Government

The relationship with the Russian government is crucial:

- Negotiation and cooperation: Establishing constructive dialogue with Russian authorities to ensure smooth operations and avoid conflict.

- Potential for conflict or expropriation: Recognizing the risk of potential disputes or government seizure of assets.

- Importance of maintaining a positive relationship: Building a reputation for responsible investment and cooperation with the Russian government.

Global Energy Market Dynamics

Global energy demand and market dynamics impact Elliott's strategy:

- Fluctuations in gas prices: Sensitivity to price volatility in the global gas market.

- Competition from other energy sources: Considering the competitive landscape with other energy sources like renewables.

- Impact of climate change policies: Assessing the potential impact of long-term policy changes toward decarbonization.

Comparison with Other Investors in the Russian Gas Pipeline Sector

Elliott's strategy differs from other investors in several key aspects.

Competitive Landscape

Elliott's approach distinguishes itself through:

- Distinguishing features of Elliott's approach: Focusing on distressed assets and employing its restructuring expertise.

- Advantages and disadvantages compared to competitors: Higher risk, higher potential reward approach compared to more conservative investors.

- Market share and competitive positioning: Targeting niche opportunities rather than pursuing broad market dominance.

Potential Synergies and Collaborations

Collaboration opportunities exist:

- Strategic alliances to share risk and resources: Partnering with other investors to share the financial burden and operational expertise.

- Joint ventures for large-scale projects: Pooling resources for significant pipeline development or expansion projects.

- Cross-border collaborations: Working with international energy companies to facilitate access to global markets.

Conclusion

Elliott Management's investment in the Russian gas pipeline sector represents a high-risk, high-reward strategy. Their approach combines sophisticated financial engineering with a deep understanding of the complex geopolitical landscape. While considerable challenges exist, including sanctions and political uncertainty, the potential for significant returns remains. Understanding the nuances of Elliott’s exclusive play on the Russian gas pipeline market provides crucial insights into the evolving dynamics of the global energy industry. To stay informed about this evolving situation and other developments in the Russian gas pipeline investment market, continue to follow our analysis and insights.

Featured Posts

-

Unprovoked Racist Attack Woman Sentenced For Killing Man

May 10, 2025

Unprovoked Racist Attack Woman Sentenced For Killing Man

May 10, 2025 -

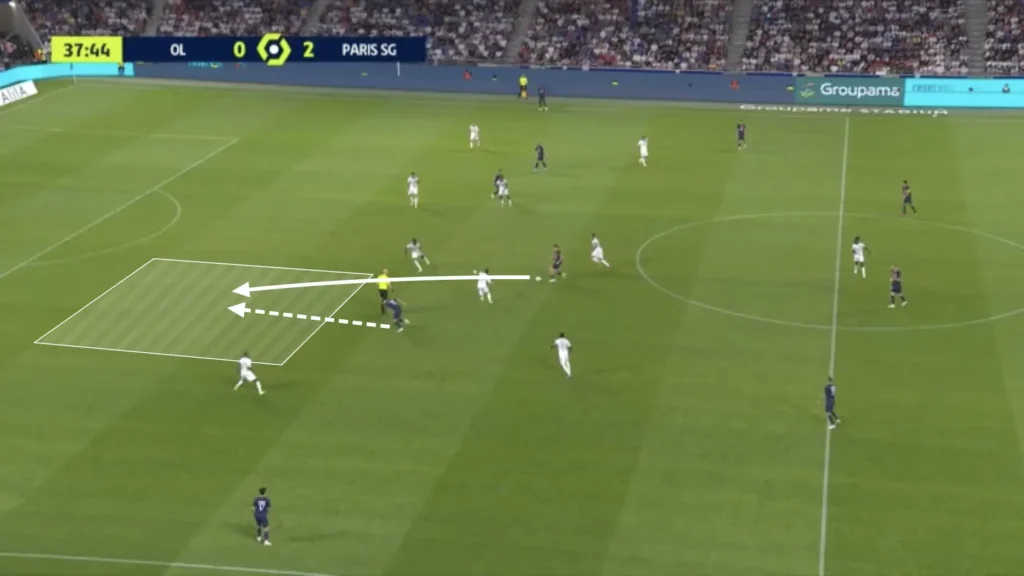

Psgs Winning Formula Luis Enriques Tactical Masterclass

May 10, 2025

Psgs Winning Formula Luis Enriques Tactical Masterclass

May 10, 2025 -

Trumps Transgender Military Policy A Closer Look At The Controversy

May 10, 2025

Trumps Transgender Military Policy A Closer Look At The Controversy

May 10, 2025 -

Macron Announces Upcoming France Poland Friendship Treaty

May 10, 2025

Macron Announces Upcoming France Poland Friendship Treaty

May 10, 2025 -

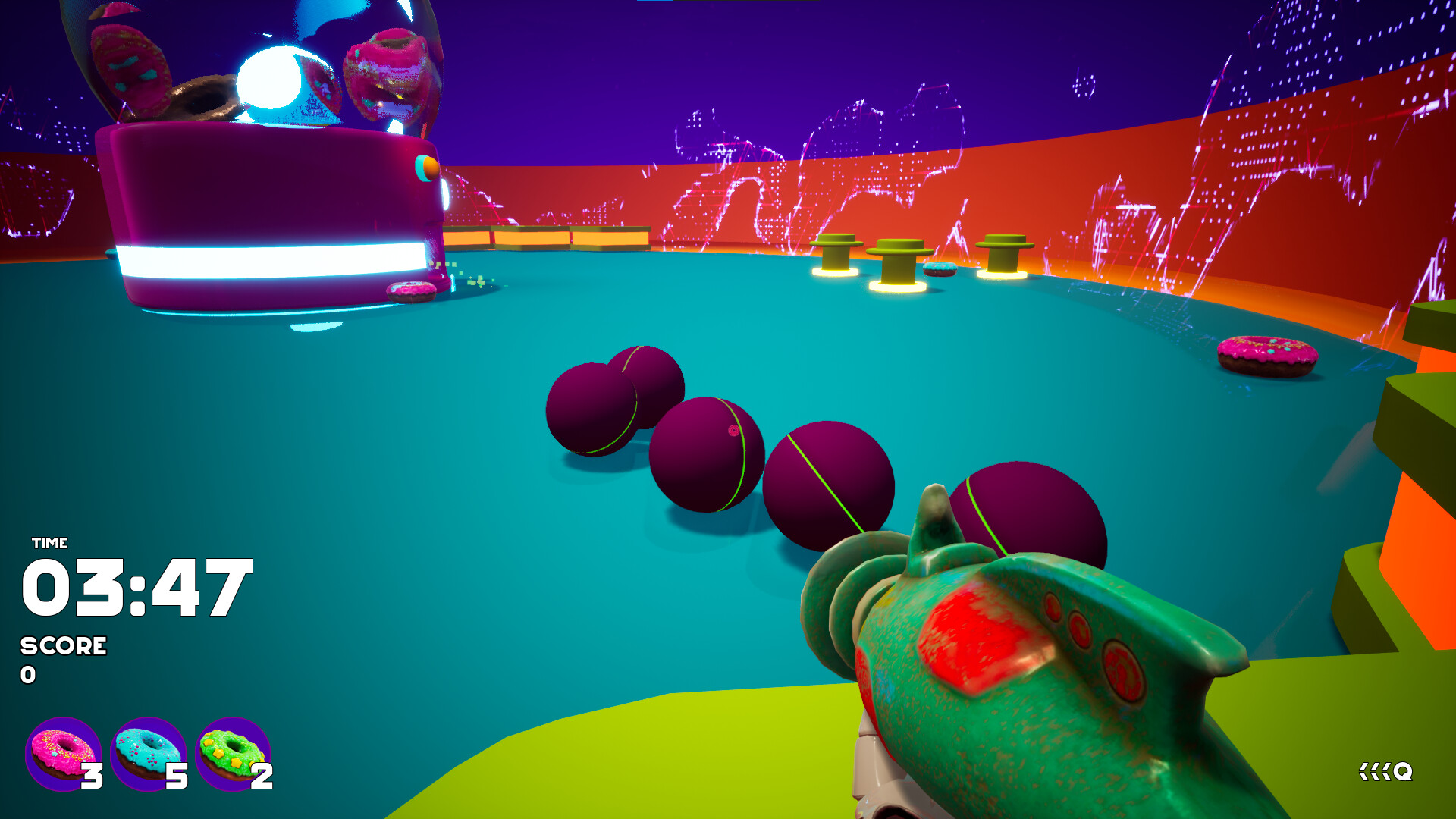

Bubble Blasters And Beyond Analyzing The Impact Of Trade Disputes On Chinese Goods

May 10, 2025

Bubble Blasters And Beyond Analyzing The Impact Of Trade Disputes On Chinese Goods

May 10, 2025